Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: Allergan plc

Subject Company:

Pfizer Inc.

Commission File Number: 001-03619

Date: November 25, 2015

BRENT SAUNDERS VIDEO PRESENTATION

|

|

|

| “TruTranscripts, The Transcription Experts” (212-686-0088) |

|

1

|

Brent Saunders Video Presentation

Allergan

ALTERED IMAGE

(Music)

BS: Hello, everyone.

I’d like to talk a little bit about what we have created at Allergan over the last few years. We have created a bold pharmaceutical company, a leader in growth pharma, an exceptional company. And we’ve done this through taking many bold

actions, through incredibly hard work and through the dedication of thousands of employees around the world. We have a company that is the envy of our industry. And the reason for that is we are bold, we are action-oriented, we have deep

capabilities. We have customer centricity. And we have a commitment to innovation and open science, unlike any other company in our industry.

But we have done that through taking bold and decisive actions and transforming ourselves through combinations with other companies and other

cultures. Today, we are announcing just yet another chapter. We had been in discussions with Pfizer for a few weeks. Throughout that, we have been looking at how do we best position our colleagues, our shareholders and our patients and customers.

And what we have determined is that by bringing Allergan and Pfizer together, we can create a much stronger environment for all of our constituents. We believe there’ll be tremendous opportunities for our colleagues in this new, stronger

combination, new opportunities for us to invest in innovation in all of our therapeutic areas. And new opportunities to enhance our capabilities to deliver products and services to our customers.

So we believe that this combination will really create a powerhouse, so this is a really big deal. It’s big in dollars; almost $160

billion of value our employees have created for shareholders. It is big in terms of numbers; the combined company will have close to $70 billion in sales. It’s big in terms of geographies; we will double our geographic footprint around the

world. And it’s big in terms of pipeline; we will more than double our pipeline. And so when we look at what this deal creates, it is really leveraging the capabilities of both firms, of both companies. And that can create an exciting wealth of

opportunities for everyone involved.

So I know many of you may be thinking: we don’t want to be Big Pharma. And yes, this

combination does create a very large pharmaceutical company. But I think what makes companies quote unquote ‘Big Pharma,’ is culture. And when we think about our culture, our bias for action, our ability to build bridges, to act boldly, to

name a few key attributes, those things will survive in this new combination. And over the last few years, under Ian Read’s leadership, Pfizer has done a tremendous job in remaking their company. And so when you look at the culture that Ian has

been building at Pfizer, it is centered around a theme of ‘own it.’ Of frank discussion, of being able to cut through the bureaucracy and make decisions.

And so there are many attributes of the Pfizer culture that are common to those of Allergan, and we will look to build on those. There are

some areas that are different, and we’ll look to take the best of both and make a stronger combined company. And I am so excited to be joining the leadership team of the combined company, as president and chief operating officer, as well as

serving on the Board of Directors along with Paul Bisaro and two other directors from Allergan to be named later. I also believe that you’ll see many familiar faces in the Pfizer leadership team as we sort through all the announcements and

decisions in the coming months.

So as we look at this combination, it always brings the question: what about me? And I know many of you

are thinking that today, and over the coming months. What I can tell you today is this deal is not about cost synergies. This deal is about creating the most exciting and dynamic pharmaceutical company in our industry. This deal is about expanding

our geographic footprint. This deal is about our commitment to innovation. Of course there will be some overlap. But the vast majority of our colleagues are expected to join the new combination.

BRENT SAUNDERS VIDEO PRESENTATION

|

|

|

| “TruTranscripts, The Transcription Experts” (212-686-0088) |

|

2

|

As we announce this deal today, we will be moving rapidly into the pre-integration phase

until the deal closes. We are going to appoint Bob Stewart, with support from Sanjiv Patel and the Integration Team, to lead the pre-integration on our side. He will be working very closely with Frank D’Amelio and other senior colleagues from

Pfizer to make sure the pre-integration period is seamless. This agreement has no impact on our plan to divest our generics business to Teva. We are working hard with Teva to accomplish this divestiture, and our pre-integration teams have been doing

a fantastic job.

So I know as everyone absorbs this news today, it may cause some distraction, and I understand that. But what we need

all of our colleagues around the world to do is to continue to focus on what they do best: delivering results. Stay focused on our customers, stay focused on delivering our pipeline, stay focused on making our products. That’s how you will win

and that’s how we will win. Let’s continue our winning formula together.

(Music)

(END OF TAPE)

NO OFFER OR SOLICITATION

This communication is not

intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall

there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

This communication is not intended to be

and is not a prospectus for the purposes of Part 23 of the Companies Act 2014 of Ireland (the “2014 Act”), Prospectus (Directive 2003/71/EC) Regulations 2005 (S.I. No. 324 of 2005) of Ireland (as amended from time to time) or the

Prospectus Rules issued by the Central Bank of Ireland pursuant to section 1363 of the 2014 Act, and the Central Bank of Ireland (“CBI”) has not approved this communication.

IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC

In connection with the proposed transaction between Pfizer Inc. (“Pfizer”) and Allergan plc (“Allergan”), Allergan will file with the U.S.

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a Joint Proxy Statement of Pfizer and Allergan that also constitutes a Prospectus of Allergan (the “Joint Proxy

Statement/Prospectus”). Pfizer and Allergan plan to mail to their respective shareholders the definitive Joint Proxy Statement/Prospectus in connection with the transaction. INVESTORS AND SECURITY HOLDERS OF PFIZER AND ALLERGAN ARE URGED TO

READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PFIZER, ALLERGAN, THE TRANSACTION AND RELATED

MATTERS. Investors and security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Pfizer and Allergan through the website maintained by the SEC at

www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the documents filed with the SEC by Pfizer by contacting Pfizer Investor Relations at Bryan.Dunn@pfizer.com or by calling (212) 733-8917, and will be

able to obtain free copies of the documents filed with the SEC by Allergan by contacting Allergan Investor Relations at investor.relations@actavis.com or by calling (862) 261-7488.

PARTICIPANTS IN THE SOLICITATION

Pfizer, Allergan and

certain of their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of the respective shareholders of Pfizer and Allergan in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, will be

set forth in the Joint Proxy Statement/Prospectus when it is filed with the SEC. Information regarding Pfizer’s directors and executive officers is contained in Pfizer’s proxy statement for its 2015 annual meeting of stockholders, which

was filed with the SEC on March 12, 2015, and certain of Pfizer’s Current Reports on Form 8-K. Information regarding Allergan’s directors and executive officers is contained in Allergan’s proxy statement for its 2015 annual

meeting of shareholders, which was filed with the SEC on April 24, 2015, and certain of Allergan’s Current Reports on Form 8-K.

Allergan Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this communication that refer to Allergan’s anticipated future events, estimated or anticipated future results, or other

non-historical facts are forward-looking statements that reflect Allergan’s current perspective of existing trends and information as of the date of this communication. Forward-looking statements generally will be accompanied by words such as

such as “anticipate”, “target”, “possible”, potential”, “predict”, “project”, “forecast”, “out-look”, “guidance”, “expect”, “estimate”,

“intend”, “plan”, “goal”, “believe”, “hope”, “aim”, “continue”, “will”, “may”, “might”, “would”, “could” or “should” or

other similar words, phrases or expressions or the negatives thereof. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed transaction, including future financial and operating results and

synergies, Pfizer’s, Allergan’s and the combined company’s plans, objectives, expectations and intentions, and the expected timing of completion of the transaction. It is important to note that Allergan’s goals and expectations

are not predictions of actual performance. Actual results may differ materially from Allergan’s current expectations depending upon a number of factors affecting Allergan’s business, Pfizer’s business and risks associated with

business combination transactions. These factors include, among others, the inherent uncertainty associated with financial projections; restructuring in connection with, and successful closing of, the proposed transaction; subsequent integration of

Pfizer and Allergan and the ability to recognize the anticipated synergies and benefits of the proposed transaction; the ability to obtain required regulatory approvals for the transaction (including the approval of antitrust authorities necessary

to complete the transaction), the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the

ability to obtain the requisite Pfizer and Allergan shareholder approvals; the risk that a condition to closing of the proposed trans-action may not be satisfied on a timely basis or at all; the failure of the proposed transaction to close for any

other reason; risksrelating to the value of the Allergan shares to be issued in the transaction; the anticipated size of the markets and continued demand for Pfizer’s and Allergan’s products; the difficulty of predicting the timing or

outcome of FDA approvals or actions, if any; the impact of competitive products and pricing; market acceptance of and continued demand for Allergan’s and Pfizer’s products; difficulties or delays in manufacturing; the risks of fluctuations

in foreign currency exchange rates; the risks and uncertainties normally incident to the pharmaceutical industry, including product liability claims and the availability of product liability insurance on reasonable terms; the difficulty of

predicting the timing or outcome of pending or future litigation or government investigations; periodic dependence on a small number of products for a material source of net revenue or income; variability of trade buying patterns; changes in

generally accepted accounting principles; risks that the carrying values of assets may be negatively impacted by future events and circumstances; the timing and success of product launches; costs and efforts to defend or enforce intellectual

property rights; the availability and pricing of third party sourced products and materials; successful compliance with governmental regulations applicable to Allergan’s and Pfizer’s facilities, products and/or businesses; changes in the

laws and regulations affecting, among other things, pricing and reimbursement of pharmaceutical products; risks associated with tax liabilities, or changes in U.S. federal or international tax laws or interpretations to which they are subject,

including the risk that the Internal Revenue Service disagrees that Allergan is a foreign corporation for U.S. federal tax purposes; the loss of key senior management or scientific staff; and such other risks and uncertainties detailed in

Allergan’s periodic public filings with the Securities and Exchange Commission, including but not limited to Allergan’s Annual Report on Form 10-K for the year ended December 31, 2014, Quarterly Report on Form 10-Q for the quarterly

period ended June 30, 2015, Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2015, and from time to time in Allergan’s other investor communications. Except as expressly required by law, Allergan disclaims

any intent or obligation to update these forward-looking statements.

Applicability of the Irish Takeover Rules

As the transaction constitutes a “reverse takeover transaction” for the purposes of the Irish Takeover Panel Act, 1997, Takeover Rules, 2013, (the

“Irish Takeover Rules”), Allergan is no longer in an offer period and therefore Rule 8 of the Irish Takeover Rules does not apply to the transaction from the date of the announcement of the transaction and therefore there is no longer a

requirement to make dealing disclosures pursuant to Rule 8.

Statement Required by the Irish Takeover Rules

The directors of Pfizer accept responsibility for the information contained on this website other than that relating to Allergan and the Allergan group of

companies and the directors of Allergan and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Pfizer (who have taken all reasonable care to ensure that

such is the case), the information contained on this website for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

The directors of Allergan accept responsibility for the information contained on this website relating to Allergan and the directors of Allergan and members of

their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Allergan (who have taken all reasonable care to ensure such is the case), the information contained on this website

for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

3

Goldman Sachs International, which is authorized by the Prudential Regulation Authority and regulated by the

Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom, and its affiliate, Goldman, Sachs & Co, are acting as joint financial adviser to Pfizer and no one else in connection with the proposed transaction.

In connection with the pro-posed transaction, Goldman Sachs International and Goldman, Sachs & Co, their affiliates and their respective partners, directors, officers, employees and agents will not regard any other per-son as their client,

nor will they be responsible to anyone other than Pfizer for providing the protections afforded to their clients or for giving advice in connection with the proposed transaction or any other matter referred to in this announcement.

Guggenheim Securities, LLC is a broker dealer registered with the United States Securities and Exchange Commission and is acting as financial advisor to

Pfizer and no one else in connection with the proposed transaction. In connection with the proposed transaction, Guggenheim Securities, LLC, its affiliates and related entities and its and their respective partners, directors, officers, employees

and agents will not regard any other person as their client, nor will they be responsible to anyone other than Pfizer for providing the protections afforded to their clients or for giving advice in connection with the proposed transaction or any

other matter referred to in this announcement.

J.P. Morgan Limited (which conducts its UK investment banking business as J.P. Morgan Cazenove)

(“J.P. Morgan”), which is authorised and regulated in the United Kingdom by the Financial Conduct Authority, is acting as financial adviser exclusively for Allergan and no one else in connection with the matters set out in this

announcement and will not regard any other person as its client in relation to the matters in this announcement and will not be responsible to anyone other than Allergan for providing the protections afforded to clients of J.P. Morgan or its

affiliates, nor for providing advice in relation to any matter referred to herein.

Morgan Stanley & Co. LLC acting through its affiliate, Morgan

Stanley & Co. International plc, is financial advisor to Allergan and no one else in connection with the matters referred to in this announcement. In connection with such matters, Morgan Stanley & Co. LLC, Morgan Stanley &

Co. International plc, each of their affiliates and each of their and their affiliates’ respective directors, officers, employees and agents will not regard any other person as their client, nor will they be responsible to any other person

other than Allergan for providing the protections afforded to their clients or for providing advice in connection with the contents of this announcement or any other matter referred to herein.

Unless otherwise defined, capitalised terms used in this Statement Required by the Irish Takeover Rules shall have the meaning given to them in the

transaction-related press release issued by Pfizer and Allergan on November 23, 2015.

4

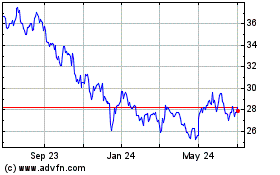

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

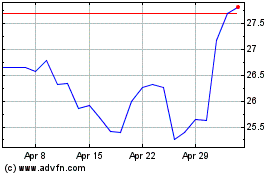

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024