PAR Technology Corporation (NYSE:PAR) today announced results

from continuing operations for the second quarter ended June 30,

2016.

Summary of Fiscal 2016 Second Quarter and Year-to-Date

Financial Results from Continuing Operations

- Revenues were reported at $52.7 million

in the second quarter of fiscal 2016, compared to $58.9 million in

the same period in 2015, a 10.6% decrease.

- GAAP net income from continuing

operations in the second quarter of fiscal 2016 was $0.1 million,

or $0.01 earnings per diluted share, compared to a GAAP net income

from continuing operations of $1.2 million, or $0.08 earnings per

diluted share in the same period in 2015.

- Non-GAAP net income from continuing

operations in the second quarter of fiscal 2016 was $0.6 million,

or $0.04 per diluted share, compared to a non-GAAP net income from

continuing operations of $1.7 million, or $0.11 earnings per

diluted share, in the same period in 2015.

- Revenue decreased to $108.0 million in

the first six months of fiscal 2016, compared to $114.1 million in

the same period in 2015.

- GAAP net income from continuing

operations in the first six months of fiscal 2016 was $0.1 million

or $0.01 earnings per diluted share, compared to GAAP net income

from continuing operations of $1.4 million, or $0.09 earnings per

diluted share, in the same period in 2015.

- Non-GAAP net income from continued

operations in the first six months of fiscal 2016 was $1.6 million,

or $0.10 earnings per diluted share, compared to non-GAAP net

income from continuing operations of $2.3 million or $0.15 earnings

per diluted share, in the same period in 2015.

A reconciliation and description of non-GAAP financial measures

to their comparable GAAP financial measures are included in the

tables following this news release.

“During the second quarter, we continued to execute against our

strategic priorities to accelerate, scale and diversify our

business,” said Karen E. Sammon, PAR Technology President and Chief

Executive Officer. “Our Company performed as expected in the

quarter, and the underlying fundamentals of our business remain

strong as the execution of PAR’s software solutions strategy is

gaining traction. Our Brink POS solution and associated hardware

had a strong quarter as its revenues grew 227% in the quarter from

the prior year’s second quarter and more than 61% growth from the

sequential quarter in 2016. Another strong metric achieved in the

quarter, is recurring revenues for our business grew 9% over the

prior year’s second quarter and 4% on a sequential quarter basis.

Recurring revenue now comprises more than 25% of our total

Restaurant/Retail business. Additional strength is being showcased

in our Government segment and we continue to secure add-on and new

contract awards and have successfully rebuilt our contract backlog

to over $125 million.”

Sammon continued, “2016 is about establishing the foundation for

long-term financial growth. We continue to make significant

progress regarding our targeted investment strategies in our

subscription revenue solutions. These strategic investments will

increase our profitability, diversify our revenue portfolio,

enhance our geographic footprint, and enable us to scale. We are

confident about our position in the markets we serve and in the

momentum from our investment strategies that will provide the

necessary tools to ensure long-term financial improvement in our

results and deliver enhanced shareholder value.”

Certain Company information in this release or statements made

by its spokespersons from time to time may contain forward-looking

statements. Any statements in this document that do and not

describe historical facts are forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Investors are cautioned that all forward-looking statements involve

risks and uncertainties, including without limitation, delays in

new product introduction, risks in technology development and

commercialization, risks in product development and market

acceptance of and demand for the Company’s products, risks of

downturns in economic conditions generally, and in the quick

service sector of the restaurant market specifically, risks of

intellectual property rights associated with competition and

competitive pricing pressures, risks associated with foreign sales

and high customer concentration, and other risks detailed in the

Company’s filings with the Securities and Exchange Commission.

About PAR Technology Corporation

PAR Technology Corporation's stock is traded on the New York

Stock Exchange under the symbol PAR. PAR’s Hospitality segment has

been a leading provider of restaurant and retail technology for

more than 35 years. PAR offers technology solutions for the full

spectrum of restaurant operations, from large chain and independent

table service restaurants to international quick service chains.

Products from PAR also can be found in retailers, cinemas, cruise

lines, stadiums and food service companies. PAR’s Government

Business is a leader in providing computer-based system design,

engineering and technical services to the Department of Defense and

various federal agencies. For more information visit

http://www.partech.com or connect with us on Facebook and

Twitter.

There will be a conference call at 10:00 a.m. (Eastern) on July

27, 2016, during which the Company’s management will discuss the

financial results for the second quarter of 2016. To participate in

the call, please call 866-868-9502, approximately 10 minutes

in advance. No passcode is required to participate in the live call

or to listen to the replay version. Individual & Institutional

Investors will have the opportunity to listen to the conference

call/event over the internet by visiting PAR’s website at

www.partech.com. Alternatively, listeners may access an archived

version of the presentation call after 6:00 p.m. ET on July 27,

2016 through August 5, 2016 by dialing 855-859-2056 and using

conference ID 53282383.

PAR TECHNOLOGY CORPORATION CONSOLIDATED

BALANCE SHEETS

(in thousands, except share amounts)

(Unaudited) June 30, December 31,

Assets 2016

2015 Current assets: Cash and cash equivalents $ 5,374 $ 8,024

Accounts receivable-net 29,462 29,530 Inventories-net 25,392 21,499

Note receivable 4,366 - Income taxes receivable 223 - Deferred

income taxes 6,689 6,741 Other current assets 4,559

3,808 Total current assets 76,065 69,602 Property, plant and

equipment - net 6,055 5,716 Note receivable - 4,259 Deferred income

taxes 11,038 11,038 Goodwill 11,051 11,051 Intangible assets - net

11,102 10,898 Other assets 3,792 3,687

Total Assets $ 119,103 $ 116,251

Liabilities and

Shareholders’ Equity Current liabilities: Current portion of

long-term debt $ 2,156 $ 2,103 Accounts payable 16,532 11,729

Accrued salaries and benefits 5,864 5,727 Accrued expenses 5,217

7,644 Customer deposits and deferred service revenue 11,732 10,819

Income taxes payable - 279 Liabilities of discontinued operations

142 441 Total current liabilities 41,643

38,742 Long-term debt 476 566 Other long-term liabilities

8,759 8,883 Total liabilities 50,878

48,191 Commitments and contingencies Shareholders’ Equity:

Preferred stock, $.02 par value, 1,000,000 shares authorized - -

Common stock, $.02 par value, 29,000,000 shares authorized;

17,478,622 and 17,352,838 shares issued; 15,770,513 and 15,644,729

outstanding at June 30, 2016 and December 31, 2015, respectively

349 347 Capital in excess of par value 45,977 45,753 Retained

earnings 30,663 30,574 Accumulated other comprehensive loss (2,928)

(2,778) Treasury stock, at cost, 1,708,109 shares (5,836)

(5,836) Total shareholders’ equity 68,225

68,060

Total Liabilities and Shareholders’

Equity $ 119,103 $ 116,251

PAR

TECHNOLOGY CORPORATION CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

amounts)

(Unaudited)

For the three For the three For the six For the six

months ended months ended months ended months ended June 30, June

30, June 30, June 30, 2016 2015 2016 2015 Net revenues: Product $

21,444 $ 25,267 $ 43,528 $ 46,275 Service 11,804 12,100 23,508

22,474 Contract 19,410 21,561 40,927

45,397 52,658 58,928 107,963 114,146

Costs of sales: Product 16,137 18,292 32,579 33,200 Service 8,219

8,754 16,818 16,592 Contract 17,857 20,189

37,512 42,663 42,213 47,235 86,909

92,455 Gross margin 10,445 11,693

21,054 21,691 Operating expenses: Selling, general and

administrative 7,058 6,845 14,600 13,505 Research and development

2,793 2,661 5,555 5,095 Amoritzation of identifiable intangible

assets 242 249 483 498

10,093 9,755 20,638 19,098 Operating income

from continuing operations 352 1,938 416 2,593 Other (expense)

income, net (210) 20 (280) (186) Interest income (expense), net

3 (85) 32 (171) Income from continuing

operations before provision for income taxes 145 1,873 168 2,236

Provision for income taxes (45) (629) (53)

(800) Income from continuing operations 100 1,244 115 1,436

Discontinued operations Loss on discontinued operations (net of

tax) (26) (1,143) (26) (1,720) Net

income (loss) $ 74 $ 101 $ 89 $ (284) Basic Earnings per Share:

Income from continuing operations 0.01 0.08 0.01 0.09 Loss from

discontinued operations (0.00) (0.07) (0.00)

(0.11) Net income (loss) $ 0.00 $ 0.01 $ 0.01 $ (0.02)

Diluted Earnings per Share: Income from continuing operations 0.01

0.08 0.01 0.09 Loss from discontinued operations (0.00)

(0.07) (0.00) (0.11) Net income (loss) $ 0.00

$ 0.01 $ 0.01 $ (0.02) Weighted average shares outstanding Basic

15,615 15,584 15,651 15,541 Diluted

15,670 15,671 15,717 15,658

PAR TECHNOLOGY CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL RESULTS

(in thousands, except per share data)

(Unaudited)

For the three months

ended June 30, 2016 For the three months ended June 30, 2015

Comparable

Comparable

Reported basis basis (Non- Reported basis

basis (Non-

(GAAP) Adjustments GAAP) (GAAP) Adjustments

GAAP)

Net revenues $ 52,658 - 52,658 $ 58,928 - 58,928 Costs of

sales 42,213 - 42,213

47,235 85 47,150 Gross

Margin 10,445 - 10,445 11,693 85 11,778 Operating Expenses

Selling, general and administrative 7,058 572 6,486 6,845 346 6,499

Research and development 2,793 - 2,793 2,661 13 2,648 Amortization

of identifiable intangible assets 242 242

- 249 249 -

Total operating expenses 10,093 814 9,279 9,755 608 9,147

Operating income from continuing operations 352 814 1,166 1,938 693

2,631 Other income, net (210 ) - (210 ) 20 - 20 Interest income

(expense), net 3 26 29

(85 ) 25 (60 ) Income from continuing

operations before provision for income taxes 145 840 985 1,873 718

2,591 Provision for income taxes (45 ) (311 )

(356 ) (629 ) (266 ) (895 ) Income from

continuing operations $ 100 $ 529 $ 629 $

1,244 $ 452 $ 1,696 Loss from discontinued

operations, (net of tax) $ (26 ) $ (26 ) $ (1,143 ) $ (1,143 ) Net

income $ 74 $ 603 $ 101 $ 553 Income

per diluted share from continuing operations $ 0.01 $ 0.04

$ 0.08 $ 0.11 Loss per diluted share from

discontinuing operations $ (0.00 ) $ (0.00 ) $ (0.07 ) $ (0.07 )

Income per diluted share $ 0.00 $ 0.04 $ 0.01

$ 0.04

The Company reports its financial results in accordance with

GAAP, which refers to financial information presented in accordance

with generally accepted accounting principles in the United States.

However, non-GAAP adjusted financial measures, as defined in the

reconciliation table above, are provided herein because management

uses such measures in evaluating the results of the continuing

operations of the Company and believes this information provides

investors supplemental insight into underlying business trends and

performance. Non-GAAP financial measures should be viewed in

addition to, and not as an alternative for, the Company's reported

results prepared in accordance with GAAP.

PAR's results of operations are impacted by certain items which

include severance charges from restructuring business operations,

equity based compensation, acquisition related expenditures, and

other one-time charges that may not be indicative of the Company’s

business trends. Management believes that adjusting its operating

expenses, operating income, net earnings and diluted earnings per

share to remove these certain items provides an useful perspective

with respect to our results and provides meaningful supplemental

information to both management and investors that removes these

items which are difficult to predict and are often unanticipated,

and which, as a result are difficult to include in analyst's

financial models and our investors' expectations with any degree of

specificity. PAR believes the adjusted totals facilitate comparison

on a year-over-year basis.

PAR's results of operations are further impacted by costs from

its multi-year ERP system implementation. Management believes that

further adjusting its operating expenses, operating income, net

earnings and diluted earnings per share to remove the impact of the

ERP expenses provides a useful perspective with respect to

underlying business trends and results and provides meaningful

supplemental information to both management and investors that is

indicative of the performance of the Company's underlying

operations and facilitates comparison on a year-over-year

basis.

The Company uses these non-GAAP measures when evaluating its

financial results as well as for internal planning and forecasting

purposes. These financial measures should not be used as a

substitute in assessing the company's results of operations for the

periods presented. An analysis of any non-GAAP financial measure

should be used in conjunction with results presented in accordance

with GAAP. As a result, in the tables that follow, each period

presented is adjusted to remove the certain items noted above. Each

period has been further adjusted to remove expenses related to the

ERP system implementation.

During the second quarter of 2016, the Company recorded charges

within selling, general and administrative of $304,000 of

investigation costs related to certain unauthorized transfers of

Company funds that were made in contravention of the Company’s

policies and procedures, $127,000 related to the initial phase of

the planned implementation of a new enterprise resource system in

connection with the ERP system implementation and equity based

compensation charges of $141,000. Lastly, related to the

acquisition of Brink, the Company recognized amortization of

acquired intangible assets of $242,000 and accreted interest of

$26,000. During the second quarter of 2015, the Company recorded

severance and other related charges of $416,000, of which $85,000

is included in cost of sales, $13,000 is included in research and

development and $318,000 is included in selling, general and

administrative. Also included within selling, general and

administrative is equity based compensation charges of $28,000.

Lastly, related to the acquisition of Brink, the Company recognized

amortization of acquired intangible assets of $249,000 and accreted

interest of $25,000. The aforementioned charges, along with an

associated adjustment to the Company’s provision for income taxes

have been excluded in the Company’s non-GAAP measures because they

are considered non-recurring in nature and/or are quantitatively

and qualitatively different from the Company’s core operations

during any particular period.

PAR TECHNOLOGY CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL RESULTS

(in thousands, except per share data)

(Unaudited)

For the six

months ended June 30, 2016 For the six months ended June 30, 2015

Comparable

Comparable

Reported basis basis (Non- Reported basis

basis (Non-

(GAAP) Adjustments GAAP) (GAAP) Adjustments

GAAP)

Net revenues $ 107,963 - $ 107,963 $ 114,146 - $ 114,146

Costs of sales 86,909 - 86,909

92,455 151 92,304

Gross Margin 21,054 - 21,054 21,691 151 21,842 Operating

Expenses Selling, general and administrative 14,600 1,749 12,851

13,505 706 12,799 Research and development 5,555 - 5,555 5,095 13

5,082 Acquisition amortization 483 483

- 498 498 -

Total operating expenses 20,638 2,232 18,406 19,098 1,217 17,881

Operating income from continuing operations 416 2,232 2,648 2,593

1,368 3,961 Other (expense) income, net (280 ) - (280 ) (186 ) -

(186 ) Interest expense 32 52 84

(171 ) 51 (120 ) Income from

continuing operations before provision for income taxes 168 2,284

2,452 2,236 1,419 3,655 Provision for income taxes (53 )

(845 ) (898 ) (800 ) (525 )

(1,325 ) Income from continuing operations $ 115 $ 1,439

$ 1,554 $ 1,436 $ 894 $ 2,330

Loss from discontinued operations, (net of tax) $ (26 ) $ (26 ) $

(1,720 ) $ (1,720 ) Net income (loss) $ 89 $ 1,528 $

(284 ) $ 610 Income per diluted share from continuing

operations $ 0.01 $ 0.10 $ 0.09 $ 0.15

Loss per diluted share from discontinuing operations $ (0.00 ) $

(0.00 ) $ (0.11 ) $ (0.11 ) Income (loss) per diluted share $ 0.01

$ 0.10 $ (0.02 ) $ 0.04

During the six months ended June 30, 2016, the Company recorded

charges within selling, general and administrative of $1,070,000 of

investigation costs related to certain unauthorized transfers of

Company funds that were made in contravention of the Company’s

policies and procedures, $472,000 related to the initial phase of

the planned implementation of a new enterprise resource system in

connection with the ERP system implementation and equity based

compensation charges of $207,000. Lastly, related to the

acquisition of Brink, the Company recognized amortization of

acquired intangible assets of $483,000 and accreted interest of

$52,000. During the six months ended June 30, 2015, the Company

recorded severance and other related charges of $597,000, of which

$151,000 is included in cost of sales, $13,000 is included in

research and development and $433,000 is included in selling,

general and administrative. Also included within selling, general

and administrative is equity based compensation charges of

$273,000. Lastly, related to the acquisition of Brink, the Company

recognized amortization of acquired intangible assets of $498,000

and accreted interest of $51,000. The aforementioned charges, along

with an associated adjustment to the Company’s provision for income

taxes have been excluded in the Company’s non-GAAP measures because

they are considered non-recurring in nature and/or are

quantitatively and qualitatively different from the Company’s core

operations during any particular period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160727005497/en/

PAR Technology CorporationChristopher R. Byrnes, 315-738-0600

ext. 6226cbyrnes@partech.comwww.partech.com

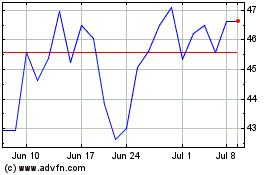

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

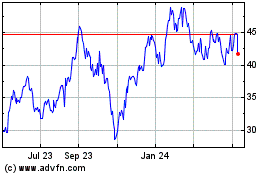

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024