Pfizer Beats Expectations, but Guidance Disappoints

February 02 2016 - 8:20AM

Dow Jones News

Pfizer Inc. on Tuesday reported better-than-expected results for

its fourth quarter thanks to last year's acquisition of Hospira

Inc. and strong sales of new drugs, but the pharmaceutical giant

offered soft guidance for 2016.

Pfizer, which struck a $155 billion deal in November to combine

with Allergan PLC, said it expects to earn $2.20 to $2.30 a share

this year, excluding special items. Analysts polled by Thomson

Reuters had forecast $2.36 a share in earnings.

The company forecast $49 billion to $51 billion in revenue,

while analysts were expecting $52.49 billion in revenue. Pfizer

said it expects heightened competition from generic drugs to cut

$2.3 billion from full-year revenue, while a stronger U.S. dollar

is expected to shave another $2.3 billion from the top line.

The guidance excludes any impact from its inversion deal with

Allergan, which would move Pfizer's headquarters to Ireland, where

the tax rate is lower. The deal would also create the world's

biggest drugmaker by sales. The deal is expected to close in the

second half of 2016.

The disappointing guidance comes as Pfizer reported a return to

core revenue growth for the first time since it began to lose

exclusivity for many of its drugs. Pfizer's stand-alone revenues

grew 5% in the fourth quarter and 3% for the full-year.

For the fourth quarter ended Dec. 31, new drugs such as Prevnar

pneumonia vaccines, cancer drug Ibrance and blood-thinner Eliquis

helped drive a 15% increase in innovative product sales, or a 22%

increase when backing out the impact of foreign exchange rates.

In September, Pfizer bought Hospira Inc. in a $16 billion deal

that has made the company a leading player in the growing market

for lower-priced versions of costly biotech drugs. Pfizer, like

many of its peers, has faced a string of patent expirations over

recent years as well as growing generic competition for former

blockbusters like cholesterol fighter Lipitor and pain pill

Celebrex.

Sales slipped 2.2% in the established drug business, but were up

5% excluding currency impacts, mostly due to the inclusion of

Hospira's results. That offset the impact of losing exclusivity for

Celebrex in the U.S. and Lyrica in certain developed Europe

markets.

In all, Pfizer reported a profit of $613 million, or 10 cents a

share, down from $1.23 billion, or 19 cents a share a year

earlier.

The quarter included several special items, including a $878

million foreign currency loss related to Venezuela and a $491

million pension settlement charge.

Excluding those and other special items, adjusted earnings were

53 cents a share. Analysts polled by Thomson Reuters had forecast

adjusted earnings of 52 cents a share.

Revenue rose 7.1% to $14.05 billion. Analysts had forecast

$13.56 billion in revenue.

Shares of Pfizer declined 0.5% premarket to $30.02.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 02, 2016 08:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

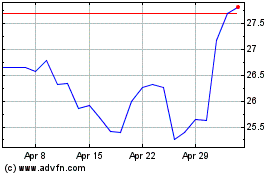

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

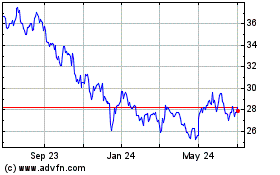

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024