Defense Companies Feel Oil's Knock

January 28 2016 - 11:44PM

Dow Jones News

By Doug Cameron

The first signs are emerging that falling commodity prices are

starting to hurt U.S. defense exports, as companies deal with

varying levels of demand for equipment, especially in the Middle

East.

L-3 Communications Holdings Inc. and Oshkosh Corp. said they are

facing tougher business conditions in the Middle East, with budget

pressures from falling oil revenues leading government customers to

push back on signing off on contracts on trucks and

communication-related equipments.

On the other hand, Raytheon Co., and its counterparts at

Lockheed Martin Corp. and Northrop Grumman Corp., say they have

seen strong demand from the region.

Analysts suggest that this reflected some changing priorities

among overseas buyers, with a focus on boosting air defenses and

munitions stockpiles.

The Middle East is the largest export market for U.S. defense

companies, which have been selling billions of dollars in combat

aircraft, missile defense systems and other equipment to the

region.

"The Mid-East has slowed down, and Australia as well," said L-3

Chief Executive Michael Strianese on an investor call, adding that

demand has strengthened in other parts of Asia.

Oshkosh, a big maker of mine-resistant military trucks, said a

hoped-for deal to sell hundreds of its M-ATV armored vehicles to a

Middle East nation failed to materialize last quarter, forcing the

company to trim its 2016 guidance.

Wilson Jones, the company's chief executive, said on an investor

call that he learned the unnamed customer had frozen its budget

last quarter, and was reviewing its spending plans.

Mr. Jones, who recently visited the region, said he remained

confident of completing the deal at some point.

Oshkosh, previously, has sold hundreds of the trucks, which

analysts said was its most profitable product, to the United Arab

Emirates.

Defense export sales are notoriously lumpy, and negotiations can

take far longer to complete than domestic deals as customers

wrangle over work-sharing, technology transfer and pricing.

U.S. companies have invested heavily to boost exports, in part

to counter a decline in Pentagon spending that only now is starting

to recover.

Exports account for a fifth of the total revenue across the

largest contractors.

Many of these companies have set up local bases and partnerships

with local companies to split the work and to win more deals.

Other defense executives this week said such efforts were

bearing fruit, with overseas sales continuing to expand, even

though U.S. products have become relatively more expensive as the

dollar strengthened.

"If anything, we're seeing a stronger demand than a slowdown,"

Raytheon's Chief Executive Tom Kennedy told investors Thursday,

after returning from a recent trip to the Middle East.

Raytheon derived 31% of its sales last year from overseas, the

highest proportion among big U.S. contractors, as countries look to

acquire its Patriot air defense system and Paveway laser-guided

bombs.

"There's probably been some re-prioritization," said Rob

Stallard at RBC Capital. "It doesn't mean the projects that have

been moved down the list are toast--it just means they'll take

longer."

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

January 28, 2016 23:29 ET (04:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

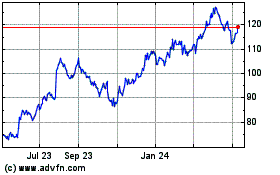

Oshkosh (NYSE:OSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

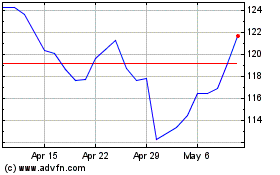

Oshkosh (NYSE:OSK)

Historical Stock Chart

From Apr 2023 to Apr 2024