Q4 Revenue and EPS Exceeded Guidance

Verifone (NYSE:PAY), a world leader in payments and commerce

solutions, today announced financial results for the three months

and fiscal year ended October 31, 2016.

Fiscal Year Financial Highlights

- GAAP net revenues of $1.992 billion and

Non-GAAP net revenues of $2.006 billion

- GAAP net loss per diluted share of

$0.08

- Non-GAAP net income per diluted share

of $1.66

- Operating cash flow of $194

million

Fourth Quarter Financial Highlights

- GAAP net revenues of $464 million and

Non-GAAP net revenues of $468 million

- GAAP net loss per diluted share of

$0.04

- Non-GAAP net income per diluted share

of $0.30

- Operating cash flow of $67 million

“Our fourth quarter results were better than our outlook on both

the top and bottom line. Total revenues were consistent with our

expectations of EMV-related demand in the U.S., we reported 16%

growth in Services revenues from both acquisitions and organic

business, and we saw good growth in EMEA and Latin America as a

result of several important competitive wins," said Paul Galant,

Chief Executive Officer of Verifone. “There is significant

opportunity ahead for our business as we move through the many cash

to cashless migrations that are happening across the globe, and I

am looking forward to addressing our customers’ evolving needs with

our newest device platform as we launch pilots, obtain

certifications and begin generating more meaningful sales volumes

in 2017.”

(UNAUDITED, IN MILLIONS,

EXCEPT PER SHARE AND PERCENTAGES)

Three Months Ended

October 31, Years Ended October 31, 2016

2015 Change (1) 2016 2015 Change

(1) GAAP: Net revenues $ 464

$ 514 (9.7 )% $ 1,992

$ 2,000 (0.4 )% Gross margin as a %

of net revenues 38.2 % 42.1 %

(3.9

) pts

39.9 % 41.3 %

(1.4

) pts

Net income (loss) per diluted share $ (0.04

) $ 0.33 nm $ (0.08

) $ 0.68 nm

Non-GAAP (2): Net revenues $ 468 $ 514 (9.1 )% $ 2,006 $ 2,001 0.2

% Gross margin as a % of net revenues 39.5 % 43.4 %

(3.9

) pts

41.8 % 42.6 %

(0.8

) pts

Net income per diluted share $ 0.30 $ 0.49 (38.8 )% $ 1.66 $ 1.83

(9.3 )% (1) "nm" means not meaningful. (2) Reconciliations

for the Non-GAAP measures are provided at the end of this press

release.

Fiscal 2017 and First Quarter 2017 Outlook

Guidance for the full fiscal year 2017 is as follows:

- GAAP net revenues of approximately

$1.895 billion to $1.910 billion

- Non-GAAP net revenues of approximately

$1.900 billion to $1.915 billion

- GAAP net income per diluted share of

approximately $0.37 to $0.41

- Non-GAAP net income per diluted share

of $1.35 to $1.39

Guidance for the first fiscal quarter of 2017 is as follows:

- GAAP net revenues of approximately $446

million

- Non-GAAP net revenues of approximately

$450 million

- GAAP net loss per diluted share of

approximately $0.08

- Non-GAAP net income per diluted share

of $0.20

Conference Call

Verifone will hold its earnings conference call today, December

12, 2016, at 1:30 p.m. (PT) / 4:30 p.m. (ET). To listen to the call

and view the slides, visit Verifone’s website

http://ir.verifone.com. The recorded audio webcast will be

available on Verifone's website until January 12, 2017.

About Verifone

Verifone is transforming everyday transactions into

opportunities for connected commerce. We’re connecting payment

devices to the cloud, merging the online and in-store shopping

experience and creating the next generation of digital engagement

between merchants and consumers. We are built on a 30-year history

of uncompromised security with approximately 29 million devices and

terminals deployed worldwide. Our people are known as trusted

experts that work with our clients and partners, helping to solve

their most complex payments challenges. We have clients and

partners in more than 150 countries, including the world’s

best-known retail brands, financial institutions and payment

providers.

Verifone.com | (NYSE:PAY) | @verifone

Additional Resources:

http://ir.verifone.com

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations or beliefs and on currently available competitive,

financial and economic data and are subject to uncertainty and

changes in circumstances. Actual results may vary materially from

those expressed or implied by the forward-looking statements herein

due to changes in economic, business, competitive, technological,

and/or regulatory factors, and other risks and uncertainties

affecting the operation of the business of VeriFone Systems, Inc.,

including many factors beyond our control. These risks and

uncertainties include, but are not limited to, those associated

with: execution of our strategic plan and business and operational

initiatives, including whether the expected benefits of our plan

and initiatives are achieved within expected timeframes or at all,

short product cycles and rapidly changing technologies, our ability

to maintain competitive leadership position with respect to our

payment solution offerings, our dependence on a limited number of

customers, the pace of EMV adoption in the United States, the

conduct of our business and operations internationally, including

the complexity of compliance with international laws and

regulations and risks related to adverse regulatory actions,

including tax-related audits and assessments, our ability to

protect our computer systems and networks from fraud, cyber-attacks

or security breaches, our assumptions, judgments and estimates

regarding the impact on our business of political instability in

markets where we conduct business, uncertainty in the global

economic environment and financial markets, the status of our

relationships with and condition of third parties such as our

contract manufacturers, key customers, distributors and key

suppliers upon whom we rely in the conduct of our business, our

ability to effectively integrate the businesses we acquire and to

achieve the expected benefits of such acquisitions, our ability to

effectively hedge our exposure to foreign currency exchange rate

fluctuations, successful execution of our restructuring plans,

including whether the expected benefits of restructuring plans are

achieved within expected timeframes or at all, and our dependence

on a limited number of key employees. For a further list and

description of the risks and uncertainties affecting the operations

of our business, see our filings with the Securities and Exchange

Commission, including our annual report on Form 10-K and our

quarterly reports on Form 10-Q. The forward-looking statements

speak only as of the date such statements are made. Verifone is

under no obligation to, and expressly disclaims any obligation to,

update or alter its forward-looking statements, whether as a result

of new information, future events, changes in assumptions or

otherwise.

VERIFONE SYSTEMS,

INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE DATA AND

PERCENTAGES) Three Months Ended October 31,

Fiscal Years Ended October 31, 2016 2015 %

Change (1) 2016 2015 % Change (1) Net

revenues: Systems $ 264.3 $ 338.9 (22.0 )% $ 1,236.3 $ 1,309.6

(5.6 )% Services 199.9 175.2 14.1 %

755.8 690.9 9.4 % Total net revenues

464.2 514.1 (9.7 )% 1,992.1

2,000.5 (0.4 )%

Cost of net

revenues: Systems 173.3 197.9 (12.4 )% 744.3 773.8 (3.8 )%

Services 113.4 99.8 13.6 % 453.5

400.7 13.2 % Total cost of net revenues

286.7 297.7 (3.7 )% 1,197.8

1,174.5 2.0 %

Total gross margin

177.5 216.4 (18.0 )% 794.3

826.0 (3.8 )%

Operating expenses:

Research and development 49.4 51.0 (3.1 )% 207.5 198.2 4.7 % Sales

and marketing 49.8 57.2 (12.9 )% 217.0 224.7 (3.4 )% General and

administrative 47.5 53.6 (11.4 )% 204.6 204.0 0.3 % Restructuring

and related charges 7.1 1.2 nm 41.2 8.4 nm Litigation settlement

and loss contingency expense — — nm 0.7 1.2 nm Amortization of

purchased intangible assets 24.6 19.6

25.5 % 90.5 82.5 9.7 % Total operating

expenses 178.4 182.6 (2.3 )%

761.5 719.0 5.9 %

Operating income

(loss) (0.9 ) 33.8 nm 32.8 107.0 nm Interest expense, net (8.7

) (7.9 ) 10.1 % (34.6 ) (31.5 ) 9.8 % Other income (expense), net

10.5 0.9 nm 3.6

(2.6 ) nm Income before income taxes 0.9 26.8 nm 1.8 72.9 nm Income

tax provision (benefit) 6.2 (11.7 ) nm

11.5 (7.5 ) nm

Consolidated net income (loss)

(5.3 ) 38.5 nm (9.7 ) 80.4 nm Net income (loss) attributable to

noncontrolling interests 0.8 (0.3 ) nm

0.4 (1.3 ) nm

Net income (loss) attributable to

VeriFone Systems, Inc. stockholders $ (4.5 ) $ 38.2 nm $

(9.3 ) $ 79.1 nm

Net income (loss) per share

attributable to VeriFone Systems, Inc. stockholders: Basic $

(0.04 ) $ 0.33 $ (0.08 ) $ 0.69 Diluted $ (0.04 ) $

0.33 $ (0.08 ) $ 0.68

Weighted average

number of shares used in computing net income (loss) per share

attributable to VeriFone Systems, Inc. stockholders: Basic

111.1 114.4 110.8

114.0 Diluted 111.1 115.6

110.8 115.9 (1) "nm" means not

meaningful

VERIFONE SYSTEMS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED, IN

MILLIONS) October 31, 2016 2015

ASSETS Current assets: Cash and cash equivalents $ 148.4 $

208.9 Accounts receivable, net of allowances of $14.6 and $8.8,

respectively 323.4 362.0 Inventories 175.2 129.7 Prepaid expenses

and other current assets 110.4 81.7

Total current assets 757.4 782.3 Property and equipment, net

202.3 191.0 Purchased intangible assets, net 306.3 317.5 Goodwill

1,110.5 1,084.0 Deferred tax assets, net 37.0 35.9 Other long-term

assets 81.3 62.4

Total assets $

2,494.8 $ 2,473.1

LIABILITIES AND

EQUITY Current liabilities: Accounts payable $ 154.6 $ 189.4

Accruals and other current liabilities 213.4 229.9 Deferred

revenue, net 104.8 82.9 Short-term debt 66.0

39.1

Total current liabilities 538.8 541.3 Long-term

deferred revenue, net 66.5 55.3 Deferred tax liabilities, net 99.4

102.9 Long-term debt 859.9 760.2 Other long-term liabilities

76.8 78.9

Total liabilities 1,641.4

1,538.6 Redeemable noncontrolling interest in subsidiary 5.0

— Stockholders’ equity: Common stock 1.1 1.1 Additional

paid-in capital 1,771.9 1,726.5 Accumulated deficit (618.3 ) (535.7

) Accumulated other comprehensive loss (341.0 )

(292.3 )

Total VeriFone Systems, Inc. stockholders’ equity

813.7 899.6 Noncontrolling interests in subsidiaries 34.7

34.9

Total equity 848.4

934.5

Total liabilities, redeemable noncontrolling

interest in subsidiary and equity $ 2,494.8 $ 2,473.1

VERIFONE SYSTEMS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED, IN MILLIONS) Years Ended October

31, 2016 2015 Cash flows from operating

activities Consolidated net income (loss) $ (9.7 ) $ 80.4

Adjustments to reconcile consolidated net income (loss) to net cash

provided by operating activities: Depreciation and amortization,

net 179.2 169.4 Stock-based compensation expense 42.3 42.3 Deferred

income taxes, net (14.0 ) (31.6 ) Non-cash restructuring and

related charges 31.2 — Other (6.2 ) 13.0 Net

cash provided by operating activities before changes in operating

assets and liabilities 222.8 273.5

Changes in operating assets and liabilities: Accounts receivable,

net 59.6 (75.4 ) Inventories (45.7 ) (16.4 ) Prepaid expenses and

other assets 0.8 (16.9 ) Accounts payable (39.6 ) 41.2 Deferred

revenue, net 28.7 12.7 Other current and long-term liabilities

(32.9 ) 30.6 Net change in operating assets

and liabilities (29.1 ) (24.2 ) Net cash provided by

operating activities 193.7 249.3

Cash flows from investing activities Capital expenditures

(105.3 ) (106.4 ) Acquisition of businesses, net of cash and cash

equivalents acquired (172.2 ) (22.1 ) Other investing activities,

net 2.3 0.1 Net cash used in investing

activities (275.2 ) (128.4 )

Cash flows

from financing activities Proceeds from debt, net of issuance

costs 560.4 125.0 Repayments of debt (453.0 ) (198.3 ) Proceeds

from issuance of common stock through employee equity incentive

plans 5.1 13.2 Stock repurchases (79.9 ) (70.1 ) Other financing

activities, net (8.2 ) (3.4 ) Net cash provided by

(used in) financing activities 24.4 (133.6 )

Effect of foreign currency exchange rate changes on cash and

cash equivalents (3.4 ) (28.6 ) Net decrease

in cash and cash equivalents (60.5 ) (41.3 ) Cash and cash

equivalents, beginning of period 208.9 250.2

Cash and cash equivalents, end of period $ 148.4 $

208.9

VERIFONE SYSTEMS, INC. NET REVENUES

INFORMATION (UNAUDITED, IN MILLIONS, EXCEPT PERCENTAGES)

Three Months Ended Fiscal Years Ended

October 31, July 31, October 31, %

Change % Change October 31, October 31,

% Change

Note

2016 2016 2015 (1) SEQ (1)

YoY 2016 2015

(1)

GAAP net revenues: North America

$ 167.1

$ 191.5 $ 229.9 (12.7 )%

(27.3 )% $ 803.6 $ 791.7

1.5 % Latin America

68.3 55.1

62.8 24.0 % 8.8 % 247.9

275.7 (10.1 )% EMEA

180.8 190.0

164.1 (4.8 )% 10.2 %

738.3 696.4 6.0 % Asia-Pacific

48.0 51.5 57.3

(6.8 )% (16.2 )%

202.3 236.7 (14.5

)% Total

$ 464.2 $ 488.1

$ 514.1 (4.9 )%

(9.7 )% $ 1,992.1 $

2,000.5 (0.4 )% Systems

$

264.3 $ 292.1 $ 338.9

(9.5 )% (22.0 )% $

1,236.3 $ 1,309.6 (5.6 )%

Services

199.9 196.0

175.2 2.0 % 14.1 %

755.8 690.9 9.4

% Total

$ 464.2 $ 488.1

$ 514.1 (4.9 )%

(9.7 )% $ 1,992.1 $

2,000.5 (0.4 )% Non-GAAP net

revenues: (2) North America A $ 170.5 $ 196.0 $ 229.9 (13.0 )%

(25.8 )% $ 817.6 $ 791.8 3.3 % Latin America A 68.3 55.1 62.8 24.0

% 8.8 % 247.9 275.7 (10.1 )% EMEA A 180.8 190.0 164.2 (4.8 )% 10.1

% 738.3 697.2 5.9 % Asia-Pacific A 48.0 51.5

57.3 (6.8 )% (16.2 )% 202.3

236.8 (14.6 )% Total $ 467.6 $ 492.6 $

514.2 (5.1 )% (9.1 )% $ 2,006.1 $ 2,001.5 0.2

% Systems A $ 264.3 $ 292.1 $ 338.9 (9.5 )% (22.0 )% $

1,236.3 $ 1,309.6 (5.6 )% Services A 203.3

200.5 175.3 1.4 % 16.0 % 769.8

691.9 11.3 % Total $ 467.6 $ 492.6 $

514.2 (5.1 )% (9.1 )% $ 2,006.1 $ 2,001.5 0.2

%

GAAP net revenues $ 464.2 $

488.1 $ 514.1 (4.9 )%

(9.7 )% $ 1,992.1 $

2,000.5 (0.4 )% Plus: Non-GAAP net revenues

adjustments A 3.4 4.5 0.1

nm nm 14.0 1.0 nm

Non-GAAP net

revenues (2) 467.6 492.6 $ 514.2 (5.1 )% (9.1 )% 2,006.1 $

2,001.5 0.2 % Net revenues from businesses acquired in the past 12

months B (20.9 ) (22.8 ) (0.9 ) nm nm

(73.5 ) (1.2 ) nm

Non-GAAP organic net revenues (2) $

446.7 $ 469.8 $ 513.3 (4.9 )% (13.0 )% $

1,932.6 $ 2,000.3 (3.4 )% (1) "nm" means not

meaningful. (2) Reconciliations for the non-GAAP measures are

provided at the end of this press release.

For three months ended October 31,

2016, compared with three months ended October 31, 2015

For fiscal year ended October 31, 2016,

compared with fiscal year ended October 31, 2015

Net revenues growth (decline) Impact due to acquired

businesses (A) (B)

Non-GAAP organic net revenues growth

(decline) Impact due to foreign currency (C)

Non-GAAP

organic net revenues at constant currency growth (decline)

Net revenues growth (decline) Impact due to acquired

businesses (A) (B)

Non-GAAP organic net revenues growth

(decline) Impact due to foreign currency (C)

Non-GAAP

organic net revenues at constant currency growth (decline)

North America

(27.3 )% 1.3 pts (28.6 )% 0.0 pts (28.6

)%

1.5 % 1.0 pts 0.5 % (0.1 )pts 0.6 % Latin America

8.8 % 0.1 pts 8.7 % 1.4 pts 7.3 %

(10.1

)% 0.0 pts (10.1 )% (12.6 )pts 2.5 % EMEA

10.2

% 8.4 pts 1.8 % (2.4 )pts 4.2 %

6.0 % 7.3 pts

(1.3 )% (4.6 )pts 3.3 % Asia-Pacific

(16.2 )% 0.1 pts

(16.3 )% 2.2 pts (18.5 )%

(14.5 )% 0.1 pts (14.6 )%

(4.3 )pts (10.3 )% Total

(9.7 )% 3.3 pts (13.0 )%

(0.4 )pts (12.6 )%

(0.4 )% 3.0 pts (3.4 )% (3.9 )pts

0.5 %

Non-GAAP Reconciliations

VERIFONE

SYSTEMS, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED, IN MILLIONS, EXCEPT PER SHARE

AMOUNTS) GAAP net revenues Amortization of

step-down in deferred revenue at acquisition Non-GAAP net

revenues Net revenues from businesses acquired in the past

12 months Non-GAAP organic net revenues Constant

currency adjustment Non-GAAP organic net revenues at

constant currency Note (A) (A) (B)

(B) (C) (C) Three Months Ended

October 31, 2016 North America

$ 167.1 $ 3.4 $

170.5 $ (6.6 ) $ 163.9 $ — $ 163.9 Latin America

68.3 — 68.3

— 68.3 (0.9 ) 67.4 EMEA

180.8 — 180.8 (14.3 ) 166.5 4.0

170.5 Asia-Pacific

48.0 — 48.0 —

48.0 (1.3 ) 46.7 Total

$

464.2 $ 3.4 $ 467.6 $ (20.9 ) $ 446.7 $ 1.8 $ 448.5

Systems

$ 264.3 $ — $ 264.3 $ (0.9 ) $ 263.4 $

1.8 $ 265.2 Services

199.9 3.4 203.3

(20.0 ) 183.3 — 183.3 Total

$ 464.2 $ 3.4 $ 467.6 $ (20.9 ) $ 446.7 $ 1.8

$ 448.5

Three Months Ended July 31, 2016 North

America

$ 191.5 $ 4.5 $ 196.0 $ (7.1 ) $ 188.9 Latin

America

55.1 — 55.1 — 55.1 EMEA

190.0 — 190.0 (15.7 )

174.3 Asia-Pacific

51.5 — 51.5 —

51.5 Total

$ 488.1 $ 4.5 $ 492.6 $

(22.8 ) $ 469.8 Systems

$ 292.1 $ — $ 292.1 $

(2.3 ) $ 289.8 Services

196.0 4.5 200.5

(20.5 ) 180.0 Total

$ 488.1 $ 4.5 $

492.6 $ (22.8 ) $ 469.8

Three Months Ended October 31,

2015 North America

$ 229.9 $ — $ 229.9 $ (0.3 ) $

229.6 Latin America

62.8 — 62.8 — 62.8 EMEA

164.1 0.1

164.2 (0.6 ) 163.6 Asia-Pacific

57.3 —

57.3 — 57.3 Total

$ 514.1 $ 0.1

$ 514.2 $ (0.9 ) $ 513.3 Systems

$ 338.9 $ — $

338.9 $ — $ 338.9 Services

175.2 0.1

175.3 (0.9 ) 174.4 Total

$ 514.1 $ 0.1

$ 514.2 $ (0.9 ) $ 513.3

VERIFONE SYSTEMS, INC. RECONCILIATIONS OF

NON-GAAP FINANCIAL MEASURES (UNAUDITED, IN MILLIONS)

GAAP net revenues Amortization of step-down in

deferred revenue at acquisition Non-GAAP net revenues

Net revenues from businesses acquired in the past 12 months

Non-GAAP organic net revenues Constant currency

adjustment Non-GAAP organic net revenues at constant

currency Note (A) (A) (B)

(B) (C) (C) Fiscal Year Ended

October 31, 2016 North America

$ 803.6 $ 14.0 $

817.6 $ (22.3 ) $ 795.3 $ 1.0 $ 796.3 Latin America

247.9 —

247.9 — 247.9 34.8 282.7 EMEA

738.3 — 738.3 (51.2 ) 687.1

31.8 718.9 Asia-Pacific

202.3 — 202.3

— 202.3 10.2 212.5 Total

$ 1,992.1 $ 14.0 $ 2,006.1 $ (73.5 ) $ 1,932.6 $ 77.8

$ 2,010.4 Systems

$ 1,236.3 $ — $ 1,236.3 $

(8.0 ) $ 1,228.3 $ 46.8 $ 1,275.1 Services

755.8

14.0 769.8 (65.5 ) 704.3 31.0

735.3 Total

$ 1,992.1 $ 14.0 $ 2,006.1 $ (73.5

) $ 1,932.6 $ 77.8 $ 2,010.4

Fiscal Year Ended October

31, 2015 North America

$ 791.7 $ 0.1 $ 791.8 $

(0.3 ) $ 791.5 Latin America

275.7 — 275.7 — 275.7 EMEA

696.4 0.8 697.2 (0.9 ) 696.3 Asia-Pacific

236.7 0.1 236.8 — 236.8

Total

$ 2,000.5 $ 1.0 $ 2,001.5 $ (1.2 ) $ 2,000.3

Systems

$ 1,309.6 $ — $ 1,309.6 $ — $ 1,309.6

Services

690.9 1.0 691.9 (1.2 )

690.7 Total

$ 2,000.5 $ 1.0 $ 2,001.5 $ (1.2 )

$ 2,000.3

VERIFONE SYSTEMS, INC. RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES (UNAUDITED, IN MILLIONS, EXCEPT PER SHARE

AMOUNTS AND PERCENTAGES)

Note

Net revenues Gross margin Gross margin

percentage Operating income (loss) Income tax

provision Net income (loss) attributable to VeriFone

Systems, Inc. stockholders Three Months Ended October

31, 2016 GAAP $ 464.2 $

177.5 38.2 % $ (0.9 )

$ 6.2 $ (4.5 ) Adjustments:

Amortization of step-down deferred services net revenues at

acquisition and associated costs of goods sold A 3.4 2.4 2.4 2.4

Amortization of purchased intangible assets D — 3.4 28.0 — 28.0

Other merger and acquisition related expenses D — — 0.8 — (11.7 )

Stock based compensation E — 0.8 9.4 — 9.4 Restructuring and

related charges F — — 7.1 — 7.1 Other charges and income F — 0.6

1.9 — 1.9 Income tax effect of non-GAAP exclusions G —

— — (0.5 ) 0.5 Non-GAAP $

467.6 $ 184.7 39.5 % $ 48.7 $ 5.7 $ 33.1

Weighted average number of shares used in computing net

income (loss) per share: Net income (loss) per share

attributable to VeriFone Systems, Inc. stockholders (1)

Basic Diluted Basic Diluted GAAP

111.1 111.1 $ (0.04 ) $

(0.04 ) Adjustment for diluted shares H —

0.3 Non-GAAP 111.1 111.4 $ 0.30 $ 0.30

Note

Net revenues Gross margin

Gross margin percentage Operating income

(loss) Income tax provision Net income

(loss) attributable to VeriFone Systems, Inc. stockholders

Three Months Ended July 31, 2016 GAAP $

488.1 $ 191.1 39.2 % $

(22.3 ) $ 0.3 $ (31.1

) Adjustments: Amortization of step-down deferred services

net revenues at acquisition and associated costs of goods sold A

4.5 3.1 3.1 — 3.1 Amortization of purchased intangible assets D —

3.9 28.2 — 28.2 Other merger and acquisition related expenses D — —

1.0 — (1.1 ) Stock based compensation E — 0.9 10.8 — 10.8

Restructuring and related charges F — 5.2 38.9 — 38.9 Other charges

and income F — 3.8 5.2 — 5.2 Income tax effect of non-GAAP

exclusions G — — — 7.7

(7.7 ) Non-GAAP $ 492.6 $ 208.0 42.2 % $ 64.9 $ 8.0

$ 46.3

Weighted average number of shares

used in computing net income (loss) per share: Net income

(loss) per share attributable to VeriFone Systems, Inc.

stockholders (1) Basic Diluted Basic

Diluted GAAP 110.7

110.7 $ (0.28 ) $ (0.28

) Adjustment for diluted shares H — 0.7

Non-GAAP 110.7 111.4 $ 0.42 $ 0.42

(1) Diluted net income (loss) per share is

calculated by dividing the Net income (loss) attributable to

VeriFone Systems, Inc. stockholders by the Weighted average number

of shares used in computing net income (loss) per share

attributable to VeriFone Systems, Inc. stockholders.

VERIFONE

SYSTEMS, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS

AND PERCENTAGES)

Note

Net revenues Gross margin Gross margin

percentage Operating income Income tax provision

(benefit) Net income attributable to VeriFone Systems, Inc.

stockholders Three Months Ended October 31, 2015

GAAP $ 514.1 $ 216.4 42.1

% $ 33.8 $ (11.7 )

$ 38.2 Adjustments: Amortization of step-down in

deferred services net revenues at acquisition A 0.1 0.1 0.1 — 0.1

Amortization of purchased intangible assets D — 4.5 24.1 — 24.1

Other merger and acquisition related expenses D — 0.3 1.1 — (1.8 )

Stock based compensation E — 1.0 10.0 — 10.0 Restructuring and

related charges F — 0.1 1.2 — 1.2 Other charges and income F — 0.8

5.7 — 5.7 Income tax effect of non-GAAP exclusions G —

— — 21.3 (21.3 ) Non-GAAP $

514.2 $ 223.2 43.4 % $ 76.0 $ 9.6 $ 56.2

Weighted average number of shares used in computing net income

per share: Net income per share attributable to VeriFone

Systems, Inc. stockholders (1) Basic Diluted

Basic Diluted GAAP 114.4

115.6 $ 0.33 $ 0.33

Non-GAAP 114.4 115.6 $ 0.49 $ 0.49

(1) Diluted net income (loss) per share is

calculated by dividing the Net income (loss) attributable to

VeriFone Systems, Inc. stockholders by the Weighted average number

of shares used in computing net income (loss) per share

attributable to VeriFone Systems, Inc. stockholders.

VERIFONE

SYSTEMS, INC. RECONCILIATIONS OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS

AND PERCENTAGES)

Note

Net revenues Gross margin Gross margin

percentage Operating income Income tax provision

Net income (loss) attributable to VeriFone Systems, Inc.

stockholder Fiscal Year Ended October 31, 2016

GAAP $ 1,992.1 $ 794.3

39.9 % $ 32.8 $ 11.5

$ (9.3 ) Adjustments: Amortization of

step-down in deferred services net revenues at acquisition and

associated costs of goods sold A 14.0 9.9 9.9 — 9.9 Amortization of

purchased intangible assets D — 15.1 105.7 — 105.7 Other merger and

acquisition related expenses D — — 5.7 —

(9.0

) Stock based compensation E — 3.3 42.3 — 42.3 Restructuring and

related charges F — 5.1 46.3 — 46.3 Other charges and income F —

11.0 15.4 — 19.4 Income tax effect of non-GAAP exclusions G

— — — 20.3 (20.3 ) Non-GAAP $

2,006.1 $ 838.7 41.8 % $ 258.1 $ 31.8 $ 185.0

Weighted average number of shares used in computing net income

(loss) per share: Net income (loss) per share attributable

to VeriFone Systems, Inc. stockholders (1) Basic

Diluted Basic Diluted GAAP 110.8

110.8 $ (0.08 ) $ (0.08

) Adjustment for diluted shares H — 0.8

Non-GAAP 110.8 111.6 $ 1.67 $ 1.66

Note

Net revenues Gross margin Gross margin

percentage Operating income Income tax provision

Net income attributable to VeriFone Systems, Inc.

stockholder Fiscal Year Ended October 31, 2015

GAAP $ 2,000.5 $ 826.0

41.3 % $ 107.0 $ (7.5

) $ 79.1 Adjustments: Amortization of

step-down in deferred services net revenues at acquisition A 1.0

1.0 1.0 — 1.0 Amortization of purchased intangible assets D — 18.3

100.8 — 100.8 Other merger and acquisition related expenses D — 1.5

4.3 — 1.2 Stock based compensation E — 2.6 42.3 — 42.3

Restructuring and related charges F — 0.3 8.7 — 8.7 Other charges

and income F — 2.2 22.9 — 22.9 Income tax effect of non-GAAP

exclusions G — — — 43.9

(43.9 ) Non-GAAP $ 2,001.5 $ 851.9 42.6 % $ 287.0 $ 36.4 $

212.1

Weighted average number of shares used in

computing net income per share: Net income per share

attributable to VeriFone Systems, Inc. stockholders (1)

Basic Diluted Basic Diluted GAAP

114.0 115.9 $ 0.69 $

0.68 Non-GAAP 114.0 115.9 $ 1.86

$ 1.83

(1) Diluted net income (loss) per share is

calculated by dividing the Net income (loss) attributable to

VeriFone Systems, Inc. stockholders by the Weighted average number

of shares used in computing net income (loss) per share

attributable to VeriFone Systems, Inc. stockholders.

VERIFONE SYSTEMS, INC.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

Three Months

Ending

Year Ending January 31, October 31,

Guidance 2017 2017 GAAP net revenues

$ 446 $ 1,895-$1,910 Adjustments to net

revenues: A 4 5 Non-GAAP net revenues $

450 $ 1,900-$1,915

Diluted GAAP

earnings per share (1) $ (0.08 ) $

0.37-0.41 Adjustments: (2) Amortization of step-down in

deferred services net revenues at acquisition A $ 0.02 $ 0.02

Amortization of purchased intangible assets D $ 0.20 $ 0.70 Stock

based compensation E $ 0.10 $ 0.40 Income tax effect of non-GAAP

exclusions (3) $ (0.04 ) $ (0.14 ) Diluted Non-GAAP earnings per

share (1) $ 0.20 $ 1.35-1.39

(1) Diluted GAAP and non-GAAP earnings per

share are determined using the most dilutive weighted average

number of shares, which includes outstanding RSU and RSA shares in

the calculation of the weighted average diluted shares outstanding

for periods in which we expect net income.

(2) Except for the adjustments noted

herein, this guidance does not include the effects of any future

acquisition or divestiture related costs, restructuring activities,

significant legal matters, and non-recurring income tax

adjustments, which are difficult to predict and may or may not be

significant.

(3) Assuming a GAAP effective tax rate of 12.5% applied to the

above non-GAAP exclusions.

NON-GAAP FINANCIAL MEASURES

This press release and its attachments include several non-GAAP

financial measures, including non-GAAP net revenues; non-GAAP

Systems net revenues; non-GAAP Services net revenues; net revenues

from businesses acquired in the past 12 months; non-GAAP organic

net revenues; non-GAAP organic net revenues at constant currency;

non-GAAP gross margin; non-GAAP gross margin as a percentage of

non-GAAP net revenues; non-GAAP operating income; non-GAAP income

tax provision; non-GAAP net income attributable to VeriFone

Systems, Inc. shareholders; non-GAAP weighted average diluted

shares; and non-GAAP net income (loss) per diluted share. This

press release also includes certain forward-looking non-GAAP

financial measures, specifically projected non-GAAP net revenues

and non-GAAP net income per diluted share for the first fiscal

quarter and full fiscal year 2017. The corresponding

reconciliations of these non-GAAP financial measures to the most

comparable GAAP financial measures, to the extent available without

unreasonable effort, are included in this press release.

Management uses non-GAAP financial measures only in addition to

and in conjunction with results presented in accordance with GAAP.

Management believes that these non-GAAP financial measures help it

to evaluate Verifone's performance and operations and to compare

Verifone's current results with those for prior periods as well as

with the results of peer companies. Verifone incurs, due to

differences in debt, capital structure and investment history,

geographic presence and associated currency impacts, certain income

and expense items, such as stock based compensation, amortization

of acquired intangibles and other non-cash expenses that differ

significantly from Verifone's competitors. The non-GAAP financial

measures reflect Verifone's reported operating performance without

such items. Management also uses these non-GAAP financial measures

in Verifone's budget and planning process. Management believes that

the presentation of these non-GAAP financial measures is useful to

investors in comparing Verifone's operating performance in any

period with its performance in other periods and with the

performance of other companies that represent alternative

investment opportunities. These non-GAAP financial measures contain

limitations and should be considered as a supplement to, and not as

a substitute for, or superior to, disclosures made in accordance

with GAAP.

These non-GAAP financial measures are not based on any

comprehensive set of accounting rules or principles and may

therefore differ from non-GAAP financial measures used by other

companies. In addition, these non-GAAP financial measures do not

reflect all amounts and costs, such as acquisition related costs,

employee stock-based compensation costs, cash that may be expended

for future capital expenditures or contractual commitments, working

capital needs, cash used to service interest or principal payments

on Verifone's debt, income taxes and the related cash requirements,

and restructuring charges, associated with Verifone's results of

operations as determined in accordance with GAAP.

Furthermore, Verifone expects to continue to incur income and

expense items that are similar to those that are excluded by the

non-GAAP adjustments described herein. Management compensates for

these limitations by also relying on the comparable GAAP financial

measures.

Our GAAP and non-GAAP net revenues are presented for our four

main geographic regions: North America, Latin America, EMEA and

Asia-Pacific. North America includes the US and Canada. Latin

America includes South America, Central America, Mexico and the

Caribbean. EMEA includes Europe, Russia, the Middle East, and

Africa. Asia-Pacific includes Australia, New Zealand, China, India

and throughout the rest of Greater Asia, including other

Asia-Pacific Rim countries.

Note A: Non-GAAP net revenues, costs of goods sold and gross

margin. Non-GAAP net revenues exclude the fair value decrease

(step-down) in deferred revenue at acquisition. Non-GAAP costs of

goods sold exclude the costs of goods associated with the fair

value decrease (step-down) in deferred revenue at acquisition.

Although the step-down of deferred revenue fair value at

acquisition and associated costs of goods sold are reflected in our

GAAP financial statements, they result in net revenues and gross

margins immediately post-acquisition that are lower than net

revenues and gross margins that would be recognized in accordance

with GAAP on those same services if they were sold under contracts

entered into post-acquisition. Accordingly, we adjust the step-down

to achieve comparability to net revenues and gross margins of the

acquired entity earned pre-acquisition and to our GAAP net revenues

and gross margins to be earned on contracts sold in future periods.

These adjustments, which relate principally to our acquisition of

AJB during February 2016, enhance the ability of our management and

our investors to assess our financial performance and trends. These

non-GAAP net revenues, costs of goods sold and gross margin amounts

are not intended to be a substitute for our GAAP disclosures of net

revenues, costs of goods sold and gross margin, and should be read

together with our GAAP disclosures.

Note B: Non-GAAP organic net revenues. "Non-GAAP organic

net revenues" is a non-GAAP financial measure of net revenues

excluding "net revenues from businesses acquired in the past 12

months" (as defined below). Verifone determines non-GAAP organic

net revenues by deducting net revenues from businesses acquired in

the past 12 months from non-GAAP net revenues. This non-GAAP

measure is used to evaluate Verifone net revenues without the

impact of net revenues from acquired businesses. Because Verifone's

business has grown through both organic growth and strategic

acquisitions, Verifone analyzes performance both with and without

the impact of our recent acquisitions. Accordingly, Verifone

believes that both non-GAAP net revenues and non-GAAP organic net

revenues provide useful information to investors.

Net revenues from businesses acquired in the past 12

months consists of net revenues derived from the sales channels

of acquired resellers and distributors, and net revenues from

Systems and Services attributable to businesses acquired in the 12

months preceding the respective financial quarter(s), such as

Intercard and AJB. For acquisitions of small businesses that are

integrated within a relatively short time after the close of the

acquisition, we assume quarterly net revenues attributable to such

acquired businesses during the 12 months following acquisition

remain at the same level as in the first full quarter after the

acquisition closed. During periods prior to our acquisition of

former customers, net revenues from businesses acquired in the past

12 months consists of sales by Verifone to that former customer for

that period.

Note C: Non-GAAP organic net revenues at constant

currency. Verifone determines non-GAAP organic net revenues at

constant currency by recomputing non-GAAP organic net revenues

denominated in currencies other than U.S. Dollars in the current

fiscal period using average exchange rates for that particular

currency during the corresponding financial period of the prior

year. Verifone uses this non-GAAP measure to evaluate business

performance and trends on a comparable basis excluding the impact

of foreign currency fluctuations.

Note D: Merger and Acquisition Related. Verifone adjusts

certain revenues and expenses for items that are the result of

mergers and acquisitions. Merger and acquisition related

adjustments include the amortization of intangible assets,

contingent consideration fair market value adjustments, interest on

contingent consideration, transaction expenses associated with

acquisitions, and acquisition integration expenses.

Amortization of intangible assets: Verifone incurs amortization

of intangible assets in connection with its acquisitions, such as

amortization of finite lived customer relationships intangibles. We

are required to allocate a portion of the purchase price of each

business acquisition to the intangible assets acquired and to

amortize this amount over the estimated useful lives of those

acquired intangible assets. Because these amounts have no direct

correlation to Verifone’s underlying business operations, we

eliminate these amortization charges and any associated minority

interest impact from our non-GAAP operating results to provide

better comparability of pre-acquisition and post-acquisition

operating results.

Contingent consideration fair market value adjustments and

interest on contingent consideration: In connection with its

acquisitions, Verifone owes contingent consideration payments based

upon the post-acquisition performance of and other factors related

to acquired businesses. These contingent consideration liabilities

are reported at fair market value and incur non-cash imputed

interest. Changes in the fair market value of contingent

consideration and imputed interest expense vary independent of our

ongoing operating results and have no direct correlation to our

underlying business operations. Accordingly, Verifone excludes

these amounts from our non-GAAP operating results to provide better

comparability of pre-acquisition and post-acquisition operating

results.

Transaction expenses associated with acquisitions: Verifone

incurs transaction expenses in connection with its acquisitions,

which include legal and other professional fees such as advisory,

accounting, valuation and consulting fees. These transaction

expenses are related to acquisitions and have no direct correlation

with the ongoing operation of Verifone’s business. Accordingly,

Verifone excludes these amounts from our non-GAAP operating results

to provide better comparability of pre-acquisition and

post-acquisition operating results.

Acquisition integration expenses: In connection with its

acquisitions, Verifone incurs costs relating to the integration of

the acquired business with Verifone’s ongoing business, which

includes expenses relating to the integration of facilities and

other infrastructure, information technology systems and

employee-related costs such as costs of personnel required to

assist with integration transitions. These acquisition integration

expenses are related to acquisitions and have no direct correlation

with the ongoing operation of Verifone’s business. Accordingly,

Verifone excludes these amounts from our non-GAAP operating results

to provide better comparability of pre-acquisition and

post-acquisition operating results.

Note E: Stock-Based Compensation. Our non-GAAP financial

measures eliminate the effect of expense for stock-based

compensation because they are non-cash expenses that management

believes are not reflective of ongoing operating results. In

particular, because of varying available valuation methodologies,

subjective assumptions and the variety of award types which affect

the calculations of stock-based compensation, we believe that the

exclusion of stock-based compensation allows for more accurate

comparisons of our operating results to our peer companies.

Stock-based compensation is very different from other forms of

compensation. A cash salary or bonus has a fixed and unvarying cash

cost. In contrast the expense associated with a stock based award

is unrelated to the amount of compensation ultimately received by

the employee; and the cost to the company is based on valuation

methodology and underlying assumptions that may vary over time and

does not reflect any cash expenditure by the company. Furthermore,

the expense associated with granting an employee a stock based

award can be spread over multiple years and may be reversed based

on forfeitures which may differ from our original assumptions

unlike cash compensation expense which is typically recorded

contemporaneously with the time of award or payment. Accordingly,

we believe that excluding stock-based compensation expense from our

non-GAAP operating results facilitates better understanding of our

long-term business performance and enhances period-to-period

comparability.

Note F: Other Charges and Income. Verifone excludes

certain expenses, other income (expense) and gains (losses) that we

have determined are not reflective of ongoing operating results or

that vary independent of business performance. It is difficult to

estimate the amount or timing of these items in advance. Although

these events are reflected in our GAAP financial statements, we

exclude them in our non-GAAP financial measures because we believe

these items limit the comparability of our ongoing operations with

prior and future periods. These adjustments for other charges and

income include:

Transformation and restructuring: Over the past several years,

we have incurred certain expenses, such as professional services,

contract cancellation fees and certain personnel and personnel

related costs incurred on initiatives to transform, streamline,

centralize and restructure our global operations. These charges

include involuntary termination costs, costs to cancel facility

leases, write down of assets held for sale, charges for costs to

terminate a contract related to a service we will no longer offer

in Turkey, associated legal and other advisory fees, as well as

operating income and losses of businesses identified to exit as

part of our strategic review of under-performing businesses and

global transformation initiatives. Each of these charges has been

incurred in connection with discrete activities in furtherance of

specific business objectives in light of prevailing circumstances,

and each charge and the associated activity or activities have had

differing impacts on our business operations. We do not incur these

costs in the ordinary course of business. While certain of these

items have recurred in recent years and may continue to recur in

the near future, the amount of these items has varied significantly

from period to period. Accordingly, management assesses our

operating performance with these amounts included and excluded, and

we believe that by providing this information, users of our

financial statements are better able to understand the financial

results of what we consider to be our continuing operations and

compare our current operating performance to our past operating

performance.

Foreign exchange losses related to obligations denominated in

currencies of highly inflationary economies: Our non-GAAP operating

results do not include foreign exchange losses related to

obligations denominated in highly inflationary economies, such as

the devaluation of the Argentina Peso during the first and second

quarter of fiscal year 2016. We believe that excluding such losses

provides a better indication of our business performance in the

current period, as the existence of high inflation in these

economies varies independent of our business performance, and

enhances the comparability of our business performance during

periods before and after such inflation occurred.

Costs associated with litigation and other loss contingencies,

penalties and settlements: Our non-GAAP operating results do not

include costs associated with litigation and other loss

contingencies, penalties and settlements. These costs and loss

contingencies relate to events that occurred in prior periods and

their ultimate amount and resolution are uncorrelated with our

operating performance during the current period. Accordingly, we

believe that excluding such amounts provides a better indication of

our business performance in the current period and enhances the

comparability of our business performance across periods.

Other charge: During the first quarter of 2015 we incurred $2.0

million of personnel related costs related to a senior executive

management change. While these types of costs may recur, this

particular cost was significantly larger than ordinary hiring

costs. Accordingly, management assesses our operating performance

with this amount included and excluded, and we believe that by

providing this information, users of our financial statements are

better able to understand the financial results of what we consider

to be our continuing operations and compare our current operating

performance to our past operating performance.

Note G: Income Tax Effect of Non-GAAP exclusions. Income

taxes are adjusted for the tax effect of the adjusting items

related to our non-GAAP financial measures and to reflect our

medium to long term estimate of cash taxes on a non-GAAP basis, in

order to provide our management and users of the financial

statements with better clarity regarding the on-going comparable

performance and future liquidity of our business. Under GAAP our

Income tax provision as a percentage of Income before income taxes

was 701.2% for the fiscal quarter ended October 31, 2016,

(43.7)% for the fiscal quarter ended October 31, 2015, 631.9%

for the fiscal year ended October 31, 2016, and (10.2)% for

the fiscal year ended October 31, 2015. For the purpose of

computing non-GAAP actual results, we used a 14.5% rate for all

periods presented.

Note H: Non-GAAP diluted shares. Diluted GAAP and

non-GAAP weighted-average shares outstanding are the same in all

periods except where there is a GAAP net loss. In accordance with

GAAP, we do not consider dilutive shares in periods that there is a

net loss. However, in periods when we have a non-GAAP net income

and a GAAP basis net loss, diluted non-GAAP weighted average shares

include additional shares that are dilutive for non-GAAP

computations of earnings per share.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161212006116/en/

VerifoneInvestor Relations:Chris Mammone,

408-232-7230ir@verifone.comorMedia Relations:Andy Payment,

770-754-3541andy.payment@verifone.com

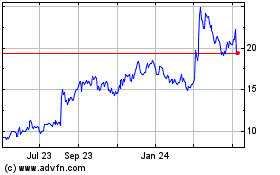

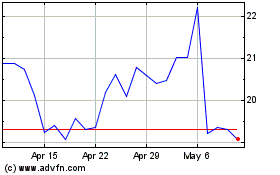

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024