UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2015

VERIFONE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-32465

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

04-3692546

(IRS Employer Identification No.)

2099 Gateway Place, Suite 600

San Jose, CA 95110

(Address of principal executive offices, including zip code)

408-232-7800

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On March 10, 2015, VeriFone Systems, Inc. (the "Company") announced its financial results for the fiscal quarter ended January 31, 2015. A copy of the Company's press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

During the Company's conference call and webcast to report these financial results on March 10, 2015, the Company will present certain supplemental financial information regarding its financial results for the fiscal quarter ended January 31, 2015. A copy of this supplemental financial information is attached hereto as Exhibit 99.2 and is incorporated herein by reference. This information is also available on the Company's investor relations website at http://ir.verifone.com.

The information in this Form 8-K provided under Item 2.02 and Exhibits 99.1 and 99.2 attached hereto are furnished to, but shall not be deemed filed with, the Securities and Exchange Commission or incorporated by reference into the Company's filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 7.01. Regulation FD Disclosure

Mr. Paul Galant, Chief Executive Officer of the Company, will be speaking at the Barclays Emerging Payments Forum on March 23, 2015 in an event that will be broadcast live via webcast.

A live audio webcast of the above event will be accessible through the Company's website at http://ir.verifone.com and will be available for seven days after the event.

The information in this Form 8-K provided under Item 7.01 is furnished to, but shall not be deemed filed with, the Securities and Exchange Commission or incorporated by reference into the Company's filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

99.1 Press release, dated March 10, 2015, titled "Verifone Reports Results for the First Quarter of Fiscal 2015"

99.2 Financial Results for the First Quarter Ended January 31, 2015 – Supplemental Financial Information

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| VERIFONE SYSTEMS, INC. |

| |

Date: March 10, 2015 | By: /s/ Albert Liu Name: Albert Liu Title: Executive Vice President, Corporate Development and General Counsel |

| |

EXHIBIT INDEX

Exhibit No. Description

| |

99.1 | Press release, dated March 10, 2015, titled "Verifone Reports Results for the First Quarter of Fiscal 2015" |

| |

99.2 | Financial Results for the First Quarter Ended January 31, 2015 – Supplemental Financial Information |

Exhibit 99.1

Verifone Reports Results for the First Quarter of Fiscal 2015

Revenues and Earnings per Share Exceed Guidance

SAN JOSE, Calif. - (BUSINESS WIRE) - VeriFone Systems, Inc. (NYSE: PAY):

First Quarter Financial Highlights

| |

• | GAAP net revenues of $486 million |

| |

• | Non-GAAP net revenues of $487 million |

| |

• | GAAP net income per diluted share of $0.12 |

| |

• | Non-GAAP net income per diluted share of $0.44 |

| |

• | Operating cash flow of $41 million |

VeriFone Systems, Inc. (NYSE: PAY), the global leader in secure electronic payment solutions, today announced financial results for the three months ended January 31, 2015. GAAP net revenues for the quarter were $486 million, compared to $436 million a year ago, an 11% increase. Non-GAAP net revenues were $487 million, compared to $437 million a year ago, an 11% increase. GAAP net income per diluted share for the quarter was $0.12, compared to a net loss of $0.15 a year ago. Non-GAAP net income per diluted share was $0.44, compared to $0.31 a year ago, a 42% increase.

“I’m pleased with our performance in Q1, and the team’s accomplishments. We again exceeded our financial guidance despite foreign exchange and macro-economic related headwinds,” said Paul Galant, Chief Executive Officer of Verifone. “We are successfully executing on our transformation, better serving our clients, and capitalizing on opportunities in key markets. At the same time, we are investing in delivering important new products for our clients, and in the future growth of our Terminals Solutions, Payment-as-a-Service and Commerce Enablement businesses.”

The table below provides additional summary GAAP and non-GAAP financial information and comparisons.

|

| | | | | | | | | | |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AND PERCENTAGES) | | |

| Three Months Ended January 31, |

| 2015 | | 2014 | | Change (2) |

GAAP: | | | | | |

Net revenues | $ | 486 |

| | $ | 436 |

| | 11 | % |

Gross margin as a % of net revenues | 41.0 | % | | 39.0 | % | | 2.0 pts |

|

Net income (loss) per diluted share | $ | 0.12 |

| | $ | (0.15 | ) | | nm |

|

| | | | | |

Non-GAAP (1): | | | | | |

Net revenues | $ | 487 |

| | $ | 437 |

| | 11 | % |

Gross margin as a % of net revenues | 42.4 | % | | 42.4 | % | | — |

|

Net income per diluted share | $ | 0.44 |

| | $ | 0.31 |

| | 42 | % |

(1) Reconciliations for the non-GAAP measures are provided at the end of this press release

(2) "nm" means not meaningful

Additional Financial and Business Highlights

| |

• | Achieved record North America net revenues driven by security and EMV migration |

| |

• | Secured 20 large U.S. retail client wins for EMV-capable devices including eight competitive takeaways and seven new hospitality wins |

| |

• | Announced new mPOS terminal offering and executed a small tuck-in acquisition of a Cloud POS solution for the SMB market |

| |

• | Began the roll out of next generation in-store site management and POS systems for petroleum vertical |

| |

• | Made initial deliveries on 3G countertop terminal solutions deal with a major financial institution in Mexico |

| |

• | Continued Payment-as-a-Service expansion in U.S., U.K., Turkey, and Australia |

| |

• | Expanded network of taxis with Verifone payment systems in Florida, Canada, and Ireland |

Guidance

Our updated guidance reflects the impact of a more unfavorable foreign exchange environment and a more challenged Russia market since the last time we provided our outlook on December 15th. These factors are partially offset by continued strength in certain geographies, primarily North America.

Second fiscal quarter of 2015:

| |

• | Non-GAAP net revenues of $485 million to $489 million |

| |

• | Non-GAAP net income per diluted share of $0.41 to $0.42 |

Full fiscal year 2015:

| |

• | Non-GAAP net revenues of $1,990 million to $2,000 million |

| |

• | Non-GAAP net income per diluted share of $1.78 to $1.82 |

Conference Call

Verifone will hold its earnings conference call today, March 10th, at 1:30 pm (PT). To listen to the call and view the slides, visit Verifone’s website http://ir.verifone.com. The recorded audio webcast will be available on Verifone's website until March 17, 2015.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or beliefs and on currently available competitive, financial and economic data and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the forward-looking statements herein due to changes in economic, business, competitive, technological, and/or regulatory factors, and other risks and uncertainties affecting the operation of the business of VeriFone Systems, Inc., including many factors beyond our control. These risks and uncertainties include, but are not limited to, those associated with: execution of our strategic plan and business and operational initiatives, including whether the expected benefits of our plan and initiatives are achieved within expected timeframes or at all, short product cycles and rapidly changing technologies, our ability to maintain competitive leadership position with respect to our payment solution offerings, our dependence on a limited number of customers, the conduct of our business and operations internationally, our ability to protect our computer systems and networks from fraud, cyber-attacks or security breaches, our assumptions, judgments and estimates regarding the impact on our business of political instability in markets where we conduct business, uncertainty in the global economic environment and financial markets, the status of our relationships with and condition of third parties such as our contract manufacturers, key customers, distributors and key suppliers and service providers upon whom we rely in the conduct of our business, the impact of foreign currency exchange rate fluctuations on our business and results and our ability to effectively hedge our exposure to foreign currency exchange rate fluctuations, and our dependence on a limited number of key employees. For a further list and description of the risks and uncertainties affecting the operations of our business, see our filings with the Securities and Exchange Commission, including our annual report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements speak only as of the date such statements are made. Verifone is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise.

About Verifone

Verifone is transforming everyday transactions into opportunities for connected commerce. We’re connecting more than 27 million payment devices to the cloud-merging the online and in-store shopping experience and creating the next generation of digital engagement between merchants and consumers. We are built on a 30-year history of uncompromised security. Our people are known as trusted experts that work with our clients and partners, helping to solve their most complex payments challenges. We have clients and partners in more than 150 countries, including the world’s best-known retail brands, financial institutions and payment providers.

Verifone.com | (NYSE: PAY) | @verifone

Additional Resources:

http://ir.verifone.com

|

| | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE DATA AND PERCENTAGES) |

|

| | | | Three Months Ended January 31, |

| | | | 2015 | | 2014 | | % Change (1) |

Net revenues: | | | | | | |

| System solutions | | $ | 313.4 |

| | $ | 261.2 |

| | 20.0 | % |

| Services | | 172.8 |

| | 174.9 |

| | (1.2 | )% |

| | Total net revenues | | 486.2 |

| | 436.1 |

| | 11.5 | % |

| | | | | | | |

|

|

Cost of net revenues: | | | | | | |

| System solutions | | 185.6 |

| | 167.5 |

| | 10.8 | % |

| Services | | 101.4 |

| | 98.4 |

| | 3.0 | % |

| | Total cost of net revenues | 287.0 |

| | 265.9 |

| | 7.9 | % |

| | | | | | | | |

Total gross margin | | 199.2 |

| | 170.2 |

| | 17.0 | % |

| | | | | | | | |

Operating expenses: | | | | | | |

| Research and development | | 48.9 |

| | 50.5 |

| | (3.2 | )% |

| Sales and marketing | | 57.4 |

| | 50.6 |

| | 13.4 | % |

| General and administrative | | 47.4 |

| | 50.9 |

| | (6.9 | )% |

| Amortization of purchased intangible assets | | 22.3 |

| | 24.7 |

| | (9.7 | )% |

| | Total operating expenses | | 176.0 |

| | 176.7 |

| | (0.4 | )% |

Operating income (loss) | | 23.2 |

| | (6.5 | ) | | nm |

|

Interest, net | | (7.9 | ) | | (11.4 | ) | | (30.7 | )% |

Other income (expense), net | | 0.2 |

| | (5.1 | ) | | nm |

|

Income (loss) before income taxes | | 15.5 |

| | (23.0 | ) | | nm |

|

Income tax provision (benefit) | | 1.4 |

| | (6.9 | ) | | nm |

|

Consolidated net income (loss) | | 14.1 |

| | (16.1 | ) | | nm |

|

Net income attributable to noncontrolling interests | | (0.3 | ) | | (0.1 | ) | | nm |

|

Net income (loss) attributable to VeriFone Systems, Inc. stockholders | | $ | 13.8 |

| | $ | (16.2 | ) | | nm |

|

| | | | | | |

Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders: | | | | | | |

| Basic | | $ | 0.12 |

| | $ | (0.15 | ) | | |

| Diluted | | $ | 0.12 |

| | $ | (0.15 | ) | | |

| | | | | | | | |

Weighted average number of shares used in computing net income (loss) per share: | | | | | | |

| Basic | | 113.4 |

| | 110.3 |

| | |

| Diluted | | 115.5 |

| | 110.3 |

| | |

| | | | | | | | |

| | (1) "nm" means not meaningful | | |

|

| | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

NET REVENUES INFORMATION |

(UNAUDITED, IN MILLIONS, EXCEPT PERCENTAGES) |

| | | | | |

| | | Three Months Ended |

| Note | | January 31, 2015 | | October 31, 2014 | | January 31, 2014 | | % Change (1) SEQ | | % Change (1) YoY |

GAAP net revenues: | | | | | | | | |

North America | | | $ | 160.3 |

| | $ | 149.1 |

| | $ | 122.1 |

| | 7.5 | % | | 31.3 | % |

LAC | | | 71.1 |

| | 82.1 |

| | 68.4 |

| | (13.4 | )% | | 3.9 | % |

EMEA | | | 180.0 |

| | 189.2 |

| | 185.2 |

| | (4.9 | )% | | (2.8 | )% |

Asia-Pacific | | | 74.8 |

| | 70.1 |

| | 60.4 |

| | 6.7 | % | | 23.8 | % |

Total | | | $ | 486.2 |

| | $ | 490.5 |

| | $ | 436.1 |

| | (0.9 | )% | | 11.5 | % |

| | | | | | | | | | | |

Non-GAAP net revenues: (2) | | | | | | | | |

North America | A | | $ | 160.4 |

| | $ | 149.0 |

| | $ | 122.1 |

| | 7.7 | % | | 31.4 | % |

LAC | | | 71.1 |

| | 82.1 |

| | 68.4 |

| | (13.4 | )% | | 3.9 | % |

EMEA | A | | 180.5 |

| | 189.4 |

| | 186.3 |

| | (4.7 | )% | | (3.1 | )% |

Asia-Pacific | A | | 74.9 |

| | 70.2 |

| | 60.4 |

| | 6.7 | % | | 24.0 | % |

Total | | | $ | 486.9 |

| | $ | 490.7 |

| | $ | 437.2 |

| | (0.8 | )% | | 11.4 | % |

| | | | | | | | | | | |

GAAP net revenues | | $ | 486.2 |

| | $ | 490.5 |

| | $ | 436.1 |

| | (0.9 | )% | | 11.5 | % |

Plus: Non-GAAP net revenues adjustments | A | | 0.7 |

| | 0.2 |

| | 1.1 |

| | nm |

| | nm |

|

Non-GAAP net revenues (2) | | 486.9 |

| | 490.7 |

| | 437.2 |

| | (0.8 | )% | | 11.4 | % |

(1) "nm" means not meaningful.

(2) Reconciliations for the non-GAAP measures are provided at the end of this press release.

|

| | | | | | | | | | | | | | |

| For three months ended January 31, 2015 compared with three months ended January 31, 2014 |

| Net revenues growth | | Impact due to Non-GAAP net revenues adjustments and acquired businesses (A) (B) | | Non-GAAP organic net revenues growth | | Impact due to foreign currency (C) | | Non-GAAP organic net revenues at constant currency growth |

North America | 31.3 | % | | (0.1)pts |

| | 31.4 | % | | (0.2)pts |

| | 31.6 | % |

LAC | 3.9 | % | | 0.0pts |

| | 3.9 | % | | (11.1)pts |

| | 15.0 | % |

EMEA | (2.8 | )% | | 0.3pts |

| | (3.1 | )% | | (6.8)pts |

| | 3.7 | % |

Asia-Pacific | 23.8 | % | | (0.3)pts |

| | 24.1 | % | | (3.4)pts |

| | 27.5 | % |

Total | 11.5 | % | | 0.1pts |

| | 11.4 | % | | (5.1)pts |

| | 16.5 | % |

|

| | | | | | | | |

VERIFONE SYSTEMS, INC. |

CONDENSED CONSOLIDATED BALANCE SHEETS |

(UNAUDITED, IN MILLIONS) |

| | January 31, 2015 | | October 31, 2014 |

ASSETS | | | |

Current assets: | | | |

| Cash and cash equivalents | $ | 240.6 |

| | $ | 250.2 |

|

| Accounts receivable, net of allowances of $9.8 and $9.9 | 287.3 |

| | 305.5 |

|

| Inventories | 137.6 |

| | 124.3 |

|

| Prepaid expenses and other current assets | 103.8 |

| | 105.6 |

|

Total current assets | 769.3 |

| | 785.6 |

|

Fixed assets, net | 168.6 |

| | 177.7 |

|

Purchased intangible assets, net | 389.3 |

| | 457.6 |

|

Goodwill | 1,099.3 |

| | 1,185.9 |

|

Deferred tax assets, net | 13.7 |

| | 30.4 |

|

Other long-term assets | 63.9 |

| | 65.0 |

|

Total assets | $ | 2,504.1 |

| | $ | 2,702.2 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Current liabilities: | | | |

| Accounts payable | $ | 146.3 |

| | $ | 161.2 |

|

| Accruals and other current liabilities | 189.6 |

| | 207.0 |

|

| Deferred revenue, net | 94.1 |

| | 92.1 |

|

| Short-term debt | 32.1 |

| | 32.1 |

|

Total current liabilities | 462.1 |

| | 492.4 |

|

Long-term deferred revenue, net | 50.2 |

| | 51.0 |

|

Long-term debt | 831.2 |

| | 851.0 |

|

Long-term deferred tax liabilities, net | 129.3 |

| | 136.1 |

|

Other long-term liabilities | 69.5 |

| | 101.0 |

|

Total liabilities | 1,542.3 |

| | 1,631.5 |

|

| | | |

Redeemable noncontrolling interest in subsidiary | 0.8 |

| | 0.8 |

|

| | | |

Stockholders’ equity: | | | |

Common stock | 1.1 |

| | 1.1 |

|

Additional paid-in capital | 1,690.3 |

| | 1,675.7 |

|

Accumulated deficit | (524.4 | ) | | (538.2 | ) |

Accumulated other comprehensive loss | (242.2 | ) | | (104.8 | ) |

Total VeriFone Systems, Inc. stockholders’ equity | 924.8 |

| | 1,033.8 |

|

Noncontrolling interest in subsidiaries | 36.2 |

| | 36.1 |

|

Total equity | 961.0 |

| | 1069.9 |

|

Total liabilities and equity | $ | 2,504.1 |

| | $ | 2,702.2 |

|

|

| | | | | | | | | |

VERIFONE SYSTEMS, INC. |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

(UNAUDITED, IN MILLIONS) |

|

| | | Three Months Ended January 31, |

| | | 2015 | | 2014 |

Cash flows from operating activities | | | |

Consolidated net income (loss) | $ | 14.1 |

| | $ | (16.1 | ) |

Adjustments to reconcile consolidated net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization, net | 44.4 |

| | 53.1 |

|

| Stock-based compensation expense | 12.2 |

| | 15.7 |

|

| Other | 8.6 |

| | (6.4 | ) |

| Net cash provided by operating activities before changes in operating assets and liabilities | 79.3 |

| | 46.3 |

|

| Changes in operating assets and liabilities: | | | |

| | Accounts receivable, net | 9.4 |

| | 17.3 |

|

| | Inventories | (19.1 | ) | | 15.5 |

|

| | Prepaid expenses and other assets | (6.3 | ) | | 11.7 |

|

| | Accounts payable | (11.6 | ) | | (4.8 | ) |

| | Deferred revenue, net | 7.8 |

| | 17.7 |

|

| | Other current and long-term liabilities | (18.4 | ) | | (71.8 | ) |

| | Net change in operating assets and liabilities | (38.2 | ) | | (14.4 | ) |

Net cash provided by operating activities | 41.1 |

| | 31.9 |

|

| | | | | |

Cash flows from investing activities | | | |

Capital expenditures | (19.6 | ) | | (20.9 | ) |

Other investing activities, net | — |

| | 2.6 |

|

Net cash used in investing activities | (19.6 | ) | | (18.3 | ) |

| | | | | |

Cash flows from financing activities | | | |

Proceeds from debt, net of issuance costs | 10.0 |

| | 86.9 |

|

Repayments of debt | (30.1 | ) | | (121.9 | ) |

Other financing activities, net | 3.7 |

| | 5.6 |

|

Net cash used in financing activities | (16.4 | ) | | (29.4 | ) |

| | | | | |

Effect of foreign currency exchange rate changes on cash and cash equivalents | (14.7 | ) | | (3.1 | ) |

| | | | | |

Net decrease in cash and cash equivalents | (9.6 | ) | | (18.9 | ) |

Cash and cash equivalents, beginning of period | 250.2 |

| | 268.2 |

|

Cash and cash equivalents, end of period | $ | 240.6 |

| | $ | 249.3 |

|

|

| | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income (loss) | | Net income (loss) attributable to VeriFone Systems, Inc. stockholders |

Three Months Ended January 31, 2015 | | | | | | | | | | |

GAAP | | $ | 486.2 |

| | $ | 199.2 |

| | 41.0 | % | | $ | 23.2 |

| | $ | 13.8 |

|

Adjustments: | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 0.7 |

| | 0.7 |

| | | | 0.7 |

| | 0.7 |

|

| Amortization of purchased intangible assets | D | — |

| | 4.7 |

| | | | 27.0 |

| | 27.0 |

|

| Other merger and acquisition related expenses | D | — |

| | 0.3 |

| | | | 0.7 |

| | (1.9 | ) |

| Stock based compensation | E | — |

| | 0.7 |

| | | | 12.2 |

| | 12.2 |

|

| Restructuring charges | F | — |

| | — |

| | | | 1.4 |

| | 1.4 |

|

| Other charges and income | F | — |

| | 0.8 |

| | | | 4.9 |

| | 4.9 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | F | — |

| | — |

| | | | — |

| | (7.3 | ) |

Non-GAAP | | $ | 486.9 |

| | $ | 206.4 |

| | 42.4 | % | | $ | 70.1 |

| | $ | 50.8 |

|

| | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income (loss) per share: | | | | Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | Basic | | Diluted |

GAAP | | 113.4 |

| | 115.5 |

| | | | $ | 0.12 |

| | $ | 0.12 |

|

Non-GAAP | | 113.4 |

| | 115.5 |

| | | | $ | 0.45 |

| | $ | 0.44 |

|

(1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income (loss) | | Net income (loss) attributable to VeriFone Systems, Inc. stockholders |

Three Months Ended October 31, 2014 | | | | | | | | | | |

GAAP | | $ | 490.5 |

| | $ | 196.5 |

| | 40.1 | % | | $ | 33.5 |

| | $ | 31.1 |

|

Adjustments: | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 0.2 |

| | 0.2 |

| |

|

| | 0.2 |

| | 0.2 |

|

| Amortization of purchased intangible assets | D | — |

| | 10.0 |

| | | | 33.8 |

| | 33.8 |

|

| Other merger and acquisition related expenses | D | — |

| | 0.6 |

| | | | 1.0 |

| | (3.5 | ) |

| Stock based compensation | E | — |

| | 0.7 |

| | | | 13.0 |

| | 13.0 |

|

| Restructuring charges | F | — |

| | 0.2 |

| | | | 1.5 |

| | 1.5 |

|

| Other charges and income | F | — |

| | (0.8 | ) | | | | (14.9 | ) | | (15.9 | ) |

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | F | — |

| | — |

| | | | — |

| | (10.1 | ) |

Non-GAAP | | $ | 490.7 |

| | $ | 207.4 |

| | 42.3 | % | | $ | 68.1 |

| | $ | 50.1 |

|

| | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income (loss) per share: | | | | Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | Basic | | Diluted |

GAAP | | 113.1 |

| | 115.1 |

| | | | $ | 0.27 |

| | $ | 0.27 |

|

Non-GAAP | | 113.1 |

| | 115.1 |

| | | | $ | 0.44 |

| | $ | 0.44 |

|

(1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS, EXCEPT PER SHARE AMOUNTS AND PERCENTAGES) |

| | Note | Net revenues | | Gross margin | | Gross margin percentage | | Operating income (loss) | | Net income (loss) attributable to VeriFone Systems, Inc. stockholders |

Three Months Ended January 31, 2014 | | | | | | | | | | |

GAAP | | $ | 436.1 |

| | $ | 170.2 |

| | 39.0 | % | | $ | (6.5 | ) | | $ | (16.2 | ) |

Adjustments: | | | | | | | | | | |

| Amortization of step-down in deferred services net revenues at acquisition | A | 1.1 |

| | 1.1 |

| | | | 1.1 |

| | 1.1 |

|

| Amortization of purchased intangible assets | D | — |

| | 11.4 |

| | | | 36.1 |

| | 36.1 |

|

| Other merger and acquisition related expenses | D | — |

| | 2.0 |

| | | | 3.2 |

| | 5.7 |

|

| Stock based compensation | E | — |

| | 0.5 |

| | | | 15.7 |

| | 15.7 |

|

| Other charges and income | F | — |

| | — |

| | | | 3.6 |

| | 5.2 |

|

| Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate | F | — |

| | — |

| | | | — |

| | (12.8 | ) |

Non-GAAP | | $ | 437.2 |

| | $ | 185.2 |

| | 42.4 | % | | $ | 53.2 |

| | $ | 34.8 |

|

| | | | | | | | | | | |

| | | Weighted average number of shares used in computing net income (loss) per share: | | | | Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) |

| | | Basic | | Diluted | | | | Basic | | Diluted |

GAAP | | 110.3 |

| | 110.3 |

| | | | $ | (0.15 | ) | | $ | (0.15 | ) |

| Adjustment for diluted shares | G | — |

| | 2.1 |

| | | | | | |

Non-GAAP | | 110.3 |

| | 112.4 |

| | | | $ | 0.32 |

| | $ | 0.31 |

|

(1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS) |

| | | | | | | | | | | | | | | | |

| | | | GAAP net revenues | | Amortization of step-down in deferred revenue at acquisition | | Non-GAAP net revenues | | Net revenues from businesses acquired in the past 12 months | | Non-GAAP organic net revenues | | Constant currency adjustment | | Non-GAAP organic net revenues at constant currency |

| | Note | | | | (A) | | (A) | | (B) | | (B) | | (C) | | (C) |

| | | | | | | | | | | | | | | | |

Three Months Ended January 31, 2015 |

North America | | $ | 160.3 |

| | $ | 0.1 |

| | $ | 160.4 |

| | $ | — |

| | $ | 160.4 |

| | $ | 0.3 |

| | $ | 160.7 |

|

LAC | | 71.1 |

| | — |

| | 71.1 |

| | — |

| | 71.1 |

| | 7.6 |

| | 78.7 |

|

EMEA | | 180.0 |

| | 0.5 |

| | 180.5 |

| | — |

| | 180.5 |

| | 12.6 |

| | 193.1 |

|

Asia-Pacific | | 74.8 |

| | 0.1 |

| | 74.9 |

| | — |

| | 74.9 |

| | 2.0 |

| | 76.9 |

|

| | Total | | $ | 486.2 |

| | $ | 0.7 |

| | $ | 486.9 |

| | $ | — |

| | $ | 486.9 |

|

| $ | 22.5 |

| | $ | 509.4 |

|

| | | | | | | | | | | | | | |

System Solutions | | $ | 313.4 |

| | $ | — |

| | $ | 313.4 |

| | | | | | | | |

Services | | 172.8 |

| | 0.7 |

| | 173.5 |

| | | | | | | | |

| | Total | | $ | 486.2 |

| | $ | 0.7 |

| | $ | 486.9 |

| |

|

|

| |

| |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended October 31, 2014 |

North America | | $ | 149.1 |

| | $ | (0.1 | ) | | $ | 149.0 |

| | | | | | | | |

LAC | | 82.1 |

| | — |

| | 82.1 |

| | | | | | | | |

EMEA | | 189.2 |

| | 0.2 |

| | 189.4 |

| | | | | | | | |

Asia-Pacific | | 70.1 |

| | 0.1 |

| | 70.2 |

| | | | | | | | |

| | Total | | $ | 490.5 |

| | $ | 0.2 |

| | $ | 490.7 |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

System Solutions | | $ | 310.9 |

| | $ | — |

| | $ | 310.9 |

| | | | | | | | |

Services | | 179.6 |

| | 0.2 |

| | 179.8 |

| | | | | | | | |

| | Total | | $ | 490.5 |

| | $ | 0.2 |

| | $ | 490.7 |

| | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended January 31, 2014 |

North America | | $ | 122.1 |

| | $ | — |

| | $ | 122.1 |

| | $ | — |

| | $ | 122.1 |

| | | | |

LAC | | 68.4 |

| | — |

| | 68.4 |

| | — |

| | 68.4 |

| | | | |

EMEA | | 185.2 |

| | 1.1 |

| | 186.3 |

| | — |

| | 186.3 |

| | | | |

Asia-Pacific | | 60.4 |

| | — |

| | 60.4 |

| | — |

| | 60.4 |

| | | | |

| | Total | | $ | 436.1 |

| | $ | 1.1 |

| | $ | 437.2 |

| | $ | — |

| | $ | 437.2 |

|

| | | |

| | | | | | | | | | | | | | | | |

System Solutions | | $ | 261.2 |

| | $ | — |

| | $ | 261.2 |

| | | | | | | | |

Services | | 174.9 |

| | 1.1 |

| | 176.0 |

| | | | | | | | |

| | Total | | $ | 436.1 |

| | $ | 1.1 |

| | $ | 437.2 |

| | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | |

VERIFONE SYSTEMS, INC. |

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES |

(UNAUDITED, IN MILLIONS) |

| | | | | |

| | | Three Months Ended |

| Note | | January 31, 2015 | | October 31, 2014 | | January 31, 2014 | | % Change SEQ | | % Change YoY |

Free Cash Flow | | | | | | | | | | | |

GAAP net cash provided by operating activities | H | | $ | 41.1 |

| | $ | 51.6 |

| | $ | 31.9 |

| | (20.3 | )% | | 28.8 | % |

Less: GAAP capital expenditures | H | | (19.6 | ) | | (22.2 | ) | | (20.9 | ) | | (11.7 | )% | | (6.2 | )% |

Free cash flow | H | | $ | 21.5 |

| | $ | 29.4 |

| | $ | 11.0 |

| | (26.9 | )% | | 95.5 | % |

| | | | | | | | | | | |

| | | Three Months Ending April 30, 2015 | | Year Ending October 31, 2015 | | |

Guidance | | | Range of Guidance | | Range of Guidance | | |

GAAP net revenues | | | $ | 485 |

| | $ | 489 |

| | $ | 1,989 |

| | $ | 1,999 |

| | |

Adjustments to net revenues | A | | — |

| | — |

| | 1 |

| | 1 |

| | |

Non-GAAP net revenues | | | $ | 485 |

| | $ | 489 |

| | $ | 1,990 |

| | $ | 2,000 |

| | |

NON-GAAP FINANCIAL MEASURES

This press release and its attachments include several non-GAAP financial measures, including non-GAAP net revenues; non-GAAP Services net revenues, net revenues from businesses acquired in the past 12 months; non-GAAP organic net revenues; non-GAAP organic net revenues at constant currency; non-GAAP gross margin as a percentage of non-GAAP net revenues; non-GAAP net income (loss) per diluted share, and free cash flow. This press release also includes certain forward-looking non-GAAP financial measures, specifically projected Non-GAAP net revenues and Non-GAAP net income per diluted share for the second fiscal quarter and full fiscal year 2015. The corresponding reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measures, to the extent available without unreasonable effort, are included in this press release.

Management uses non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. Management believes that these non-GAAP financial measures help it to evaluate Verifone's performance and operations and to compare Verifone's current results with those for prior periods as well as with the results of peer companies. Verifone incurs, due to differences in debt, capital structure and investment history, certain income and expense items, such as stock based compensation, amortization of acquired intangibles and other non-cash expenses, that differ significantly from Verifone's competitors. The non-GAAP financial measures reflect Verifone's reported operating performance without such items. Management also uses these non-GAAP financial measures in Verifone's budget and planning process. Management believes that the presentation of these non-GAAP financial measures is useful to investors in comparing Verifone's operating performance in any period with its performance in other periods and with the performance of other companies that represent alternative investment opportunities. These non-GAAP financial measures contain limitations and should be considered as a supplement to, and not as a substitute for, or superior to, disclosures made in accordance with GAAP.

These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and may therefore differ from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures do not reflect all amounts and costs, such as acquisition related costs, employee stock-based compensation costs, cash that may be expended for future capital expenditures or contractual commitments, working capital needs, cash used to service interest or principal payments on Verifone's debt, income taxes and the related cash requirements, and restructuring charges, associated with Verifone's results of operations as determined in accordance with GAAP.

Furthermore, Verifone expects to continue to incur income and expense items that are similar to those that are excluded by the non-GAAP adjustments described herein. Management compensates for these limitations by also relying on the comparable GAAP financial measures.

Our GAAP and non-GAAP net revenues are presented for our geographic regions: North America, LAC, EMEA and Asia-Pacific. North America includes the US and Canada. LAC includes South America, Central America, and the Caribbean. EMEA includes Europe, Russia. the Middle East, and Africa. Asia-Pacific includes Australia, New Zealand, China, India and throughout the rest of Greater Asia, including other Asia-Pacific Rim countries.

Note A: Non-GAAP net revenues. Non-GAAP net revenues exclude the fair value decrease (step-down) in deferred revenue at acquisition. Although the step-down of deferred revenue fair value at acquisition is reflected in our GAAP financial statements, it results in net revenues immediately post-acquisition that are lower than net revenues that would be recognized in accordance with GAAP on those same services if they were sold under contracts entered into post-acquisition. We adjust the step-down to achieve comparability to net revenues of the acquired entity earned pre-acquisition and to our GAAP net revenues to be earned on contracts sold in future periods. These non-GAAP net revenues amounts are not intended to be a substitute for our GAAP disclosures of net revenues, and should be read together with our GAAP disclosures.

Note B: Non-GAAP organic net revenues. "Non-GAAP organic net revenues" is a non-GAAP financial measure of net revenues excluding "net revenues from businesses acquired in the past 12 months" (as defined below). Verifone determines non-GAAP organic net revenues by deducting net revenues from businesses acquired in the past 12 months from non-GAAP net revenues. This non-GAAP measure is used to evaluate Verifone net revenues without the impact of net revenues from acquired businesses, as Verifone analyzes performance both with and without the impact of our recent acquisitions.

Net revenues from businesses acquired in the past 12 months consists of net revenues derived from the sales channels of acquired resellers and distributors, and net revenues from System solutions and Services attributable to businesses acquired in the 12 months preceding the respective financial quarter(s). For acquisitions of small businesses that are integrated within a relatively short time after the close of the acquisition, we assume quarterly net revenues attributable to such acquired businesses during the 12 months following acquisition remain at the same level as in the first full quarter after the acquisition closed. During periods prior to our acquisition of former customers, net revenues from businesses acquired in the past 12 months consists of sales by Verifone to that former customer for that period.

Note C: Non-GAAP organic net revenues at constant currency. Verifone determines non-GAAP organic net revenues at constant currency by recomputing non-GAAP organic net revenues denominated in currencies other than U.S. Dollars in the current fiscal period using average exchange rates for that particular currency during the corresponding financial period of the prior year. Verifone uses this non-GAAP measure to evaluate performance on a comparable basis excluding the impact of foreign currency fluctuations.

Note D: Merger and Acquisition Related. Verifone adjusts certain revenues and expenses for items that are the result of merger and acquisitions.

Acquisition related adjustments include the amortization of purchased intangible assets, fixed asset fair value adjustments, contingent consideration adjustments, incremental costs associated with acquisitions (such as legal fees related to litigation assumed as part of acquisitions) and acquisition integration expenses (such as costs of personnel required to assist with integration transitions). In addition, we adjust for changes in estimate and final resolution of contingencies that existed at the time of acquisition. Acquisition related expenses also result from events which arise from unforeseen circumstances which often occur outside the ordinary course of business.

Verifone analyzes the performance of its operations without regard to these adjustments. In determining whether any merger or acquisition related adjustment is appropriate, Verifone takes into consideration, among other things, how such adjustments would or would not aid the understanding of the performance of its operations.

Note E: Stock-Based Compensation. Our non-GAAP financial measures eliminate the effect of expense for stock-based compensation because they are non-cash expenses that management believes are not reflective of ongoing operating results. In particular, because of varying available valuation methodologies, subjective assumptions and the variety of award types which affect the calculations of stock-based compensation, we believe that the exclusion of stock-based compensation allows for more accurate comparisons of our operating results to our peer companies. Stock-based compensation is very different from other forms of compensation. A cash salary or bonus has a fixed and unvarying cash cost. In contrast the expense associated with an award of an option or other stock based award is unrelated to the amount of compensation ultimately received by the employee; and the cost to the company is based on valuation methodology and underlying assumptions that may vary over time and does not reflect any cash expenditure by the company. Furthermore, the expense associated with granting an employee an option or other stock based award can be spread over multiple years and may be reversed based on forfeitures which may differ from our original assumptions unlike cash compensation expense which is typically recorded contemporaneously with the time of award or payment.

Note F: Other Charges and Income. Verifone excludes certain revenue, expenses and other income (expense) that we have determined is not reflective of ongoing operating results. It is difficult to estimate the amount or timing of these items in advance. Although these events are reflected in our GAAP financial statements, we exclude them in our non-GAAP financial measures because we believe these items may limit the comparability of our ongoing operations with prior and future periods. These adjustments for other charges and income include:

| |

• | Benefits associated with the reversal of litigation loss contingency expense. |

| |

• | Certain costs incurred in connection with senior executive management changes, such as separation payments, non-compete arrangement fees, legal fees, recruiter fees and sign on bonuses. |

| |

• | Certain expenses, such as professional services and certain personnel costs, incurred on initiatives to transform, streamline and centralize our global operations. |

| |

• | Restructure and impairment charges related to certain exit activities initiated as part of our global transformation initiatives. |

We assess our operating performance with these amounts included and excluded, and by providing this information, we believe that users of our financial statements are better able to understand the financial results of what we consider to be our continuing operations.

Income taxes are adjusted for the tax effect of the adjusting items related to our non-GAAP financial measures and to reflect our estimate of cash taxes on a non-GAAP basis, in order to provide our management and users of the financial statements with better clarity regarding the on-going comparable performance and future liquidity of our business. Under GAAP our Income tax provision (benefit) as a percentage of Income (loss) before income taxes was 9.0% for the fiscal quarter ended January 31, 2015, (5.3)% for the fiscal quarter ended October 31, 2014, and 30.1% for the fiscal quarter ended January 31, 2014. For non-GAAP purposes, we used a 14.5% rate for the fiscal quarters ended January 31, 2015, October 31, 2014 and January 31, 2014.

Note G: Non-GAAP diluted shares. Diluted non-GAAP weighted average shares include additional shares that are dilutive for non-GAAP computations of earnings per share in periods when we have a non-GAAP net income and a GAAP basis net loss.

Note H: Free Cash Flow. Free cash flow is not defined under GAAP. Therefore, it should not be considered a substitute for income or cash flow data prepared in accordance with GAAP and may not be comparable to similarly titled measures used by other companies. Verifone determines free cash flow as net cash provided by operating activities less capital expenditures. We use this non-GAAP measure to evaluate our operating cash spend including the impact of our investments in long-term operating assets, such as property, equipment and capitalized software.

Contacts

VeriFone Systems, Inc.

Investor Relations:

Douglas D. Reed, 408-232-7979

SVP, Treasury & Investor Relations

ir@verifone.com

or

Media Relations:

Andy Payment, 770-754-3541

andy.payment@verifone.com

Source: VeriFone Systems, Inc.

FINANCIAL RESULTS For the First Quarter Ended January 31, 2015 Exhibit 99.2

Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. Verifone’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to Verifone’s filings with the Securities and Exchange Commission, including its annual report on Form 10-K and quarterly reports on Form 10-Q. Verifone is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. FORWARD-LOOKING STATEMENTS

NON-GAAP FINANCIAL MEASURES 3 With respect to any Non-GAAP financial measures presented in the information, reconciliations of Non-GAAP to GAAP financial measures may be found in Verifone’s quarterly earnings release as filed with the Securities and Exchange Commission as well as the Appendix to these slides. Management uses Non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. Management believes that these Non-GAAP financial measures help it to evaluate Verifone’s performance and to compare Verifone’s current results with those for prior periods as well as with the results of peer companies. These Non-GAAP financial measures contain limitations and should be considered as a supplement to, and not as a substitute for, or superior to, disclosures made in accordance with GAAP.

INTRODUCTION Paul Galant CEO

Q1 RESULTS: KEY TAKEAWAYS 5 Grew top line by 11% year-over-year; increased profitability Increased profit margins by 50bps over Q4; 200+bps YOY Record revenues in North America Improving free cash flow; de-leveraging our balance sheet Continued transformation progress Executing in Year of Product

TOP THREE VERIFONE INITIATIVES: YEAR TWO PRIORITIES 6 • Complete site and Center of Excellence consolidation • 90% of apps on new architecture • Consolidate 3 gateways by end of 2015 • Continue headcount efficiency • Complete 20% data center consolidation • Consolidate distribution, repair & warehouse operations • Close additional 11 facilities • Liquidate additional 13 legal entities • 60% of entities covered by shared services Product Portfolio Management R&D Re-Engineering Cost Optimization • Ongoing portfolio optimization • Transition to next gen HW/SW platform • Mobile solution re-design 6

COMMERCE ENABLEMENT FY15: THE “YEAR OF PRODUCT” 7 PAYMENT AS A SERVICE TERMINAL SLUTIONS TERMINAL SOLUTIONS Next Gen Terminals (Launch in Q415) New mPOS Suite (Next gen mobile terminal, SMB cloud POS) China (Low cost solution out of pilot) U.S. (Additional investments in EMV certifications for SMB) New Market Growth (U.S., U.K., Turkey) Security (Encryption in U.S., U.K.) Estate Management (New version of global solution) SCA (Processor & merchant wins, connecting 100k terminals) Media (Screen network growth; media solution in Germany) Petroleum (New payment, media and site control solutions) Triggers (Beaconized terminal proof of concept at NRF) App Store (Launch in FY15) 7

Q1 FINANCIAL RESULTS AND GUIDANCE Marc Rothman CFO

NON-GAAP KEY METRICS* 9 * Net Income = Net Income attributable to VeriFone Systems, Inc. stockholders * Operating Cash Flow = GAAP net cash provided by operating activities * A reconciliation of our GAAP to Non-GAAP financial measures, including Free Cash Flow, can be found in the appendix section Q115 Q114 Q414 Q115 % SEQ Inc(Dec) % YoY Inc(Dec) Net Revenues 437 491 487 (1)% 11% Gross Margin 185 207 206 0% 11% % of Revenue 42.4% 42.3% 42.4% 0.1pts 0.0pts Operating Income 53 68 70 3% 32% % of Revenue 12.2% 13.9% 14.4% 0.5pts 2.2pts Net Income* 35 50 51 2% 46% EPS 0.31 0.44 0.44 0% 42% Operating Cash Flow* 32 52 41 (21)% 28% Free Cash Flow 11 29 22 (24)% 100%

$ in millions NON-GAAP NET REVENUES PROFILE* Q115 Q114 Q414 Q115 % SEQ Inc(Dec) % YoY Inc(Dec) Organic YoY Growth Organic YoY Constant Currency Growth North America 122 149 160 8% 31% 31% 32% LAC 68 82 71 (13)% 4% 4% 15% EMEA 186 189 181 (5)% (3)% (3)% 4% Asia-Pacific 60 70 75 7% 24% 24% 28% TOTAL 437 491 487 (1)% 11% 11% 17% Q414 Q115 Q114 NA 28% ASIA-PAC 14% LAC 15% EMEA 43% NA 30% ASIA-PAC 14% LAC 17% EMEA 39% NA 33% ASIA-PAC 15% LAC 15% EMEA 37% * A reconciliation of our GAAP to Non-GAAP total net revenues can be found in the appendix section 10

NON-GAAP NET REVENUES AND GROSS MARGIN* $ in millions Q114 Q414 Q115 System Solutions 261 311 313 Services 176 180 174 Total Net Revenues 437 491 487 Services % of Total Net Revenues 40% 37% 36% $ in millions % of Revenue * A reconciliation of our GAAP to Non-GAAP Net revenues and gross margin can be found in the appendix section 11 Q114 Q414 Q115 System Solutions 40.1% 41.5% 42.4% Services 45.7% 43.6% 42.4% Total Gross Margin % 42.4% 42.3% 42.4%

NON-GAAP OPERATING EXPENSES* 12 * A reconciliation of our GAAP to Non-GAAP operating expenses can be found in the appendix section $ in millions Q114 Q414 Q115 Research and Development 46 47 46 % of Revenue 11% 10% 9% Sales and Marketing 47 50 50 % of Revenue 11% 10% 10% General and Administrative 38 42 40 % of Revenue 9% 9% 8% Total Operating Expenses 132 139 136 % of Revenue 30% 28% 28%

TOTAL CASH, GROSS DEBT AND NET DEBT Total Cash ($ in millions) 506 309 268 249 230 264 250 241 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Gross Debt ($ in millions) 1279 1119 1036 1001 940 924 883 863 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 863 As of January 31, 2015: $863M Outstanding Debt: – Short-term of $32M – Long-term of $831M Credit Ratings: – S&P . . . BB- – Moody’s . . . Ba3 Net Debt ($ in millions) 773 810 768 752 710 660 633 622 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 13

Q114 Q414 Q115 $ Days $ Days $ Days Accounts Receivables, net 263 54 306 56 287 53 Inventories, net 121 46 124 38 138 42 Accounts Payable 110 39 161 51 146 47 Cash Conversion Cycle 61 43 48 $ in millions, except days Notes: Accounts Receivable Days is calculated as Accounts Receivable, net divided by Non-GAAP Total Net Revenues * 90 days Inventory Days is calculated as Average Inventory, net divided by Non-GAAP Total Cost of Net Revenues * 90 days Accounts Payable Days is calculated as Accounts Payable divided by Non-GAAP Total Cost of Net Revenues * 90 days Cash Conversion Cycle is calculated as Accounts Receivable Days plus Inventory Days less Accounts Payable Days A reconciliation of our GAAP to Non-GAAP total net revenues and GAAP to Non-GAAP total cost of net revenues can be found in the appendix section BALANCE SHEET SELECT DATA 14

WORKING CAPITAL TREND Working Capital Performance* 20.1% 19.7% 17.7% 15.7% 14.3% 14.1% 13.7% 14.3% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Percent of S a le s Y/Y changes • AR increased $24M • Inventory increased $16M • AP increased $36M * Working Capital Performance, as % of Non-GAAP Total Net Revenues = working capital / quarterly non-GAAP Total Net Revenues annualized • Working Capital = AR + Inventory – AP • A reconciliation of our GAAP to Non-GAAP total net revenues can be found in the appendix section 15

CASH FLOW 58 31 38 11 36 38 29 22 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Free Cash Flow* 22 ($ in millions) ($ in millions) Operating Cash Flow: $41M Free Cash Flow: $22M * Operating Cash Flow = GAAP net cash provided by operating activities. Free Cash Flow is a non-GAAP financial measure. CapEx: $20M 79 49 55 32 57 59 52 Q213 Q313 Q413 Q114 Q214 Q314 Q414 Q115 Operating Cash Flow* 16 * A reconciliation of our GAAP net cash provided by operating activities to Free Cash Flow can be found in the appendix section 41

17 Guidance Q215 Full Year FY15 Non-GAAP Net Revenues $485M – 489M $1.99B - 2.00B Non-GAAP EPS $0.41 – 0.42 $1.78 - 1.82 Free Cash Flow ~$30M $140M – 150M Other Items Q215 Full Year FY15 Non-GAAP Operating Expenses ~$139M ~$555M Non-GAAP Effective Tax Rate ~14.5% ~14.5% Capital Expenditures ~$30M ~$125M Non-GAAP Fully Diluted Shares ~116M ~117M * Reconciliations to GAAP of these forward-looking Non-GAAP financial measures, to the extent available without unreasonable effort, can be found in the appendix section. GUIDANCE*

CONCLUSION Paul Galant CEO

Q&A SESSION

APPENDIX

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q115 21 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, D-F at the end of the appendix. 21 (In millions, except per share data and percentages) Note Net revenues Gross margin Gross margin percentage Operating income (loss) Net income (loss) attributable to VeriFone Systems, Inc. stockholders Three Months Ended January 31, 2015 GAAP $ 486.2 $ 199.2 41.0 % $ 23.2 $ 13.8 Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.7 0.7 0.7 0.7 Amortization of purchased intangible assets D — 4.7 27.0 27.0 Other merger and acquisition related expenses D — 0.3 0.7 (1.9 ) Stock based compensation E — 0.7 12.2 12.2 Restructuring charges F — — 1.4 1.4 Other charges and income F — 0.8 4.9 4.9 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate F — — — (7.3 ) Non-GAAP $ 486.9 $ 206.4 42.4 % $ 70.1 $ 50.8 Weighted average number of shares used in computing net income (loss) per share: Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 113.4 115.5 $ 0.12 $ 0.12 Non-GAAP 113.4 115.5 $ 0.45 $ 0.44

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q414 22 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, D-F at the end of the appendix. 22 (In millions, except per share data and percentages) Note Net revenues Gross margin Gross margin percentage Operating income (loss) Net income (loss) attributable to VeriFone Systems, Inc. stockholders Three Months Ended October 31, 2014 GAAP $ 490.5 $ 196.5 40.1 % $ 33.5 $ 31.1 Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 0.2 0.2 0.2 0.2 Amortization of purchased intangible assets D — 10.0 33.8 33.8 Other merger and acquisition related expenses D — 0.6 1.0 (3.5 ) Stock based compensation E — 0.7 13.0 13.0 Restructuring charges F — 0.2 1.5 1.5 Other charges and income F — (0.8 ) (14.9 ) (15.9 ) Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate F — — — (10.1 ) Non-GAAP $ 490.7 $ 207.4 42.3 % $ 68.1 $ 50.1 Weighted average number of shares used in computing net income (loss) per share: Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 113.1 115.1 $ 0.27 $ 0.27 Non-GAAP 113.1 115.1 $ 0.44 $ 0.44

RECONCILIATION OF GAAP TO NON-GAAP KEY METRICS Q114 23 (1) Net income (loss) per share is calculated by dividing the Net income (loss) attributable to VeriFone Systems, Inc. stockholders by the Weighted average number of shares. See explanatory notes for A, D-G at the end of the appendix. (In millions, except per share data and percentages) Not e Net revenues Gross margin Gross margin percentage Operating income (loss) Net income (loss) attributable to VeriFone Systems, Inc. stockholders Three Months Ended January 31, 2014 GAAP $ 436.1 $ 170.2 39.0 % $ (6.5 ) $ (16.2 ) Adjustments: Amortization of step-down in deferred services net revenues at acquisition A 1.1 1.1 1.1 1.1 Amortization of purchased intangible assets D — 11.4 36.1 36.1 Other merger and acquisition related expenses D — 2.0 3.2 5.7 Stock based compensation E — 0.5 15.7 15.7 Other charges and income F — — 3.6 5.2 Income tax effect of non-GAAP exclusions and adjustment to cash basis tax rate F — — — (12.8 ) Non-GAAP $ 437.2 $ 185.2 42.4 % $ 53.2 $ 34.8 Weighted average number of shares used in computing net income (loss) per share: Net income (loss) per share attributable to VeriFone Systems, Inc. stockholders (1) Basic Diluted Basic Diluted GAAP 110.3 110.3 $ (0.15 ) $ (0.15 ) Adjustment for diluted shares G — 2.1 Non-GAAP 110.3 112.4 $ 0.32 $ 0.31

RECONCILIATION OF GAAP TO NON-GAAP GROSS MARGIN 24 See explanatory notes for A, D-F at the end of the appendix (In millions, except percentages) Note System solutions net revenues Services net revenues Total net revenues Total cost of net revenues System solutions gross margin Services gross margin Total gross margin Three Months Ended January 31, 2015 GAAP $ 313.4 $ 172.8 $ 486.2 $ 287.0 $ 127.8 $ 71.4 $ 199.2 Amortization of step-down in deferred services net revenues at acquisition A — 0.7 0.7 — — 0.7 0.7 Other acquisition and restructure related, net D — — — (5.0 ) 4.6 0.4 5.0 Stock based compensation E — — — (0.7 ) 0.5 0.2 0.7 Other charges and income F — — — (0.8 ) — 0.8 0.8 Non-GAAP $ 313.4 $ 173.5 $ 486.9 $ 280.5 $ 132.9 $ 73.5 $ 206.4 Percentage of total net revenues 64.4 % 35.6 % 57.6 % 42.4 % 42.4 % 42.4 % Three Months Ended October 31, 2014 GAAP $ 310.9 $ 179.6 $ 490.5 $ 294.0 $ 119.8 $ 76.7 $ 196.5 Amortization of step-down in deferred services net revenues at acquisition A — 0.2 0.2 — — 0.2 0.2 Other acquisition and restructure related, net D — — — (10.8 ) 9.5 1.3 10.8 Stock based compensation E — — — (0.7 ) 0.5 0.2 0.7 Other charges and income F — — — 0.8 (0.8 ) — (0.8 ) Non-GAAP $ 310.9 $ 179.8 $ 490.7 $ 283.3 $ 129.0 $ 78.4 $ 207.4 Percentage of total net revenues 63.4 % 36.6 % 57.7 % 41.5 % 43.6 % 42.3 % Three Months Ended January 31, 2014 GAAP $ 261.2 $ 174.9 $ 436.1 $ 265.9 $ 93.7 $ 76.5 $ 170.2 Amortization of step-down in deferred services net revenues at acquisition A — 1.1 1.1 — — 1.1 1.1 Other acquisition and restructure related, net D — — — (13.4 ) 10.8 2.6 13.4 Stock based compensation E — — — (0.5 ) 0.3 0.2 0.5 Non-GAAP $ 261.2 $ 176.0 $ 437.2 $ 252.0 $ 104.8 $ 80.4 $ 185.2 Percentage of total net revenues 59.7 % 40.3 % 57.6 % 40.1 % 45.7 % 42.4 %

RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSES 25 See explanatory notes for D-F at the end of the appendix (In millions, except percentages) Note Research and development Sales and marketing General and administrative Total Three Months Ended January 31, 2015 GAAP $ 48.9 $ 57.4 $ 47.4 $ 153.7 Other acquisition and restructure related, net D (0.1 ) (0.7 ) (1.0 ) (1.8 ) Stock based compensation E (2.7 ) (4.1 ) (4.6 ) (11.4 ) Other charges and income F (0.5 ) (2.2 ) (1.5 ) (4.2 ) Non-GAAP $ 45.6 $ 50.4 $ 40.3 $ 136.3 As a percentage of Non-GAAP Net Revenues 9 % 10 % 8 % 28 % Three Months Ended October 31, 2014 GAAP $ 50.0 $ 56.3 $ 50.6 $ 156.9 Other acquisition and restructure related, net D (0.3 ) (0.2 ) (1.3 ) (1.8 ) Stock based compensation E (2.8 ) (4.9 ) (4.6 ) (12.3 ) Other charges and income F — (0.8 ) (2.8 ) (3.6 ) Non-GAAP $ 46.9 $ 50.4 $ 41.9 $ 139.2 As a percentage of Non-GAAP Net Revenues 10 % 10 % 8 % 28 % Three Months Ended January 31, 2014 GAAP $ 50.5 $ 50.6 $ 50.9 $ 152.0 Other acquisition and restructure related, net D — — (1.2 ) (1.2 ) Stock based compensation E (4.1 ) (2.8 ) (8.3 ) (15.2 ) Other charges and income F — (0.4 ) (3.2 ) (3.6 ) Non-GAAP $ 46.4 $ 47.4 $ 38.2 $ 132.0 As a percentage of Non-GAAP Net Revenues 11 % 11 % 9 % 30 %

RECONCILIATION OF GAAP TO NON-GAAP NET REVENUES 26 See explanatory notes for A-C at the end of the appendix. $ in millions GAAP net revenues Amortization of step-down in deferred revenue at acquisition Non-GAAP net revenues Net revenues from businesses acquired in the past 12 months Non-GAAP organic net revenues Constant currency adjustment Non-GAAP organic net revenues at constant currency Note (A) (A) (B) (B) (C) (C) Three Months Ended January 31, 2015 North America $ 160.3 $ 0.1 $ 160.4 $ — $ 160.4 $ 0.3 $ 160.7 LAC 71.1 — 71.1 — 71.1 7.6 78.7 EMEA 180.0 0.5 180.5 — 180.5 12.6 193.1 Asia-Pacific 74.8 0.1 74.9 — 74.9 2.0 76.9 Total $ 486.2 $ 0.7 $ 486.9 $ — $ 486.9 $ 22.5 $ 509.4 Three Months Ended October 31, 2014 North America $ 149.1 $ (0.1 ) $ 149.0 LAC 82.1 — 82.1 EMEA 189.2 0.2 189.4 Asia-Pacific 70.1 0.1 70.2 Total $ 490.5 $ 0.2 $ 490.7 Three Months Ended January 31, 2014 North America $ 122.1 $ — $ 122.1 $ — $ 122.1 LAC 68.4 — 68.4 — 68.4 EMEA 185.2 1.1 186.3 — 186.3 Asia-Pacific 60.4 — 60.4 — 60.4 Total $ 436.1 $ 1.1 $ 437.2 $ — $ 437.2

RECONCILIATION OF OPERATING CASH FLOW TO FREE CASH FLOW 27 See explanatory notes for H at the end of the appendix. Three Months Ended $ in millions Note January 31, 2015 October 31, 2014 July 31, 2014 April 30, 2014 Free Cash Flow GAAP net cash provided by operating activities H $ 41.1 $ 51.6 $ 58.9 $ 56.5 Less: GAAP capital expenditures H (19.6 ) (22.2 ) (20.9 ) (21.0 ) Free cash flow H $ 21.5 $ 29.4 $ 38.0 $ 35.5 Three Months Ended January 31, 2014 October 31, 2013 July 31, 2013 April 30, 2013 Free Cash Flow GAAP net cash provided by operating activities H $ 31.9 $ 54.9 $ 49.0 $ 79.2 Less: GAAP capital expenditures H (20.9 ) (17.2 ) (18.1 ) (21.4 ) Free cash flow H $ 11.0 $ 37.7 $ 30.9 $ 57.8

RECONCILIATION OF NET REVENUES GUIDANCE 28 See explanatory notes for A at the end of the appendix. Three Months Ending April 30, 2015 Year Ending October 31, 2015 Range of Guidance Range of Guidance GAAP net revenues $ 485 $ 489 $ 1,989 $ 1,999 Adjustments to net revenues A — — 1 1 Non-GAAP net revenues $ 485 $ 489 $ 1,990 $ 2,000

EXPLANATORY NOTES TO RECONCILIATIONS OF GAAP TO NON-GAAP ITEMS 29 Note A: Non-GAAP net revenues. Non-GAAP net revenues exclude the fair value decrease (step-down) in deferred revenue at acquisition. Note B: Non-GAAP organic net revenues. Verifone determines non-GAAP organic net revenues by deducting net revenues from businesses acquired in the past 12 months from non-GAAP net revenues. Net revenues from businesses acquired in the past 12 months consists of net revenues derived from the sales channels of acquired resellers and distributors, and net revenues from System solutions and Services attributable to businesses acquired in the 12 months preceding the respective financial quarter(s). For acquisitions of small businesses that are integrated within a relatively short time after the close of the acquisition, we assume quarterly net revenues attributable to such acquired businesses during the 12 months following acquisition remain at the same level as in the first full quarter after the acquisition closed. Note C: Non-GAAP organic net revenues at constant currency. Verifone determines non-GAAP organic net revenues at constant currency by recomputing non-GAAP organic net revenues denominated in currencies other than U.S. Dollars in the current fiscal period using average exchange rates for that particular currency during the corresponding financial period of the prior year. Verifone uses this non-GAAP measure to evaluate performance on a comparable basis excluding the impact of foreign currency fluctuations. Note D: Merger and Acquisition Related. Verifone adjusts certain revenues and expenses for items that are the result of merger and acquisitions. Acquisition related adjustments include the amortization of purchased intangible assets, fixed asset fair value adjustments, contingent consideration adjustments, incremental costs associated with acquisitions, acquisition integration expenses and changes in estimate on contingencies that existed at the time of acquisition. Note E: Stock-Based Compensation. Our non-GAAP financial measures eliminate the effect of expense for stock-based compensation. Note F: Other Charges and Income. Verifone excludes certain revenue, expenses and other income (expense) that are the result of unique or unplanned events, such as benefits associated with the reversal of litigation loss contingency expense, certain costs incurred in connection with senior executive management changes, certain personnel and outside professional service fees incurred on initiatives to transform, streamline and centralize our global operations, and restructure and impairment charges related to certain exit activities initiated as part of our global transformation initiatives. In addition, income taxes are adjusted for the tax effect of the adjusting items related to our non-GAAP financial measures and to reflect our estimate of cash taxes on a non-GAAP basis. Under GAAP our Income tax provision (benefit) as a percentage of Income (loss) before income taxes was 9.0% for the fiscal quarter ended January 31, 2015, (5.3)% for the fiscal quarter ended October 31, 2014, and 30.1% for the fiscal quarter ended January 31, 2014. For non-GAAP purposes, we used a 14.5% rate for the fiscal quarters ended January 31, 2015, October 31, 2014 and January 31, 2014. Note G: Non-GAAP diluted shares. Diluted non-GAAP weighted average shares include additional shares that are dilutive for non-GAAP computations of earnings per share in periods when we have a non-GAAP net income and a GAAP basis net loss. Note H: Free Cash Flow. Verifone determines free cash flow as net cash provided by operating activities less capital expenditures.

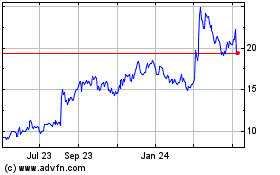

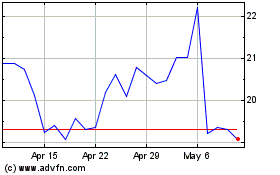

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024