Current Report Filing (8-k)

December 02 2016 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 29, 2016

PAR Technology Corporation

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

1-09720

|

16-1434688

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S Employer Identification No.)

|

|

8383 Seneca Turnpike

New Hartford, New York

|

|

13413-4991

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

(315) 738-0600

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement

|

Credit Agreement

On November 29, 2016, PAR Technology Corporation (the “Company”) entered into a Credit Agreement (the “Credit Agreement”) by and among the Company, as the Borrower thereunder, together with certain of the Company’s US subsidiaries, as “Loan Guarantors” (together with the Company, the “Loan Parties”), and JPMorgan Chase Bank, N.A., as the “Lender”. The Credit Agreement provides for revolving loans in an aggregate principal amount of up to $15.0 million to be made available to the Company; availability at any time being equal to the lesser of (i) $15.0 million and (ii) a borrowing base (equal to the sum of 80% eligible accounts, 50% eligible raw materials inventory and 35% eligible finished goods inventory, with no more than 50% of total eligible inventory included in the borrowing base), less the aggregate principal amount outstanding (the “Credit Facility”). Interest accrues on outstanding principal balances at an applicable rate per annum determined, as of the end of each fiscal quarter of the Company, by reference to the CBFR Spread or the Eurodollar Spread based on the Company’s consolidated indebtedness ratio as at the determination date. The Credit Facility replaces the Company’s asset-based credit agreement dated September 9, 2014 with JPMorgan Chase, N.A. (the “2014 ABL Credit Agreement”) and a portion of the proceeds of the Credit Facility were used to pay-off all indebtedness outstanding under the Company’s 2014 ABL Credit Agreement.

The Credit Facility matures three (3) years from the date of the Credit Agreement and is guaranteed by the Loan Guarantors. The Credit Facility is secured by substantially all of the assets of the Company and of the other Loan Parties; provided, that the Credit Facility is not secured by any liens on more than 65% of the voting stock of the Company’s foreign subsidiaries. The Credit Agreement contains representations and warranties and affirmative and negative covenants that are usual and customary, including representations, warranties and covenants that, among other things, restrict the ability of the Company and its subsidiaries to incur additional indebtedness, incur or permit to exist liens on assets, make investments, loans, advances, guarantees and acquisitions, consolidate or merge with or into any other company, engage in asset sales and pay dividends and make distributions. The Credit Agreement requires that the Company’s consolidated indebtedness ratio at the end of each of its fiscal quarters to be greater than 3.0 to 1.0 and maintain a fixed charge coverage ratio of not less than 1.15 to 1.0 for the Company’s fiscal quarter ending December 31, 2016 (to be tested only in the event the Company’s total consolidated indebtedness equals or exceeds $5,000,000 at the end of such fiscal quarter) and 1.25 to 1.0 for the quarter ending March 31, 2017 and each quarter thereafter. Obligations under the Credit Agreement may be accelerated upon certain customary events of default (subject to grace periods, as appropriate), including among others: nonpayment of principal, interest or fees; breach of the affirmative or negative covenants; breach of the representations or warranties in any material respect; event of default under, or acceleration of, other material indebtedness; bankruptcy or insolvency; material judgments entered against the Company or any of its subsidiaries; invalidity or unenforceability of any collateral documentation associated with the Credit Facility; and a change of control of the Company.

The foregoing description of the Credit Agreement and resulting Credit Facility does not purport to be complete and is qualified in its entirety by reference to the complete text of the Credit Agreement, a copy of which will be filed as an exhibit to the Company's Annual Report on Form 10-K for the period ending December 31, 2016 to be filed with the Securities and Exchange Commission.

|

Item 1.02.

|

Termination of a Material Definitive Agreement

|

The disclosure required by this item is included in Item 1.01 above and is incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The disclosure required by this item is included in Item 1.01 above and is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

PAR Technology Corporation

|

|

|

|

|

|

/s/ Matthew J. Trinkaus

|

|

|

Matthew J. Trinkaus,

|

|

|

Chief Accounting Officer & Corporate Controller

|

Date: December 2, 2016

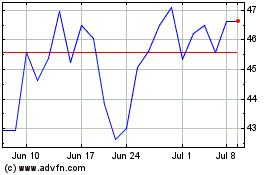

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

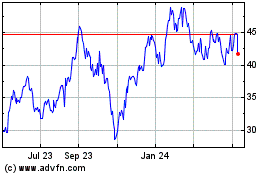

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024