Pfizer Cleared to Buy Nanotech Drug Firm Bind Therapeutics

July 27 2016 - 1:25PM

Dow Jones News

By Peg Brickley

Pfizer Inc. won bankruptcy-court approval Wednesday to buy the

assets of Bind Therapeutics after an auction doubled Pfizer's

starting offer, for a final price of $40 million.

The results mean estimated profits of $22.5 million to be

divided among Bind shareholders, company lawyer Peter Gilhuly said

at the Wednesday court hearing when the sale was approved.

"To call this a success would be an understatement," said Judge

Brendan Shannon of the U.S. Bankruptcy Court in Wilmington,

Del.

When Bind filed for chapter 11 protection on May 1, it had

limited funds and time to find a buyer for its business. The sale

price means the business, which develops drug treatments that use

nanoparticles to treat cancer, will continue in Pfizer's hands. The

deal also enables Bind to pay its bills and will allow shareholders

to walk away with some cash.

"We will pay every creditor in full, and we will have a

substantial distribution," Mr. Gilhuly said.

Bind's shareholders include Koch Industries Inc.'s David Koch,

Polaris Partners, and company co-founder Robert S. Langer Jr., who

is a David H. Koch Institute professor at the Massachusetts

Institute of Technology.

Pfizer was up against international competition at the

bankruptcy auction, which stretched over a period of days.

Japan's NanoCarrier Co. Ltd. stepped up first, topping Pfizer's

opening offer. Like Bind, NanoCarrier grew out of university

research in the use of nanoparticle technology to treat cancer,

according to its website. NanoCarrier was designated the backup

bidder for Bind, and will complete a deal if Pfizer fails to

close.

Pfizer expects to close the transaction Monday, said Thomas

Califano, a lawyer for Pfizer.

Germany's MagForce AG also entered the competition for Bind's

operation, Mr. Gilhuly said. MagForce claims bragging rights as the

"first and only nanotechnology-based therapy" with European

regulatory approval for the treatment of brain tumors.

Based in Cambridge, Mass., Bind was founded in 2007 by

Massachusetts Institute of Technology and Harvard Medical School

professors. It filed for bankruptcy protection after the company

received a notice of default from lender Hercules Technology III LP

demanding immediate payment of $14.5 million on a loan.

--Patrick Fitzgerald and Jacqueline Palank contributed to this

article.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

July 27, 2016 13:10 ET (17:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

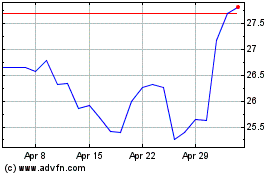

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

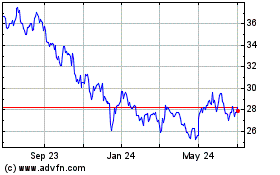

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024