UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

VERIFONE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-32465

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

04-3692546

(IRS Employer Identification No.)

88 West Plumeria Drive

San Jose, CA 95134

(Address of principal executive offices, including zip code)

Albert Liu

408-232-7800

(Name and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies

[X] Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014.

Section 1 - Conflict Minerals Disclosure

VeriFone Systems, Inc. (“Verifone”, “we” or “us”) is a global leader in secure electronic payment solutions at the point of sale. We design, manufacture and sell electronic point of sale terminals and pin pads, and related accessories and peripheral equipment, as well as complementary solutions and services that enable secure electronic payment transactions and value-added services at the point of sale. The manufacture of our point of sale terminals and pin pads, and related accessories and peripheral equipment, is outsourced to third party contract manufacturers.

Pursuant to the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, also known as the Dodd-Frank Act, certain public companies, including us, are required to provide disclosures about the use of specified conflict minerals originating from the Democratic Republic of the Congo or any of nine adjoining countries, collectively referred to as the Covered Countries.1 The term “conflict minerals” is defined as: (A) columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin, and tungsten; or (B) any other mineral or its derivatives determined by the U.S. Secretary of State to be financing conflict in the Democratic Republic of the Congo or an adjoining country. For purposes of this Specialized Disclosure Report on Form SD and the accompanying Conflict Minerals Report, we refer to tin, tantalum, tungsten and gold as the “3TG”.

In August 2012, the Securities and Exchange Commission (“SEC”) issued Rule 13p-1 of the Securities Exchange Act of 1934, as amended (“Rule 13p-1”), to implement the reporting and disclosure requirements related to conflict minerals imposed by the Dodd-Frank Act. Under Rule 13p-1, we, like other U.S. public companies, are first required to determine whether our manufactured products contain any of the 3TG and whether, for each product, such minerals are necessary to: (i) the functionality of the manufactured product and (ii) the production process of the manufactured product. If so, we are further required to conduct a reasonable country of origin inquiry (“RCOI”) into the origin of any 3TG used in our products and determine whether the 3TG may have originated from any of the Covered Countries, or are from recycled or scrap sources. If we are unable to determine based on our RCOI that the 3TG are not from a Covered Country or are from recycled or scrap sources, then we must additionally exercise due diligence to determine the source and chain of custody of the 3TG.

For calendar year 2014, we determined that conflict minerals are necessary to the functionality or production of our electronic point of sale terminals and pin pad products, and related accessories and peripheral equipment (collectively, the “Products”) and, accordingly, conducted an RCOI with the suppliers for these Products, as described in Item 1.01 below, and are providing this report on Form SD.

Item 1.01 - Conflict Minerals Disclosure and Report

Reasonable Country of Origin Inquiry

Under Rule 13p-1, U.S. public companies that manufacture products that contain 3TG that are necessary to the functionality or production of such products are required to conduct an RCOI regarding such minerals. The SEC did not prescribe specific procedures for the RCOI determination, but provides that the inquiry must be reasonably designed to determine whether any of the 3TG originated in a Covered Country and are not from recycled or scrap sources.

________________________

1 Section 1502 of the Dodd-Frank Act defines the adjoining countries as any country that shares an internationally recognized border with the Democratic Republic of the Congo (DRC), which presently include the Central African Republic, South Sudan, Zambia, Angola, The Republic of the Congo, Tanzania, Burundi, Rwanda and Uganda.

For the calendar year ended December 31, 2014, we conducted a round of inquiries as part of our RCOI determination. We used similar processes and procedures, with certain enhancements, similar to the RCOI determination we conducted for the calendar year ended December 31, 2013. We also continued to enhance our processes with the goal of maintaining practices that were in line with industry standards for technology companies and recommended practices by leading conflict-free sourcing organizations. The purpose of our RCOI was to determine whether any of the conflict minerals that are necessary to the functionality or production of our Products originated in the Covered Countries. With the support of our executive management, our conflict minerals committee, comprised of an internal cross-functional team with representatives from Procurement and Supply-Chain Operations, R&D/Product Compliance, and Legal and Compliance, is responsible for developing and enhancing the program for conducting our conflict minerals assessment and preparing the related annual reporting.

We outsource the manufacturing of our Products to third party contract manufacturers located in China, Singapore, Malaysia, Brazil, Germany, Romania and France. The purchase of components for our Products is managed directly by our contract manufacturers. Our contract manufacturers purchase components for our Products only through suppliers that have been qualified and approved by us. Among other criteria, we consider a potential supplier’s conflict minerals policy and/or practice in our supplier qualification process.

We used the standard conflict minerals survey and reporting template developed jointly by the Electronic Industry Citizenship Coalition (EICC) and the Global e-Sustainability Initiative (GeSI). We chose this template given the broad actions that have been taken by both the EICC and GeSI to address responsible sourcing, including their development of the Conflict-Free Smelter (CFS) program aimed to enable companies to source conflict-free minerals. Further, we believe this template is widely used by many other companies in our industry in their due diligence processes related to conflict minerals.

In conducting our RCOI for calendar year 2014, we contacted all suppliers of the materials identified in our initial review as likely to contain one or more of the 3TG. We provided the conflict minerals survey and reporting template to each such supplier, along with a brief background on our undertaking. We rely upon our suppliers to provide information on the origin of the 3TG contained in components and materials supplied to us, including sources of 3TG that are supplied to them from suppliers further up the supply chain. In addition, during the calendar year ended December 31, 2014, we participated in the Conflict-Free Sourcing Initiative (CFSI) and utilized its shared information in validating smelter/refinery compliance status. Where we received specific smelter and/or refinery information from a supplier and were able to ascertain (1) that the smelter and/or refinery has been certified under the CFS Program or other similar recognized certification program as conflict-free and/or (2) that, based on all information available to us, including additional information available to us as a CFSI participant, the RCOI information we received does not indicate that any of the 3TG originated in a Covered Country and are not from recycled or scrap sources, we concluded that such supplier constituted a conflict-free supplier. For those suppliers that provided responses indicating that the supplied materials do not contain any 3TG, and where such information appeared reasonable in light of other information collected for such supplier, we determined those suppliers to be conflict-free.

Despite having conducted an RCOI and the good faith exercise of due diligence over the origin of the 3TG in our supply chain, we have not been able to conclude that our Products qualify as DRC conflict free. We have reached this conclusion primarily because some of our suppliers are still in the process of completing their inquiries and assessments with their suppliers further upstream in the supply chain or the identified smelters and/or refineries are yet to be independently verified as conflict-free. Due to the breadth of materials and components applicable to our Products and the complexity of our supply chain, we expect that it will take time for many of our suppliers to fully verify the origin of all of the minerals. As a result, we have been unable to determine the origin of all of the 3TG used in our Products for calendar year 2014.

We continue to undertake due diligence procedures as required by Rule 13p-1. As described in our Conflict Minerals Report, attached as Exhibit 1.01 to this Form SD, we have developed an internal management system comprised of processes and procedures to achieve our objectives to support a conflict free supply chain as set forth in our Conflict Minerals Statement.

Item 1.02 - Exhibit

VeriFone’s Conflict Minerals Report is filed as Exhibit 1.01 to this Form SD and is also available at VeriFone’s website under http://ir.verifone.com/.

Section 2 - Exhibits

Exhibit 1.01 - Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

| |

| VERIFONE SYSTEMS, INC. |

| |

Date: June 1, 2015 | By: /s/ Albert Liu Name: Albert Liu Title: Executive Vice President, Corporate Development and General Counsel |

| |

Exhibit 1.01

VeriFone Systems, Inc.

Conflict Minerals Report

This Conflict Minerals Report of VeriFone Systems, Inc. (“Verifone”, “we or “us”) for the year ended December 31, 2014 is presented in compliance with Rule 13p-1 under the Securities Exchange Act of 1934.

Due diligence over conflict minerals source and chain of custody

Based on the results of our reasonable country of origin inquiry, or RCOI, for calendar year 2014, we were not able to conclude whether certain parts or components of one or more of our Products may contain conflict minerals from a Covered Country that are not sourced from recycled or scrap sources. As a result, we conducted additional due diligence as further described in this Conflict Minerals Report.

Our due diligence framework is intended to track in material respects the recommendations set forth in “Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas” developed by the Organization for Economic Cooperation and Development, or OECD, which is an internationally recognized due diligence framework. Our due diligence framework incorporates the recommendations of the OECD’s due diligence guidance, including the OECD supplements on the 3TG, as adapted for our facts and circumstances.

The OECD guidance is designed to help companies develop a system to avoid contributing to conflict through their mineral or metal purchasing decisions and practices. It includes a five-step framework that can be used to create a responsible supply chain, including (1) establishing a management system, (2) identifying and assessing risks in the supply chain, (3) designing and implementing a strategy to respond to identified risks, (4) supporting the development and implementation of independent third-party audits of smelters/refiners’ sourcing, and (5) publicly reporting on supply chain practices and due diligence.

We use this framework to conduct further due diligence if we are unable to determine that the 3TG in the materials supplied for our Products are conflict-free based on information gathered from our suppliers. As we continue to work through the verification processes with our suppliers, we expect to build out this diligence framework, including tailoring processes and strategies based on information specific to our supply chain, in order to create a program that meaningfully supports our conflict minerals objectives.

Our due diligence framework consists of the following key components:

| |

1. | Internal management system for Conflict Minerals. |

The below Conflict Minerals Statement sets forth our basic philosophy and objectives with respect to conflict minerals in our supply chain:

Verifone is committed to being a responsible corporate citizen in its sourcing and procurement activities. We believe that if each company does its part, enormous strides can be made in responsible sourcing. We support government and industry initiatives for responsible sourcing. We seek to avoid the use of conflict minerals purchased from sources that finance or benefit armed groups who commit human rights abuses in the Democratic Republic of the Congo and adjoining countries, and avoid contributing to conflict in our sourcing and procurement practices. We expect our suppliers to provide required information to support our due diligence efforts and to support our goals for conflict-free sourcing. We intend to source from socially responsible suppliers.

In order to support the objectives of our Conflict Minerals Statement, we formed an internal cross-functional conflict minerals committee that is responsible for designing and enhancing our processes and procedures for the evaluation of our supply chain, determining the tools and templates that are utilized for our evaluation and reporting, and setting the protocols for conducting further diligence and inquiries of our supply chain. These processes and procedures, along with a data management system developed and maintained by our third party service provider that specializes in conflict minerals data collection and verification, the templates we utilize to assess our supply chain, and our internal database used for tracking RCOI determination of smelters identified by our suppliers, form our internal management system for conflict minerals.

As an initial matter, we conducted a review of our product components and materials at risk of containing one or more of the 3TG in order to identify the suppliers for our conflict minerals assessment. We are many tiers removed in the supply chain from the smelters, refineries and mines of origin for minerals contained or used in our Products. Therefore, we rely on our suppliers to identify those “upstream” companies, namely, the smelters/refiners of the sources of the 3TG in our supply chain and, accordingly our RCOI and due diligence efforts focus primarily on our suppliers. Our review included all suppliers that have been qualified and approved by us for our contract manufacturers for Products manufactured in calendar year 2014. As mentioned above, for calendar year 2014, we engaged a third-party service provider to assist us to collect and compile the results of our RCOI to enable us to better track and analyze our supply chain data and conduct our conflict minerals assessment. The third-party service provider compiles the results and provides us with additional reporting and analytics that we utilize to conduct our diligence and assessment. We also use these reports to better engage with our suppliers on information related to our supply chain.

The conflict minerals committee then considered, in this review, whether any of the 3TG is necessary to the functionality or production of our Products. The committee reviewed relevant supply information in our data systems, including the types of materials supplied, the product models where the supplied materials have been used or are expected to be used, alternative sources of the materials, and the materiality of the vendor to our supply chain and for our Products. For each supplier, the committee conducted a review using internally available information and input from our supply chain and procurement personnel. The committee then determined whether, based on review and consideration of the information gathered for such supplier base, the materials supplied are likely to include any of the 3TG necessary to the functionality or production of our Products.

Key elements of our processes and procedures include:

| |

• | Direct communications with suppliers |

| |

• | Utilization of a standardized conflict minerals reporting template to collect information for consistent data collection suitable for further analysis |

| |

• | Use of shared information of conflict-free smelters and/or refineries, such as the audited and certified conflict-free smelters and refineries under the Conflict-Free Smelters (CFS) Program and RCOI data developed by the Conflict-Free Sourcing Initiative (CFSI) co-founded by members of the EICC and the GeSI, to validate source of 3TG in our supply chain |

| |

• | Inclusion in our supplier communications information on smelters that are identified in the CFS Program |

| |

• | Use of a risk ranking system to categorize our suppliers for purposes of targeted communications, additional verification against internal data and technical resources, other validation procedures and further diligence as needed |

| |

• | Use of targeted follow up communications to gather further information and/or supplier declaration forms as needed |

| |

• | Archiving and categorization of information collected from our suppliers and other sources, in our conflict minerals data management system for monitoring our supply chain for conflict minerals compliance |

| |

• | Monitoring our supplier’s efforts, policies and diligence toward determining smelter names and locations |

| |

• | Participation in industry-wide efforts to identify smelters that are conflict-free, including the CFS Program, and use of collaborative industry processes in order to most effectively assess our supply chain |

| |

• | Inclusion of information about our conflict minerals objectives expectations of our suppliers in communications to key suppliers in connection with due diligence efforts |

| |

• | Consideration of a supplier’s conflict-free status in the supplier qualification process |

Our conflict minerals committee will continue to oversee our management system for conflict minerals, including developing additional and/or enhanced processes and procedures as well as tools to measure and monitor our continued efforts to support the objectives set out in our Conflict Minerals Statement. This committee also reports periodically to our management and to our disclosure committee.

We have conducted both internal data collection and analysis directly and through our third party service provider, as well as directly engaged with our suppliers, including targeted direct follow-up communications for certain suppliers. To date the efforts we have undertaken to assess our supply chain have provided us a better understanding of our supply chain that will allow us to further tailor our inquiries and verification processes. In our communications to our suppliers, we have also encouraged our suppliers to reach out to our committee with any questions in an endeavor to encourage open communications with our suppliers on our conflict minerals objectives.

| |

2. | Identifying and assessing risk in our supply chain. |

Our Products are manufactured by third-party contract manufacturers who source components and materials directly from suppliers that we have qualified and approved. Given the breadth of materials and components used in our Products, the number of suppliers we have qualified within our supply chain and the evolution of our supply chain (including complexities related to supply chain operations from acquired businesses), it is difficult and time-consuming to identify actors upstream in the supply chain from our direct suppliers. We rely on our direct suppliers to further assess their upstream suppliers and request that the inquiries we have provided be conducted further upstream to the source in order to provide us with the information we require.

All suppliers of components and materials that have been qualified and approved by us and that had components or materials included in manufactured Products in calendar year 2014 were included in our review. For purposes of our assessment, we considered these suppliers, along with our contract manufacturers, as our direct suppliers.

To survey these suppliers, we used the then-latest version of the “EICC/GeSI Conflict Minerals Reporting Template” (CMRT), which is an industry-designed survey and reporting template for conflict minerals assessment, to collect the relevant data for our determination of smelter information and the RCOI of the 3TG. To facilitate response rates, we engaged a third-party service provider, who specializes in conflict minerals data collection and verification. We utilized a methodology consistent with those outlined by the CFSI (which is consistent with OECD guidelines) in order to encourage our suppliers to report to us in a consistent manner using the CMRT. The CMRT requests suppliers to identify the sources of the 3TG by identifying the specific smelters, refineries or recyclers and scrap supplier sources. In general, our suppliers were able to report their declared sources using lists set out by the CFSI of known smelters by standard smelter name and/or smelter identification number. In turn, we were able to rely on the CFS Program to validate RCOI and conflict-free sourcing to the extent sourcing by suppliers is from smelters that have been audited and certified under the CFS Program as conflict-free. We also validated certain gold smelters to the London Bullion Market Association (LBMA) certification program and tungsten smelters to the Tungsten Industry - Conflict Minerals Council (TI-CMC) membership program. As of the date of this Conflict Minerals Report, we have received a response from 68% of the surveyed suppliers with coverage of approximately 82% parts surveyed for calendar year 2014.

We designed our processes to enable us to evaluate our supply chain using a risk-based approach. We used the in-depth supply chain data collected by the third-party service provider to guide our conflict minerals assessments, prioritization of supplier engagement and further diligence efforts. We believe that our conflict minerals data management system allows for a centralized and systematic approach for supplier assessment. Using an internal risk ranking system, we broadly categorize smelter information we received related to our supply chain in order to inform our decisions on further verification and validation procedures and diligence to be conducted.

We conducted an initial review of responses received to assess completeness of information, and sent multiple rounds of follow up questions and/or supplier declarations to those suppliers for which we deem further information

is warranted. By leveraging our third party service provider and the analytics provided by our third party conflict minerals module, we were able to engage more frequently with our suppliers and to provide more targeted communications. For responses that appeared complete based on this initial review, we conducted a validation of the smelter information against the CFS Program list of smelters certified as “conflict-free” as well as the LBMA list and the TI-CMC list for gold and tungsten smelters, respectively. Further diligence is underway for smelters that we have not been able to validate against the lists of certified smelters. Additionally, we have sent targeted follow up requests to those suppliers that have not yet responded.

We assess our conflict minerals policy, risks and impacts, including with input from our management, on an ongoing basis. In order to increase transparency, we continue to evaluate ways to incorporate processes at key touch points of our supply chain that may include additional inquiries and validation during the qualification of suppliers, or as part of the periodic assessments of our contract manufacturers and production activities within our supply chain.

| |

3. | Responding to risks in our supply chain. |

We rely primarily on industry tools such as the CFS Program to assess smelter information and, specifically, rely on information provided through validation programs such as the CFS Program and LBMA that provide validation programs to certify smelters and refineries as conflict free (see Item 5 below). We also utilize the RCOI data available to us as a CFSI participant, and the information provided by TI-CMC for its membership. We track our efforts to validate supplier compliance with our Conflict Minerals Statement, including identifying and escalating of non-responsive suppliers, or challenges in validating supplier information. As we further implement our conflict minerals compliance procedures and gain experience in the diligence process, we intend to mitigate risks through continued and enhanced supplier communications, training to improve our data collection and validation and steps to encourage support from our supply chain partners for conflict-free sourcing. We continue to evaluate ways to incorporate processes at key touch points of our supply chain that may mitigate risks in our supply chain. These processes may include additional inquiries and validation during the qualification of suppliers, or as part of the periodic assessments of our contract manufacturers and production activities within our supply chain.

| |

4. | Independent third-party audits of smelters/refiners’ sourcing. |

We are generally several tiers removed from the relationship with the originating smelters or refineries with no direct relationships or contact with smelters or refineries, and have not performed or been in a position to require direct audits of smelters or refineries that provide the 3TG to our supply chain. We have relied on industry efforts, such as those by the EICC and GeSI, to influence smelters and refineries to complete audits and certification through the CFS Program. To the extent we have the opportunity to do so within our supply chain, including through flowing information upstream about the CFS Program and other relevant information, we will do so as we believe such actions can encourage support for these industry efforts. Leveraging the shared information and materials from our participation in the CFSI, we are developing additional supplier communication programs to engage with our suppliers regarding conflict minerals.

Our due diligence process includes internal reporting up to our management, as well as to our disclosure committee. Our conflict minerals committee regularly reviews our key metrics and measures of our progress against our objectives. Where requested by customers or prospective customers, we have shared information on our efforts and progress on conflict minerals compliance.

This Conflict Minerals Report is also available on our website under our Investor Relations section at http://ir.verifone.com/.

Results of due diligence

As of the date of this Conflict Minerals Report, we have received a response from approximately 68% of the surveyed suppliers, which covered approximately 82% of parts surveyed. We reviewed the submitted data and related information to assess whether the information appeared complete and sufficiently responsive to our inquiries. We further assessed whether the supplier has indicated that any of the 3TGs may have been sourced from the Covered Countries and utilized the CFSI’s conflict free smelter program (CFSP) protocol to evaluate RCOI information related to the smelters identified by our suppliers as potentially sourcing from the Covered Countries. In addition, we reviewed and assessed RCOI for these smelters based on other materials available through the CFSI and other industry members and organizations, and other publicly available information regarding the smelters. Of the total smelters identified for the surveyed parts from suppliers submitting a response:

| |

• | Approximately 64% are currently identified by our suppliers as not sourcing from the Covered Countries and based on our review we otherwise do not have any reason to believe are sourcing from the Covered Countries; and |

| |

• | Approximately 12% are identified under the CFSP protocol as a known smelter or refiner and indicated as: (1) compliant, (2) re-audit in process, (3) active and or otherwise have signed the CFSP’s agreements to exchange information and/or be audited under the CFSP, (4) having agreed to complete a CFSP validation by the TI-CMC within two years of membership, or (5) sources from recycled or scrap sources. |

We continue to monitor the status of these smelters on an ongoing basis, which status may change based on further information we are able to obtain and/or changes in certified status. We continue to conduct diligence on the remaining 24% of smelters. Based on our assessment, we do not yet have sufficient information to enable us to determine the origin and/or conflict-free status. We have provided, as Appendix A hereto a list of smelters identified by our suppliers consisting of (1) “known” smelters, that is, smelters that have an ID number assigned by the EICC, but which we were not able to validate under the CFS Program, LBMA or similar certification programs, or TI-CMC and (2) facilities that do not currently have smelter ID numbers but were nevertheless identified by the suppliers as smelters and/or refineries. We continue our due diligence with respect to the smelter and related information supplied by our suppliers.

As discussed above, we plan to continue to participate in industry efforts by enhancing our supplier communications program (including encouraging our suppliers to work with their smelters to become certified as conflict free) and sharing information to facilitate and support our conflict minerals policy objectives.

Appendix A - Smelter List

|

| | |

Mineral | Smelter Name | Location |

Gold | Acade Noble Metal (Zhao Yuan) Corporation | CHINA |

Gold | Tongling Nonferrous Metals Group Co., Ltd. | CHINA |

Gold | Yunnan Copper Industry Co., Ltd. | CHINA |

Gold | Sino-Platinum Metals Co.,Ltd | CHINA |

Gold | Daye Non-Ferrous Metals Mining Ltd. | CHINA |

Gold | Gansu Seemine Material Hi-Tech Co., Ltd. | CHINA |

Gold | Gansu-based Baiyin Nonferrous Metals Corporation (BNMC) | CHINA |

Gold | Gold and Silver Refining Strokes Ltd. | CHINA |

Gold | Guangdong Jinding Gold Limited | CHINA |

Gold | Hangzhou Fuchunjiang Smelting Co., Ltd. | CHINA |

Gold | Henan Sanmenxia Lingbao City Jinyuan Mining Industry Co., Ltd | CHINA |

Gold | Hunan Chenzhou Mining Group Co., Ltd. | CHINA |

Gold | Hung Cheong Metal Manufacturing Limited | CHINA |

Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Company Limited | CHINA |

Gold | Jiangxi Copper Company Limited | CHINA |

Gold | JIE SHENG | CHINA |

Gold | Jinlong Copper Co., Ltd. | CHINA |

Gold | Lingbao Gold Company Limited | CHINA |

Gold | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | CHINA |

Gold | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | CHINA |

Gold | Metalor Technologies (Suzhou) Ltd. | CHINA |

Gold | Penglai Penggang Gold Industry Co., Ltd. | CHINA |

Gold | Realized the enterprise co. ltd. | CHINA |

Gold | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | CHINA |

Gold | Shen Zhen Thousand Island Ltd. | CHINA |

Gold | Shenzhen Heng Zhong Industry Co.,Ltd. | CHINA |

Gold | Suzhou Xingrui Noble | CHINA |

Gold | Tai zhou chang san Jiao electron Co.,Ltd | CHINA |

Gold | The Great Wall Gold and Silver Refinery of China | CHINA |

Gold | Wuxi City Precious Metal Electronic Material Fty | CHINA |

Gold | Yunnan Copper Industry Co., Ltd. | CHINA |

Gold | Zhejiang Hexing Electroplating Company | CHINA |

Gold | Bauer Walser AG | GERMANY |

Gold | UNIFORCE METAL INDUSTRIAL CORP. | HONG KONG |

Gold | PT Timah (Persero) Tbk Kundur | INDONESIA |

Gold | PT Timah (Persero) Tbk Mentok | INDONESIA |

Gold | Harima Smelter | JAPAN |

Gold | Sen Silver | JAPAN |

Gold | DS force Shop | JAPAN |

Gold | Daejin Indus Co., Ltd. | KOREA, REPUBLIC OF |

Gold | Yoo Chang Metal | KOREA, REPUBLIC OF |

|

| | |

Mineral | Smelter Name | Location |

Gold | Kyrgyzaltyn JSC | KYRGYZSTAN |

Gold | Caridad | MEXICO |

Gold | EM Vinto | PERU |

Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | PHILIPPINES |

Gold | Aktyubinsk Copper Company TOO | RUSSIAN FEDERATION |

Gold | OJSC Novosibirsk Refinery | RUSSIAN FEDERATION |

Gold | Moscow Special Alloys Processing Plant | RUSSIAN FEDERATION |

Gold | OJSC Kolyma Refinery | RUSSIAN FEDERATION |

Gold | Prioksky Plant of Non-Ferrous Metals | RUSSIAN FEDERATION |

Gold | Cheng Yang | TAIWAN |

Gold | Hon Shen Co. Ltd | TAIWAN |

Gold | Jia Lung Corp | TAIWAN |

Gold | Advanced Chemical Company | UNITED STATES |

Gold | Asarco | UNITED STATES |

Gold | Sabin Metal Corp. | UNITED STATES |

Gold | So Accurate Group, Inc. | UNITED STATES |

Gold | Almalyk Mining and Metallurgical Complex (AMMC) | UZBEKISTAN |

Gold | Navoi Mining and Metallurgical Combinat | UZBEKISTAN |

Tantalum | Nantong Tongjie Electrical Co., Ltd. | CHINA |

Tantalum | JX Nippon Mining & Metals Co., Ltd. | JAPAN |

Tantalum | NTET, Thailand | THAILAND |

Tantalum | Talley Metals | UNITED STATES |

Tin | SGS | BOLIVIA |

Tin | Best Metais | BRAZIL |

Tin | Estanho de Rondônia S.A. | BRAZIL |

Tin | An Xin Xuan Xin Yue You Se Jin Shu Co. Ltd. | CHINA |

Tin | Anchen Solder Tin Products Co., Ltd | CHINA |

Tin | Central Copper Co. Ltd. Zhejiang | CHINA |

Tin | China Yunnan Gejiu Nonferrous Electrolysis Company | CHINA |

Tin | Yunnan GeJiu Jin Ye Mineral Co.,Ltd | CHINA |

Tin | Gejiu Kai Meng Industry and Trade LLC | CHINA |

Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | CHINA |

Tin | Gejiu Zili Mining And Metallurgy Co., Ltd. | CHINA |

Tin | Goodway | CHINA |

Tin | High Quality Technology Co., Ltd. | CHINA |

Tin | High-Power Surface Technology | CHINA |

Tin | Hop Hing Electroplating Company Zhejiang | CHINA |

Tin | Huichang Jinshunda Tin Co., Ltd. | CHINA |

Tin | Hunan Chang Ning Great Wall | CHINA |

Tin | Jin Tian | CHINA |

Tin | JU TAI INDUSTRIAL CO.,LTD. | CHINA |

Tin | Kaimeng(Gejiu) Industry and Trade Co., Ltd. | CHINA |

Tin | Kewei Tin Co.,ltd | CHINA |

Tin | Linwu Xianggui Ore Smelting Co., Ltd. | CHINA |

Tin | MENG NENG | CHINA |

|

| | |

Mineral | Smelter Name | Location |

Tin | Ming Li Jia smelt Metal Factory | CHINA |

Tin | Ningbo Jintian copper (Group ) Company Limited | CHINA |

Tin | Pro Wu Xianggui Mining Co., Ltd. | CHINA |

Tin | Qian Dao Tin Products | CHINA |

Tin | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | CHINA |

Tin | ShangHai YueQiang Metal Products Co., LTD | CHINA |

Tin | Shenzhen City Jin Chun Tin Co., Ltd. | CHINA |

Tin | Shenzhen keaixin Technology | CHINA |

Tin | Shenzhen Yi Cheng Industrial | CHINA |

Tin | Taicang City Nancang Metal Material Co.,Ltd | CHINA |

Tin | Tianshui ling bo technology co., Ltd | CHINA |

Tin | TIN PLATING GEJIU | CHINA |

Tin | TONG LONG | CHINA |

Tin | TONGXIN | CHINA |

Tin | Wu Xi Shi Yi Zheng Ji Xie She Bei Company | CHINA |

Tin | Wuxi Lantronic Electronic Co Ltd | CHINA |

Tin | WUXI YUNXI SANYE SOLDER FACTORY | CHINA |

Tin | XINQIAN | CHINA |

Tin | Yifeng Tin | CHINA |

Tin | Zhangzhou Xiangcheng Hongyu Building | CHINA |

Tin | ZhongShi | CHINA |

Tin | KOVOHUTE PRÍBRAM NÁSTUPNICKÁ, A.S. | CZECH REPUBLIC |

Tin | Feinhütte Halsbrücke GmbH | GERMANY |

Tin | RST | GERMANY |

Tin | Westfalenzinn | GERMANY |

Tin | Heraeus Ltd. Hong Kong | HONG KONG |

Tin | CV Duta Putra Bangka | INDONESIA |

Tin | CV Makmur Jaya | INDONESIA |

Tin | CV Serumpun Sebalai | INDONESIA |

Tin | Indonesia Smelting Corporation Berhad | INDONESIA |

Tin | KIHONG T & G | INDONESIA |

Tin | PT Fang Di MulTindo | INDONESIA |

Tin | PT Hanjaya Perkasa Metals | INDONESIA |

Tin | PT Seirama Tin Investment | INDONESIA |

Tin | PT Supra Sukses Trinusa | INDONESIA |

Tin | PT Yinchendo Mining Industry | INDONESIA |

Tin | UNIFORCE METAL INDUSTRIAL CORP. | INDONESIA |

Tin | Hikaru Suites Ltd. | JAPAN |

Tin | LS-NIKKO Copper Inc. | JAPAN |

Tin | Materials Eco-Refining CO.LTD | JAPAN |

Tin | Matsuo nn da Ltd. | JAPAN |

Tin | Stretti | JAPAN |

Tin | Tanaka Kikinzoku Kogyo K.K. | JAPAN |

Tin | Dae Kil Metal Co., Ltd | KOREA, REPUBLIC OF |

Tin | Hanbaek nonferrous metals | KOREA, REPUBLIC OF |

|

| | |

Mineral | Smelter Name | Location |

Tin | Hana-High Metal | MALAYSIA |

Tin | Novosibirsk Processing Plant Ltd. | RUSSIAN FEDERATION |

Tin | Metalor Technologies SA | SWITZERLAND |

Tin | Ami Bridge Enterprise Co., Ltd. | TAIWAN |

Tin | Cheng Yang | TAIWAN |

Tin | Full Armor Industries (shares) Ltd. | TAIWAN |

Tin | Taiwan high-tech Co., Ltd. | TAIWAN |

Tin | Jau Janq Enterprise Co. Ltd. | TAIWAN |

Tin | LUPON ENTERPRISE CO., LTD | TAIWAN |

Tin | Xia Yi Metal Industries (shares) Co., Ltd. | TAIWAN |

Tin | Zong Yang Industrial Co., Ltd. | TAIWAN |

Tin | Fuji Metal Mining Corp. | THAILAND |

Tin | MCP Metalspecialties, Inc | UNITED KINGDOM |

Tin | Aurubis AG | UNITED STATES |

Tin | Kennametal Huntsville | UNITED STATES |

Tin | Imperial Zinc | UNITED STATES |

Tin | Metallic Resources, Inc. | UNITED STATES |

Tungsten | Western Australian Mint trading as The Perth Mint | AUSTRALIA |

Tungsten | Metallo-Chimique N.V. | BELGIUM |

Tungsten | Sumitomo Metal Mining Co., Ltd. | CANADA |

Tungsten | Changchun up-optotech | CHINA |

Tungsten | Ganxian Shirui New Material Co., Ltd. | CHINA |

Tungsten | JX Nippon Mining & Metals Co., Ltd. | CHINA |

Tungsten | Jiangxi Minmetals Gao'an Non-ferrous Metals Co., Ltd. | CHINA |

Tungsten | AXISMATERIAL LIMITED | JAPAN |

Tungsten | KYORITSU GOKIN CO. LTD | JAPAN |

Tungsten | Mitsui Mining and Smelting Co., Ltd. | JAPAN |

Tungsten | Tanaka Kikinzoku Kogyo K.K. | JAPAN |

Tungsten | Degutea | KOREA, REPUBLIC OF |

Tungsten | Materion | UNITED STATES |

Tungsten | Ram Sales | UNITED STATES |

Tungsten | Sylham | UNITED STATES |

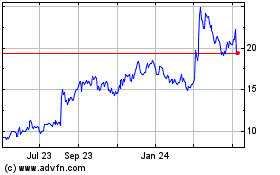

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

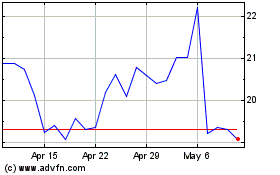

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024