J&J Brushes off Looming Biosimilar Competition -- 2nd Update

October 18 2016 - 12:43PM

Dow Jones News

By Jonathan D. Rockoff and Anne Steele

Johnson & Johnson on Tuesday sought to reassure investors

and analysts that lower-priced competition for one of its

top-selling products won't slow a company that posted slightly

better-than-expected results in the third quarter.

The health-products company said world-wide sales in the quarter

grew by 4.2%, to $17.8 billion. The company reported profit of

$4.27 billion, or $1.53 a share, up from $3.36 billion, or $1.20 a

share, in the same period a year ago.

Looking ahead, J&J lifted the low end of its financial

guidance for the year.

J&J's shares have performed strongly, up 15% this year,

propelled by a drugs business that has been delivering new big

sellers. But shares fell 2% Tuesday morning as investors digested

the announcement from rival Pfizer Inc. late Monday that it planned

to challenge J&J's Remicade rheumatoid-arthritis treatment by

launching a lower-priced copy, known as a biosimilar, in late

November.

Pfizer said its biosimilar, called Inflectra, would list for a

price 15% less than Remicade's.

Remicade was J&J's top-selling drug in the quarter, with

$1.2 billion in U.S. sales alone. Chief Financial Officer Dominic

Caruso said on a conference call that J&J didn't expect its

yearly results to be affected by any Inflectra competition.

Analysts say the competition could reduce Remicade sales by $1

billion next year. Yet J&J officials sought to push back on

concerns about the impact, especially in the near-term. They noted

the company is fighting Inflectra in the courts.

Joaquin Duato, J&J's pharmaceuticals chief, also said the

company expected stable Remicade patients to stay on the therapy,

and that J&J will compete on price. The discount Pfizer is

offering on Inflectra is at the bottom of the range that analysts

and payers had expected.

J&J also detailed how new uses for existing medicines and

drug launches through 2019 could offset any sales losses and

provide new revenue growth.

Mr. Duato said the company is working on 10 line extensions on

existing products that could add more than $500 million in sales

apiece and 10 new drugs that could have $1 billion or more in sales

each.

"We plan to continue to grow our pharmaceuticals business in the

face of biosimilar competition," including in the treatment of

immunology diseases like the ones treated by Remicade, Mr. Duato

said in an interview.

The New Brunswick, N.J., company now expects earnings for the

year of $6.68 to $6.73 a share, compared with its previous guidance

for $6.63 at the bottom end of the range. It repeated its revenue

forecast of $71.5 billion to $72.2 billion.

Prescription-drug sales grew 9.2% to $8.4 billion in the

quarter, driven by strength in new products including blood-cancer

drug Imbruvica, blood-thinner Xarelto and multiple myeloma therapy

Darzalex.

J&J's other segments, however, continued to lag. During the

quarter, sales of J&J consumer health products slipped 1.6% to

$3.26 billion, dragged down by currency headwinds. Meanwhile,

J&J's medical device sales rose just 1.1% to $6.16 billion.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 18, 2016 12:28 ET (16:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

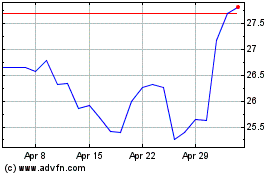

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

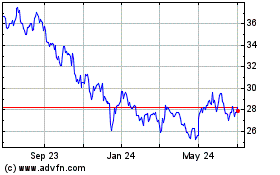

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024