- Recurring Revenues now total more

than 24% of Restaurant/Retail Business

- Government Segment Reports Record Q1

Profits

PAR Technology Corporation (NYSE: PAR) a leading provider of

restaurant/retail management systems and Government contract

services today announced results for the first quarter ended March

31, 2016.

Summary of Fiscal 2016 First Quarter Financial Results

From Continuing Operations

- Revenue reported at $55.3 million,

compared to $55.2 million in the first quarter of 2015

- GAAP net income from continuing

operations in the first quarter of fiscal 2016 was $15,000, or

$0.00 per diluted share, compared to net income from continuing

operations of $192,000, or $0.01 earnings per share for the same

period in 2015

- Adjusted non-GAAP net income from

continuing operations was $925,000 or $0.06 per diluted share,

compared to adjusted non-GAAP net income from continuing operations

of $634,000 or $0.04 per diluted share, in the same period last

year

A reconciliation and description of GAAP financial measures to

their comparable non-GAAP financial measures are included in the

tables following this news release.

“In the first quarter our Company again saw steady growth in our

restaurant and retail technology revenues reflected by the 8%

increase over Q1 2015. Our Government revenues were lower in the

quarter due to the timing of specific contract startups and lower

task orders, but we were still able to report the highest Q1 profit

in our Company’s history for this segment,” commented Karen E.

Sammon, President & CEO of PAR Technology. “We made real

progress in the quarter as we realized strong double digit growth

in our SaaS revenues as we consistently add new “cloud” customers

with our Brink and SureCheck solutions. Simultaneously we continue

to grow our Tier 1 business and announced Jack-in-the-Box as a new

customer in the quarter. We are creating a strong foundation that

will enable us to deliver greater shareholder value in the

future.”

There will be a conference call at 4:45 p.m. eastern time on May

3, 2016, during which the Company’s management will discuss the

financial results for the first quarter of 2016. If you would like

to participate in this conference, please call (866)

868-9502 approximately 10 minutes before the call is scheduled

to begin. No passcode is required to participate in the live the

call. Individual & Institutional Investors will have the

opportunity to listen to the conference call/event over the

Internet. Individual Investors can listen to the call by visiting

PAR’s website at www.partech.com. Alternatively, listeners may

access an archived version of the conference call after 6:00 p.m.

ET on May 3, 2016 through May 10, 2016 by dialing 855-859-2056 and

using conference ID 95359526 and also by accessing the link on

PAR’s website.

About PAR Technology Corporation

PAR Technology Corporation's stock is traded on the New York

Stock Exchange under the symbol PAR. PAR’s Hospitality segment has

been a leading provider of restaurant and retail technology for

more than 35 years and offers technology solutions for the full

spectrum of restaurant operations, from large global quick service

chains and table service restaurants to fast casual and independent

operators. PAR’s products can be found in retailers, cinemas,

cruise lines, stadiums and food service companies. PAR’s Government

Business is a leader in providing computer-based system design,

engineering and mission services to the Department of Defense and

various federal agencies. For more information visit

www.partech.com or connect with PAR on Facebook at

www.facebook.com/parpointofsale or Twitter at

www.twitter.com/Par_tech .

Certain Company information in this release or statements made

by its spokespersons from time to time may contain forward-looking

statements. Any statements in this document that do not describe

historical facts are forward-looking statements. Forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Investors are

cautioned that all forward-looking statements involve risks and

uncertainties, including without limitation, delays in new product

introduction, risks in technology development and

commercialization, risks in product development and market

acceptance of and demand for the Company’s products, risks of

downturns in economic conditions generally, and in the quick

service sector of the restaurant market specifically, risks of

intellectual property rights associated with competition and

competitive pricing pressures, risks associated with foreign sales

and high customer concentration, and other risks detailed in the

Company’s filings with the Securities and Exchange Commission.

PAR TECHNOLOGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands, except share amounts)

(Unaudited)

March 31, December 31,

Assets 2016 2015 Current assets:

Cash and cash equivalents

$ 5,770 $ 8,024 Accounts receivable-net 33,972 29,530

Inventories-net 22,376 21,499 Income taxes receivable 73 - Deferred

income taxes 6,810 6,741 Other current assets 3,582

3,808 Total current assets 72,583 69,602 Property,

plant and equipment - net 5,724 5,716 Note receivable 3,387 3,320

Deferred income taxes 11,038 11,038 Goodwill 11,051 11,051

Intangible assets - net 11,053 10,898 Other assets 3,780

3,687

Total Assets $ 118,616 $

115,312

Liabilities and Shareholders’ Equity Current

liabilities: Current portion of long-term debt $ 2,130 $ 2,103

Accounts payable 15,256 11,729 Accrued salaries and benefits 5,285

5,727 Accrued expenses 6,910 6,705 Customer deposits and deferred

service revenue 11,478 10,819 Income taxes payable - 279

Liabilities of discontinued operations 280 441

Total current liabilities 41,339 37,803 Long-term debt 521

566 Other long-term liabilities 8,701 8,883

Total liabilities 50,561 47,252

Commitments and contingencies Shareholders’ Equity: Preferred

stock, $.02 par value, 1,000,000 shares authorized - - Common

stock, $.02 par value, 29,000,000 shares authorized; 17,314,960 and

17,352,838 shares issued; 15,606,851 and 15,644,729 outstanding at

March 31, 2016 and December 31, 2015, respectively 346 347 Capital

in excess of par value 45,856 45,753 Retained earnings 30,589

30,574 Accumulated other comprehensive loss (2,900 ) (2,778 )

Treasury stock, at cost, 1,708,109 shares (5,836 )

(5,836 ) Total shareholders’ equity 68,055

68,060

Total Liabilities and Shareholders’ Equity $

118,616 $ 115,312

PAR TECHNOLOGY CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

amounts)

(Unaudited)

For the three months endedMarch 31,

2016

2015 Net revenues: Product $ 22,084 $ 20,745 Service 11,704

10,637 Contract 21,517 23,836

55,305 55,218 Costs of sales: Product 16,442

14,713 Service 8,599 8,033 Contract 19,655

22,474 44,696 45,220 Gross

margin 10,609 9,998 Operating expenses:

Selling, general and administrative 7,542 6,660 Research and

development 2,762 2,434 Amortization of identifiable intangible

assets 241 249 10,545

9,343 Operating income from continuing operations 64

655 Other expense, net (70 ) (206 ) Interest income (expense), net

29 (86 ) Income from continuing operations

before provision for income taxes 23 363 Provision for income taxes

(8 ) (171 ) Income from continuing operations 15 192

Discontinued Operations Loss on discontinued operations, (net of

tax) 0 (577 ) Net income (loss) $ 15 $

(385 ) Basic Earnings per Share: Income from continuing operations

0.00 0.01 Loss from discontinued operations 0.00

(0.04 ) Net income (loss) $ 0.00 $ (0.02 ) Diluted

Earnings per Share: Income from continuing operations 0.00 0.01

Loss from discontinued operations 0.00 (0.04 )

Net income (loss) $ 0.00 $ (0.02 ) Weighted average

shares outstanding Basic 15,646 15,596

Diluted 15,723 15,710

The Company reports its financial results in accordance with

GAAP, which refers financial information presented in accordance

with generally accepted accounting principles in the United States.

However, non-GAAP adjusted financial measures, as defined in the

reconciliation table above, are provided herein because management

uses such measures in evaluating the results of the continuing

operations of the Company and believes this information provides

investors better insight into underlying business trends and

performance. Non-GAAP financial measures should be viewed in

addition to, and not as an alternative for, the Company's reported

results prepared in accordance with GAAP.

PAR's results of operations are impacted by certain items which

include severance charges from restructuring business operations,

equity based compensation, acquisition related expenditures, and

other one-time charges that are should not be considered in

analyzing the trends of the business. Management believes that

adjusting its operating expenses, operating income, net earnings

and diluted earnings per share to remove these certain items

provides an important perspective with respect to our results and

provides meaningful supplemental information to both management and

investors that removes these items which are difficult to predict

and are often unanticipated, and which, as a result are difficult

to include in analyst's financial models and our investors'

expectations with any degree of specificity. PAR believes the

adjusted totals facilitate comparison on a year-over-year

basis.

PAR's results of operations are further impacted by costs from

its multi-year Business Transformation Project. Management believes

that further adjusting its operating expenses, operating income,

net earnings and diluted earnings per share to remove the impact of

the Business Transformation Project expenses provides an important

perspective with respect to underlying business trends and results

and provides meaningful supplemental information to both management

and investors that is indicative of the performance of the

company's underlying operations and facilitates comparison on a

year-over-year basis.

The company uses these non-GAAP measures when evaluating its

financial results as well as for internal planning and forecasting

purposes. These financial measures should not be used as a

substitute in assessing the company's results of operations for the

periods presented. An analysis of any non-GAAP financial measure

should be used in conjunction with results presented in accordance

with GAAP. As a result, in the tables that follow, each period

presented is adjusted to remove the certain items noted above. Each

period has been further adjusted to remove expenses related to the

Business Transformation Project.

PAR TECHNOLOGY CORPORATION RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES (in thousands, except per share

data) (Unaudited) For the

three months ended March 31, 2016 For the three months ended March

31, 2015

Reportedbasis (GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Reported basis(GAAP)

Adjustments

Comparablebasis (Non-GAAP)

Net revenues $ 55,305 - $ 55,305 $ 55,218 - $ 55,218 Costs

of sales 44,696 - 44,696

45,220 66 45,154 Gross

Margin 10,609 - 10,609 9,998 66 10,064 Operating Expenses

Selling, general and administrative 7,542 1,177 6,365 6,660 360

6,300 Research and development 2,762 - 2,762 2,434 - 2,434

Amortization of indentifiableintangible

assets

241 241 - 249

249 - 10,545 1,418 9,127 9,343

609 8,734

Operating income from

continuingoperations

64 1,418 1,482 655 675 1,330 Other expense, net (70 ) - (70 ) (206

) - (206 ) Interest income (expense), net 29

26 55 (86 ) 26 (60

)

Income from continuing operationsbefore

provision for income taxes

23 1,444 1,467 363 701 1,064 Provision for income taxes (8 )

(534 ) (542 ) (171 ) (259 ) (430

) Income from continuing operations $ 15 $ 910 $ 925

$ 192 $ 442 $ 634

Loss from discontinued operations,(net of

tax)

$ 0 $ 0 $ (577 ) $ (577 ) Net income (loss) $ 15

$ 925 $ (385 ) $ 57

Income per diluted share fromcontinuing

operations

$ 0.00 $ 0.06 $ 0.01 $ 0.04

Loss per share from

discontinuingoperations

$ 0.00 $ 0.00 $ (0.04 ) $ (0.04 ) Income (loss) per

diluted share $ 0.00 $ 0.06 $ (0.02 ) $ 0.00

During the first quarter of 2016, the Company recorded charges

of $766,000 of investigation costs related to certain unauthorized

transfers of Company funds that were made in contravention of the

Company’s policies and procedures, $345,000 related to the initial

phase of the planned implementation of a new enterprise resource

system in connection with the Business Transformation Project and

equity based compensation charges of $66,000. Lastly, related to

the acquisition of Brink, the Company recognized amortization of

acquired intangible assets of $241,000 and accreted interest of

$26,000. During the first quarter of 2015, the Company recorded

severance and other related charges of $181,000, of which $66,000

is included in cost of sales and $115,000 is included in selling,

general and administrative. Also included within selling, general

and administrative is equity based compensation charges of

$245,000. Lastly, related to the acquisition of Brink, the Company

recognized amortization of acquired intangible assets of $249,000

and accreted interest of $26,000. The aforementioned charges, along

with an associated adjustment to the Company’s provision for income

taxes have been excluded in the Company’s non-GAAP measures because

they are considered non-recurring in nature and are quantitatively

and qualitatively different from the Company’s core operations

during any particular period.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160503006937/en/

PAR Technology CorporationChristopher R. Byrnes, (315) 738-0600

ext. 6226cbyrnes@partech.comwww.partech.com

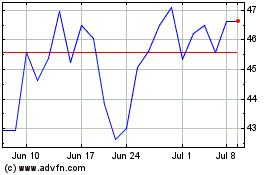

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

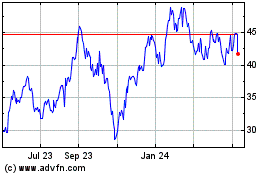

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024