Pfizer Inc. (PFE) filed a Form 8K - Entry Into a Definitive

Agreement - with the U.S Securities and Exchange Commission on

August 22, 2016.

On August 20, 2016, Pfizer Inc., a Delaware corporation

("Pfizer"), entered into an Agreement and Plan of Merger (the

"Merger Agreement") with Medivation, Inc., a Delaware corporation

("Medivation"), and Montreal, Inc., a Delaware corporation

("Purchaser") and a wholly owned subsidiary of Pfizer.

Pursuant to the Merger Agreement, and upon the terms and subject

to the conditions described therein, Pfizer will cause Purchaser to

commence a cash tender offer (the "Offer") within seven business

days following the date of the Merger Agreement to acquire all of

Medivation's outstanding shares of common stock, par value $0.01

per share (the "Medivation Stock"), for $81.50 per share, net to

the seller in cash, without interest, subject to any required

withholding of taxes (the "Offer Price"). The Offer will remain

open for a minimum of 20 business days from the date of

commencement.

The obligation of Purchaser to purchase shares of Medivation

Stock tendered in the Offer is subject to customary closing

conditions, including, among others, (i) shares of Medivation Stock

having been validly tendered and not validly withdrawn that

represent, together with the shares then owned by Pfizer and its

affiliates, at least a majority of the then-outstanding shares of

Medivation Stock, (ii) the expiration or termination of the waiting

period applicable to the Offer and the Merger (as defined below)

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as

amended, (iii) the absence of any injunction or other order issued

by a court of competent jurisdiction prohibiting the consummation

of the Offer or the Merger and (iv) other customary conditions set

forth in Annex I of the Merger Agreement. The consummation of the

Offer is not subject to any financing condition.

As soon as practicable after the time at which shares of

Medivation Stock are first accepted for payment and paid for under

the Offer (the "Acceptance Time"), subject to the satisfaction or

waiver of certain customary conditions set forth in the Merger

Agreement, Purchaser will be merged with and into Medivation, with

Medivation surviving the merger as a wholly owned subsidiary of

Pfizer (the "Merger"), pursuant to the procedure provided for under

Section 251(h) of the Delaware General Corporation Law without any

additional stockholder approvals. At the effective time of the

Merger (the "Effective Time"), each share of Medivation Stock

(other than treasury shares held by Medivation and any shares of

Medivation Stock owned by Pfizer or any of its subsidiaries or any

person who is entitled to and properly demands statutory appraisal

of his or her shares) will be converted into the right to receive

the Offer Price in cash, without interest (the "Merger

Consideration"), subject to any required withholding taxes.

At the Effective Time, each outstanding option to purchase

shares of Medivation Stock (each, a "Company Option") and stock

appreciation right with respect to shares of Medivation Stock

(each, a "Company SAR") will become fully vested and exercisable as

of immediately prior to such time and will be cancelled in exchange

for the right to receive a cash payment equal to the product of (i)

the excess, if any, of the Merger Consideration less the applicable

per share exercise price of such Company Option or base price of

such Company SAR, as applicable, multiplied by (ii) the number of

shares of Medivation Stock that are subject to such fully vested

Company Option or Company SAR, as applicable, as of immediately

prior to the Effective Time. At the Effective Time, each

outstanding restricted stock unit of Medivation will become fully

vested as of immediately prior to such time and will be cancelled

in exchange for the right to receive a cash payment equal to the

product of (i) the Merger Consideration multiplied by (ii) the

number of shares of Medivation Stock underlying such fully vested

restricted stock unit (with any such restricted stock units that

are subject to performance-based vesting being deemed earned

assuming achievement of all performance goals at the maximum levels

effective immediately prior to the Effective Time). Additionally,

each outstanding restricted share of Medivation will be cancelled

and converted into the right to receive an amount in cash equal to

the Merger Consideration. With respect to its Employee Stock

Purchase Plan ("ESPP"), Medivation will cause any outstanding

offering period under such plan to terminate as of the last

business day prior to the Acceptance Time, with outstanding rights

under such plan being exercised as of the Effective Time. Any

shares of Medivation Stock so purchased under the ESPP will be

canceled and converted into the right to receive an amount in cash

equal to the Merger Consideration.

The Merger Agreement contains representations, warranties and

covenants of the parties customary for a transaction of this

nature, including an agreement that, subject to certain exceptions,

the parties will use reasonable best efforts to cause the Offer and

the Merger to be consummated. Until the earlier of the termination

of the Merger Agreement and the Effective Time, Medivation has

agreed to operate its business in the ordinary course of business

consistent with past practice and has agreed to certain other

negative operating covenants, as set forth more fully in the Merger

Agreement.

The Merger Agreement also contains a "no-shop" provision that,

in general, restricts Medivation's ability to (i) solicit,

facilitate or encourage the making of Acquisition Proposals (as

defined in the Merger Agreement) or any inquiries regarding

Acquisition Proposals from third parties or (ii) provide non-public

information to or engage in discussions or negotiations with third

parties in connection with or in response to an Acquisition

Proposal. The no shop provision is subject to a "fiduciary out"

provision that

allows Medivation, under certain circumstances and in compliance

with certain obligations, to provide information and participate in

discussions and negotiations with respect to unsolicited

third-party acquisition proposals that constitute or would

reasonably be expected to lead to a Superior Offer (as defined in

the Merger Agreement) and, subject to compliance with certain

obligations, to terminate the Merger Agreement and accept a

Superior Offer upon payment to Pfizer of the termination fee

discussed below.

The Merger Agreement also includes customary termination

provisions for both Pfizer and Medivation, and provides that, in

connection with the termination of the Merger Agreement under

specified circumstances, including a termination by Medivation to

accept and enter into a definitive agreement with respect to a

Superior Offer, Medivation will pay Pfizer a termination fee of

$510,000,000.

The foregoing description of the Merger Agreement does not

purport to be complete, and is qualified in its entirety by

reference to the full text of the Merger Agreement, which is

attached hereto as Exhibit 2.1 and is incorporated herein by

reference.

A copy of the Merger Agreement has been included to provide

Pfizer stockholders and other security holders with information

regarding its terms and is not intended to provide any factual

information about Pfizer or Medivation. The representations,

warranties and covenants contained in the Merger Agreement have

been made solely for the purposes of the Merger Agreement and as of

specific dates; were solely for the benefit of the parties to the

Merger Agreement; are not intended as statements of fact to be

relied upon by Pfizer stockholders or other security holders, but

rather as a way of allocating the risk between the parties to the

Merger Agreement in the event the statements therein prove to be

inaccurate; have been modified or qualified by certain confidential

disclosures that were made between the parties in connection with

the negotiation of the Merger Agreement, which disclosures are not

reflected in the Merger Agreement itself; may no longer be true as

of a given date; and may apply standards of materiality in a way

that is different from what may be viewed as material by Pfizer

stockholders or other security holders. Pfizer stockholders or

other security holders are not third-party beneficiaries under the

Merger Agreement (except with respect to Medivation stockholders or

other security holders' right to receive the Merger Consideration

following the Effective Time) and should not rely on the

representations, warranties and covenants or any descriptions

thereof as characterizations of the actual state of facts or

condition of Pfizer, Purchaser or Medivation. Moreover, information

concerning the subject matter of the representations and warranties

may change after the date of the Merger Agreement, which subsequent

information may or may not be fully reflected in Pfizer's or

Medivation's public disclosures.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/78003/000119312516686937/d57934d8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/78003/000119312516686937/0001193125-16-686937-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

August 22, 2016 08:27 ET (12:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

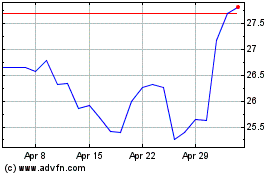

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

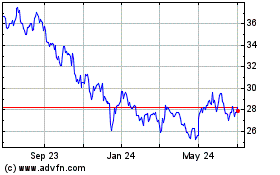

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024