UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

February 2, 2015

Date of Report (Date of earliest event reported)

OWENS-ILLINOIS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction

of incorporation) |

|

1-9576

(Commission

File Number) |

|

22-2781933

(IRS Employer

Identification No.) |

|

One Michael Owens Way

Perrysburg, Ohio

(Address of principal executive offices) |

|

43551-2999

(Zip Code) |

(567) 336-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On February 2, 2015, Owens-Illinois, Inc. issued a press release announcing its results of operations for the quarter and year ended December 31, 2014. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. Additional financial information, posted to the Company’s web site, is attached hereto as Exhibit 99.2.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

Exhibit

No. |

|

Description |

|

99.1 |

|

Press Release dated February 2, 2015, announcing results of operations for the quarter and year ended December 31, 2014 |

|

|

|

|

|

99.2 |

|

Additional financial information — quarter and year ended December 31, 2014 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OWENS-ILLINOIS, INC. |

|

|

|

|

|

|

|

|

Date: February 2, 2015 |

By: |

/s/ Stephen P. Bramlage, Jr. |

|

|

Name: |

Stephen P. Bramlage, Jr. |

|

|

Title: |

Senior Vice President and |

|

|

|

Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit

No. |

|

Description |

|

99.1 |

|

Press Release dated February 2, 2015, announcing results of operations for the quarter and year ended December 31, 2014 |

|

|

|

|

|

99.2 |

|

Additional financial information — quarter and year ended December 31, 2014 |

4

Exhibit 99.1

FOR IMMEDIATE RELEASE

O-I REPORTS FULL YEAR AND FOURTH QUARTER 2014 RESULTS

O-I generates second highest free cash flow in the Company’s history

PERRYSBURG, Ohio (February 2, 2015) — Owens-Illinois, Inc. (NYSE: OI) today reported financial results for the full year and fourth quarter ending December 31, 2014.

· Full year 2014 earnings from continuing operations attributable to the Company were $1.01 per share (diluted), compared with $1.22 per share in 2013. Excluding certain items management considers not representative of ongoing operations, adjusted earnings(1) were $2.63 per share compared with $2.72 per share in the prior year.

· Fourth quarter 2014 adjusted earnings were $0.46 per share, compared with $0.51 per share in the same period of 2013.

· Global volumes for 2014 were flat compared to the prior year, excluding the deliberate retrenchment in China. Volume growth in Europe was 2 percent, and South America posted 4 percent growth for the year, led by broad-based gains in beer.

· O-I positioned itself to benefit from fast-growing Mexican beer imports to the U.S. through a joint venture with Constellation Brands, Inc. in Mexico, as well as a related long-term supply agreement with Constellation.

· O-I generated $329 million of free cash flow(2) for the full year 2014, the Company’s second highest on record, despite an adverse currency impact of approximately $40 million.

· The Company continues to employ disciplined capital allocation. As committed, O-I used 10 percent of its free cash flow to repurchase shares and also funded non-organic growth opportunities and reduced net debt. O-I’s leverage ratio(3) improved to 2.4 at year-end.

· The Board of Directors authorized $500 million in share repurchases through 2017. The Company expects to repurchase at least $125 million in shares in 2015.

· In 2015, the Company expects to generate $300 million of free cash flow for the third consecutive year, despite an expected $30 million headwind from currency exchange rates.

Commenting on the Company’s 2014 results, Chairman and Chief Executive Officer Al Stroucken said, “We successfully generated significant free cash flow, despite strong currency

(1) Adjusted earnings refers to earnings from continuing operations attributable to the Company, excluding items management does not consider representative of ongoing operations, as cited in the table entitled Reconciliation to Adjusted Earnings in this release.

(2) Free cash flow is calculated as cash provided by continuing operating activities less additions to property, plant and equipment as presented in the appendix of the Company’s fourth quarter and full year 2014 earnings presentation.

(3) The leverage ratio is calculated as total debt, less cash, divided by adjusted EBITDA as presented in the appendix of the Company’s fourth quarter and full year 2014 earnings presentation.

headwinds that intensified in the fourth quarter. Our European asset optimization program has strengthened financial performance in our largest region, and volume growth in South America allowed us to reach our margin target of 20 percent in that region. We are confident that our concentrated efforts to optimize our operations will improve financial performance, particularly in North America and Asia Pacific, where we experienced challenges in 2014.

“We successfully drove financial improvement by reducing our pension obligations and refinancing $600 million in debt. We will distribute benefits derived from our value-added actions to our shareholders through a $500 million share repurchase program. O-I is the world’s leading glass container maker, and we are well-positioned to generate sustainable, long-term value for our shareholders.”

|

|

|

Three months ended |

|

Year ended |

|

|

|

|

December 31 |

|

December 31 |

|

|

(Dollars in millions, except per share amounts and operating profit margin) |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,603 |

|

$ |

1,761 |

|

$ |

6,784 |

|

$ |

6,967 |

|

|

Segment operating profit |

|

180 |

|

195 |

|

908 |

|

947 |

|

|

Segment operating profit margin |

|

11.3 |

% |

11.1 |

% |

13.5 |

% |

13.6 |

% |

|

Earnings (loss) attributable to the Company from continuing operations |

|

(130 |

) |

(144 |

) |

167 |

|

202 |

|

|

Earnings (loss) per share from continuing operations (diluted) |

|

$ |

(0.79 |

) |

$ |

(0.88 |

) |

$ |

1.01 |

|

$ |

1.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings (non-GAAP) |

|

$ |

75 |

|

$ |

85 |

|

$ |

436 |

|

$ |

450 |

|

|

Adjusted earnings per share (non-GAAP) |

|

$ |

0.46 |

|

$ |

0.51 |

|

$ |

2.63 |

|

$ |

2.72 |

|

Fourth Quarter 2014

Net sales in the fourth quarter of 2014 were $1.6 billion, down 9 percent from the prior year fourth quarter. The Company benefited from price gains of 1 percent. The stronger U.S. dollar adversely impacted the value of sales by 6 percent.

Sales volume declined by 4 percent. Volume in Europe increased 1 percent, driven by higher beer sales. Shipments in South America were down 4 percent. Volume in the Andean countries was on par with the prior year, while shipments in Brazil were down mid-single digits, as expected.

Volume in North America fell approximately 4 percent. Whereas sales volumes in most categories in the region were flat with prior year, volumes in beer were lower, consistent with the ongoing decline in major domestic beer sales. Shipments in Asia Pacific declined nearly 20 percent, due primarily to the deliberate retrenchment in China and lower sales in Australia.

Fourth quarter segment operating profit was $180 million, down $15 million compared with the prior year fourth quarter. Europe reported a nearly 40 percent increase in operating profit, primarily due to benefits from the asset optimization program and cost containment measures. South America’s operating profit was on par with prior year, driven by improved productivity and a geographic sales mix that offset lower shipments and currency headwinds in the quarter. North America’s profit contracted significantly year on year, due to sales volume declines and deeper production curtailments to control inventory. Asia Pacific reported lower profit due to lower sales and production volumes.

Corporate and other costs improved by $6 million compared with prior year, primarily driven by lower pension expense.

In the fourth quarter of 2014, the Company recorded several significant non-cash charges to reported results as presented in the table entitled Reconciliation to Adjusted Earnings. Management considers these charges not representative of ongoing operations.

Full Year 2014

Full year net sales were $6.8 billion, down 3 percent from 2013. Price increased 1 percent on a global basis. Currency was a more than 2 percent headwind, primarily due to the Australian dollar, the Brazilian real and the Colombian peso.

Although sales volume fell nearly 2 percent for the year, shipments were on par with prior year when excluding the Company’s planned retrenchment in China. South America reported strong sales volumes on growth of 4 percent, led by record volumes in Brazil and recovery in the Andean region. Shipments in Europe increased 2 percent, driven by wine and beer gains.

Volume in North America was dampened by the ongoing decline in major domestic beer brands. Shipments in Asia Pacific were down 20 percent, primarily due to China, as well as the decline in beer and wine demand in Australia.

Segment operating profit was $908 million in 2014, compared with $947 million in the prior year. In Europe, operating profit increased 16 percent, driven by the asset optimization program, as well as sales volume gains. South America also achieved a double-digit expansion in operating profit due to productivity improvement and higher sales volumes.

North America and Asia Pacific reported lower operating profit in 2014. In North America, operating profit was dampened by reduced sales and production volumes, as well as lower productivity. In Asia Pacific, the Company responded to lower wine volumes in Australia by modestly reducing capacity to improve financial returns.

The Company entered into two promising agreements with Constellation Brands to supply glass containers for CBI’s growing Mexican beer export business to the United States. O-I and Constellation Brands created a joint venture to operate and expand a glass container plant adjacent to CBI’s brewery in Nava, Mexico. Separately, O-I will supply additional containers from North America under a long-term supply contract with Constellation Brands. These transactions are expected to be accretive to earnings in 2016 and allow the Company to benefit from the fast-growing Mexican beer import market in the United States.

Full year 2014 earnings from continuing operations attributable to the Company were $1.01 per share (diluted), compared with $1.22 per share in full year 2013. Excluding certain items management considers not representative of ongoing operations, adjusted earnings were $2.63 per share compared with $2.72 per share in the prior year.

Cash payments and new claims filed related to asbestos continued to decline. In 2014, payments were $148 million, down $10 million from 2013. In the fourth quarter, the Company conducted its annual comprehensive review of asbestos-related liabilities and recorded a charge of $135 million, as presented in the table entitled Reconciliation to Adjusted Earnings.

The Company continued its strong focus on cash generation in 2014. Despite lower segment operating profits, cash provided by continuing operations in 2014 was $698 million, similar to the strong performance in the prior year. The Company generated $329 million of free cash flow in

2014, the second highest in the Company’s history. This includes the nearly $40 million adverse impact of currency exchange rates.

The Company successfully refinanced $600 million in debt in the fourth quarter as part of its ongoing efforts to enhance financial flexibility. The new bonds extended the Company’s debt maturity profile. Net debt declined by $236 million for the year, aided by foreign exchange rates, resulting in an improved leverage ratio of 2.4 at year end 2014.

The Company’s ongoing efforts to reduce the cost and risk associated with its pension plans has resulted in a reduction of approximately $600 million in pension obligations in 2014.

In line with stated capital allocation priorities for free cash flow in 2014, the Company repurchased 1.1 million shares worth $32 million, funded the initial $115 million investment in the joint venture with Constellation Brands, and reduced net debt.

Outlook

Commenting on the Company’s outlook for 2015, Stroucken said, “While we are not projecting much change in local market conditions, we are expecting solid improvement in our operations due to our strong manufacturing and technology expertise and our concentrated focus on optimizing our manufacturing process. In addition, we will see some benefit from our re-financing activities, and we will adjust our approach to capital allocation by returning at least $125 million to our shareholders through share repurchases. In all, we expect to generate $300 million in free cash flow, despite a strong U.S. dollar causing an expected $30 million translation headwind.”

Reflecting unfavorable currency translation, O-I expects adjusted earnings for full year 2015 to be in the range of $2.20 to $2.60. Assuming constant currency (at 2014 currency rates), comparable adjusted earnings for full year 2015 are expected to be in the range of $2.60 to $3.00. The midpoint of the range using constant currency is higher than prior year adjusted earnings due to an anticipated improvement in operating results.

About O-I

Owens-Illinois, Inc. (NYSE: OI) is the world’s largest glass container manufacturer and preferred partner for many of the world’s leading food and beverage brands. The Company had revenues of $6.8 billion in 2014 and employs approximately 21,100 people at 75 plants in 21 countries. With global headquarters in Perrysburg, Ohio, USA, O-I delivers safe, sustainable, pure, iconic, brand-building glass packaging to a growing global marketplace. For more information, visit o-i.com.

O-I’s Glass Is Life™ movement promotes the widespread benefits of glass packaging in key markets around the globe. Learn more about the reasons to choose glass and join the movement at glassislife.com.

Regulation G

The information presented above regarding adjusted net earnings relates to net earnings from continuing operations attributable to the Company exclusive of items management considers not representative of ongoing operations and does not conform to U.S. generally accepted accounting principles (GAAP). It should not be construed as an alternative to the reported

results determined in accordance with GAAP. Management has included this non-GAAP information to assist in understanding the comparability of results of ongoing operations. Further, the information presented above regarding free cash flow does not conform to GAAP. Management defines free cash flow as cash provided by continuing operating activities less capital spending (both as determined in accordance with GAAP) and has included this non-GAAP information to assist in understanding the comparability of cash flows. Management uses non-GAAP information principally for internal reporting, forecasting, budgeting and calculating compensation payments. Management believes that the non-GAAP presentation allows the board of directors, management, investors and analysts to better understand the Company’s financial performance in relationship to core operating results and the business outlook.

The Company routinely posts important information on its website — www.o-i.com/investors.

Forward looking statements

This document contains “forward looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Forward looking statements reflect the Company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward looking statements. It is possible the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) foreign currency fluctuations relative to the U.S. dollar, specifically the Euro, Brazilian real and Australian dollar, (2) changes in capital availability or cost, including interest rate fluctuations and the ability of the Company to refinance debt at favorable terms, (3) the general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, disruptions in capital markets, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, and changes in tax rates and laws, (4) consumer preferences for alternative forms of packaging, (5) cost and availability of raw materials, labor, energy and transportation, (6) the Company’s ability to manage its cost structure, including its success in implementing restructuring plans and achieving cost savings, (7) consolidation among competitors and customers, (8) the ability of the Company to acquire businesses and expand plants, integrate operations of acquired businesses and achieve expected synergies, (9) unanticipated expenditures with respect to environmental, safety and health laws, (10) the Company’s ability to further develop its sales, marketing and product development capabilities, and (11) the timing and occurrence of events which are beyond the control of the Company, including any expropriation of the Company’s operations, floods and other natural disasters, events related to asbestos-related claims, and the other risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and any subsequently filed Annual Report on Form 10-K or Quarterly Report on Form 10-Q. It is not possible to foresee or identify all such factors. Any forward looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward looking statements contained in this document.

Conference call scheduled for February 3, 2015

O-I CEO Al Stroucken and CFO Steve Bramlage will conduct a conference call to discuss the Company’s latest results on Tuesday, February 3, 2015, at 8:00 a.m., Eastern Time. A live webcast of the conference call, including presentation materials, will be available on the O-I website, www.o-i.com/investors, in the Presentations & Webcast section.

The conference call also may be accessed by dialing 888-733-1701 (U.S. and Canada) or 706-634-4943 (international) by 7:50 a.m., Eastern Time, on February 3. Ask for the O-I conference call. A replay of the call will be available on the O-I website, www.o-i.com/investors, for a year following the call.

|

Contact: |

Sasha Sekpeh, 567-336-5128 — O-I Investor Relations |

|

|

Lisa Babington, 567-336-1445 — O-I Corporate Communications |

O-I news releases are available on the O-I website at www.o-i.com.

O-I’s first quarter 2015 earnings conference call is currently scheduled for Wednesday, April 29, 2015, at 8:00 a.m., Eastern Time.

OWENS-ILLINOIS, INC.

Condensed Consolidated Results of Operations

(Dollars in millions, except per share amounts)

|

|

|

Three months ended

December 31 |

|

Year ended

December 31 |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,603 |

|

$ |

1,761 |

|

$ |

6,784 |

|

$ |

6,967 |

|

|

Cost of goods sold |

|

(1,366 |

) |

(1,470 |

) |

(5,531 |

) |

(5,636 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

237 |

|

291 |

|

1,253 |

|

1,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative expense |

|

(141 |

) |

(129 |

) |

(523 |

) |

(506 |

) |

|

Research, development and engineering expense |

|

(16 |

) |

(17 |

) |

(63 |

) |

(62 |

) |

|

Interest expense, net |

|

(69 |

) |

(51 |

) |

(230 |

) |

(229 |

) |

|

Equity earnings |

|

16 |

|

18 |

|

64 |

|

67 |

|

|

Other expense, net |

|

(144 |

) |

(249 |

) |

(214 |

) |

(266 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations before income taxes |

|

(117 |

) |

(137 |

) |

287 |

|

335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

(3 |

) |

(10 |

) |

(92 |

) |

(120 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations |

|

(120 |

) |

(147 |

) |

195 |

|

215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations |

|

(1 |

) |

(3 |

) |

(23 |

) |

(18 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

|

(121 |

) |

(150 |

) |

172 |

|

197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (earnings) loss attributable to noncontrolling interests |

|

(10 |

) |

3 |

|

(28 |

) |

(13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) attributable to the Company |

|

$ |

(131 |

) |

$ |

(147 |

) |

$ |

144 |

|

$ |

184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts attributable to the Company: |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations |

|

$ |

(130 |

) |

$ |

(144 |

) |

$ |

167 |

|

$ |

202 |

|

|

Loss from discontinued operations |

|

(1 |

) |

(3 |

) |

(23 |

) |

(18 |

) |

|

Net earnings (loss) |

|

$ |

(131 |

) |

$ |

(147 |

) |

$ |

144 |

|

$ |

184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share: |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations |

|

$ |

(0.79 |

) |

$ |

(0.88 |

) |

$ |

1.01 |

|

$ |

1.22 |

|

|

Loss from discontinued operations |

|

(0.01 |

) |

(0.02 |

) |

(0.14 |

) |

(0.11 |

) |

|

Net earnings (loss) |

|

$ |

(0.80 |

) |

$ |

(0.90 |

) |

$ |

0.87 |

|

$ |

1.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (thousands) |

|

164,422 |

|

164,709 |

|

164,721 |

|

164,425 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations |

|

$ |

(0.79 |

) |

$ |

(0.88 |

) |

$ |

1.01 |

|

$ |

1.22 |

|

|

Loss from discontinued operations |

|

(0.01 |

) |

(0.02 |

) |

(0.14 |

) |

(0.11 |

) |

|

Net earnings (loss) |

|

$ |

(0.80 |

) |

$ |

(0.90 |

) |

$ |

0.87 |

|

$ |

1.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted average shares (thousands) |

|

164,422 |

|

164,709 |

|

166,047 |

|

165,828 |

|

OWENS-ILLINOIS, INC.

Condensed Consolidated Balance Sheets

(Dollars in millions)

|

|

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

512 |

|

$ |

383 |

|

|

Receivables |

|

744 |

|

943 |

|

|

Inventories |

|

1,035 |

|

1,117 |

|

|

Prepaid expenses |

|

80 |

|

107 |

|

|

Total current assets |

|

2,371 |

|

2,550 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

2,445 |

|

2,632 |

|

|

Goodwill |

|

1,893 |

|

2,059 |

|

|

Other assets |

|

1,193 |

|

1,178 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

7,902 |

|

$ |

8,419 |

|

|

|

|

|

|

|

|

|

Liabilities and Share Owners’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Short-term loans and long-term debt due within one year |

|

$ |

488 |

|

$ |

322 |

|

|

Current portion of asbestos-related liabilities |

|

143 |

|

150 |

|

|

Accounts payable |

|

1,137 |

|

1,144 |

|

|

Other liabilities |

|

535 |

|

638 |

|

|

Total current liabilities |

|

2,303 |

|

2,254 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

2,972 |

|

3,245 |

|

|

Asbestos-related liabilities |

|

292 |

|

298 |

|

|

Other long-term liabilities |

|

991 |

|

1,019 |

|

|

Share owners’ equity |

|

1,344 |

|

1,603 |

|

|

|

|

|

|

|

|

|

Total liabilities and share owners’ equity |

|

$ |

7,902 |

|

$ |

8,419 |

|

OWENS-ILLINOIS, INC.

Condensed Consolidated Cash Flows

(Dollars in millions)

|

|

|

Three months ended

December 31 |

|

Year ended

December 31 |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) |

|

$ |

(121 |

) |

$ |

(150 |

) |

$ |

172 |

|

$ |

197 |

|

|

Loss from discontinued operations |

|

1 |

|

3 |

|

23 |

|

18 |

|

|

Non-cash charges |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

105 |

|

108 |

|

448 |

|

429 |

|

|

Pension expense |

|

5 |

|

24 |

|

43 |

|

101 |

|

|

Restructuring, asset impairment and related charges |

|

(3 |

) |

109 |

|

76 |

|

119 |

|

|

Pension settlement charges |

|

65 |

|

|

|

65 |

|

|

|

|

Future asbestos-related costs |

|

135 |

|

145 |

|

135 |

|

145 |

|

|

Cash Payments |

|

|

|

|

|

|

|

|

|

|

Pension contributions |

|

(3 |

) |

(73 |

) |

(28 |

) |

(96 |

) |

|

Asbestos-related payments |

|

(76 |

) |

(50 |

) |

(148 |

) |

(158 |

) |

|

Cash paid for restructuring activities |

|

(13 |

) |

(24 |

) |

(58 |

) |

(78 |

) |

|

Change in components of working capital |

|

429 |

|

433 |

|

117 |

|

124 |

|

|

Other, net (a) |

|

(34 |

) |

(74 |

) |

(147 |

) |

(101 |

) |

|

Cash provided by continuing operating activities |

|

490 |

|

451 |

|

698 |

|

700 |

|

|

Cash utilized in discontinued operating activities |

|

(1 |

) |

(11 |

) |

(23 |

) |

(18 |

) |

|

Total cash provided by operating activities |

|

489 |

|

440 |

|

675 |

|

682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

Additions to property, plant and equipment |

|

(79 |

) |

(122 |

) |

(369 |

) |

(361 |

) |

|

Acquisitions, net of cash acquired |

|

(115 |

) |

(4 |

) |

(114 |

) |

(4 |

) |

|

Other, net |

|

6 |

|

(27 |

) |

28 |

|

(37 |

) |

|

Cash utilized in investing activities |

|

(188 |

) |

(153 |

) |

(455 |

) |

(402 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

Changes in borrowings, net |

|

(11 |

) |

(105 |

) |

7 |

|

(264 |

) |

|

Issuance of common stock |

|

|

|

|

|

5 |

|

19 |

|

|

Treasury shares purchased |

|

(20 |

) |

(13 |

) |

(32 |

) |

(33 |

) |

|

Distributions to noncontrolling interests |

|

|

|

(1 |

) |

(37 |

) |

(22 |

) |

|

Other, net |

|

(11 |

) |

(4 |

) |

(13 |

) |

(21 |

) |

|

Cash utilized in financing activities |

|

(42 |

) |

(123 |

) |

(70 |

) |

(321 |

) |

|

Effect of exchange rate fluctuations on cash |

|

(11 |

) |

|

|

(21 |

) |

(7 |

) |

|

Increase (decrease) in cash |

|

248 |

|

164 |

|

129 |

|

(48 |

) |

|

Cash at beginning of period |

|

264 |

|

219 |

|

383 |

|

431 |

|

|

Cash at end of period |

|

$ |

512 |

|

$ |

383 |

|

$ |

512 |

|

$ |

383 |

|

(a) Other, net includes other non cash charges plus other changes in non-current assets and liabilities.

OWENS-ILLINOIS, INC.

Reportable Segment Information

(Dollars in millions)

|

|

|

Three months ended

December 31 |

|

Year ended

December 31 |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

Europe |

|

$ |

589 |

|

$ |

658 |

|

$ |

2,794 |

|

$ |

2,787 |

|

|

North America |

|

460 |

|

477 |

|

2,003 |

|

2,002 |

|

|

South America |

|

333 |

|

366 |

|

1,159 |

|

1,186 |

|

|

Asia Pacific |

|

209 |

|

252 |

|

793 |

|

966 |

|

|

Reportable segment totals |

|

1,591 |

|

1,753 |

|

6,749 |

|

6,941 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

12 |

|

8 |

|

35 |

|

26 |

|

|

Net sales |

|

$ |

1,603 |

|

$ |

1,761 |

|

$ |

6,784 |

|

$ |

6,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating profit (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

|

$ |

53 |

|

$ |

38 |

|

$ |

353 |

|

$ |

305 |

|

|

North America |

|

26 |

|

53 |

|

240 |

|

307 |

|

|

South America |

|

72 |

|

72 |

|

227 |

|

204 |

|

|

Asia Pacific |

|

29 |

|

32 |

|

88 |

|

131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Reportable segment totals |

|

180 |

|

195 |

|

908 |

|

947 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Items excluded from segment operating profit: |

|

|

|

|

|

|

|

|

|

|

Retained corporate costs and other |

|

(21 |

) |

(27 |

) |

(100 |

) |

(119 |

) |

|

Items not considered representative of ongoing operations (b) |

|

(207 |

) |

(254 |

) |

(291 |

) |

(264 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net (b) |

|

(69 |

) |

(51 |

) |

(230 |

) |

(229 |

) |

|

Earnings (loss) from continuing operations before income taxes |

|

$ |

(117 |

) |

$ |

(137 |

) |

$ |

287 |

|

$ |

335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment operating profit margin (c): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

|

9.0 |

% |

5.8 |

% |

12.6 |

% |

10.9 |

% |

|

North America |

|

5.7 |

% |

11.1 |

% |

12.0 |

% |

15.3 |

% |

|

South America |

|

21.6 |

% |

19.7 |

% |

19.6 |

% |

17.2 |

% |

|

Asia Pacific |

|

13.9 |

% |

12.7 |

% |

11.1 |

% |

13.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Reportable segment margin totals |

|

11.3 |

% |

11.1 |

% |

13.5 |

% |

13.6 |

% |

(a) Segment operating profit consists of consolidated earnings before interest income, interest expense, and provision for income taxes and excludes amounts related to certain items that management considers not representative of ongoing operations as well as certain retained corporate costs.

The Company presents information on segment operating profit because management believes that it provides investors with a measure of operating performance separate from the level of indebtedness or other related costs of capital. The most directly comparable GAAP financial measure to segment operating profit is earnings from continuing operations before income taxes. The Company presents segment operating profit because management uses the measure, in combination with net sales and selected cash flow information, to evaluate performance and to allocate resources.

(b) Reference reconciliation to adjusted earnings.

(c) Segment operating profit margin is segment operating profit divided by segment sales.

OWENS-ILLINOIS, INC.

Reconciliation to Adjusted Earnings

(Dollars in millions, except per share amounts)

|

|

|

Three months ended

December 31 |

|

Year ended

December 31 |

|

|

Unaudited |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) from continuing operations attributable to the Company |

|

$ |

(130 |

) |

$ |

(144 |

) |

$ |

167 |

|

$ |

202 |

|

|

Items impacting cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

Restructuring, asset impairment and related charges |

|

|

|

|

|

8 |

|

|

|

|

Pension settlement charges |

|

50 |

|

|

|

50 |

|

|

|

|

Items impacting selling and administrative expense: |

|

|

|

|

|

|

|

|

|

|

Pension settlement charges |

|

15 |

|

|

|

15 |

|

|

|

|

Items impacting equity earnings |

|

|

|

|

|

5 |

|

|

|

|

Items impacting other expense, net: |

|

|

|

|

|

|

|

|

|

|

Charges for asbestos related costs |

|

135 |

|

145 |

|

135 |

|

145 |

|

|

Restructuring, asset impairment and other charges |

|

7 |

|

109 |

|

78 |

|

119 |

|

|

Items impacting interest expense: |

|

|

|

|

|

|

|

|

|

|

Charges for note repurchase premiums and write-off of finance fees |

|

20 |

|

|

|

20 |

|

11 |

|

|

Items impacting income tax: |

|

|

|

|

|

|

|

|

|

|

Net benefit for income tax on items above |

|

(14 |

) |

(13 |

) |

(34 |

) |

(14 |

) |

|

Net benefit for certain tax adjustments |

|

(8 |

) |

|

|

(8 |

) |

|

|

|

Items impacting net earnings (loss) attributable to noncontrolling interests: |

|

|

|

|

|

|

|

|

|

|

Net impact of noncontrolling interests on items above |

|

|

|

(12 |

) |

|

|

(13 |

) |

|

Total adjusting items |

|

205 |

|

229 |

|

269 |

|

248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings |

|

$ |

75 |

|

$ |

85 |

|

$ |

436 |

|

$ |

450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted average shares (thousands) |

|

164,422 |

|

164,709 |

|

166,047 |

|

165,828 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share from continuing operations (diluted) |

|

$ |

(0.79 |

) |

$ |

(0.88 |

) |

$ |

1.01 |

|

$ |

1.22 |

|

|

Adjusted earnings per share |

|

$ |

0.46 |

|

$ |

0.51 |

|

$ |

2.63 |

|

$ |

2.72 |

|

The above reconciliation to adjusted earnings describes the items that management considers not representative of ongoing operations.

Exhibit 99.2

|

|

O-I Fourth

Quarter and Full Year 2014 Earnings Presentation February 3, 2015

|

|

|

Safe harbor

comments Regulation G The information presented here regarding adjusted net

earnings relates to net earnings from continuing operations attributable to

the Company exclusive of items management considers not representative of

ongoing operations and does not conform to U.S. generally accepted accounting

principles (GAAP). It should not be construed as an alternative to the

reported results determined in accordance with GAAP. Management has included

this non-GAAP information to assist in understanding the comparability of

results of ongoing operations. Further, the information presented here

regarding free cash flow does not conform to GAAP. Management defines free

cash flow as cash provided by continuing operating activities less capital

spending (both as determined in accordance with GAAP) and has included this

non-GAAP information to assist in understanding the comparability of cash

flows. Management uses non-GAAP information principally for internal

reporting, forecasting, budgeting and calculating compensation payments.

Management believes that the non-GAAP presentation allows the board of

directors, management, investors and analysts to better understand the

Company’s financial performance in relationship to core operating results and

the business outlook. Forward Looking Statements This document contains

"forward looking" statements within the meaning of Section 21E of

the Securities Exchange Act of 1934 and Section 27A of the Securities Act of

1933. Forward looking statements reflect the Company's current expectations

and projections about future events at the time, and thus involve uncertainty

and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,”

“would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,”

“potential,” “continue,” and the negatives of these words and other similar

expressions generally identify forward looking statements. It is possible the

Company's future financial performance may differ from expectations due to a

variety of factors including, but not limited to the following: (1) foreign

currency fluctuations relative to the U.S. dollar, specifically the Euro,

Brazilian real and Australian dollar, (2) changes in capital availability or

cost, including interest rate fluctuations and the ability of the Company to

refinance debt at favorable terms, (3) the general political, economic and

competitive conditions in markets and countries where the Company has operations,

including uncertainties related to economic and social conditions,

disruptions in capital markets, disruptions in the supply chain, competitive

pricing pressures, inflation or deflation, and changes in tax rates and laws,

(4) consumer preferences for alternative forms of packaging, (5) cost and

availability of raw materials, labor, energy and transportation, (6) the

Company’s ability to manage its cost structure, including its success in

implementing restructuring plans and achieving cost savings, (7)

consolidation among competitors and customers, (8) the ability of the Company

to acquire businesses and expand plants, integrate operations of acquired

businesses and achieve expected synergies, (9) unanticipated expenditures

with respect to environmental, safety and health laws, (10) the Company’s

ability to further develop its sales, marketing and product development

capabilities, and (11) the timing and occurrence of events which are beyond

the control of the Company, including any expropriation of the Company’s

operations, floods and other natural disasters, events related to

asbestos-related claims, and the other risk factors discussed in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and

any subsequently filed Annual Report on Form 10-K or Quarterly Report on Form

10-Q. It is not possible to foresee or identify all such factors. Any forward

looking statements in this document are based on certain assumptions and

analyses made by the Company in light of its experience and perception of

historical trends, current conditions, expected future developments, and

other factors it believes are appropriate in the circumstances. Forward

looking statements are not a guarantee of future performance and actual

results or developments may differ materially from expectations. While the

Company continually reviews trends and uncertainties affecting the Company's

results of operations and financial condition, the Company does not assume

any obligation to update or supplement any particular forward looking

statements contained in this document. Presentation Note Unless otherwise

noted, the information presented in this presentation reflects continuing

operations only. 1

|

|

|

Full year 2014

summary 2 Free cash flow of $329M Second highest in Company history Despite

$40M currency headwind Adjusted EPS of $2.63 Improved European profits from

volume gains and asset optimization South America achieved ~20% operating

profit margin on record volumes Continued discipline in capital allocation Strategic

JV investment and long-term supply agreement to supply Constellation Brands’

glass needs in Mexico

|

|

|

3 O-I

performance by region in 2014 Volume gains in food and non-alcoholic

beverages offset by megabeer headwinds Substantial progress on earlier supply

chain and production challenges Sluggish macroeconomic conditions Volume up

2%, led by wine and beer gains Asset optimization on track Europe North

America Sales volume up 4% Record volume in Brazil Recovery in Andean

countries Pronounced currency headwinds in 2H14 Deliberate capacity

rationalization in China and Australia Growth in Southeast Asia markets Asia

Pacific South America

|

|

|

4Q14 segment

sales and operating profit 4 Note: Reportable segment data excludes the

Company’s global equipment business. Price up 1% Shipments down ~2.5%,

excluding China Strengthening USD decreased sales by 6% Segment Sales ($ Millions) 4Q13 $1,753 Price 21 Sales volume (70) 4Q14, constant currency*

$1,704 Currency (113) 4Q14 $1,591 Segment Operating Profit ($ Millions) 4Q13

$195 Price 21 Sales volume (14) Operating costs (14) 4Q14, constant currency*

$188 Currency (8) 4Q14 $180 Operating costs: Benefits from footprint actions

offset by cost inflation and inventory control actions Currency headwinds

comprised half of segment operating profit decline * Using prior year

currency exchange rates

|

|

|

Adjusted EPS

bridges 5 4th Quarter Adjusted EPS 4Q13 $0.51 Segment operating profit

(excluding currency impact) (0.04) Currency impact (on segment operating

profit) (0.04) Retained corporate costs 0.04 Net interest expense 0.01

Noncontrolling interests – Effective tax rate (0.02) Total reconciling items

(0.05) 4Q14 $0.46 Full Year Adjusted EPS 2013 $2.72 Segment operating profit

(excluding currency impact) (0.15) Currency impact (on segment operating

profit) (0.03) Retained corporate costs 0.09 Net interest expense 0.04

Noncontrolling interests (0.02) Effective tax rate (0.02) Total reconciling

items (0.09) 2014 $2.63

|

|

|

2014 full year

financial review 6 1 Free cash flow is defined as cash provided by continuing

operating activities less additions to property, plant and equipment. See

appendix for free cash flow reconciliations. 2 Leverage ratio is defined as

total debt, less cash, divided by adjusted EBITDA. See appendix for adjusted

EBITDA reconciliations. 3 Return on invested capital is defined as segment

operating profit less corporate and other costs multiplied by one minus the

Company’s tax rate (exclusive of items management considers not

representative of ongoing operations), divided by total debt and total

shareowners’ equity. (Accumulated Other Comprehensive Income is held constant

at the average of 2011-2013.) 2014 impacted ~$40M from FX headwind Free Cash

Flow1 Allocation of Cash from Operations $698 million Leverage Ratio2 Return

on Invested Capital3

|

|

|

2015 business

outlook Operations improve in largely stable macro environment 7 Europe Flat

volume, with increasing competition in S. Europe Continued savings from asset

optimization program North America Continuation of unfavorable volume trends

in megabeer Productivity and supply chain improvements South America Volume

plateaus against strong comparables Inflation: Brazil electricity; USD-priced

raw materials (soda ash) Asia Pacific Volume decline in 1H; largely offset in

2H Restructuring benefits outweigh inflation on USD-priced raw matls Segment

Operating Profit Operations expected to improve * Using prior year currency

exchange rates 2015 YoY change in segment operating profit on a constant

currency basis*

|

|

|

FX headwinds

expected to intensify in 2015 8 2014 Average Rates Assumed* Devaluation Euro

1.32 1.13 14% Brazilian real 2.35 2.60 10% Colombian peso 2,014 2,400 16%

Australian dollar 0.91 0.80 12% At current rates,* the strong USD will

adversely impact 2015 financials Lowers expected sales revenue by > $600M

Reduces expected segment operating profit by ~$120M Increases inflation from

USD priced raw materials by ~$20M (e.g., soda ash in South America) Decreases

translation of segment operating profit by ~$100M Includes CHF revaluation

impact of ~$10M-$15M Reduces expected EPS by ~$0.40 * Based on rates in late

January 2015.

|

|

|

2015

non-operational outlook Management actions drive improvement 9 Stable

corporate expense expected Pension expense essentially flat, due to active

liability management Modest increase in long-term investments in R&D,

technology and innovation Interest expense1 projected to decline by $10-15M

Benefits from refinancing Euro devaluation Tax rate1 expected to be in the

range of 23-25% 1 Exclusive of items management considers not representative

of ongoing operations Corporate Expense $ Millions Net Interest Expense1

|

|

|

Enhancing

financial flexibility: Pension Management actions reduce pension obligation

by $750 million Lower discount rate and new mortality tables adversely impact

pension Management actions favorably impact pension Liability management:

reduce benefits and close plans to new hires, convert to defined contribution

plans, buyouts, annuitize Asset management: discretionary contributions In

2015, lower pension contributions by ~$10M and flat pension expense 10 1

Related to the “amortization of actuarial loss” component of pension expense,

which may be excluded in certain non-GAAP pension accounting methods

Sustained non cash pension expense1 reduces EPS by ~$0.50 Pension Expense

Pension Contributions $ Millions $ Millions

|

|

|

Higher adjusted

earnings in 2015 On a constant currency basis 11 Business Performance ~$0.40

FX Headwind 2014 Adjusted EPS $2.63 + Business performance 2015 Adjusted EPS

on a constant currency basis $2.60 - $3.00 - Estimated currency impact 2015

Adjusted EPS $2.20 - $2.60 Range Adjusted Earnings Per Share

|

|

|

1Q15 business

outlook 12 Europe Stable sales volume Lower planned production due to project

timing Competitive pressure in Southern Europe North America Continuation of

unfavorable volume trends in megabeer Supply chain recovery South America

Volume plateaus against strong comparable in 1Q14 Inflation headwinds

(electricity, USD-priced raw matls) Asia Pacific Continuation of lower volume

trends Benefits of restructuring offset inflation pressure Segment Operating

Profit Corporate and Other Costs Corporate costs maintained at prior year

level Net interest expense flat to prior year Adjusted Earnings, constant

currency Currency Impact ~$0.07 Adjusted Earnings $0.40 - $0.45 1

Corresponding periods use same currency exchange rates 1Q15 vs 1Q14 On a

constant currency basis1

|

|

|

Free cash flow

projected to be ~$300 million Higher segment operating profit on constant

currency basis Currency rates at current levels a headwind (by ~$30 million)

Working capital not a source of cash after two strong years of contributions

Declining asbestos payments (by $5 million – $10 million) Lower pension

contributions (by ~$10 million) Capex and restructuring continue to

approximate depreciation & amortization Lower spending for returnable

packaging, tax installment payments 13 2015 outlook for free cash flow

|

|

|

Continued

balanced approach to use of cash 14 Capital Investment Capital Allocation Maintenance

Continue strong operating profit generation Enhance productivity and

flexibility Strategic Exceed cost of capital Greenfield/ brownfield (e.g.,

Brazil furnance in early 2013) Non-organic growth (e.g., JV with CBI in Mexico)

Invest in R&D, technology and innovation Liabilities Improve financial

flexibility Lower interest expense Manage pension and asbestos liabilities

Shareholders Increase share buybacks $500M share repurchase program through

2017 At least $ 125M in share repurchases in 2015

|

|

|

CEO succession

planning process advances Dec 2014 Dec 2015 Definition and Planning Internal

& External Candidates Identified / Hired Performance Evaluation Lopez

named COO CEO Succession Transition Chairperson Role Robust, Board-driven

process began several years ago Internal and external candidates identified

External firms engaged to assess, coach, track performance Andres Lopez

identified as succession candidate Transfer CEO responsibility by the end of

2015 Transition to non-executive Chair in first half 2016

|

|

|

Summary of our

2015 outlook 16 Similar market conditions, as well as ongoing USD strength

Improvement in underlying operations Improvement in non-operational items

Strong FCF generation Shift in capital allocation Return more cash to

shareholders via buybacks Invest in value-added projects (e.g., partnership

with CBI) New Zealand

|

|

|

Appendix 17

|

|

|

4Q regional

financial performance 18 North America ($ Millions) 4Q 2014 4Q 2013 Net Sales

- constant currency1 $589 $648 $658 Segment Operating Profit - constant

currency1 $53 $56 $38 Segment Operating Profit Margin 9.0% 5.8% Europe 1

Using 2013 currency exchange rates Asia Pacific South America ($ Millions) 4Q

2014 4Q 2013 Net Sales - constant currency1 $460 $463 $477 Segment Operating

Profit - constant currency1 $26 $26 $53 Segment Operating Profit Margin 5.7%

11.1% ($ Millions) 4Q 2014 4Q 2013 Net Sales - constant currency1 $333 $370

$366 Segment Operating Profit - constant currency1 $72 $77 $72 Segment

Operating Profit Margin 21.6% 19.7% ($ Millions) 4Q 2014 4Q 2013 Net Sales -

constant currency1 $209 $223 $252 Segment Operating Profit - constant

currency1 $29 $34 $32 Segment Operating Profit Margin 13.9% 12.7%

|

|

|

Full year

regional financial performance 19 North America ($ Millions) FY 2014 FY 2013

Net Sales - constant currency1 $2,794 $2,797 $2,787 Segment Operating Profit

- constant currency1 $353 $350 $305 Segment Operating Profit Margin 12.6%

10.9% Europe 1 Using 2013 currency exchange rates Asia Pacific South America

($ Millions) FY 2014 FY 2013 Net Sales - constant currency1 $2,003 $2,017

$2,002 Segment Operating Profit - constant currency1 $240 $241 $307 Segment

Operating Profit Margin 12.0% 15.3% ($ Millions) FY 2014 FY 2013 Net Sales -

constant currency1 $1,159 $1,255 $1,186 Segment Operating Profit - constant

currency1 $227 $233 $204 Segment Operating Profit Margin 19.6% 17.2% ($ Millions) FY 2014 FY 2013 Net Sales - constant currency1 $793 $833 $966

Segment Operating Profit - constant currency1 $88 $90 $131 Segment Operating

Profit Margin 11.1% 13.6%

|

|

|

Full year

segment operating profit 20 Segment Operating Profit ($ Millions) FY13 $947

Price 73 Sales volume (7) Operating costs (99) FY14, constant currency $914

Currency (6) FY14 $908 Sales volume impact on profit Gains in EU and SA

offset by decline in AP and NA Operating costs Inflation of $112M Benefits

from European asset optimization and footprint actions were partially offset

by lower production in NA and AP

|

|

|

4Q price,

volume and currency impact on reportable segment sales 21 1 Reportable

segment sales exclude the Company’s global equipment business $ Millions

Europe North America South America Asia Pacific Total 1 4Q13 Segment Sales

$658 $477 $366 $252 $1,753 Price (12) 7 20 6 21 Volume 2 (21) (16) (35) (70)

Currency (59) (3) (37) (14) (113) Total reconciling (69) (17) (33) (43) (162)

4Q14 Segment Sales $589 $460 $333 $209 $1,591

|

|

|

Full year

price, volume and currency impact on reportable segment sales 22 1 Reportable

segment sales exclude the Company’s global equipment business $ Millions

Europe North America South America Asia Pacific Total 1 FY13 Segment Sales

$2,787 $2,002 $1,186 $966 $6,941 Price (39) 45 55 12 73 Volume 49 (30) 14

(145) (112) Currency (3) (14) (96) (40) (153) Total reconciling 7 1 (27)

(173) (192) FY14 Segment Sales $2,794 $2,003 $1,159 $793 $6,749

|

|

|

Reconciliation

to adjusted earnings 23 $ Millions 2014 2013 2014 2013 (130) $ (144) $ 167 $ 202 $ Restructuring, asset impairment and related charges 8 Pension settlement

charges 50 50 Pension settlement charges 15 15 5 Charges for asbestos related

costs 135 145 135 145 Restructuring, asset impairment and other charges 7 109

78 119 Charges for note repurchase premiums and write-off of finance fees 20

20 11 Items impacting income tax: Net benefit for income tax on items above

(14) (13) (34) (14) Net benefit for certain tax adjustments (8) (8) Items

impacting net earnings (loss) attributable to noncontrolling interests: Net

impact of noncontrolling interests on items above (12) (13) Total adjusting

items 205 229 269 248 Adjusted earnings 75 $ 85 $ 436 $ 450 $ 164,422 164,709

166,047 165,828 Earnings (loss) per share from continuing operations

(diluted) (0.79) $ (0.88) $ 1.01 $ 1.22 $ Adjusted earnings per share 0.46 $ 0.51 $ 2.63 $ 2.72 $ Items impacting other expense, net: Items impacting

interest expense: Diluted average shares (thousands) Year ended December 31

Earnings (loss) from continuing operations attributable to the Company Three

months ended December 31 Items impacting equity earnings Items impacting cost

of goods sold: Items impacting selling and administrative expense: Earnings

(loss) per share from continuing operations (diluted) 164,422 164,709,166,047

165,828 $(0.79) $(0.88) $1.01 $1.22

|

|

|

Reconciliation

to free cash flow 24 Year ended December 31 $ Millions Year ended December 31 2014 2013

2012 2011 Cash provided by continuing operating activities $698

$700 $580 $505 Additions to property, plant and

equipment (369) (361)

(290) (285) Free cash flow $329

$339 $290 $220

|

|

|

Leverage ratio Reconciliations of adjusted

EBITDA and net debt 25 $ Millions 2014 2013 2012 2011 Earnings (loss) from

continuing operations 195 $ 215 $ 220 $ (491) $ Interest expense 235 239 248

314 Provision for income taxes 92 120 108 85 Depreciation 335 350 378 405

Amortization of intangibles 83 47 34 17 EBITDA 940 971 988 330 Adjustments to

EBITDA: Asia Pacific goodwill adjustment 641 Charges for asbestos-related

costs 135 145 155 165 Restructuring, asset impairment and other 91 119 168

112 Pension settlement charges 65 Gain on China land compensation (61)

Adjusted EBITDA 1,231 $ 1,235 $ 1,250 $ 1,248 $ Total debt 3,460 3,567 3,773

4,033 Less cash 512 383 431 400 Net debt 2,948 3,184 3,342 3,633 Net debt

divided by adjusted EBITDA 2.4 2.6 2.7 2.9 Year ended December 31

|

|

|

Estimated

impact from currency rate changes 26 Impact on EPS from a 10% change compared

with the U.S. dollar EU (primarily Euro): ~$0.10 SA (primarily Brazilian Real

and Colombian Peso): ~$0.09 AP (primarily Australian Dollar and New Zealand

Dollar): ~$0.05

|

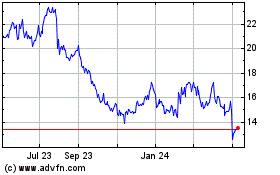

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to Apr 2024

OI Glass (NYSE:OI)

Historical Stock Chart

From Apr 2023 to Apr 2024