U.S. Trade Deficit Narrowed in March

May 04 2016 - 9:10AM

Dow Jones News

WASHINGTON—The trade deficit narrowed in March as imports fell

faster than exports, underscoring slow growth at home and abroad in

the opening months of the year.

The trade gap decreased 13.9% from February to a seasonally

adjusted $40.44 billion, the Commerce Department said Wednesday.

Exports of goods and services fell 0.9% while imports dropped

3.6%.

Economists surveyed by The Wall Street Journal had expected a

deficit of $41 billion in March. February's trade deficit was

revised to $46.96 billion from a previously estimated $47.06

billion.

While the smaller March deficit is welcome and may point to less

of a drag from the strong dollar, it also highlights weak global

demand for goods and services during the first quarter. For the

January to March period, U.S. exports are down 5.4% and imports are

down 4.5%.

The trade deficit took a toll on U.S. economic growth during the

opening months of the year. Trade subtracted an estimated 0.34

percentage point from gross domestic product in the first quarter,

Commerce said in a separate report last week. Overall, GDP advanced

at a scant 0.5% seasonally adjusted annual rate, the worst

performance in two years.

In March, imports of goods and services were the lowest since

February 2011, led by a fall in shipments of consumer goods such as

toys and textiles, as well as another decline for petroleum. March

petroleum imports were the lowest since September 2002.

March exports of foods, feeds and beverages were the lowest

since September 2010, industrial supplies were the lowest since

February 2010 and consumer goods the lowest since March 2013.

Slow global growth has curbed demand for American-made products,

while the dollar's rise in value against other currencies over the

past year-and-a-half has made exports more expensive for foreign

buyers, imports cheaper in the U.S. and depressed earnings of

American companies with significant overseas business.

More recently, currencies have changed direction, with the euro,

yen and others firming against the dollar. That's offered some

relief for U.S. firms.

Glass-bottle manufacturer Owens-Illinois Inc. said the strong

dollar translated into $62 million hit for net sales during its

first quarter. But the Perrysburg, Ohio, company has been

encouraged by the recent currency shifts.

"With the recent reversal of the dollar at the end of the first

quarter, we believe some of the dramatic currency headwinds that

O-I has experienced over the past 18 months could be easing

somewhat," Jan Bertsch, senior vice president and chief financial

officer of Owens-Illinois, told investors on Tuesday.

Write to Jeffrey Sparshott at jeffrey.sparshott@wsj.com and

Harriet Torry at harriet.torry@wsj.com

(END) Dow Jones Newswires

May 04, 2016 08:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to Apr 2024

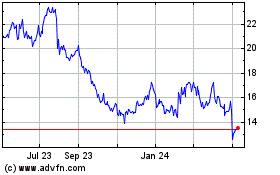

OI Glass (NYSE:OI)

Historical Stock Chart

From Apr 2023 to Apr 2024