HONG KONG—China's internet-finance heavyweight, Ant Financial

Services Group, is expanding overseas.

The financial affiliate of Chinese online-shopping giant Alibaba

Group Holding Ltd. is forging partnerships in the U.S., Europe and

Asia, building a global network of merchants that accept its

payment services. On Tuesday, it is set to announce a tie-up with

the online-payments arm of Thai conglomerate Charoen Pokphand

Group, people familiar with the situation said.

For now, those overseas services are aimed at a surging number

of Chinese tourists who use Ant Financial's Alipay mobile-payments

application at home. But by distributing its technology platform to

retailers world-wide, Ant is laying the groundwork for what could

eventually be a challenge to Visa Inc. and MasterCard Inc.

"I was surprised to see Alipay" at a 7-Eleven in Thailand, said

Li Na, a 33-year-old Chinese startup employee who used Alipay to

buy ice cream while vacationing on the island of Ko Samui in

August. "It was convenient." At home, Ms. Li said she uses Alipay

almost every day for shopping, dinner and taxis.

Alipay was created in 2004 to support transactions on Alibaba's

Taobao online-shopping site and grew alongside the e-commerce

business. It was later separated from Alibaba—an offshore company

with foreign investors—and reincorporated as a domestic company

under chairman Jack Ma's control, after worries that new

regulations could have threatened its ability to be licensed for

payments. Alipay accounts are linked to bank accounts, and users

move money into Alipay to pay bills, buy movie tickets and even

invest in mutual funds.

As Alipay grew, its became part of an umbrella holding company,

Ant Financial, that expanded into new businesses. The payment app's

huge user base and Alibaba's connections with merchants allowed Ant

to move into other financial services such as loans, money-market

funds and credit scoring. Alipay remains Ant's biggest business by

far.

Overseas, Alipay is accepted at more than 80,000 merchants in 70

countries, according to Ant. It has set a goal of one million

merchants in three years.

"Eventually, Chinese Alipay users wouldn't need to worry about

money exchange or discovery of local dining and shopping

information, wherever they go," said Jia Hang, an executive at

Alipay's international operations.

Ant has some powerful advantages as it rolls out its business

abroad. With more than 450 million users, Alipay dominates China,

the world's biggest e-commerce market, handling nearly half of the

estimated $738 billion Chinese spent online last year, according to

iResearch. Alipay processed 153 million online transactions a day,

on average, in the first quarter—almost 10 times more than PayPal

Holdings Inc., nearly as many as MasterCard and around 60% of the

volume of industry leader Visa, according to an Alibaba investors

presentation in June.

In China, where credit cards aren't as widespread as in the

U.S., hundreds of millions of consumers have turned to smartphone

apps such as Alipay, making China the world's biggest

mobile-payment market. Last year, mobile transactions in the

country more than doubled to $235 billion, pushing it ahead of the

U.S., which grew 42% to $231 billion, according to data provider

Euromonitor International.

Investors hung a $60 billion price tag on the company in its

latest fundraising round in April and bankers say a future initial

public offering—expected as early as next year—could raise as much

as Alibaba's $25 billion IPO and value Ant at around $100 billion.

A spokeswoman for Ant Financial said the company doesn't have a

timeline for the IPO, nor a preferred exchange on which to

list.

In May, the company hired a senior Goldman Sachs Group Inc.

banker, Douglas Feagin, to lead the push to build a network of

global partners.

The tie-up with Charoen Pokphand's Ascend Money Holding, fits

the pattern. The Wall Street Journal reported in June that Ant

would buy a 20% stake in the Thai firm for an unknown amount. Last

year, Ant Financial together with Alibaba paid more than $500

million for a 40% stake in Indian online-payment and e-commerce

firm Paytm.

In London, Harrods department store, a mecca for Chinese

tourists, accepts Alipay. Ant has also teamed up with partners such

as France's Ingenico Group SA, whose in-store payment system is

widespread among European merchants. Ant Financial is also working

with First Data Corp. and VeriFone Systems Inc. to tap more U.S.

merchants. Chinese travelers can use Alipay to pay for Uber

Technologies Inc. rides and shopping at San Francisco International

Airport.

Taking Alipay global isn't a slam dunk. Banking is a tightly

regulated industry, meaning Ant needs to pursue alliances, such as

the Ascend tie-up in Thailand or Paytm deal in India, to get access

to a local market. Wooing global consumers in markets where

credit-card use is widespread will likely be harder.

Competitors include rival Tencent Holdings Ltd.'s WeChat Pay at

home and Apple Inc.'s Apple Pay abroad. Tencent is gaining ground

in China thanks to the popularity of its WeChat messaging app,

which includes a mobile wallet. In the first quarter, Tencent's

share of China's mobile-payment market more than tripled to 38%

from a year earlier, while Alipay's share fell to 52% from 79%,

according to iResearch.

Alec Macfarlane and Julie Steinberg contributed to this

article.

Write to Kane Wu at Kane.Wu@wsj.com and Juro Osawa at

juro.osawa@wsj.com

(END) Dow Jones Newswires

October 31, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

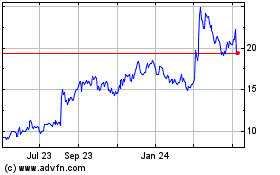

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

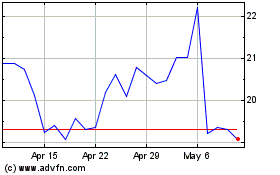

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024