Pfizer, Allergan to Hunt for Deals of Their Own

April 06 2016 - 8:11PM

Dow Jones News

By Jonathan D. Rockoff

Now that their $150 billion deal with each other is over, Pfizer

Inc. and Allergan PLC will look to do deals of their own.

Pfizer must still find acquisitions to boost its revenue and

growth, according to a person familiar with the matter. But the

company has given up on doing another tax-inversion transaction,

given the Treasury Department's clear opposition, according to the

person.

Allergan CEO Brent Saunders struck a similar note, saying the

company could do its own deal at any time to add to its pipeline or

portfolio.

"We could act immediately if we saw the right opportunity with

the right growth profile and the right strategic logic," he said in

an interview.

Each company was seeking to quickly move past the planned

combination Wednesday, after announcing they were abandoning the

deal in the wake of new Treasury Department rules designed to deter

so-called inversions like theirs, which garner lower tax rates by

moving tax headquarters overseas.

Pfizer's decision to walk away marked the biggest withdrawal

ever from a deal, according to Dealogic. Under the terms, Pfizer

will pay $150 million to reimburse Allergan for transaction-related

expenses.

By hooking up with Dublin-based Allergan, Pfizer would have not

only benefited from lower tax rates. The tie-up would have also

added Botox and other fast-growing Allergan products to Pfizer's

modestly rising sales. Such a boost would have accelerated Pfizer's

growth, and might have paved the way for Pfizer to set loose its

slower-growing but cash-generating "established products" business

selling older drugs.

Now, Pfizer must find a new way to put its new-drugs business on

firmer ground if it is to go independent, some analysts say.

After a $16 billion takeover of Hospira solidified Pfizer's

established-products business, "Pfizer probably has critical mass

to transform" that into an independent company, but the company's

patent-protected-drugs side may need "additional assets acquired

from outside," Evercore ISI analyst Mark Schoenebaum said in a note

to investors.

Pfizer moved up the deadline for deciding whether to shed the

older-drugs business to the end of this year, the company said in a

statement.

Pfizer has "the financial strength and flexibility to pursue

attractive business development and other shareholder-friendly

capital allocation opportunities," CEO Ian Read said in the

statement.

In an internal company email, Mr. Read told employees that

Pfizer "knew there would be risks," and even though it had to

abandon the combination "based on the actions taken" by the

Treasury Department, it would benefit from pre-integration efforts

to simplify the company's structure and strengthen its commercial

operations.

Allergan sales are growing by double-digit percentages, in part

because of Botox's increasing appeal for antiwrinkle use and

mounting treatment of medical conditions like chronic migraines and

overactive bladders. Executives also see strong sales potential

from new products, such as the antipsychotic Vraylar, which the

company is launching this week.

Executives also tout strong commercial potential in several

Allergan drugs in late-stage development, though analysts see some

threats to key products like the Restasis dry-eye drug.

The deal would have allowed Allergan to take advantage of

Pfizer's extensive operations outside the U.S., which the company

said could have provided a sizable sales boost. Now, Allergan will

have to build out its overseas business on its own.

After agreeing to a merger last November, Pfizer and Allergan

had said they structured their combination to fit within U.S. tax

law and federal tax regulations. The Treasury Department rules,

issued Monday and effective immediately, added a new wrinkle: They

took aim at tax inversions involving companies like Allergan, which

has grown through several acquisitions over the past several

years.

Yet, many Allergan employees welcomed the deal's cancellation,

because it would mean an end to the disruption and uncertainty that

accompanies being acquired, Mr. Saunders said. "This is a very easy

pivot for us," he said.

In a call with senior management, Mr. Saunders acknowledged the

distraction, and anxiety triggered by the prospective combination

but said its termination wouldn't mean an end to change at

Allergan.

"We have to be willing to work in an environment where the

unexpected is expected," Mr. Saunders said.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

April 06, 2016 19:56 ET (23:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

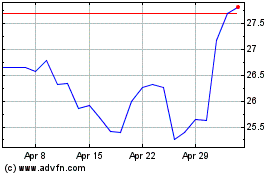

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

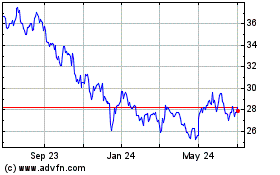

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024