AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON SEPTEMBER 2, 2015

REGISTRATION NO. 333-203990

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

OLIN CORPORATION

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Virginia |

|

190 Carondelet Plaza, Suite 1530

Clayton, Missouri 63105-3443

(314) 480-1400 |

|

13-1872319 |

(State or other jurisdiction of

incorporation or organization) |

|

|

(I.R.S. Employer

Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal

executive offices)

George H. Pain, Esq.

Senior Vice President, General Counsel and Secretary

Olin Corporation

190

Carondelet Plaza, Suite 1530

Clayton, Missouri 63105-3443

(314) 480-1400

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

| George F. Schoen, Esq.

Cravath, Swaine & Moore LLP

Worldwide Plaza 825 Eighth

Avenue New York, New York 10019

(212) 474-1000 |

|

|

|

George A. Casey, Esq.

Richard B. Alsop, Esq.

Heiko Schiwek, Esq.

Shearman & Sterling LLP

599 Lexington Avenue New

York, New York 10022 (212) 848-7333 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable on or after the effective date of this

registration statement and after all other conditions to the completion of the exchange offer and merger described herein have been satisfied or waived.

If

the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following

box. ¨

If this Form is filed to register additional securities for an offering pursuant to

Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration

statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Olin Corporation (“Olin”) is filing this registration statement on Form S-4 (Reg. No. 333-203990) to register shares of its common stock, par

value $1 per share, which will be issued in the merger (the “Merger”) of Blue Cube Acquisition Corp., a Delaware corporation (“Merger Sub”), which is a wholly-owned subsidiary of Olin, with and into Blue Cube Spinco Inc.

(“Splitco”), which is a wholly-owned subsidiary of The Dow Chemical Company (“TDCC”), whereby the separate corporate existence of Merger Sub will cease and Splitco will continue as the surviving company and a wholly-owned

subsidiary of Olin. The shares of Splitco common stock will be immediately converted into shares of Olin common stock in the Merger. Olin has filed a proxy statement that relates to the special meeting of shareholders of Olin to approve the issuance

of shares of Olin common stock in the Merger and an amendment to Olin’s Amended and Restated Articles of Incorporation. In addition, Splitco has filed a registration statement on Form S-4 and Form S-1 (Reg. No. 333-204006) to register

shares of its common stock, par value $0.001 per share, which common shares will be distributed to TDCC shareholders pursuant to a spin-off or a split-off in connection with the Merger.

TDCC is offering its shareholders the option to exchange their shares of TDCC common stock for shares of Splitco common stock in an exchange offer, which

shares would immediately be converted into shares of Olin common stock in the Merger, resulting in a reduction in TDCC’s outstanding shares. If the exchange offer is undertaken and consummated but the exchange offer is not fully subscribed

because less than all shares of Splitco common stock owned by TDCC are exchanged, the remaining shares of Splitco common stock owned by TDCC would be distributed on a pro rata basis to TDCC shareholders whose shares of TDCC common stock remain

outstanding after the consummation of the exchange offer (the “clean-up spin”).

The information in this document may change. The exchange offer and issuance of securities

being registered pursuant to the registration statement of which this document forms a part may not be completed until the registration statement is effective. This document is not an offer to sell these securities, and it is not soliciting an offer

to buy these securities, in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION

DATED SEPTEMBER 2, 2015

PRELIMINARY PROSPECTUS—OFFER TO EXCHANGE

THE DOW CHEMICAL COMPANY

Offer to Exchange All Shares of Common Stock of

BLUE CUBE SPINCO INC.

which are owned by The Dow Chemical Company

and will be converted into Shares of Common Stock of

OLIN CORPORATION

for

Shares of Common Stock of The Dow Chemical Company

The Dow Chemical Company (“TDCC”) is offering to exchange all shares of common stock of Splitco (“Splitco common stock”) owned by TDCC for

shares of common stock of TDCC (“TDCC common stock”) that are validly tendered and not properly withdrawn. None of TDCC, Blue Cube Spinco Inc. (“Splitco”), Olin Corporation (“Olin”), any of their respective directors or

officers or any of their respective representatives makes any recommendation as to whether you should participate in this exchange offer. You must make your own decision after reading this document and consulting with your advisors.

TDCC’s obligation to exchange shares of Splitco common stock for shares of TDCC common stock is subject to the satisfaction of certain conditions,

including conditions to the consummation of the Transactions, which include approval by the shareholders of Olin of the issuance of shares of common stock of Olin (“Olin common stock”) in the merger and an amendment to Olin’s Amended

and Restated Articles of Incorporation.

The Transactions are being undertaken to transfer the Dow Chlorine Products Business from TDCC to Olin. Immediately

following the consummation of this exchange offer, a special purpose merger subsidiary of Olin named Blue Cube Acquisition Corp. (“Merger Sub”) will be merged with and into Splitco, and Splitco, as the surviving company, will become a

wholly-owned subsidiary of Olin (the “Merger”). In the Merger, each issued and outstanding share of Splitco common stock will be converted into the right to receive 0.87482759 shares of Olin common stock. Accordingly, shares of Splitco

common stock will not be transferred to participants in this exchange offer; such participants will instead receive shares of Olin common stock in the Merger. No trading market currently exists or will ever exist for shares of Splitco common stock.

Immediately after the Merger, approximately 52.7 percent of the outstanding shares of Olin common stock are expected to be held by pre-Merger holders of Splitco common stock and approximately 47.3 percent of the outstanding shares of Olin common

stock are expected to be held by pre-Merger holders of Olin common stock.

This exchange offer is designed to permit you to exchange your shares of TDCC

common stock for a number of shares of Splitco common stock that corresponds to a 10 percent discount in value, calculated as set forth in this document, to the equivalent amount of Olin common stock based on the Merger exchange ratio set forth

above.

The value of TDCC common stock and Splitco common stock (by reference to Olin common stock) will be determined by TDCC by reference to the simple

arithmetic average of the daily volume-weighted average prices (“VWAP”) on each of the last three trading days of the exchange offer period (not including the expiration date) as it may be voluntarily extended, but not including the last

two trading days that are part of any Mandatory Extension (as described below) (“Valuation Dates”), of TDCC common stock and Olin common stock on the New York Stock Exchange (“NYSE”). Based on an expiration date of October 1,

2015, the Valuation Dates are expected to be September 28, 2015, September 29, 2015, and September 30, 2015.

For each $1.00 of TDCC common stock accepted

in this exchange offer, you will receive approximately $1.11 of Splitco common stock, subject to an upper limit of 2.9318 shares of Splitco common stock per share of TDCC common stock. This exchange offer does not provide for a lower limit or

minimum exchange ratio. If the upper limit is in effect, then the exchange ratio will be fixed at that limit and this exchange offer will be automatically extended (a “Mandatory Extension”) until 8:00 a.m., New York City time, on the

day after the second trading day following the last trading day prior to the originally contemplated expiration date to permit shareholders to tender or withdraw their TDCC common stock during that period. IF THE UPPER LIMIT IS IN EFFECT, UNLESS YOU

PROPERLY WITHDRAW YOUR SHARES, YOU WILL ULTIMATELY RECEIVE LESS THAN $1.11 OF SPLITCO COMMON STOCK FOR EACH $1.00 OF TDCC COMMON STOCK THAT YOU TENDER, AND YOU COULD RECEIVE MUCH LESS.

TDCC common stock is listed on the NYSE under the symbol “DOW.” Olin common stock is listed on the NYSE under the symbol “OLN.” On September

1, 2015, the last reported sale price of TDCC common stock on the NYSE was $41.66, and the last reported sale price of Olin common stock on the NYSE was $19.65. The market price of TDCC common stock and of Olin common stock will fluctuate prior to

the completion of this exchange offer and therefore may be higher or lower at the expiration date than the prices set forth above.

THIS EXCHANGE OFFER AND

WITHDRAWAL RIGHTS WILL EXPIRE AT 8:00 A.M., NEW YORK CITY TIME, ON OCTOBER 1, 2015, UNLESS THE OFFER IS EXTENDED OR TERMINATED. SHARES OF TDCC COMMON STOCK TENDERED PURSUANT TO THIS EXCHANGE OFFER MAY BE WITHDRAWN AT ANY TIME PRIOR TO THE

EXPIRATION OF THIS EXCHANGE OFFER.

The terms and conditions of this exchange offer and the Transactions are described in this document, which you

should read carefully.

In reviewing this document, you should carefully consider the risk factors set forth in the section entitled “Risk

Factors” beginning on page 44 of this document.

Neither the Securities and Exchange Commission (the “SEC”) nor any state

securities commission has approved or disapproved of these securities or determined if this Prospectus—Offer to Exchange is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus—Offer to Exchange is

, 2015.

This document incorporates by reference important business and financial information

about TDCC and Olin from documents filed with the SEC that have not been included in or delivered with this document. This information is available at the website that the SEC maintains at www.sec.gov, as well as from other sources. See “Where

You Can Find More Information; Incorporation by Reference.” You also may ask any questions about this exchange offer or request copies of the exchange offer documents from TDCC, without charge, upon written or oral request to TDCC’s

information agent, Georgeson Inc., located at 480 Washington Blvd., 26th Floor, Jersey City, NJ 07310 or at telephone number (888) 566-8006. In order to receive timely delivery of the

documents, you must make your requests no later than September 28, 2015.

If you are a participant in the Dow Chemical Company

Employees’ Savings Plan, you may ask questions about this exchange offer with respect to the plan, without charge, upon written or oral request to the trustee of the trust established under the plan, Fidelity Management Trust Company, located

at 245 Summer Street, Boston, MA 02210 or at telephone number 1-877-440-4015.

All information contained or incorporated by reference in this document

with respect to Olin and Merger Sub and their respective subsidiaries, as well as information about Olin after the consummation of the Transactions, has been provided by Olin. All other information contained or incorporated by reference in this

document with respect to TDCC, Splitco or their respective subsidiaries, or the Dow Chlorine Products Business, and with respect to the terms and conditions of the exchange offer has been provided by TDCC. This document contains or incorporates by

reference references to trademarks, trade names and service marks, including ACRYSOL, ADSORBSIA, AFFINITY, AMBERJET, AMBERLYST, AQUASET, AQUCAR, AVANSE, BETAMATE, BIOBAN, DOW, DOWEX, EDI, ELITE, EVOQUE, FILMTEC, FORMASHIELD, FROTH-PAK, GREAT STUFF,

HARVISTA, LIQUID ARMOR, NEPTUNE, NORDEL, OPTIPORE, POWERHOUSE, PRIMAL, RHOPLEX, RIPELOCK, SAFECHEM, SAFE-TAINER, SILVADUR, STYROFOAM, TAMOL, TEQUATIC, TERAFORCE, UNIPOL, WALOCEL, XENERGY, ARYLEX, BROADWAY, BRODBECK, CLINCHER, CLOSER, DAIRYLAND SEED,

DITHANE, DURANGO, ENLIST, ENLIST DUO, FENCER, GARLON, HYLAND, ISOCLAST, LONTREL, LORSBAN, MILESTONE, MYCOGEN, N-SERVE, NEXERA, PANZER, PFISTER, PHYTOGEN, PRAIRIE BRAND SEEDS, PRIMUS, RADIANT, REFUGE ADVANCED, SENTRICON, SPIDER, STARANE, SURESTART,

TELONE, TORDON, TRACER, TRANSFORM, and TRIUMPH, that are owned by TDCC and its related entities.

This document is not an offer to

sell or exchange and it is not a solicitation of an offer to buy any shares of TDCC common stock, Splitco common stock or Olin common stock in any jurisdiction in which the offer, sale or exchange is not permitted. Non-U.S. shareholders should

consult their advisors in considering whether they may participate in the exchange offer in accordance with the laws of their home countries and, if they do participate, whether there are any restrictions or limitations on transactions in the shares

of Splitco common stock that may apply in their home countries. TDCC, Splitco and Olin cannot provide any assurance about whether such limitations may exist. See “This Exchange Offer—Certain Matters Relating to Non-U.S. Jurisdictions”

for additional information about limitations on the exchange offer outside the United States.

TABLE OF CONTENTS

i

ii

iii

iv

HELPFUL INFORMATION

In this document:

| |

• |

|

“Above Basis Amount” means $2,030 million less the Below Basis Amount, subject to a possible adjustment based on Splitco’s working capital in accordance with the terms of the Separation Agreement;

|

| |

• |

|

“ASC” means the Financial Accounting Standards Board Accounting Standards Codification; |

| |

• |

|

“Below Basis Amount” means $875 million, subject to increase or decrease if elected by TDCC in accordance with the terms of the Separation Agreement, but not more than $1,050 million without the

consent of Olin; |

| |

• |

|

“Bridge Commitment Letter” means the bridge commitment letter dated March 26, 2015, among JPMorgan Chase Bank, N.A., J.P. Morgan Securities LLC, Wells Fargo Bank, N.A., Wells Fargo Securities, LLC and

Olin; |

| |

• |

|

“Charter Amendment” means the proposed amendment to the Olin Charter to increase the number of authorized shares of Olin common stock from 120,000,000 to 240,000,000; |

| |

• |

|

“CIP Shares” means TDCC common stock in uncertificated form held through Computershare CIP, a dividend reinvestment plan for TDCC common stock maintained by Computershare Trust Company, N.A. |

| |

• |

|

“Code” means the Internal Revenue Code of 1986, as amended; |

| |

• |

|

“Commitment Letters” means, collectively, the Bridge Commitment Letter and the Commitment Letter dated March 26, 2015, among JPMorgan Chase Bank, N.A., J.P. Morgan Securities LLC, Wells Fargo Bank, N.A., Wells

Fargo Securities LLC and Olin; |

| |

• |

|

“Commitment Parties” means, collectively, JPMorgan Chase Bank, N.A., J.P. Morgan Securities LLC, Wells Fargo Bank N.A. and Wells Fargo Securities, LLC, together with all additional lenders added to the

Commitment Letters; |

| |

• |

|

“Contribution” means the contribution by TDCC, directly or indirectly, of the equity interests in the DCP Subsidiaries to Splitco pursuant to the Separation Agreement; |

| |

• |

|

“Daily VWAP” means the daily volume-weighted average price, and considering prices observed on the NYSE, with respect to TDCC, the Bloomberg command is “DOW UN <Equity> VAP” and with respect to

Olin, the Bloomberg command is “OLN UN <Equity> VAP”; |

| |

• |

|

“DCP Subsidiaries” means the newly-formed direct and indirect subsidiaries of TDCC that will hold the transferred assets and certain assumed liabilities related to DCP following the Separation and will be

contributed to Splitco prior to the consummation of the Distribution, pursuant to the Contribution; |

| |

• |

|

“Debt Exchange” means the transfer of the Splitco Securities by TDCC on or about the closing date of the Merger to investment banks and/or commercial banks in exchange for existing TDCC debt as described in

the section of this document entitled “Debt Financing—Debt Exchange”; |

| |

• |

|

“Distribution” means the distribution by TDCC of its shares of Splitco common stock to the holders of shares of TDCC common stock by way of an exchange offer and, with respect to any shares of Splitco common

stock that are not subscribed for in the exchange offer, a pro rata distribution to the holders of shares of TDCC common stock; |

| |

• |

|

“Dow Chlorine Products Business” or “DCP” means TDCC’s U.S. chlor-alkali and vinyl, global epoxy and global chlorinated organics business, including TDCC’s equity interests in the JV

Entity; |

| |

• |

|

“Dow Savings Plan” means The Dow Chemical Company Employees’ Savings Plan, as may be amended from time to time; |

| |

• |

|

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended; |

| |

• |

|

“Exchange Act” means the Securities Exchange Act of 1934, as amended; |

| |

• |

|

“GAAP” means generally accepted accounting principles in the United States; |

1

| |

• |

|

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended; |

| |

• |

|

“JV Entity” means Dow-Mitsui Chlor-Alkali LLC, a joint venture between TDCC and Mitsui & Co. Texas Chlor-Alkali, Inc. For more information about the transfer of TDCC’s interest in the JV Entity

to Splitco, see “The Separation Agreement—Separation of the Dow Chlorine Products Business—Transfer of the JV Entity Interests”; |

| |

• |

|

“JV Partner” means Mitsui & Co. Texas Chlor-Alkali, Inc.; |

| |

• |

|

“Merger” means the combination of Olin’s business and the Dow Chlorine Products Business through the merger of Merger Sub with and into Splitco, whereby the separate corporate existence of Merger Sub will

cease and Splitco will continue as the surviving company and as a wholly-owned subsidiary of Olin, as contemplated by the Merger Agreement; |

| |

• |

|

“Merger Agreement” means the Agreement and Plan of Merger, dated as of March 26, 2015, among TDCC, Splitco, Olin and Merger Sub; |

| |

• |

|

“Merger Sub” means Blue Cube Acquisition Corp., a Delaware corporation and a wholly-owned subsidiary of Olin; |

| |

• |

|

“New Credit Facilities” means, collectively, the Olin Credit Facilities and the Splitco Term Facility, in each case as defined in the section of this document entitled “Debt Financing—New Credit

Facilities”; |

| |

• |

|

“New Term Facilities” means, collectively, the Olin Term Facility and the Splitco Term Facility, in each case as defined in the section of this document entitled “Debt Financing—New Credit

Facilities”; |

| |

• |

|

“NYSE” means The New York Stock Exchange; |

| |

• |

|

“Olin” means Olin Corporation, a Virginia corporation, and, unless the context otherwise requires, its subsidiaries including, after the consummation of the Merger, Splitco and the DCP Subsidiaries;

|

| |

• |

|

“Olin Charter” means the Amended and Restated Articles of Incorporation of Olin; |

| |

• |

|

“Olin common stock” means the common stock, par value $1 per share, of Olin; |

| |

• |

|

“Other Splitco Debt Securities” means other senior debt securities, term loans or a combination thereof that Splitco expects to issue and sell as described in the section of this document entitled “Debt

Financing”; |

| |

• |

|

“Private Letter Ruling” means a private letter ruling from the IRS including rulings substantially to the effect that (a) the continuing arrangements between TDCC and Splitco will not preclude TDCC and

Splitco from satisfying the active trade or business requirement of Section 355(a) of the Code; (b) the receipt of Olin stock by a TDCC shareholder will be treated for federal income tax purposes as if the TDCC shareholder received Splitco

common stock in the Distribution and exchanged such Splitco stock for Olin stock in the Merger; (c) the sale of fractional shares in the market will not be treated as acquisitions that are part of a plan that includes the Distribution for

purposes of Section 355(e); (d) TDCC will not recognize gain or loss on the receipt of the Special Payment under Section 361(b)(3) of the Code (it being understood that the Special Payment does not include any additional cash

distributed pursuant to the Merger Agreement and the Separation Agreement); (e) unless TDCC shall have elected to receive cash from Splitco in lieu of the Splitco Securities, as described below under “The Merger Agreement—Debt

Exchange,” TDCC will not recognize gain or loss upon the Debt Exchange under Section 361(c) of the Code; (f) TDCC will not recognize gain under Section 357(c) of the Code in the Contribution and the Distribution; and

(g) such additional or supplemental tax rulings material to TDCC’s tax treatment of the Separation or Merger as have been or will be requested by TDCC subject to the prior written consent of Olin (not to be unreasonably withheld,

conditioned or delayed); |

| |

• |

|

“SEC” means the U.S. Securities and Exchange Commission; |

| |

• |

|

“Securities Act” means the Securities Act of 1933, as amended; |

2

| |

• |

|

“Separation” means the transfer by TDCC to Splitco or the DCP Subsidiaries directly or indirectly of the transferred assets and certain assumed liabilities related to DCP pursuant to the Separation Agreement;

|

| |

• |

|

“Separation Agreement” means the Separation Agreement, dated as of March 26, 2015, between TDCC and Splitco; |

| |

• |

|

“Share Issuance” means the issuance of shares of Olin common stock to the shareholders of Splitco in the Merger; |

| |

• |

|

“Special Payment” means the cash payment to be made in connection with the Transactions by Splitco to TDCC in an amount equal to the Below Basis Amount; |

| |

• |

|

“Splitco” means Blue Cube Spinco Inc., a Delaware corporation, and prior to the Merger, a wholly-owned subsidiary of TDCC; |

| |

• |

|

“Splitco common stock” means the common stock, par value $0.001, of Splitco; |

| |

• |

|

“Splitco Securities” means nonconvertible debt instruments in a principal face amount equal to the Above Basis Amount (subject to increase to account for customary underwriting fees) that Splitco will issue to

TDCC (unless TDCC elects to receive cash from Splitco in lieu of the Splitco Securities), that TDCC thereafter expects to exchange for existing debt obligations of TDCC in the Debt Exchange, and that will be the debt obligations of Splitco, and are

expected to be guaranteed by Olin after the consummation of the Merger; |

| |

• |

|

“Sumitomo Term Facility” means the term facility under the Sumitomo Credit Agreement, as defined in the section of this document entitled “Debt Financing—Sumitomo Credit Agreement”;

|

| |

• |

|

“Tag Event” means the exercise by the JV Partner prior to the closing date of the Merger of its right to transfer all of its equity interests in the JV Entity to TDCC or TDCC’s designee in connection with

the Transactions pursuant to the organizational documents of the JV Entity; |

| |

• |

|

“Tax Matters Agreement” means the Tax Matters Agreement, dated as of March 26, 2015, among Olin, TDCC and Splitco; |

| |

• |

|

“TDCC” means The Dow Chemical Company, a Delaware corporation, and, unless the context otherwise requires, its subsidiaries, which, after consummation of the Distribution, will not include Splitco and the DCP

Subsidiaries; |

| |

• |

|

“TDCC common stock” means the common stock, par value $2.50 per share, of TDCC; |

| |

• |

|

“TDCC RMT Tax Opinion” means an opinion from Shearman & Sterling LLP, tax counsel to TDCC, as to the tax-free status of the Separation, Contribution, Distribution and Merger, including that

(i) the Separation, Contribution and Distribution will constitute a “reorganization” within the meaning of Section 368(a) of the Code and each of TDCC and Splitco will be a party to the reorganization within the meaning of

Section 368(b) of the Code, (ii) TDCC will not recognize a gain or loss for U.S. federal income tax purposes in connection with the receipt of the Splitco Securities under the Separation Agreement and the Debt Exchange, and (iii) the

Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Code and each of TDCC and Splitco will be a party to the reorganization within the meaning of Section 368(b) of the Code; |

| |

• |

|

“TDCC shareholders” means the holders of TDCC common stock; |

| |

• |

|

“TDCC Stock Fund” means, collectively, the Dow Stock Fund and the LESOP Stock Fund, as such terms are defined in the Dow Savings Plan, which are unitized investment funds invested exclusively in shares of TDCC

common stock except for such amounts of cash, securities or other property as are necessary for liquidity purposes, subject to such limits on cash and short-term investments as are set forth in the Dow Savings Plan; |

| |

• |

|

“Transaction Documents” means the Separation Agreement, the Merger Agreement, the Employee Matters Agreement and the Tax Matters Agreement,

as well as the Additional Agreements and the |

3

| |

Local Conveyances (as described under “The Separation Agreement—Separation of the Dow Chlorine Products Business—Local Conveyances and Additional Agreements”), each of which

have been entered into or will be entered into in connection with the Transactions; |

| |

• |

|

“Transactions” means the transactions contemplated by the Merger Agreement and the Separation Agreement, which provide for, among other things, the Separation, the Contribution, the Distribution and the

Merger, as described in the section of this document entitled “The Transactions”; |

| |

• |

|

“Trust” means any trust established under the Dow Savings Plan that holds shares of TDCC common stock; |

| |

• |

|

“Trustee” means the trustee of the Trust; |

| |

• |

|

“Valuation Dates” means each of the last three trading days of the exchange offer period (not including the expiration date), as it may be voluntarily extended, but not including the last two trading days that

are part of any Mandatory Extension (as described in the section of this document entitled “This Exchange Offer—Terms of this Exchange Offer—Extension; Termination; Amendment—Mandatory Extension”); and |

| |

• |

|

“VWAP” means volume-weighted average price. |

4

QUESTIONS AND ANSWERS ABOUT THIS EXCHANGE OFFER AND THE TRANSACTIONS

The following are some of the questions that shareholders may have, and answers to those questions. These questions and answers, as

well as the following summary, are not meant to be a substitute for the information contained in the remainder of this document, and this information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere

in this document. You are urged to read this document in its entirety prior to making any decision.

Questions and Answers

About this Exchange Offer

| Q: |

Who may participate in this Exchange Offer? |

| A: |

Any U.S. holders of shares of TDCC common stock during the exchange offer period may participate in this exchange offer. Holders of TDCC’s Cumulative Convertible Perpetual Preferred Stock, Series A, may participate

in this exchange offer only to the extent that they convert their preferred shares into shares of TDCC common stock and validly tender those shares of TDCC common stock prior to the expiration of this exchange offer. Although TDCC has mailed this

document to its shareholders to the extent required by U.S. law, including shareholders located outside the United States, this document is not an offer to buy, sell or exchange and it is not a solicitation of an offer to buy, sell or exchange any

shares of TDCC common stock, shares of Olin common stock or shares of Splitco common stock in any jurisdiction in which such offer, sale or exchange is not permitted. |

Countries outside the United States generally have their own legal requirements that govern securities offerings made to persons resident in

those countries and often impose stringent requirements about the form and content of offers made to the general public. None of TDCC, Olin or Splitco has taken any action under non-U.S. regulations to facilitate a public offer to exchange shares of

TDCC common stock, shares of Olin common stock or shares of Splitco common stock outside the United States. Accordingly, the ability of any non-U.S. person to tender shares of TDCC common stock in the exchange offer will depend on whether there is

an exemption available under the laws of such person’s home country that would permit the person to participate in the exchange offer without the need for TDCC, Olin or Splitco to take any action to facilitate a public offering in that country

or otherwise. For example, some countries exempt transactions from the rules governing public offerings if they involve persons who meet certain eligibility requirements relating to their status as sophisticated or professional investors.

Non-U.S. shareholders should consult their advisors in considering whether they may participate in the exchange offer in accordance with the

laws of their home countries and, if they do participate, whether there are any restrictions or limitations on transactions in the shares of TDCC common stock, Splitco common stock or Olin common stock that may apply in their home countries. None of

TDCC, Olin or Splitco can provide any assurance about whether such limitations may exist. See “This Exchange Offer—Certain Matters Relating to Non-U.S. Jurisdictions” for additional information about limitations on the exchange offer

outside the United States.

TDCC believes a substantial majority of its shareholders are U.S. investors and does not expect the legal

limitations described under this heading to cause the exchange offer to be underscribed.

| Q: |

How many shares of Splitco common stock will I receive for each share of TDCC common stock that I tender? |

| A: |

This exchange offer is designed to permit you to exchange your shares of TDCC common stock for shares of Splitco common stock at a 10 percent

discount, calculated as set forth in this document, to the per-share equivalent value of Splitco common stock. Stated another way, for each $1.00 of your TDCC common stock accepted in this exchange offer, you will receive approximately $1.11 of

Splitco common stock. The value of the TDCC common stock will be based on the calculated per-share value for the TDCC common stock on the NYSE and the value of the Splitco common stock will be based on the calculated per-share

|

5

| |

value for Olin common stock on the NYSE multiplied by 0.87482759 (which is the number of shares of Olin common stock to be received for each share of Splitco common stock), in each case

determined by reference to the simple arithmetic average of the daily VWAP on each of the Valuation Dates. Please note, however, that the number of shares you can receive is subject to an upper limit of an aggregate of 2.9318 shares of Splitco

common stock for each share of TDCC common stock accepted in this exchange offer. The next question and answer below describes how this limit may impact the value you receive. This exchange offer does not provide for a lower limit or minimum

exchange ratio. See “This Exchange Offer—Terms of this Exchange Offer.” Because this exchange offer is subject to proration in the event of oversubscription, TDCC may accept for exchange only a portion of the shares of TDCC common

stock tendered by you. |

| Q: |

Is there a limit on the number of shares of Splitco common stock I can receive for each share of TDCC common stock that I tender? |

| A: |

The number of shares you can receive is subject to an upper limit of 2.9318 shares of Splitco common stock for each share of TDCC common stock accepted in this exchange offer. If the upper limit is in effect, you will

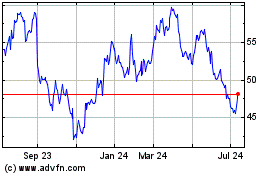

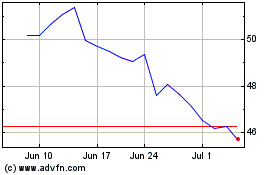

ultimately receive less than $1.11 of Splitco common stock for each $1.00 of TDCC common stock that you tender, and you could receive much less. For example, if the calculated per-share value of TDCC common stock was $53.59 (the highest closing

price for TDCC common stock on the NYSE during the three-month period prior to commencement of this exchange offer) and the calculated per-share value of Splitco common stock was $16.42 (based on the lowest closing price for Olin common stock on the

NYSE during that three-month period multiplied by 0.87482759 (which is the number of shares of Olin common stock to be received for each share of Splitco common stock)), the value of Splitco common stock received for each $1.00 of TDCC common stock

accepted for exchange would be approximately $0.90. |

The upper limit represents a 15 percent discount for shares of Splitco

common stock relative to shares of TDCC common stock based on the average daily VWAPs of TDCC common stock on the NYSE and Olin common stock on the NYSE on August 28, 2015, August 31, 2015, and September 1, 2015 (the last three trading days before

the commencement of this exchange offer). The averages of the daily VWAPs of TDCC common stock and Olin common stock on August 28, 2015, August 31, 2015 and September 1, 2015, were $43.1746 and $19.8043, respectively. The upper limit was determined

by dividing 100% of the calculated per-share value of TDCC common stock for such dates by 85% of the calculated per-share value of Splitco common stock for such dates (in each case determined in the manner described under “This Exchange

Offer—Terms of this Exchange Offer—General”). TDCC set this upper limit to ensure that an unusual or unexpected drop in the trading price of Olin common stock, relative to the trading price of TDCC common stock, would not result in an

unduly high number of shares of Splitco common stock being exchanged for each share of TDCC common stock accepted in this exchange offer, preventing a situation that might significantly reduce the benefits of this exchange offer to TDCC and its

continuing shareholders due to a smaller number of outstanding shares being acquired by TDCC in this exchange offer.

| Q: |

What will happen if the upper limit is in effect? |

| A: |

TDCC will announce whether the upper limit on the number of shares that can be received for each share of TDCC common stock tendered will be in effect at the expiration of the exchange offer period, through

www.edocumentview.com/dowexchange and by press release, no later than 4:30 p.m., New York City time, on the last trading day prior to the expiration date. If the upper limit is in effect at that time, then the exchange ratio will

be fixed at the upper limit and a Mandatory Extension of this exchange offer will be made until 8:00 a.m., New York City time, on the day after the second trading day following the last trading day prior to the originally contemplated

expiration date to permit shareholders to tender or withdraw their shares of TDCC common stock during those days. The daily VWAP and trading prices of TDCC common stock and Olin common stock during this Mandatory Extension will not, however, affect

the upper limit, which will be fixed at 2.9318 shares of Splitco common stock per share of TDCC common stock. See “This Exchange Offer—Terms of this Exchange Offer—Extension; Termination; Amendment—Mandatory Extension.”

|

6

| Q: |

How are the calculated per-share values of TDCC common stock and Splitco common stock determined for purposes of calculating the number of shares of Splitco common stock to be received in this exchange offer?

|

| A: |

The calculated per-share value of a share of TDCC common stock for purposes of this exchange offer will equal the simple arithmetic average of the daily VWAP of TDCC common stock on the NYSE on each of the Valuation

Dates. The calculated per-share value of a share of Splitco common stock for purposes of this exchange offer will equal the simple arithmetic average of the daily VWAP of Olin common stock on the NYSE on each of the Valuation Dates multiplied by

0.87482759 (which is the number of shares of Olin common stock to be received for each share of Splitco common stock). TDCC will determine such calculations of the per-share values of TDCC common stock and Splitco common stock and such determination

will be final. |

| Q: |

What is the “daily volume-weighted average price” or “daily VWAP?” |

| A: |

The “daily volume-weighted average price” for TDCC common stock and Olin common stock will be the volume-weighted average price of TDCC and Olin common stock on the NYSE during the period beginning at 9:30

a.m., New York City time (or such other time as is the official open of trading on the NYSE), and ending at 4:00 p.m., New York City time (or such other time as is the official close of trading on the NYSE), except that such data will only take into

account adjustments made to reported trades included by 4:10 p.m., New York City time. The daily VWAP will be as reported by Bloomberg Finance L.P. and displayed under the heading Bloomberg VWAP on the Bloomberg pages “DOW

UN<Equity>VAP” with respect to TDCC common stock and “OLN UN<Equity>VAP” with respect to Olin common stock (or their equivalent successor pages if such pages are not available). The daily VWAPs provided by Bloomberg

Finance L.P. may be different from other sources of volume-weighted average prices or investors’ or security holders’ own calculations of volume-weighted average prices. |

| Q: |

Where can I find the daily VWAP of TDCC common stock and Olin common stock during the exchange offer period? |

| A: |

TDCC will maintain a website at www.edocumentview.com/dowexchange that provides the daily VWAP of both TDCC common stock and Olin common stock, indicative calculated per-share values for shares of TDCC common

stock and shares of Splitco common stock, together with indicative exchange ratios, for each day during this exchange offer. During the period of the Valuation Dates, when the values of TDCC common stock and Olin common stock are calculated for the

purposes of this exchange offer, the website will show the indicative exchange ratios based on indicative calculated per-share values calculated by TDCC, which will equal (i) on the first Valuation Date, the intra-day VWAP during the elapsed

portion of that day, (ii) on the second Valuation Date, the intra-day VWAP during the elapsed portion of that day averaged with the actual daily VWAP on the first Valuation Date and (iii) on the third Valuation Date, the intra-day VWAP

during the elapsed portion of that day averaged with the actual daily VWAP on the first Valuation Date and the actual daily VWAP on the second Valuation Date. During this period, the indicative exchange ratios and calculated per-share values will be

updated at 10:30 a.m., 1:30 p.m. and no later than 4:30 p.m., New York City time. |

| Q: |

Why is the calculated per-share value for Splitco common stock based on the trading prices for Olin common stock? |

| A: |

There is currently no trading market for Splitco common stock and no such trading market will be established in the future. TDCC believes, however,

that the trading prices for Olin common stock, adjusted for the exchange ratio in the Merger, are an appropriate proxy for the trading prices of Splitco common stock because (a) prior to the Distribution, Splitco will issue to TDCC a number of

shares of Splitco common stock such that the total number of shares of Splitco common stock outstanding immediately prior |

7

| |

to the Merger will be 100,000,000; (b) in the Merger, each share of Splitco common stock will be converted into the right to receive 0.87482759 shares of Olin common stock for each such

share of Splitco common stock; and (c) at the Valuation Dates, it is expected that all the major conditions to the consummation of the Merger will have been satisfied and the Merger will be expected to be consummated shortly, such that

investors should be expected to be valuing Olin common stock based on the expected value of such Olin common stock after the Merger. There can be no assurance, however, that Olin common stock after the Merger will trade on the same basis as Olin

common stock trades prior to the Merger. See “Risk Factors—Risks Related to the Transactions—The trading prices of Olin common stock may not be an appropriate proxy for the prices of Splitco common stock.” |

| Q: |

How and when will I know the final exchange ratio? |

| A: |

Subject to the possible Mandatory Extension of this exchange offer described below, the final exchange ratio showing the number of shares of Splitco common stock that you will receive for each share of TDCC common stock

accepted in this exchange offer will be available at www.edocumentview.com/dowexchange and separately announced by press release no later than 4:30 p.m., New York City time, on the last trading day prior to the expiration date. In

addition, as described below, you may also contact the information agent to obtain these indicative exchange ratios and the final exchange ratio at its toll-free number provided on the back cover of this document. |

TDCC will announce whether the upper limit on the number of shares that can be received for each share of TDCC common stock tendered is in

effect at www.edocumentview.com/dowexchange and separately by press release, no later than 4:30 p.m., New York City time, on the last trading day prior to the expiration date. If the upper limit is in effect at that time, then the

exchange ratio will be fixed at the upper limit and a Mandatory Extension until 8:00 a.m., New York City time, on the day after the second trading day following the last trading day prior to the originally contemplated expiration date will be

made to permit shareholders to tender or withdraw their shares of TDCC common stock during those days.

| Q: |

Will indicative exchange ratios be provided during the tender offer period? |

| A: |

Yes. Indicative exchange ratios will be available by contacting the information agent at the toll-free number provided on the back cover of this document on each day during the exchange offer period, calculated as

though that day were the expiration date of this exchange offer. The indicative exchange ratio will also reflect whether the upper limit on the exchange ratio, described above, would have been in effect. You may also contact the information agent at

its toll-free number to obtain these indicative exchange ratios. |

In addition, for purposes of illustration, a table that

indicates the number of shares of Splitco common stock that you would receive per share of TDCC common stock, calculated on the basis described above and taking into account the upper limit, assuming a range of averages of the daily VWAP of TDCC

common stock and Olin common stock on the Valuation Dates is provided under “This Exchange Offer—Terms of this Exchange Offer.”

| Q: |

What if shares of TDCC common stock or shares of Olin common stock do not trade on any of the Valuation Dates? |

| A: |

If a market disruption event occurs with respect to TDCC common stock or Olin common stock on any of the Valuation Dates, the calculated per-share value of TDCC common stock and Splitco common stock will be determined

using the daily VWAP of shares of TDCC common stock and shares of Olin common stock on the preceding trading day or days, as the case may be, on which no market disruption event occurred with respect to both TDCC common stock and Olin common stock.

If, however, a market disruption event occurs as specified above, TDCC may terminate this exchange offer if, in its reasonable judgment, the market disruption event has impaired the benefits of this exchange offer. For specific information as to

what would constitute a market disruption event, see “This Exchange Offer—Conditions for the Consummation of this Exchange Offer.” |

8

| Q: |

Are there circumstances under which I would receive fewer shares of Splitco common stock than I would have received if the exchange ratio were determined using the closing prices of TDCC common stock and Olin common

stock on the final Valuation Date for this exchange offer? |

| A: |

Yes. For example, if the trading price of TDCC common stock were to increase during the period of the Valuation Dates, the calculated per-share value of TDCC common stock would likely be lower than the closing price of

TDCC common stock on the final Valuation Date for this exchange offer. As a result, you may receive fewer shares of Splitco common stock for each $1.00 of TDCC common stock than you would have if that per-share value were calculated on the basis of

the closing price of TDCC common stock on such date. Similarly, if the trading price of Olin common stock were to decrease during the period of the Valuation Dates, the calculated per-share value of Splitco common stock would likely be higher than

the closing price of Olin common stock on the final Valuation Date for this exchange offer. This could also result in your receiving fewer shares of Splitco common stock for each $1.00 of TDCC common stock than you would otherwise receive if that

per-share value were calculated on the basis of the closing price of Olin common stock on such date. See “This Exchange Offer—Terms of this Exchange Offer.” |

| Q: |

Will TDCC distribute fractional shares? |

| A: |

Upon the consummation of this exchange offer, the exchange agent will hold the shares of Splitco common stock in trust for the holders of TDCC common stock who validly tendered their shares and, in case of a pro rata

distribution, for the holders of record of TDCC common stock for the pro rata distribution. Immediately following the consummation of this exchange offer, Merger Sub will be merged with and into Splitco, with Splitco surviving the Merger and

becoming a wholly-owned subsidiary of Olin. Each issued and outstanding share of Splitco common stock will be converted into the right to receive 0.87482759 shares of Olin common stock. In the Merger, no fractional shares of Olin common stock will

be delivered to holders of Splitco common stock. All fractional shares of Olin common stock that a holder of shares of Splitco common stock would otherwise be entitled to receive as a result of the Merger will be aggregated by a transfer agent

appointed by Olin. The transfer agent will cause the whole shares obtained thereby to be sold on behalf of such holders of shares of Splitco common stock that would otherwise be entitled to receive such fractional shares of Olin common stock in the

Merger, in the open market or otherwise, in each case at then-prevailing market prices as soon as practicable after the Merger. The transfer agent will make available the net proceeds thereof, after deducting any required withholding taxes and

brokerage charges, commissions and transfer taxes, on a pro rata basis, without interest, as soon as practicable to the holders of Splitco common stock that would otherwise be entitled to receive such fractional shares of Olin common stock in the

Merger. |

| Q: |

What is the aggregate number of shares of Splitco common stock being offered in this exchange offer? |

| A: |

In this exchange offer, TDCC is offering 100,000,000 shares of Splitco common stock, which will constitute all of the shares of Splitco common stock that will be issued and outstanding on the date of the consummation of

this exchange offer. |

| Q: |

What happens if insufficient shares of TDCC common stock are tendered to allow TDCC to exchange all of the shares of Splitco common stock it holds? |

| A: |

If this exchange offer is consummated but fewer than all of the issued and outstanding shares of Splitco common stock owned by TDCC are exchanged because this exchange offer is not fully subscribed, the remaining shares

of Splitco common stock owned by TDCC will be distributed on a pro rata basis to the holders of shares of TDCC common stock whose shares of TDCC common stock remain outstanding after the consummation of this exchange offer. Any TDCC shareholder who

validly tenders (and does not properly withdraw) shares of TDCC common stock for shares of Splitco common stock in the exchange offer will waive their rights with respect to those tendered shares of TDCC common stock to receive, and forfeit any

rights to, shares of Splitco common stock distributed on a pro rata basis to TDCC shareholders in the event the exchange offer is not fully subscribed. |

9

Upon the consummation of this exchange offer, TDCC will deliver to the exchange agent a global

certificate representing all of the Splitco common stock being distributed in this exchange offer, with irrevocable instructions to hold the shares of Splitco common stock in trust for holders of shares of TDCC common stock validly tendered and not

withdrawn in this exchange offer and, in the case of a pro rata distribution, holders of shares of TDCC common stock whose shares of TDCC common stock remain outstanding after the consummation of this exchange offer. If there is a pro rata

distribution, the exchange agent will calculate the exact number of shares of Splitco common stock not exchanged in this exchange offer and to be distributed on a pro rata basis, and that number of shares of Splitco common stock will be held in

trust for the holders of shares of TDCC common stock whose shares of TDCC common stock remain outstanding after the consummation of this exchange offer. See “This Exchange Offer—Distribution of Any Shares of Splitco Common Stock Remaining

After this Exchange Offer.”

| Q: |

What happens if TDCC declares a quarterly dividend during this exchange offer? |

| A: |

Historically, TDCC has declared quarterly dividends to be paid to shareholders of record as of the last trading day of a calendar quarter. All shareholders that own TDCC common stock as of the record date for the

dividend are eligible to receive the dividend. |

| Q: |

Will tendering my shares affect my ability to receive the TDCC quarterly dividend? |

| A: |

No. If a dividend is declared by TDCC with a record date before the completion of this exchange offer, you will be entitled to that dividend even if you tendered your shares of TDCC common stock. Tendering your shares

of TDCC common stock in this exchange offer is not a sale or transfer of those shares until they are accepted for exchange upon completion of this exchange offer. |

| Q: |

Will all shares of TDCC common stock that I tender be accepted in this exchange offer? |

| A: |

Not necessarily. Depending on the number of shares of TDCC common stock validly tendered in this exchange offer and not properly withdrawn, and the calculated per-share values of TDCC common stock and Splitco common

stock determined as described above, TDCC may have to limit the number of shares of TDCC common stock that it accepts in this exchange offer through a proration process. Any proration of the number of shares accepted in this exchange offer will be

determined on the basis of the proration mechanics described under “This Exchange Offer—Terms of this Exchange Offer—Proration; Tenders for Exchange by Holders of Fewer than 100 Shares of TDCC Common Stock.” |

An exception to proration can apply to shareholders who beneficially own “odd-lots,” that is, fewer than 100 shares of TDCC common

stock. Such beneficial holders of TDCC common stock who validly tender all of their shares, and request preferential treatment as described in “Summary—Terms of this Exchange Offer—Proration; Tenders for Exchange by Holders of Fewer

than 100 Shares of TDCC Common Stock,” will not to be subject to proration. The foregoing “odd-lots” preference does not apply to shares attributable to units of the TDCC Stock Fund held in participant accounts under the Dow Savings

Plan. Thus, participants in the Dow Savings Plan who tender shares attributable to units of the TDCC Stock Fund held in their accounts under the plan will be subject to proration even if they hold units under the plan representing fewer than 100

shares. If an individual holds units of the TDCC Stock Fund under the Dow Savings Plan, and also holds shares outside the plan, if the number of shares held outside the plan is fewer than 100, the shares outside the plan will be eligible for the

“odd-lots” preference without regard to the number of shares attributable to units of the TDCC Stock Fund the individual holds under the plan.

In all other cases, proration for each tendering shareholder will be based on (i) the proportion that the total number of shares of TDCC

common stock to be accepted bears to the total number of shares of TDCC common stock validly tendered and not properly withdrawn and (ii) the number of shares of TDCC common stock validly tendered and not properly withdrawn by that shareholder

(and not on that shareholder’s

10

aggregate ownership of shares of TDCC common stock). Any shares of TDCC common stock not accepted for exchange as a result of proration will be returned to tendering shareholders promptly after

the final proration factor is determined.

| Q: |

Will I be able to sell my shares of Splitco common stock after this exchange offer is completed? |

| A: |

No. There currently is no trading market for shares of Splitco common stock and no such trading market will be established in the future. The exchange agent will hold all issued and outstanding shares of Splitco common

stock in trust until the shares of Splitco common stock are converted into the right to receive shares of Olin common stock in the Merger. See “This Exchange Offer—Distribution of Any Shares of Splitco Common Stock Remaining After this

Exchange Offer.” |

| Q: |

How many shares of TDCC common stock will TDCC accept if this exchange offer is completed? |

| A: |

The number of shares of TDCC common stock that will be accepted if this exchange offer is completed will depend on the final exchange ratio and the number of shares of TDCC common stock tendered. The largest possible

number of shares of TDCC common stock that will be accepted would equal 100,000,000 divided by the final exchange ratio. For example, assuming that the final exchange ratio is 2.7689 (the current indicative exchange ratio based on the daily VWAPs of

TDCC common stock and Olin common stock on August 28, 2015, August 31, 2015, and September 1, 2015), then TDCC would accept up to a total of approximately 36,115,425 shares of TDCC common stock. |

| Q: |

Are there any conditions to TDCC’s obligation to complete this exchange offer? |

| A: |

Yes. This exchange offer is subject to various conditions listed under “This Exchange Offer—Conditions for the Consummation of this Exchange Offer.” If any of these conditions are not satisfied or waived

prior to the expiration of this exchange offer, TDCC will not be required to accept shares for exchange and may extend or terminate this exchange offer. |

TDCC may waive any of the conditions to this exchange offer. For a description of the material conditions precedent to this exchange offer,

including satisfaction or waiver of the conditions to the consummation of the Transactions and other conditions, see “This Exchange Offer—Conditions for the Consummation of this Exchange Offer.” Olin has no right to waive any of the

conditions to this exchange offer.

| Q: |

When does this exchange offer expire? |

| A: |

The period during which you are permitted to tender your shares of TDCC common stock in this exchange offer will expire at 8:00 a.m., New York City time, on October 1, 2015, unless TDCC extends this exchange offer.

See “This Exchange Offer—Terms of this Exchange Offer—Extension; Termination; Amendment.” |

| Q: |

Can this exchange offer be extended and under what circumstances? |

| A: |

Yes. TDCC can extend this exchange offer, in its sole discretion, at any time and from time to time. For instance, this exchange offer may be extended if any of the conditions for the consummation of this exchange offer

listed under “This Exchange Offer—Conditions for the Consummation of this Exchange Offer” are not satisfied or waived prior to the expiration of this exchange offer. In case of an extension of this exchange offer, TDCC will publicly

announce the extension at www.edocumentview.com/dowexchange and separately by press release no later than 9:00 a.m., New York City time, on the next business day following the previously scheduled expiration date. In addition, if the

upper limit on the number of shares that can be received for each share of TDCC common stock tendered is in effect at the expiration of the exchange offer period, then the exchange ratio will be fixed at the upper limit and a Mandatory Extension of

this exchange offer will be made until 8:00 a.m., New York City time, on the second trading day following the last trading day prior to the originally contemplated expiration date. |

11

| Q: |

How do I participate in this exchange offer? |

| A: |

The procedures you must follow to participate in this exchange offer will depend on whether you hold your shares of TDCC common stock in certificated form, through a broker, dealer, commercial bank, trust company or

similar institution or, or through the Trust under the Dow Savings Plan, or if your shares of TDCC common stock are held in book-entry via the Direct Registration System (“DRS”) or in uncertificated form as CIP Shares. For specific

instructions about how to participate, see “This Exchange Offer—Terms of this Exchange Offer—Procedures for Tendering.” |

| Q: |

What if I participate in The Dow Chemical Company Employees’ Savings Plan? |

| A: |

If your account holds units of the TDCC Stock Fund under the Dow Savings Plan, you may elect either to keep or to exchange all or some of the shares attributable to the units for shares of Splitco common stock. You will

receive instructions from the Trustee via letter or email (as permitted by the Dow Savings Plan) informing you how to make an election. If you do not make a timely election in accordance with the Trustee’s instructions by the deadline set forth

in the Trustee’s instructions, none of the shares attributable to the units held in your account will be exchanged for shares of Splitco common stock and your holdings of units of the TDCC Stock Fund in your Dow Savings Plan account will remain

unchanged. If you do timely elect to exchange shares attributable to the units for Splitco common stock, in the Merger, each such share of Splitco common stock will be converted into the right to receive units of a unitized stock fund holding Olin

common stock (as described further below) based on the exchange ratio set forth in the Merger Agreement, as described in the section of this document entitled “The Merger Agreement—Merger Consideration.” For a more detailed

description of how to tender your shares of TDCC common stock if you participate in the Dow Savings Plan, please refer to the specific instructions regarding how to tender your shares, if any, under the Dow Savings Plan, which will be included in

the written information to be provided to you by the Trustee. |

The TDCC Stock Fund under the Dow Savings Plan is a unitized

stock fund holding TDCC common stock and cash and short-term investments maintained for liquidity purposes. Participants in the Dow Savings Plan whose accounts are invested in the TDCC Stock Fund have units in such fund allocated to their respective

accounts, which units represent their respective pro rata interests in such fund. For purposes of this exchange offer, references to shares of TDCC common stock being held in participant accounts under the Dow Savings Plan, elections to keep or

tender such shares, and exchanges of such shares mean, with respect to a participant, the shares of TDCC common stock represented by the units in the TDCC Stock Fund allocated to the participant’s account under the plan.

In connection with the exchange, any shares of Olin common stock held under the Dow Savings Plan will be held in a unitized stock fund. In

addition to holding Olin common stock, such Olin common stock fund may also hold cash and short-term investments for liquidity purposes. Accounts of plan participants who elect to participate in the exchange offer will receive units in the Olin

common stock fund. For purposes of this document and the exchange offer, references to shares of Olin common stock being held in participant accounts under the Dow Savings Plan and liquidation of shares of Olin common stock mean, with respect to a

participant, the shares of Olin common stock represented by the units in the Olin common stock fund allocated to the participant’s account under the plan.

Notwithstanding anything in this document to the contrary, with respect to shares of TDCC common stock held under the Dow Savings Plan, the

terms of such plan and Trust and applicable law govern all transactions involving such shares of TDCC common stock. It is possible that the investment fiduciaries of the Dow Savings Plan, to fulfill their fiduciary obligations, will impose

additional conditions and limitations on the participation of the plan and its participants in the exchange offer, or will take the position that Olin stock will not be a permissible investment under the Dow Savings Plan. If that is the case,

participants in the Dow Savings Plan will be so notified. In addition, the Trustee may be prohibited under ERISA from following directions related to tendering shares attributable to units held in the Dow Savings Plan. Please refer to the materials

provided by the Trustee for more details.

12

| Q: |

How do I tender my shares of TDCC common stock after the final exchange ratio has been determined? |

| A: |

If you wish to tender your shares after the final exchange ratio has been determined, you will generally need to do so by means of delivering a notice of guaranteed delivery and complying with the guaranteed delivery

procedures described in the section entitled “This Exchange Offer—Terms of this Exchange Offer—Procedures for Tendering—Guaranteed Delivery Procedures.” If you hold shares of TDCC common stock through a broker, dealer,

commercial bank, trust company or similar institution, that institution must tender your shares on your behalf. |

If your

shares of TDCC common stock are held through an institution and you wish to tender your TDCC common stock after The Depository Trust Company has closed, the institution must deliver a notice of guaranteed delivery to the exchange agent via facsimile

prior to 8:00 a.m., New York City time, on the expiration date.

If you hold units of the TDCC Stock Fund in a Dow Savings Plan

account and you wish to tender your TDCC common stock after the final exchange ratio has been determined, the Trustee must deliver a notice of guaranteed delivery to the exchange agent via facsimile prior to 8:00 a.m., New York City time, on

the expiration date.

If you hold units of the TDCC Stock Fund in a Dow Savings Plan account, you must tender your shares attributable to

the units by the deadline set forth in the Trustee’s instructions, and it is possible that the final exchange ratio will not have been determined at the time of such deadline.

| Q: |

Can I tender only a portion of my shares of TDCC common stock in this exchange offer? |

| A: |

Yes. You may tender all, some or none of your shares of TDCC common stock. |

| Q: |

What do I do if I want to retain all of my shares of TDCC common stock? |

| A: |

If you want to retain all of your shares of TDCC common stock, you do not need to take any action. However, after the Transactions, DCP will no longer be owned by TDCC, and as a holder of TDCC common stock you will no

longer hold shares in a company that owns DCP (unless the exchange offer is consummated but is not fully subscribed and the remaining shares of Splitco common stock are distributed on a pro rata basis to TDCC shareholders whose shares of TDCC common

stock remain outstanding after consummation of the exchange offer). |

| Q: |

Can I change my mind after I tender my shares of TDCC common stock? |

| A: |

Yes. You may withdraw your tendered shares at any time before this exchange offer expires. See “This Exchange Offer—Terms of this Exchange Offer—Procedures for Tendering—Withdrawal Rights.” If

you change your mind again, you can re-tender your shares of TDCC common stock by following the tender procedures again prior to the expiration of this exchange offer. |

| Q: |

Will I be able to withdraw the shares of TDCC common stock I tender after the final exchange ratio has been determined? |

| A: |

Yes. The final exchange ratio used to determine the number of shares of Splitco common stock that you will receive for each share of TDCC common stock accepted in this exchange offer will be announced no later than

4:30 p.m., New York City time, on the last trading day prior to the expiration date of this exchange offer, which is September 30, 2015, unless this exchange offer is extended or terminated. You have the right to withdraw shares of TDCC

common stock you have tendered at any time before 8:00 a.m., New York City time, on the expiration date, which is October 1, 2015. See “This Exchange Offer—Terms of this Exchange Offer.” |

13

If the upper limit on the number of shares of Splitco common stock that can be received for each

share of TDCC common stock tendered is in effect at the expiration of the exchange offer period, then the exchange ratio will be fixed at the upper limit and a Mandatory Extension of this exchange offer will be made until 8:00 a.m., New York

City time, on the day after the second trading day following the last trading day prior to the originally contemplated expiration date, which will permit you to tender or withdraw your shares of TDCC common stock during those days, either directly

or by acting through a broker, dealer, commercial bank, trust company or similar institution on your behalf.

| Q: |

How do I withdraw my tendered TDCC common stock after the final exchange ratio has been determined? |

| A: |

If you are a registered shareholder of TDCC common stock (which includes persons holding certificated shares and book-entry shares held through DRS or CIP Shares) and you wish to withdraw your shares after the final

exchange ratio has been determined, then you must deliver a written notice of withdrawal or a facsimile transmission notice of withdrawal to the exchange agent prior to 8:00 a.m., New York City time, on the expiration date. The information that

must be included in that notice is specified under “This Exchange Offer—Terms of this Exchange Offer—Procedures for Tendering—Withdrawal Rights.” |

If you hold your shares of TDCC common stock through a broker, dealer, commercial bank, trust company or similar institution, you should

consult that institution on the procedures you must comply with and the time by which such procedures must be completed in order for that institution to provide a written notice of withdrawal or facsimile notice of withdrawal to the exchange agent

on your behalf before 8:00 a.m., New York City time, on the expiration date. If you hold your shares through such an institution, that institution must deliver the notice of withdrawal with respect to any shares you wish to withdraw. In

such a case, as a beneficial owner and not a registered shareholder, you will not be able to provide a notice of withdrawal for such shares directly to the exchange agent.

If you hold units of the TDCC Stock Fund in a Dow Savings Plan account and you wish to withdraw shares attributable to the units that you have

tendered, you must withdraw such shares by the deadline set forth in the Trustee’s instructions, and it is possible that such deadline may occur before the final exchange ratio has been determined. You should refer to the procedures and

deadlines set forth in the Trustee’s informational materials provided to you. If you hold units of the TDCC Stock Fund in a Dow Savings Plan account, the Trustee must deliver the notice of withdrawal with respect to any shares you wish to

withdraw, and you will not be able to provide a notice of withdrawal for such shares directly to the exchange agent.

If your shares of

TDCC common stock are held through an institution and you wish to withdraw shares of TDCC common stock after The Depository Trust Company has closed, the institution must deliver a written notice of withdrawal to the exchange agent prior to

8:00 a.m., New York City time, on the expiration date, in the form of The Depository Trust Company’s notice of withdrawal and you must specify the name and number of the account at The Depository Trust Company to be credited with the

withdrawn shares and must otherwise comply with The Depository Trust Company’s procedures. Shares can be properly withdrawn only if the exchange agent receives a withdrawal notice directly from the relevant institution that tendered the shares

through the Depository Trust Company. See “This Exchange Offer—Terms of this Exchange Offer—Procedures for Tendering—Withdrawing Your Shares After the Final Exchange Ratio Has Been Determined.”

| Q: |

Will I be subject to U.S. federal income tax on the shares of Splitco common stock that I receive in this exchange offer or on the shares of Olin common stock that I receive in the Merger? |

| A: |

Shareholders of TDCC generally will not recognize any gain or loss for U.S. federal income tax purposes as a result of this exchange offer or the Merger, except for any gain or loss attributable to the receipt of cash

in lieu of fractional shares of Olin common stock received in the Merger. |

The material U.S. federal income tax consequences

of the exchange offer and the Merger are described in more detail under “This Exchange Offer—Material U.S. Federal Income Tax Consequences of the Distribution and the Merger.”

14

| Q: |

Are there any material differences between the rights of holders of TDCC common stock and Olin common stock? |

| A: |

Yes. TDCC is a Delaware corporation and Olin is a Virginia corporation, and each is subject to different laws and organizational documents. Holders of TDCC common stock, whose rights are currently governed by

TDCC’s organizational documents and Delaware law, will, with respect to shares validly tendered and exchanged immediately following this exchange offer, become shareholders of Olin and their rights will be governed by Olin’s organizational

documents and Virginia law. The material differences between the rights associated with shares of TDCC common stock and shares of Olin common stock that may affect TDCC shareholders whose shares are accepted for exchange in this exchange offer and

who will obtain shares of Olin common stock in the Merger relate to, among other things, classification of the board of directors, removal of directors, special meetings, taking of shareholder action by written consent, advance notice procedures for

shareholder proposals or director nominations, procedures and thresholds for amending organizational documents, ownership limitations and procedures and thresholds for approval of certain business combinations. For a further discussion of the

material differences between the rights of holders of TDCC common stock and holders of Olin common stock, see “Comparison of Rights of Holders of TDCC Common Stock and Olin Common Stock.” |

| Q: |

Are there any appraisal rights for holders of shares of TDCC common stock? |

| A: |

No. There are no appraisal rights available to holders of shares of TDCC common stock in connection with this exchange offer. |

| Q: |

What will TDCC do with the shares of TDCC common stock that are tendered, and what is the impact of the exchange offer on TDCC’s share count? |

| A: |

The shares of TDCC common stock that are tendered and accepted for exchange in the exchange offer will be held as treasury stock by TDCC. Any shares of TDCC common stock acquired by TDCC in the exchange offer will

reduce the total number of shares of TDCC common stock outstanding, although TDCC’s actual number of shares outstanding on a given date reflects a variety of factors such as option exercises. |

| Q: |

Whom do I contact for information regarding this exchange offer? |

| A: |

You may call the information agent, Georgeson Inc., at (888) 566-8006, to ask any questions about this exchange offer or to request additional documents, including copies of this document and the letter of

transmittal (including the instructions thereto). |

Questions and Answers About the Transactions

| Q: |

What are the key steps of the Transactions? |

| A: |

Below is a summary of the key steps of the Transactions. A step-by-step description of material events relating to the Transactions is set forth under “The Transactions.” |

| |

• |

|

TDCC will transfer DCP, directly or indirectly, to Splitco or the DCP Subsidiaries. This transfer will include, among other assets and liabilities of DCP, TDCC’s equity interests in the JV Entity, which, because

the JV Partner has exercised its right to transfer its equity interests in the JV Entity to TDCC or TDCC’s designee in connection with the Transactions pursuant to the organizational documents of the JV Entity, will constitute 100 percent of

the equity interests in the JV Entity. |

| |

• |

|

Immediately prior to the Distribution, and on the closing date of the Merger, TDCC will effect the Contribution, pursuant to which all of the DCP Subsidiaries will become direct or indirect subsidiaries of Splitco.

|

| |

• |

|

On or about the closing date of the Merger, Olin and Splitco will incur new indebtedness in an aggregate principal amount of approximately $2,237