Teva, Allergan Get FTC Approval for Generics Purchase

July 27 2016 - 4:00PM

Dow Jones News

Teva Pharmaceutical Industries Ltd. on Wednesday won regulatory

approval from the Federal Trade Commission for its acquisition of

Allergan PLC's generics business, conditioned upon Teva's

divestiture of 75 drugs to rivals.

The FTC said the order will preserve competition in markets

where Teva and Allergan currently compete or would have likely

competed if not for the merger. The companies said the

cash-and-stock acquisition—which was valued at $40.5 billion when

it was announced—is expected to close next week now that regulatory

hurdles have been cleared.

The drugs to be shed span Teva's business, ranging from

treatments for cancer and Parkinson's disease to antibiotics and

anesthetics. Acquirers include India's Dr. Reddy's Laboratories

Ltd., Impax Laboratories Inc. and Perrigo Pharma International.

Some of the divesting is already under way. In its yearlong bid

to win regulators' blessing, Teva las month said it would sell 15

drugs to Impax for $586 million and eight drugs to Dr. Reddy's for

$350 million.

Teva and Allergan struck the merger deal last July, a pact that

pushes Isreal-based Teva into the top ranks of global drug

companies, giving it bigger scale in the hotly competitive

generic-drug market. Before the deal, Teva had been pursuing a

tie-up with rival Mylan NV, which itself unsuccessfully chased

generics maker Perrigo Co.

Allergan, for its part, had agreed to a separate deal by which

Pfizer would buy the rest of the company for $150 billion, but that

deal fell apart after the U.S. imposed tough new curbs on corporate

deals that would move headquarters overseas for tax purposes.

The generics deal will give Allergan cash to pay down its debt

and the ability to focus on the more profitable name-brand drugs.

Actavis was renamed Allergan last year, after striking deals that

gave it drugs such as the wrinkle fighter Botox.

Teva said in March that sealing the deal was taking longer than

it anticipated because of regulatory hurdles. The company had

earlier said it expected to close the transaction as early as the

end of the first quarter.

Analysts had said the FTC was the bottleneck, with that

regulator waiting for input from the U.S. Food and Drug

Administration on pipeline divestitures.

Shares of Teva, which said it sees the deal adding 14% to

adjusted earnings in 2017, rose 0.8% in afternoon trading

Wednesday. Allergan shares, meanwhile, gained 2.7%.

Ezequiel Minaya contributed to this article

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 27, 2016 15:45 ET (19:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

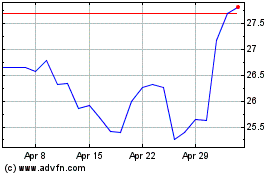

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

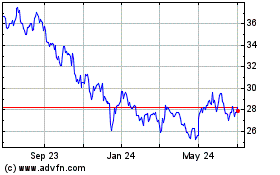

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024