SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 6, 2015

PAR Technology Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-09720

|

16-1434688

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413-4991

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (315) 738-0600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

| (a) |

The information, including Exhibits attached hereto, in this Current Report is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities and Exchange Act of 1934, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing. |

| (b) |

On August 6, 2015, PAR Technology Corporation issued a press release announcing its results of operations for the quarterly period ending June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. |

| 99.1 |

Press Release dated August 6, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

PAR TECHNOLOGY CORPORATION

|

| |

(Registrant)

|

| |

|

|

Date: August 6, 2015

|

/s/Matthew J. Trinkaus

|

| |

Matthew J. Trinkaus

|

| |

Chief Accounting Officer & Corporate Controller

|

|

|

FOR RELEASE:

CONTACT:

|

|

New Hartford, NY, August 6, 2015

Christopher R. Byrnes (315) 738-0600 ext. 6226

cbyrnes@partech.com, www.partech.com

|

PAR TECHNOLOGY CORPORATION ANNOUNCES

2015 SECOND QUARTER RESULTS

|

· |

Revenues Grow 10.3% in the Quarter – 7.9% in the First Six Months of 2015 |

New Hartford, NY- August 6, 2015 -- PAR Technology Corporation (NYSE: PAR) today announced results for the second quarter ended June 30, 2015.

Summary of Fiscal 2015 Second Quarter and Year-to-Date Financial Results

|

· |

Revenue increased 10.3% to $63.3 million in the second quarter of fiscal 2015, compared to $57.4 million in the same period in 2014. |

|

· |

Non-GAAP net income in the second quarter of fiscal 2015 was $0.6 million, or $0.04 per diluted share, compared to a non-GAAP net loss of $0.3 million, or $0.02 loss per share, in the same period in 2014. |

|

· |

GAAP net income in the second quarter of fiscal 2015 was $0.1 million, or $0.01 per diluted share, compared to a GAAP net loss of $0.5 million, or $0.03 loss per share, in the same period in 2014. |

|

· |

Revenue increased 7.9% to $122.9 million in the first six months of fiscal 2015, compared to $113.9 million in the same period in 2014. |

|

· |

Non-GAAP net income in the first six months of fiscal 2015 was $0.6 million, or $0.04 per diluted share, compared to a non-GAAP net loss of $1.0 million or $0.06 loss per share, in the same period in 2014. |

|

· |

GAAP net loss in the first six months of fiscal 2015 was $0.3 million or $0.02 loss per share, compared to a GAAP net loss of $1.5 million, or $0.10 loss per share, in the same period in 2014. |

Commenting on the second quarter results, Ronald J. Casciano, Chief Executive Officer & President, stated, “We are pleased with the quarterly performance and the progress being made in both of our business segments as they delivered revenue and income growth in the quarter. We are seeing strong interest in our new hospitality technology products, specifically our Brink POS™ software, and are encouraged by the recent new customer wins in this segment. Our Government segment also had a strong second quarter and delivered double digit revenue growth and improved profits for the quarter when compared to the same period in 2015. Going forward we fully expect to build upon our recent progress by focusing on alignment, innovation and execution to compete and succeed in the markets we serve.”

The Company previously stated its intention to make strategic and operational improvements involving its hospitality segment, primarily in its international operations to focus on global delivery of its software solutions. This restructuring realigns sales and support functions with US-based operations, increases efficiencies and reduces operating costs. In connection with this restructuring, the Company’s GAAP results include a one-time pre-tax charge in the second quarter of $416,000.

A reconciliation and description of non-GAAP financial measures to their comparable GAAP financial measures are included in the tables following this news release.

Certain Company information in this release or statements made by its spokespersons from time to time may contain forward-looking statements. Any statements in this document that do and not describe historical facts are forward-looking statements. Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including without limitation, delays in new product introduction, risks in technology development and commercialization, risks in product development and market acceptance of and demand for the Company’s products, risks of downturns in economic conditions generally, and in the quick service sector of the restaurant market specifically, risks of intellectual property rights associated with competition and competitive pricing pressures, risks associated with foreign sales and high customer concentration, and other risks detailed in the Company’s filings with the Securities and Exchange Commission.

About PAR Technology Corporation

PAR Technology Corporation's stock is traded on the New York Stock Exchange under the symbol PAR. PAR’s Hospitality segment has been a leading provider of restaurant and retail technology for more than 30 years. PAR offers technology solutions for the full spectrum of restaurant operations, from large chain and independent table service restaurants to international quick service chains. PAR’s Hospitality business also provides hotel management systems with a complete suite of powerful tools for guest management, recreation management, and timeshare/condo management. In addition, PAR offers the spa industry a leading management application specifically designed to support the unique needs of the resort spa and day spa markets, a rapidly growing hospitality segment. Products from PAR also can be found in retailers, cinemas, cruise lines, stadiums and food service companies. PAR’s Government Business is a leader in providing computer-based system design, engineering and technical services to the Department of Defense and various federal agencies. Visit www.partech.com for more information.

There will be a conference call at 4:45 p.m. (Eastern) on August 6, 2015, during which the Company’s management will discuss the financial results for the second quarter of 2015. To participate in the call, please call 866-868-9502, approximately 10 minutes in advance. No passcode is required to participate in the live call or to listen to the replay version. Individual & Institutional Investors will have the opportunity to listen to the conference call/event over the internet by visiting PAR’s website at www.partech.com. Alternatively, listeners may access an archived version of the presentation call through August 13, 2015 by dialing 855-859-2056.

###

PAR TECHNOLOGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands, except share amounts)

(Unaudited)

|

Assets

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

5,136

|

|

|

$

|

10,167

|

|

|

Accounts receivable-net

|

|

|

34,467

|

|

|

|

31,445

|

|

|

Inventories-net

|

|

|

24,936

|

|

|

|

25,922

|

|

|

Deferred income taxes

|

|

|

5,583

|

|

|

|

4,512

|

|

|

Other current assets

|

|

|

4,352

|

|

|

|

4,597

|

|

|

Total current assets

|

|

|

74,474

|

|

|

|

76,643

|

|

|

Property, plant and equipment - net

|

|

|

6,353

|

|

|

|

6,135

|

|

|

Deferred income taxes

|

|

|

10,948

|

|

|

|

11,357

|

|

|

Goodwill

|

|

|

17,167

|

|

|

|

17,167

|

|

|

Intangible assets - net

|

|

|

22,863

|

|

|

|

22,952

|

|

|

Other assets

|

|

|

3,676

|

|

|

|

3,043

|

|

|

Total Assets

|

|

$

|

135,481

|

|

|

$

|

137,297

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$

|

3,176

|

|

|

$

|

3,173

|

|

|

Borrowings under line of credit

|

|

|

3,276

|

|

|

|

5,000

|

|

|

Accounts payable

|

|

|

15,422

|

|

|

|

19,676

|

|

|

Accrued salaries and benefits

|

|

|

6,376

|

|

|

|

6,429

|

|

|

Accrued expenses

|

|

|

6,150

|

|

|

|

6,578

|

|

|

Customer deposits

|

|

|

4,078

|

|

|

|

2,345

|

|

|

Deferred service revenue

|

|

|

16,175

|

|

|

|

12,695

|

|

|

Income taxes payable

|

|

|

373

|

|

|

|

475

|

|

|

Total current liabilities

|

|

|

55,026

|

|

|

|

56,371

|

|

|

Long-term debt

|

|

|

2,528

|

|

|

|

2,566

|

|

|

Other long-term liabilities

|

|

|

8,765

|

|

|

|

8,847

|

|

|

Total liabilities

|

|

|

66,319

|

|

|

|

67,784

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.02 par value, 1,000,000 shares authorized

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, $.02 par value, 29,000,000 shares authorized; 17,250,209 and 17,274,708 shares issued; 15,542,100 and 15,566,599 outstanding

|

|

|

345

|

|

|

|

346

|

|

|

Capital in excess of par value

|

|

|

45,066

|

|

|

|

44,854

|

|

|

Retained earnings

|

|

|

31,181

|

|

|

|

31,465

|

|

|

Accumulated other comprehensive loss

|

|

|

(1,594

|

)

|

|

|

(1,316

|

)

|

|

Treasury stock, at cost, 1,708,109 shares

|

|

|

(5,836

|

)

|

|

|

(5,836

|

)

|

|

Total shareholders’ equity

|

|

|

69,162

|

|

|

|

69,513

|

|

|

Total Liabilities and Shareholders’ Equity

|

|

$

|

135,481

|

|

|

$

|

137,297

|

|

PAR TECHNOLOGY CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| |

|

For the three months ended June 30,

|

|

|

For the three months ended June 30,

|

|

|

For the six months ended June 30,

|

|

|

For the six months ended June 30,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Net revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product

|

|

$

|

25,802

|

|

|

$

|

22,953

|

|

|

$

|

47,488

|

|

|

$

|

41,545

|

|

|

Service

|

|

|

15,929

|

|

|

|

14,920

|

|

|

|

30,031

|

|

|

|

29,170

|

|

|

Contract

|

|

|

21,561

|

|

|

|

19,529

|

|

|

|

45,397

|

|

|

|

43,228

|

|

| |

|

|

63,292

|

|

|

|

57,402

|

|

|

|

122,916

|

|

|

|

113,943

|

|

|

Costs of sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product

|

|

|

18,172

|

|

|

|

15,815

|

|

|

|

33,013

|

|

|

|

28,718

|

|

|

Service

|

|

|

10,404

|

|

|

|

10,831

|

|

|

|

19,724

|

|

|

|

20,384

|

|

|

Contract

|

|

|

20,189

|

|

|

|

18,495

|

|

|

|

42,663

|

|

|

|

40,567

|

|

| |

|

|

48,765

|

|

|

|

45,141

|

|

|

|

95,400

|

|

|

|

89,669

|

|

|

Gross margin

|

|

|

14,527

|

|

|

|

12,261

|

|

|

|

27,516

|

|

|

|

24,274

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

9,253

|

|

|

|

9,513

|

|

|

|

18,317

|

|

|

|

18,776

|

|

|

Research and development

|

|

|

4,420

|

|

|

|

3,761

|

|

|

|

8,765

|

|

|

|

7,625

|

|

|

Acquisition amortization

|

|

|

249

|

|

|

|

-

|

|

|

|

498

|

|

|

|

-

|

|

| |

|

|

13,922

|

|

|

|

13,274

|

|

|

|

27,580

|

|

|

|

26,401

|

|

|

Operating income (loss):

|

|

|

605

|

|

|

|

(1,013

|

)

|

|

|

(64

|

)

|

|

|

(2,127

|

)

|

|

Other (expense) income, net

|

|

|

(10

|

)

|

|

|

406

|

|

|

|

(239

|

)

|

|

|

328

|

|

|

Interest expense

|

|

|

(85

|

)

|

|

|

(25

|

)

|

|

|

(171

|

)

|

|

|

(42

|

)

|

|

Income (loss) before (provision for) benefit from income taxes

|

|

|

510

|

|

|

|

(632

|

)

|

|

|

(474

|

)

|

|

|

(1,841

|

)

|

|

(Provision for) benefit from income taxes

|

|

|

(409

|

)

|

|

|

113

|

|

|

|

190

|

|

|

|

333

|

|

|

Net income (loss)

|

|

$

|

101

|

|

|

$

|

(519

|

)

|

|

$

|

(284

|

)

|

|

$

|

(1,508

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.01

|

|

|

$

|

(0.03

|

)

|

|

$

|

(0.02

|

)

|

|

$

|

(0.10

|

)

|

|

Diluted

|

|

$

|

0.01

|

|

|

$

|

(0.03

|

)

|

|

$

|

(0.02

|

)

|

|

$

|

(0.10

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

15,584

|

|

|

|

15,612

|

|

|

|

15,541

|

|

|

|

15,473

|

|

|

Diluted

|

|

|

15,671

|

|

|

|

15,612

|

|

|

|

15,541

|

|

|

|

15,473

|

|

PAR TECHNOLOGY CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL RESULTS

(in thousands, except per share data)

(Unaudited)

| |

|

For the three months ended June 30, 2015

|

|

|

For the three months ended June 30, 2014

|

|

| |

|

Reported basis (GAAP)

|

|

|

Adjustments

|

|

|

Comparable basis (Non-GAAP)

|

|

|

Reported basis (GAAP)

|

|

|

Adjustments

|

|

|

Comparable basis (Non-GAAP)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues

|

|

$

|

63,292

|

|

|

|

-

|

|

|

|

63,292

|

|

|

$

|

57,402

|

|

|

|

-

|

|

|

|

57,402

|

|

|

Costs of sales

|

|

|

48,765

|

|

|

|

85

|

|

|

|

48,680

|

|

|

|

45,141

|

|

|

|

-

|

|

|

|

45,141

|

|

|

Gross Margin

|

|

|

14,527

|

|

|

|

85

|

|

|

|

14,612

|

|

|

|

12,261

|

|

|

|

-

|

|

|

|

12,261

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

9,253

|

|

|

|

346

|

|

|

|

8,907

|

|

|

|

9,513

|

|

|

|

278

|

|

|

|

9,235

|

|

|

Research and development

|

|

|

4,420

|

|

|

|

13

|

|

|

|

4,407

|

|

|

|

3,761

|

|

|

|

-

|

|

|

|

3,761

|

|

|

Acquisition amortization

|

|

|

249

|

|

|

|

249

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

-

|

|

|

Total operating expenses

|

|

|

13,922

|

|

|

|

608

|

|

|

|

13,314

|

|

|

|

13,274

|

|

|

|

278

|

|

|

|

12,996

|

|

|

Operating income (loss)

|

|

|

605

|

|

|

|

693

|

|

|

|

1,298

|

|

|

|

(1,013

|

)

|

|

|

278

|

|

|

|

(735

|

)

|

|

Other (expense) income, net

|

|

|

(10

|

)

|

|

|

-

|

|

|

|

(10

|

)

|

|

|

406

|

|

|

|

-

|

|

|

|

406

|

|

|

Interest expense

|

|

|

(85

|

)

|

|

|

25

|

|

|

|

(60

|

)

|

|

|

(25

|

)

|

|

|

-

|

|

|

|

(25

|

)

|

|

Income (loss) before (provision for) benefit from income taxes

|

|

|

510

|

|

|

|

718

|

|

|

|

1,228

|

|

|

|

(632

|

)

|

|

|

278

|

|

|

|

(354

|

)

|

|

(Provision for) benefit from income taxes

|

|

|

(409

|

)

|

|

|

(266

|

)

|

|

|

(675

|

)

|

|

|

113

|

|

|

|

(95

|

)

|

|

|

18

|

|

|

Net income (loss)

|

|

$

|

101

|

|

|

$

|

452

|

|

|

$

|

553

|

|

|

$

|

(519

|

)

|

|

$

|

183

|

|

|

$

|

(336

|

)

|

|

Earnings (loss) per diluted share

|

|

$

|

0.01

|

|

|

|

|

|

|

$

|

0.04

|

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

$

|

(0.02

|

)

|

The Company reports its financial results in accordance with GAAP, which refers financial information presented in accordance with generally accepted accounting principles in the United States. However, non-GAAP adjusted financial measures, as defined in the reconciliation table above, are provided herein because management uses such measures in evaluating the results of the operations of the Company and believes this information provides investors better insight into underlying business trends and performance. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in accordance with GAAP.

During the second quarter of 2015, the Company recorded severance and other related charges of $416,000, of which $85,000 is included in cost of sales, $13,000 is included in research and development and $318,000 is included in selling, general and administrative. Also included within selling, general and administrative is equity based compensation charges of $28,000. Lastly, related to the acquisition of Brink, the Company recognized amortization of acquired intangible assets of $249,000 and accreted interest of $25,000. During the second quarter of 2014, the Company recorded a charge of $278,000 for equity based compensation expense. The aforementioned charges, along with an associated adjustment to the Company’s provision for income taxes have been excluded in the Company’s non-GAAP measures because they are considered non-recurring in nature and/or are quantitatively and qualitatively different from the Company’s core operations during any particular period.

PAR TECHNOLOGY CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL RESULTS

(in thousands, except per share data)

(Unaudited)

| |

|

For the six months ended June 30, 2015

|

|

|

For the six months ended June 30, 2014

|

|

| |

|

Reported basis (GAAP)

|

|

|

Adjustments

|

|

|

Comparable basis (Non-GAAP)

|

|

|

Reported basis (GAAP)

|

|

|

Adjustments

|

|

|

Comparable basis (Non-GAAP)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues

|

|

$

|

122,916

|

|

|

|

-

|

|

|

$

|

122,916

|

|

|

$

|

113,943

|

|

|

|

-

|

|

|

$

|

113,943

|

|

|

Costs of sales

|

|

|

95,400

|

|

|

|

151

|

|

|

|

95,249

|

|

|

|

89,669

|

|

|

|

-

|

|

|

|

89,669

|

|

|

Gross Margin

|

|

|

27,516

|

|

|

|

151

|

|

|

|

27,667

|

|

|

|

24,274

|

|

|

|

-

|

|

|

|

24,274

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

18,317

|

|

|

|

706

|

|

|

|

17,611

|

|

|

|

18,776

|

|

|

|

802

|

|

|

|

17,974

|

|

|

Research and development

|

|

|

8,765

|

|

|

|

13

|

|

|

|

8,752

|

|

|

|

7,625

|

|

|

|

|

|

|

|

7,625

|

|

|

Acquisition amortization

|

|

|

498

|

|

|

|

498

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

-

|

|

|

Total operating expenses

|

|

|

27,580

|

|

|

|

1,217

|

|

|

|

26,363

|

|

|

|

26,401

|

|

|

|

802

|

|

|

|

25,599

|

|

|

Operating income (loss)

|

|

|

(64

|

)

|

|

|

1,368

|

|

|

|

1,304

|

|

|

|

(2,127

|

)

|

|

|

802

|

|

|

|

(1,325

|

)

|

|

Other (expense) income, net

|

|

|

(239

|

)

|

|

|

-

|

|

|

|

(239

|

)

|

|

|

328

|

|

|

|

-

|

|

|

|

328

|

|

|

Interest expense

|

|

|

(171

|

)

|

|

|

51

|

|

|

|

(120

|

)

|

|

|

(42

|

)

|

|

|

-

|

|

|

|

(42

|

)

|

|

Income (loss) before (provision for) benefit from income taxes

|

|

|

(474

|

)

|

|

|

1,419

|

|

|

|

945

|

|

|

|

(1,841

|

)

|

|

|

802

|

|

|

|

(1,039

|

)

|

|

(Provision for) benefit from income taxes

|

|

|

190

|

|

|

|

(525

|

)

|

|

|

(335

|

)

|

|

|

333

|

|

|

|

(273

|

)

|

|

|

60

|

|

|

Net income (loss)

|

|

$

|

(284

|

)

|

|

$

|

894

|

|

|

$

|

610

|

|

|

$

|

(1,508

|

)

|

|

$

|

529

|

|

|

$

|

(979

|

)

|

|

Earnings (loss) per diluted share

|

|

$

|

(0.02

|

)

|

|

|

|

|

|

$

|

0.04

|

|

|

$

|

(0.10

|

)

|

|

|

|

|

|

$

|

(0.06

|

)

|

During the six months ended June 30, 2015, the Company recorded severance and other related charges of $597,000, of which $151,000 is included in cost of sales, $13,000 is included in research and development and $433,000 is included in selling, general and administrative. Also included within selling, general and administrative is equity based compensation charges of $273,000. Lastly, related to the acquisition of Brink, the Company recognized amortization of acquired intangible assets of $498,000 and accreted interest of $51,000. During the six months ended June 30, 2014, the Company recorded a charge of $802,000 for equity based compensation expense. The aforementioned charges, along with an associated adjustment to the Company’s provision for income taxes have been excluded in the Company’s non-GAAP measures because they are considered non-recurring in nature and/or are quantitatively and qualitatively different from the Company’s core operations during any particular period.

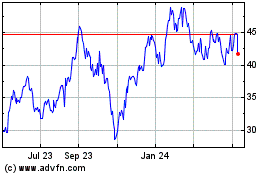

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

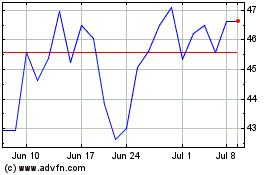

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024