Additional Proxy Soliciting Materials (definitive) (defa14a)

May 18 2015 - 11:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

Old Republic International Corporation

(Name of Registrant as Specified In Its Charter)

________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant ot Exchange Act Rule 0-11

(set forth the amount of which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

5) Total fee paid:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or Schedule and the date of its filing.

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

May 15, 2015

Dear Old Republic International Corporation Shareholders:

Subject: COMPELLING REASONS TO VOTE "AGAINST" CalPERS PROXY ITEM # 5

It has come to our attention that California Public Employees’ Retirement System (CalPERS) has made an SEC filing of a letter addressed to the shareholders of Old Republic International Corporation. The letter urges the shareholders to support the CalPERS proposal # 5 at the Company’s May 22, 2015 annual meeting of the shareholders. In its letter CalPERS maintains that as of the record date it held 715,483 shares of Old Republic common stock. These shares would represent just 0.27% of all shares outstanding as of that date. CalPERS further maintains that it is a long-term shareholder of the company. According to records provided by independent statistical sources, CalPERS has held the following Old Republic shares:

12/31/04 663,250 shares

12/31/05 979,075 shares

12/31/06 883,928 shares

12/31/07 1,054,368 shares

12/31/08 1,319,453 shares

12/31/09 748,964 shares

12/31/10 904,243 shares

12/31/11 905,107 shares

12/31/12 1,374,309 shares

12/31/13 1,532,083 shares

12/31/14 595,883 shares

As of 2015

record date 715,483 shares

As can be seen, CalPERS has been an active trader in Old Republic’s stock during this past decade and to our knowledge has not previously expressed any concerns about plurality voting.

According to its web site, CalPERS is an organization dedicated to providing retirement, and disability, death, health, and long-term care benefits to existing and future employees of government institutions and districts in the State of California. According to that web site, as of June 30, 2014, those employees fall into the following categories: State of California employees: 30.3%, school members: 39.2%, and local government agencies: 30.6%. It therefore appears that CalPERS represents the interests of California state and local government employees alone. In Old Republic’s view, such interests are not necessarily aligned with, nor are they representative of the majority of workers and investors in

for-profit businesses in the United States. Moreover, CalPERS’ interests are not necessarily aligned with those of Old Republic’s directors, executives, and employees who own shares directly and through the Old Republic Employees Savings and Stock Ownership Plan. In the aggregate, all such shares currently account for approximately 7.6% of the total shares outstanding as indicated on page 3 of this year’s Proxy Statement. Nor are CalPERS and other shareholders’ interests necessarily aligned with those of other stakeholders interested in the long-term continuity of Old Republic’s insurance business. These interests include individual shareholders, institutional shareholders, such as mutual fund and profit sharing plan money managers who have a fiduciary duty to the beneficiaries of such funds and plans, holders of the Company's debt securities, as well as the policyholders of Old Republic’s insurance subsidiaries who have a vested interest in the long-term continuity and value of promises of insurance indemnity.

In the context of all of the above summarized views, Old Republic’s Board of Directors, speaking with one voice through its chairman and chief executive officer states that it does not support and instead urges all of the Old Republic shareholders to VOTE AGAINST Proposal Item # 5 requesting majority voting for directors.

In its supplemental letter, CalPERS maintains that “plurality voting is rapidly being replaced with majority voting in uncontested elections of directors.” While this may be a true assertion, Old Republic has always relied on its own Board of Directors in the management of the business affairs of the Company, including the procedures for director elections. In this it has remained semper fidelis to its mission of securing the long-term interests of its shareholders, the policyholders of its insurance subsidiaries and those of its employees and other serious long-term stock investors and holders of Old Republic's debt securities. In this regard, plurality voting provides the greatest assurance of fidelity to this long-term view of corporate governance. After weighing the view of long-term dedication to stakeholder value against the clamors for short-term-ism and the destabilizing effect that majority voting can most likely engender, Old Republic’s Board remains committed to maintaining a plurality voting standard for the election of its directors.

In its supplemental letter CalPERS also asserts that a plurality voting standard effectively disenfranchises shareowners when directors run unopposed.

Old Republic disagrees with this premise. Instead, it believes that any such perceived dis-enfranchisement of shareholders is overwhelmed by the benefits that plurality voting engenders in the governance and long-term orientation of insurance institutions. Insurance institutions are inherently vested with the public interest and must ensure they are empowered to provide for the long-term stability and resilience of their insurance subsidiaries. Accordingly, the Board of Directors of Old Republic believes that the short-term concerns of special interest groups are not necessarily aligned with the best interests of the majority of the Company’s shareholders and other stakeholders. The Board believes that the prudent management of Old Republic for the long run, in the best interests of the shareholders also requires its Directors to always be vigilant to assure that its insurance subsidiaries can meet their just obligations to policyholders in the future.

In light of all the above, Old Republic’s Board of Directors, as it has stated on pages 30 to 33 of its Proxy Statement dated April 15, 2015, urges shareholders to VOTE AGAINST the CalPERS proposal set forth in ITEM 5.

Respectfully submitted on behalf of the Company’s Board of Directors,

/s/ A.C. Zucaro

Aldo C. Zucaro

Chairman of the Board and Chief Executive Officer

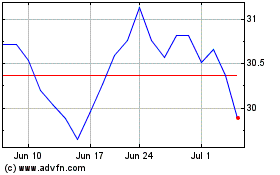

Old Republic (NYSE:ORI)

Historical Stock Chart

From Mar 2024 to Apr 2024

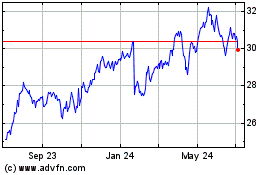

Old Republic (NYSE:ORI)

Historical Stock Chart

From Apr 2023 to Apr 2024