UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

| | |

Date of report (Date of earliest event reported) | June 8, 2015 |

| |

| |

OGE ENERGY CORP. |

(Exact Name of Registrant as Specified in Its Charter) |

| |

Oklahoma |

(State or Other Jurisdiction of Incorporation) |

| |

1-12579 | 73-1481638 |

(Commission File Number) | (IRS Employer Identification No.) |

| |

321 North Harvey, P.O. Box 321, Oklahoma City, Oklahoma | 73101-0321 |

(Address of Principal Executive Offices) | (Zip Code) |

| |

405-553-3000 |

(Registrant's Telephone Number, Including Area Code) |

| |

(Former Name or Former Address, if Changed Since Last Report) |

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events

OGE Energy Corp. (the "Company") is the parent company of Oklahoma Gas and Electric Company ("OG&E"), a regulated electric utility with approximately 818,000 customers in Oklahoma and western Arkansas. In addition, OGE holds a 26.3 percent limited partner interest and a 50 percent general partner interest in Enable Midstream Partners, LP.

As previously reported, on August 6, 2014, OG&E filed an application with the Oklahoma Corporation Commission ("OCC") for approval of its plan to comply with the Environmental Protection Agency's Mercury and Air Toxics Standards and Regional Haze Federal Implementation Program. The application seeks approval of the environmental compliance plan and for a recovery mechanism for the associated costs. The environmental compliance plan includes installing dry scrubbers at Sooner Units 1 and 2 and the conversion of Muskogee Units 4 and 5 to natural gas. The application also asks the OCC to predetermine the prudence of replacing OG&E's soon-to-be retired Mustang steam turbines in late 2017 (approximately 460 MW) with 400 MW of new, efficient combustion turbines at the Mustang site in 2018 and 2019 and approval for a recovery mechanism for the associated costs. OG&E estimates the total capital cost associated with its environmental compliance and Mustang modernization plans included in this application to be approximately $1.1 billion.

On June 8, 2015, OG&E announced that the Administrative Law Judge ("ALJ") had made a recommendation on the application. In its report, which is filed as Exhibit 99.02 hereto and is incorporated herein by reference, the ALJ recommended that the OCC pre-approve the environmental compliance plan. However, the ALJ did not recommend approval of requested rate riders to recover the associated costs. Instead, the ALJ recommended that such costs should be addressed in the next general rate case. In addition, the ALJ did not recommend approval of the replacement of the Mustang steam turbines. OG&E expects to file exceptions to some of the ALJ’s recommendations. At this time, OG&E cannot predict the outcome of the proceeding.

A copy of the Company's press release announcing the issuance of the ALJ's report is attached as Exhibit 99.01 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

|

| | |

(d) Exhibits | | |

| | |

Exhibit Number | | Description |

| | |

99.01 | | Press release dated June 8, 2015, announcing OG&E reacts to long-awaited ALJ report. |

99.02 | | Copy of the Report of the Administrative Law Judge dated June 8, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

| OGE ENERGY CORP. |

| (Registrant) |

| |

By: | /s/ Scott Forbes |

| Scott Forbes |

| Controller and Chief Accounting Officer |

| |

June 12, 2015

Exhibit 99.01

June 8, 2015

OG&E reacts to long-awaited ALJ report

Oklahoma City - Oklahoma Gas and Electric expressed mixed reactions to the recommendations of an Oklahoma Corporation Commission administrative law judge on the Company’s proposed Environmental Compliance and Mustang Modernization plans.

“We’re pleased that the ALJ agreed with so many of our positions,” said Paul Renfrow, Vice President of Public Affairs and Corporate Administration, “However, we are disappointed with the judge’s failure to allow for the recovery of costs through a rider for federally mandated environmental equipment that is already, or soon to be, in service. This simply kicks the can down the road.”

The judge agreed with the Company’s plan to be in compliance with Regional Haze and other EPA requirements by scrubbing two coal units at the Sooner Power Plant and converting two coal units at the Muskogee plant to natural gas.

The judge also affirmed that the Company’s cost estimates were reasonable for the environmental plan and agreed with OG&E’s concerns about adding more wind power at this time. The Company has already taken action regarding the judge’s recommendation to look into adding 200 MW of wind power in the future.

The Company expressed extreme disappointment that the judge did not recommend pre-approval of the Mustang plan. “We believe we presented a compelling case demonstrating the need for replacing the aging Mustang Plant,” Renfrow said. “The time pressures and need for generation do not go away.

“The judge had the difficult job of hearing more than a dozen parties to the case with multiple points of view,” he said. “We appreciate the complexity of his task. While the judge agreed with us on many facets of the case, we believe that he erred on several key points including not authorizing a recovery rider for the environmental plan.”

The company plans to file exceptions to some of the judge’s recommendations. The case will ultimately go to the three Corporation Commissioners for a final ruling.

Exhibit 99.02

BEFORE THE CORPORATION COMMISSION OF OKLAHOMA

|

| | |

IN THE MATTER OF THE APPLICATION OF | ) | |

OKLAHOMA GAS AND ELECTRIC COMPANY | ) | |

FOR COMMISSION AUTHORIZATION OF A | ) | CAUSE NO. PUD 201400229 |

PLAN TO COMPLY WITH THE FEDERAL CLEAN | ) | |

AIR ACT AND COST RECOVERY; AND FOR | ) | |

APPROVAL OF THE MUSTANG MODERNIZATION | ) | |

AND COST RECOVERY | ) | |

REPORT OF THE ADMINISTRATIVE LAW JUDGE

On March 3, 2015 through April 8, 2015, with closing arguments on May 6, 2015, Administrative Law Judge Ben Jackson ("ALJ'') conducted a full evidentiary hearing in the Commission's Courtroom, 301 Jim Thorpe Building, Oklahoma City, Oklahoma. At the hearing, the following attorneys appeared: Kimber L. Shoop, William J. Bullard, Patrick D. Shore, Stephanie G. Houle, and Charles C. Read for Oklahoma Gas and Electric Company ("OG&E"); Ronald E. Stakem and Jack G. Clark, Jr. for the OG&E Shareholders Association ("OSA"); Cheryl Vaught, Jon W. Laasch, and Scot Conner for Oklahoma Energy Results, L.L.C. ("OER"); Thomas P. Schroedter, James D. Satrom, D. Kenyon Williams, Jr. and Jennifer H. Castillo for the Oklahoma Industrial Energy Consumers ("OIEC"); Rick D. Chamberlain for Wal-Mart Stores East, LP and Sam's East, Inc. ("Walmart"); Jacquelyn Lee Dill, Susan Laureign Williams and Kristin A. Henry for the Sierra Club ("Sierra Club"); Lee Paden for the Quality of Service Coalition ("QSC"); William L. Humes, Marc Edwards, Jim A. Roth and Dominic D. Williams for the Wind Coalition, Oklahoma Cogeneration L.L.C., and Oklahoma Hospital Association (collectively "WC-OC-OHA"); Deborah R. Thompson for the AARP; Kendall W. Parrish for AES Shady Point, LLC ("AES"); Assistant Attorneys General Jerry J. Sanger, Erick W. Harris and Licensed Legal Intern Anthony Reding for Oklahoma Attorney General E. Scott Pruitt; and Senior Attorney Natasha M. Scott for the Commission's Public Utility Division ("PUD").

Being fully advised of the premises, the ALJ finds:

FINDINGS

Jurisdiction

1.The Applicant is OG&E, an investor owned public utility, with base rates set by Order No. 599558, effective July 9, 2012. In its Application now under consideration, OG&E asks the Commission to approve (1) an Environmental Compliance Plan ("ECP"), (2) a Mustang Modernization Plan ("MMP") to retire and replace two steam power plants, (3) either a cost tracker to collect the costs of both Plans or an allowance for funds used during construction (AFUDC), (4) regulatory asset treatment for attorney fees and expert witness fees, (5) recovery of costs for Air Quality Control Systems related consumable products ("AQCS") through the Fuel Adjustment Rider ("FAC"), and (6) recovery of certain stranded costs with changes in depreciation rates.

2.The Commission has jurisdiction of the subject matter and persons. Subject matter jurisdiction arises under Ok. Const. Art. IX, §18, et seq. , 17 O.S. §§151, 152, 251, 263, 284 and 286, and OAC 165:35-33, 165:35-35. 165:35-37 and 165:35-38. Notice was given as required by law, Order No. 635194, and Commission Rules.

Introduction

The Application centers on pre-approval of construction projects with either early cost recovery or an AFUDC. The construction projects consist of federally mandated emission controls, conversion of two coal-fired units to natural gas, and purchase and installation of seven new gas fired combustion turbines.

The ECP stems from two federal rulemakings: (1) the Regional Haze Rule ("RHR") 40 CFR Part 51, 64 Fed. Reg. 35714 (July 1, 1999) which limits sulfur dioxide and nitrogen oxide emissions, and (2) the Mercury and Air Toxics Standards ("MATS") 40 CFR Parts 60 and 63, 79 Fed. Reg. 68777 (November 19, 2014), which limits emissions of mercury, acid gases and particulate matter. These rules affect 4,000 MWs (63%) of OG&E-owned generating capacity and have compliance deadlines staggered over the next five years. The compliance deadlines arose from judicial decisions announced in OG&E v. U S.E.P.A. , 723 F.3d 1201 (10th Cir. 2013), cert. denied Oklahoma v. U S.E.P.A. , 134 S. Ct 2662, 79 ERC 1492, 189 L.Ed.2d

230, 82 USLW 3467, 82 USLW 3684, 82 USLW 3686 (March 27, 2014). According to those Court decisions, MATS requires control of emissions of mercury, particulate matter and acid gases at coal fired units by April 16, 2016; RHR requires compliance by January 27, 2017, with mono-nitrogen oxide limits (nitric oxide and nitrogen dioxide, collectively known as "NOx"); and RHR requires OG&E to comply with new sulfur dioxide limits by January 4, 2019. For the RHR sulfur dioxide requirements, OG&E will install dry scrubbers on Sooner units 1 and 2 and convert Muskogee units 4 and 5 to natural gas. For RHR Regional Haze NOx requirements, OG&E will install Low NOx burners on Sooner units 1 and 2, Muskogee units 4 and 5 and Seminole units 1, 2 and 3. For MATS, OG&E will install activated carbon injection ("ACI") technology on Sooner units 1 and 2 and Muskogee units 4, 5 and 6. For the entire ECP, OG&E seeks pre approval and early cost recovery under 17 O.S. Supp. 2015 §286 B.

In comparison, the MMP is a separate project, not federally mandated, involving replacement of two natural gas fired, steam turbine units near the end of their useful lives. OG&E wants to replace the two steam units with new gas fired, combustion turbines ("CTs"), and OG&E seeks pre-approval and early cost recovery for the CTs under 17 O.S. §286 C. OG&E's electrical engineer, Mr. Burch, testified that replacement of the steam units is necessary for system reliability and safety reasons because of the risk of catastrophic failure from metal fatigue due to increased plant starts by the Southwest Power Pool ("SPP"), which is in charge of dispatching this generation facility. OG&E's four electrical engineers (Burch, Howell, McCauley and Turner) also showed that using the existing location provided un-monetized benefits, namely, proximity to load, existing infrastructure, "netting" for environmental permits, support for intermittency of wind, support for growth of distributed generation, CT use in a "black start"1 and voltage-VAR support for the Oklahoma City-Metro transmission loop, which serves OG&E's largest load center.

OG&E estimates that ECP and MMP will cost approximately $1.1 billion dollars. Table 1 shows OG&E' s estimates for the revenue requirement by year.

1 A black start is a restart of all fossil fueled generators after a system wide outage.

Table 1

Revenue Requirement Summary

($ Millions)

|

| | | | | | | | | | | | | | | | |

Line No. | Description | 2015 | 2016 | 2017 | 2018 | 2019 |

1 | Average Capital Investment | $ | 117.8 |

| $ | 276.0 |

| $ | 504.4 |

| $ | 862.7 |

| $ | 1,087.1 |

|

2 | Return | 13.8 |

| 32.3 |

| 59.1 |

| 101.1 |

| 127.4 |

|

3 | O&M Expense | — |

| 0.8 |

| 0.9 |

| 10.9 |

| 23.6 |

|

4 | Depreciation | 1.1 |

| 5.5 |

| 6.1 |

| 24.3 |

| 47.3 |

|

5 | Property Tax | 0.5 |

| 1.9 |

| 3.6 |

| 6.4 |

| 10.6 |

|

6 | Regulatory Asset Amortization | — |

| — |

| — |

| — |

| 5.9 |

|

7 | Annual Revenue Requirement | $ | 15.4 |

| $ | 40.5 |

| $ | 69.6 |

| $ | 142.7 |

| $ | 214.7 |

|

| | | | | | |

8 | OK Annual Revenue Requirement | $ | 13.8 |

| $ | 36.3 |

| $ | 62.3 |

| $ | 127.7 |

| $ | 192.2 |

|

Chart may not add down due to rounding

|

OG&E proposes to pay for ECP and MMP through rate increases arising from OG&E's proposed cost tracker entitled Environmental and Generation Plans rider ("EGP rider" or "EGP"), which generates a revenue requirement for ECP and MMP. Table 2 shows OG&E estimates for rate increases under the EGP rider.

Table 2

EGP Rider Billing Impact

($/month)

|

| | | | | | | | | | | | | | | | | | | | | | | |

Class | Average Monthly Bill | Average Monthly | 2015 | 2016 | 2017 | 2018 | 2019 | Total |

Residential | $ | 108.51 |

| 1,100 |

| $ | 0.80 |

| $ | 1.27 |

| $ | 1.44 |

| $ | 3.57 |

| $ | 3.42 |

| $ | 10.50 |

|

General Service | $ | 185.61 |

| 1,800 |

| $ | 1.33 |

| $ | 2.13 |

| $ | 2.41 |

| $ | 5.98 |

| $ | 5.72 |

| $ | 17.58 |

|

Power & Light | $ | 2,982.53 |

| 43,000 |

| $ | 21.22 |

| $ | 33.89 |

| $ | 38.24 |

| $ | 95.08 |

| $ | 91.00 |

| $ | 279.43 |

|

Large Power & Light | $ | 209,584.22 |

| 4,100,000 |

| $ | 1,526.34 |

| $ | 2,437.33 |

| $ 2, 750.76 |

| $ | 6,838.93 |

| $ | 6,544.83 |

| $ | 20,098.18 |

|

OG&E proposes to pay for AQCS by adding those costs to the statutory Fuel Adjustment Rider ("FAC"). AQCS are ordinarily recovered as an operating expense through ratemaking for base rates. OG&E wants instead an automatic adjustment, because chemical consumption is variable, i.e., dependent on how much electricity is generated to meet load. Table 3 shows OG&E estimates for the combined rate impact of EGP and FAC changes.

Table 3

EGP Rider and FAC Billing Impact

($/month)

|

| | | | | | | | | | | | | | | | | | | | | | | |

Class | Average Monthly Bill | Average Monthly | 2015 | 2016 | 2017 | 2018 | 2019 | Total |

Residential | $ | 108.51 |

| 1,100 |

| $ | 0.80 |

| $ | 2.74 |

| $ | 1.63 |

| $ | 3.88 |

| $ | 7.26 |

| $ | 16.30 |

|

General Service | $ | 185.61 |

| 1,800 |

| $ | 1.33 |

| $ | 4.59 |

| $ | 2.73 |

| $ | 6.49 |

| $ | 12.16 |

| $ | 27.31 |

|

Power & Light | $ | 2,982.53 |

| 43,000 |

| $ | 21.22 |

| $ | 90.95 |

| $ | 45.81 |

| $ | 106.89 |

| $ | 240.24 |

| $ | 505.10 |

|

Large Power & Light | $ | 209,584.22 |

| 4,100,000 |

| $ | 1,526.34 |

| $ | 7,683.36 |

| $ | 3,446.16 |

| $ | 7,923.95 |

| $ | 20,265.32 |

| $ | 40,845.12 |

|

Granting early cost recovery for ECP and MMP would mean that rate increases would begin with an order in this cause. In comparison, AFUDC treatment would mean that OG&E would not recover any costs until the Commission approves final project costs in a base rate order issued after project completion.

OG&E seeks pre-approval of the ECP and MMP for several reasons. Foremost, OG&E contends that OG&E will get better financing and that lower financing costs mean lower rate increases for OG&E customers. Early cost recovery also avoids an "interest on interest" problem with carrying charges, where lenders require OG&E to pay compound interest on compound interest charges. OG&E further contends that the EGP will prevent a spike in rates around 2019 and will save customers approximately $100 million dollars over the next thirty years. The following graph shows near term, residential customer impact, with and without the EGP, i.e., CWIP rate base treatment versus AFUDC.

Residential Customer Impact Comparison

This chart illustrates the annual incremental changes to a residential bill excluding the FAC impact

For AFUDC, residential rates start to climb in 2018, with sharp increases between 2018 and 2019, while CWIP rates level out in 2018.

During the evidentiary hearing, OSA was the only party other than OG&E to support the ECP, MMP and EGP-FAC. Opposition to OG&E's proposals reflected several viewpoints. The AG contends that approval of the MMP requires additional evidence on reasonable alternative technologies, reasonable estimates on the construction and installation costs to establish rate impacts, and a firm basis to establish the lowest reasonable rates for OG&E customers. The Oklahoma Hospital Association and a number of citizens making public comments contend that they cannot afford a nineteen percent rate increase. Other public comments complained about human health and crop impacts from continued burning of coal. Meanwhile, the other Interveners aside from OSA asked the Commission to either reject or modify ECP and to deny MMP in its entirety. During closing arguments, the consensus among Interveners was to adopt the ECP subject to the conditions recommended by PUD's witness Dr. Roach, to defer consideration of cost recovery issues until the next base rate case, to deny or postpone approval of the MMP, to deny the FAC adjustment, to deny stranded costs and changes in depreciation, and to deny regulatory asset treatment for attorney and witness fees or at least defer that issue until the next base rate case.

The lnterveners' arguments to reject, approve with conditions, or postpone granting of OG&E's proposals center on whether OG&E's proposals produce the lowest reasonable rates. The dispute has five main areas of contention. First, economic waste is at issue, because OG&E failed to issue any request for proposals ("RFPs") to find out what the wholesale electricity market could provide in view of 6,000-8,000 MWs of excess generating capacity on SPP. Second, certain Interveners contend that OG&E's upgraded coal fired units may never payout, because over the next thirty years, fuel costs are volatile, load growth is uncertain, and evolving federal environmental regulation may render coal fired generation uneconomic. Third, OG&E ignored wind power, which most of the Interveners contend would provide substantial cost savings to OG&E customers through a different mix in generation, e.g., wind/coal, wind/coal/gas, or wind/gas only. In that regard, Sierra Club and OER propose that OG&E use wind for 20-25% of OG&E's peak

load, which equates with 1,360-l,700MWs of generation compared with 391.8 MWs of existing capacity shown on IRP pages 15 and 16. Sierra Club and OER contend their suggested increases in wind power would also pay for shuttering coal plants and shifting base load generation to natural gas. Fourth, certain Interveners contend that the terms of 17 O.S. §286 and OAC 165:35 limit relief to AFUDC and that CWIP is only available through a base rate case. Fifth, a base rate case is needed to address the cost issues in an appropriate fashion. The Interveners point to possible offsets on OG&E's proposed costs, such as reducing the rate of return on rate base, the return on equity, the AFUDC rate, and changing the debt-equity ratio in project financing.

In that regard, OIEC proposes reducing the overall rate increase from 19.15% to 9.65% through mitigation opportunities, namely, eliminating the MMP, eliminating the regulatory asset for OG&E, adding wind resources, shifting some of ECP's financing from corporate stock to debt, and reducing the allowed return on equity from 10.2% to 9.75%.

Procedural History

1.On August 6, 2014, OG&E filed the application.

2.On September 23, 2014, the Commission issued Order No 630945, which assessed costs for payment of witness fees for PUD's expert witness.

3.On September 23, 2014, and October 2, 2014, the Commission issued Order Nos. 630946 and 631385, which granted interventions.

4.On October 2, 2014, the Commission issued Order No. 631385, which is the protective order.

5.On October 7, 2014, the Commission issued Order No. 631620, which assessed costs for the AG to hire an expert witness, which the AG later decided not to hire.

6.On October 30, 2014, the Commission issued Order No. 632367, which set the procedural schedule.

7.On February 24, 2015, the discovery period ended, I conducted a pre-trial conference and heard motions to dismiss, which will be addressed later in this report. The Movants for dismissal at the pre-trial conference were OIEC, OSC and AARP. During the subsequent hearing on the merits, OIEC and the

AG also moved to dismiss.

8.On January 13, 2015, the Commission issued Order No. 635194, which prescribed the form of the notice.

9.On March 3, 2015, the Commission issued Order No. 637182, which authorized Charles C. Read to represent OG&E pro hac vice under a temporary license issued by the Oklahoma Bar Association for out-of-state counsel.

10.The full evidentiary hearing occurred from March 3 through April 8, 2015, with closing arguments given on May 6, 2015. At the end of the closing arguments, I closed the record and took the matter under advisement.

Issues

1.What are the requirements to add new equipment to rate base under 17 O.S. §286 B and C?

2.Is relief under 17 O.S. §286 subject to any traditional ratemaking requirement outside the statute?

3.17 O.S. §286 B requires that the proposed retrofits must be necessary to comply with the Federal Clean Air Act (42 U.S.C. §7401, et seq.). It also required OG&E to prove "reasonable costs" for new equipment proposed for inclusion in the rate base. Did OG&E's "scrub/convert" proposal for the ECP meet that burden?

4.The MMP is subject to 17 O.S. §286 C which requires a showing of need and consideration of "reasonable alternatives." Did OG&E meet that burden?

5.Is the proposed EGP rider an appropriate way to fund the costs of the ECP and MMP?

6.Is a general rate case needed to address the cost recovery issues for the ECP and MMP?

7.Should the Commission grant AFUDC, CWIP or postpone the choice of recovery

method to a new base rate case?

8.Should the Commission allow recovery of stranded costs and if so, how should the Commission address depreciation of those assets in this cause?

9.Should the Commission amend the FAC to allow OG&E to recover the cost of AQCS?

10.Has OG&E presented sufficient evidence to allow recovery of attorney fees and expert witness fees?

Summary of the Evidence

For identification purposes, I marked the preliminary exhibits as Exhibit Nos. 1-185 according to the docket list provided by the Commission's Court Clerk. I marked the trial exhibits as Trial Exhibit Nos. 1- 78 and received into evidence all of the trial exhibits. During the evidentiary hearing, the parties presented witnesses who each testified under oath. The preliminary exhibits contain pre-filed testimony from each witness and a separate summary of each witness' pre-filed testimony. All pre-filed testimony as corrected and adopted at trial was received into evidence. During the evidentiary hearing, each party was given an opportunity to cross-examine each witness. For purposes of summarizing the evidence, I hereby incorporate by reference the above-described summaries of the testimony under oath and will note in my findings major points raised during cross-examination. During the evidentiary hearing, I also received public comment, which was not under oath. Certain public comments supported the Application, while others opposed it. I discuss those public comments in the findings of this report. For future reference, the Commission's Court Reporters fully transcribed the pre-trial hearing and the entire evidentiary hearing.

Motions to Dismiss

I am denying all of the motions to dismiss. The Application and Notice properly notify everyone of the relief sought. The parties conducted extensive discovery. Before hearing any of the motions to dismiss, I read the applicable statutes and pre-filed testimony. I find that the decision in this cause should be based on the evidence.

Status of Construction

Appendix "A" shows the timetable for the construction projects and is summarized as follows:

OG&E proposes to install by January 27, 2017, low NOx burners with overtire air systems on four coal fired facilities, Sooner 1 and 2, Muskogee 4 and 5, and three natural gas fired facilities, Seminole units

1, 2 and 3. In January 2013, the Oklahoma Department of Environmental Quality ("DEQ") issued permits for Muskogee 4 & 5 and for Sooner 1 and 2. DEQ has yet to issue permits for the three Seminole units. OG&E has completed installation on three coal units (Sooner 1 and 2 and Muskogee unit 5). Installation at the other four units is scheduled during unit outages occurring between spring of 2015 and January 2017.

OG&E proposes to install activated carbon injection ("ACI") on all coal fired generating units (Muskogee units 4, 5 and 6 and Sooner units 1 and 2) by April 2016. DEQ issued permits for ACI during December 2014. While contracts for equipment were signed, installation has not begun.

OG&E proposes to install dry scrubber equipment on both coal fired generating units at the Sooner Power Plant, Sooner units 1 and 2, by January 4, 2019. DEQ issued permits for the dry scrubbers in December of 2014. Purchase contracts and installation contracts are pending, but installation has not started.

OG&E opted for conversion of two coal fired generating units at the Muskogee Power Plant, Muskogee units 4 and 5, to natural gas and to repower those boilers to accommodate that change in boiler fuel by January 4, 2019. Neither EPA's Regional Haze requirements nor EPA's federal implementation plan ("FIP") impacted Muskogee unit 6 because of its design and commercial operating date. While engineering activities are currently underway, OG&E has yet to file for DEQ permits on either Muskogee unit 4 or Muskogee unit 5 conversion. OG&E plans to file for those permits in 2017. As a result, no significant progress has occurred on this ECP component.

At the Mustang Generation Facility, OG&E proposes to retire four existing units, consisting of 463 MWs of capacity, and OG&E proposes not to renew a power purchase agreement ("PPA") with Oklahoma Cogeneration, L.L.C. for 120 MWs. OG&E proposes to replace the four existing Mustang units with seven CTs, with a combined capacity of 400 MWs. OG&E did not finalize its equipment choice until the evidentiary hearing. OG&E is still negotiating installation costs for the CTs. OG&E has not filed for DEQ permits for the CTs. There is no EPA compliance deadline for installing the Mustang CTs, because they are not a part of the ECP.

For ECP and MMP together, OG&E spent fifty million dollars in 2014 and estimates $110 million dollars in 2015.

Legislative Scheme

The Commission's ratemaking authority stems from Ok. Const. art. IX, §18, authorizing the Commission to set rates and charges for transportation and transmission companies. Ok. Const. art. IX, §34 defines the terms "transportation company" and "transmission company."

Under those definitions, OG&E is neither a transportation company nor a transmission company. However, Ok. Const. art IX, §§19 and 35 allow the Legislature to extend jurisdiction by statute. The Legislature extended ratemaking authority through what is now 17 O.S. §§152 and 263. 1913 Ok. Sess. Laws Ch. 93 §§1-6, pp. 150-152 (effective March 25, 1913) extended the Commission's ratemaking jurisdiction to cover electric utilities. 17 O.S. §152 comes from Section 2 of the 1913 legislation. 1993 Ok. Sess. Laws Ch. 231 §2 pp. 1105-1106 amended 17 O.S. §152, which was last amended by 1994 Ok. Sess. Laws Ch. 315 §6 p.1421 (effective July 1, 1994). The 1993 Act rewrote the statute establishing its current general wording and format. The 1994 Act inserted "and promulgate" into subsection A, and it substituted in subsection B.3 "forty-five (45)" for "thirty (30). Neither the 1993 Act nor the 1994 Act made any substantive change limiting or extending the scope of jurisdiction set in 1913. In comparison, 17 O.S. §263 directs the Commission to conduct periodic "detailed rate investigations" (general rates cases) for any regulated electric utility that uses a fuel adjustment clause or purchased power adjustment clause. The Legislature enacted 17 O.S. §263 through 1977 Ok. Sess. Laws Ch. 252, §14, p. 690 and amended the statute through 1987 Ok. Sess. Laws Ch. 17, §2 page 138 (effective April 13, 1987), and 1993 Ok. Sess. Laws Ch. 231, §3, page 1106 (effective May 26, 1993). None of the foregoing legislation for either 17 O.S. §152 or 17 O.S. §286 contains explicit language to amend, alter, modify or repeal any portion of Ok. Const. art. IX, §18.2 Consequently, the Commission's powers under 17 O.S. §§152 and 263 are limited by the scope of Ok. Const. art. IX, §18, meaning that the Commission's authority is limited to setting rates, charges and

2 Ok. Const. art. IX, §18 remains undiminished until explicit legislation alters or replaces a constitutional provision. Southwestern Bell Telephone Co. Ok. Corp. Comm., 1994 OK 142, 897 P.2d 1 1 16, 1122.

terms and conditions of service, because Ok. Const. art. IX, § 18 failed to grant power of internal management and control incident to ownership. Public Service Co. of Ok. v. Ok. Corp. Comm., 1996 OK 43, 918 P.2d 733, 739. In that regard, the Commission's power is limited to determining whether an act by the utility affects public rights and what steps to take to avoid an effect that is unreasonable, unfair or prejudicial to public rights. Lone Star Gas Co. v. Ok. Corp. Comm., 1934 OK 396, 39 P.2d 547, 553.

Electric utility regulation evolved from the concept of a municipal franchise agreement. Early electric generating, distribution and transmission technology required the power plant to be located within city limits, and it did not allow for inter-city transport of electricity from most power plants. As a result, early regulation was a municipal matter, frequently done through a municipal franchise agreement. By 1912, larger generators with steam turbines replaced earlier generators with reciprocating engines. The utility could then build a power plant in a rural area and generate electricity for multiple cities or towns. From a utility's view, where multiple communities are involved, state regulation through a single agency is more cost efficient than multiple city regulators, because fewer regulatory bodies means fewer rate proceedings and avoids conflicting decisions between regulators in different communities. Under the 1913 state legislation, the Commission took over the regulatory responsibilities of most cities and towns in regard to electric utilities. Commission regulation adopted many structural details from the municipal franchise contract, such as price, duration, and terms and conditions of service. Meanwhile, case law developed the concept of a privately owned electric utility as a public service corporation serving as an instrumentality of the state, providing a public service normally provided by government, with regulation creating a special relationship among the owners of the utility, the Commission and the utility's customers.3 Case law developed the concept of a regulatory contract, compact or bargain, often characterized as a set of mutual rights, obligations, and benefits that exist between a public utility and society. As with any normal contractual relationship, both sides make trade offs in establishing their rights and responsibilities as well as the allocation of risks. Under the regulatory contract,

3 The concept comes from railroad Jaw. Ok. Const. art. IX, §6 provides that a privately owned rail line is a public highway.

a utility accepts the obligation to serve and charge regulated cost-based rates, and customers forego choice of service provider in exchange for protection from monopoly pricing. In ratemaking, the Commission does not step into the shoes of utility management but takes the place of a free and open market. The Commission's role is to find an equilibrium or balance between the competing interests of investors and customers. Reasonable balancing requires factual findings establishing a balance between the investor's interest in maintaining financial integrity and access to capital markets versus the consumer interest in being charged non-exploitative rates. Jersey Central Power & Light Co. v.F.E.R.C. , 810 F.2d 1168, 1172 (D.C. Cir. 1987); F.P.C. v. Hope Natural Gas Co., 320 U.S. 591, 603, 64 S.Ct. 281, 88 L.Ed. 333 (1944).

Traditionally, this balancing of competing interests occurs during consideration of an application to set or review base rates, commonly known as a "general rate case" or "base rate case." For major electric utilities such as OG&E, the Commission sets base rates through cost of service regulation also known as "the rate base method" or "the rate of return, rate base method."4 In 2005, the Oklahoma Legislature, following the lead of nine other states and the FERC, created a discretionary remedy allowing the Commission to add new equipment to rate base between base rate cases. This alternative remedy appears at 17 O.S. §286 enacted by 2005 Ok. Sess. Laws Ch. 161, §1, pp. 776 and 777 (effective May 11, 2005). The Legislature later amended the statute by 2008 Ok. Sess. Laws Ch. 80, §1 pp. 298-300 (effective April 24, 2008) and 2008 Ok. Sess. Laws Ch. 150, §1 pp. 560-562 (effective May 12, 2008). The 2005 and 2008 Acts fail to contain language explicitly changing any part of Ok. Const. art. IX, §18. Therefore, an application to raise rates under 17 O.S. §286 must comply with Ok. Const. art. IX, §18 and 17 O.S. §152. Although an application under 17 O.S. §286 is not a general rate case, the Commission must inquire about whether all rates are just and reasonable.

17 O.S. §286 creates an exception to the prohibition against single-issue ratemaking. The central premise of 17 O.S. §286 is that adding new equipment to rate base without a general rate case is reasonable if base rates are still just and reasonable. As a result, the Commission must postpone early cost recovery to

4 The Oklahoma Supreme Curt discussed the formula in Ok.. Natural Gas Co. v. State, 1965 OK 142, 406 P.2d 273, 277 and Tureen v, Ok Corp. Comm., 1988 OK 126, 769 P.2d 1309, 1316 fn 7.

the next general rate case if the cost of service study for base rates has become stale or subject to doubt because of changes in financial markets.

Adding Equipment to Rate Base under Traditional Ratemaking

Under the legislative scheme for traditional ratemaking, the Commission lacks power to demand prior approval of construction plans for a new plant, but once the plant is built, the Commission is empowered to ascertain the plant's effect on rates. Public Service of Ok. v. Ok. v. Ok. Corp. Comm., 1983 OK 124, 688 P.2d 1274, 1277 citing OG&E v. Ok. Corp. Comm., 1975 OK 15, 543 P.2d 546 and Lone Star Gas Co. v. Ok. Corp. Comm., 1934 OK 396, 39 P.2d 547.

The PSO Case involved a base rate case with a new plant only partially complete during the test year. The new plant was only completed and operational one year after the test year. In the rate order, the Commission granted CWIP for 19.1% of the plant costs, reflecting what PSO had spent during the test year. The Oklahoma Supreme Court upheld the Commission's order finding that the amount added to rate base related directly to a portion of the plant complete during the test year, and that the Commission may disallow improvident cost and unnecessary items if not used and useful to public service or if a cost is excessive, unwarranted, unreasonable or incurred in bad faith. PSO, pp. 1277-1281.

The used and useful test came from early twentieth century cases on the concept of "fair value" for utility property. The fair value of utility property only means that property is valued based on what is used and useful in providing utility service. Denver Union Stock Yard Co. v. U.S., 304 U.S. 470, 479 (1938), 58 S. Ct. 990, 82 L.Ed. 1469. Regardless of the valuation method, the Courts have long accepted that investors are entitled to a return only upon that portion of their investment that is used and useful in the public service. Bluefield Waterworks & Imp. Co. v. P.S.C. of W Va., 262 U.S. 679 (1923), 43 S.Ct. 675, 67 L.Ed. 1176.

The traditional concept of used and useful centers on the concept of plant in service. Used and useful generally means that some physical object is currently yielding direct services to customers. For example, suppose that an electric distribution utility provides service to a neighborhood using an excessive number of distribution lines. The Commission might not include some of the investment in the rate base, even

though all of the lines are used, because many of the lines are not needed, so they are not really useful.

17 O.S. §286 departs from the traditional methodology by allowing the Commission to include in rate base certain costs incurred before a construction project is complete.

Adjustments for Construction

Public utilities generally add plant in service over time. This means that major investments are often made before an investment is placed into service. Normally, a regulated utility is entitled to recover from its ratepayers certain costs related to the construction or capital improvement of a power plant. One of the costs which a utility recovers from its customers is the debt interest and reasonable equity return on the capital investment used to finance construction. In that regard, there are two mutually exclusive ratemaking methodologies by which these carrying charges are recovered through rates.

First, an Allowance for Funds Used During Construction ("AFUDC") capitalizes the carrying charges incurred during the construction period. Under this method, the cost of the completed plant will include all carrying charges recorded during the construction period, as well as the direct costs of land, labor, and construction materials. Actual rate payments from customers to cover the carrying charges begin only when the completed plant goes into operation. Then, the entire cost of plant (including AFUDC) is added to the rate base, which earns a return on investment and is depreciated over the life of that plant.

The second method for cost recovery is called the "Construction Work in Progress Rate Base Method" ("CWIP"),5 which allows the utility to include the uncompleted plant within the rate base. Under this method, the uncompleted project is treated as if it were a plant in service. The utility recovers carrying charges currently from customers, rather than adding carrying charges to the cost of construction. The carrying charges are determined by the allowed return (debt and equity) that is applied to utility investment in an operating plant. The return on CWIP is recorded as income on a current basis (just as AFUDC) and actual cash payments are made by customers currently (unlike AFUDC).

5 The term "construction work-in-progress" is borrowed from accounting principles where it is a long-term asset account in which the costs of constructing long term assets are recorded. The account Construction Work-in - Progress will have a debit balance and will be reported on the balance sheet as part of a company's Property , Plant and Equipment. The costs of a constructed asset are accumulated in the account Construction Work-in-Progress until the asset is placed into service. When the asset is completed and placed into service, the account Construction Work-in-Progress will be credited for the accumulated costs of the asset and will be debited to the appropriate Property, Plant and Equipment account. Depreciation begins after the asset has been placed into service.

AFUDC is the traditional approach used by the Commission. Special funding for construction is not needed if demand growth generates cash flow sufficient to service the debt during construction. However, that approach broke down in the 1970s due to low sales growth, high interest and the high cost of new plants. CWIP was an innovative approach to low demand, high interest, high inflation and high construction costs after the Arab Oil Embargo in 1974, when lenders and investors became leery of excessive AFUDC on utility balance sheets because of the risk of disallowances by regulators after project completion. CWIP addresses those concerns through pre-approval of construction plans and providing cash flow to replace sales growth. Here, the adequacy of cash flow is not at issue. OG&E has agreed to accept AFUDC if the Commission denies OG&E's request for CWIP.

During the last forty years, the Commission has a track record of granting limited CWIP in general rate cases: Order No. 134222 (1977), Order No. 168923 (1980), and Order No. 206560 (1982) each granted CWIP for a year. After enactment of 17 O.S. §286 in 2005, Order No. 524078 (2006) is the only order granting CWIP, and it too was for one year.

CWIP appeared in the previously discussed PSO Case, but legal authority for CWIP was not at issue. With respect to 17 O.S. §286, the Oklahoma Supreme Court has yet to interpret that statute in an appellate decision, although the Court in a short opinion denied a request for a prerogative writ in Case No. 104,744, which involved OG&E's application for early cost recovery for the Red Rock plant, which was never built. Elsewhere, the Federal Energy Regulatory Commission ("FERC") changed its used and useful concept by adopting CWIP requirements found in 18 C.F.R. §35.25, developed in case law and rulemaking involving FERC Order Nos. 298, 474, 474-A, and 474-B. The FERC found that CWIP was used and useful to customers for several reasons: CWIP formed part of a least-cost strategy for assuring a stable long-term supply of energy. Williston Basin Interstate Pipeline Co. v. F.E.R.C., 931 F.2d 948, 955 (D.C. Cir. 1991). CWIP treatment allowed the utility to attract capital necessary to either build major projects or buy energy contracts, Id., p. 954. Furthermore, CWIP avoided rate distortion caused by AFUDC. Mid-Tex Electric Cooperative, Inc. v. F.E, R.C., 773 F.2d 327, 333, 334 (D.C. Cir. 1985). In several proceedings, FERC addressed arguments that CWIP produced unfair prices, but FERC concluded otherwise. FERC's rate distortion position on AFUDC presently has three aspects: the rate shock occurs when the FERC approves final project costs; speculators cause a spike in wholesale commodity prices, and the utility suffers a loss of revenue for the utility when customers switch pipelines to get a cheaper tariff rate. The revenue loss affects the income needed to pay for the capital project. Overall, FERC concluded that the public was better served by moving away from the traditional view of used and useful.

A problem in the OG&E application is that neither 17 O.S. § 286 nor OAC 165:35-1-2 define used and useful. As a result, I viewed used and useful as a term of art in the electric industry, and I adopt FERC's expanded view of the concept, which generally corresponds with what OG&E has proposed.

Nevertheless, OG&E received limited support for CWIP at the evidentiary hearing. OSA supported all of OG&E's proposals, but the other Interveners all opposed CWIP, although the AG and PUD's witness Dr. Roach did not object to it. The following summarizes the Interveners' major arguments against CWIP. Current utility customers would be paying for equipment that benefits future customers. Additions to rate base for ongoing construction should only occur where revenue requirement impacts can be synchronized with related known and quantifiable increases in revenues and changes to operating expenses. With respect to the first two arguments, they marginalize the economic benefit to all customers from prudent planning for future demand, which assures adequate supply and keeps costs down. In any event, OIEC provided the third reason, which is that the cost of service study for base rates is stale, and OIEC contends that the Commission needs to conduct a full rate review before granting CWIP. OIEC and Walmart also contend that CWIP is not a good deal for large customers. Walmart's expert Mr. Chriss contends that CWIP forces the customers to pay $108 million dollars between 2015 and 2018 to save only six million dollars in 2019. That savings represents only three-tenths of one percent of the revenue requirement for the construction projects. Walmart contends that an OG&E customer could offset all or most of the rate increase by investing in an interest bearing asset and then paying the income on the higher rate for AFUDC: the result being the same electric service for less money. OIEC further contends that CWIP unreasonably shifts risk to the

ratepayers. OIEC presented examples from other states of plants with cost overruns and plants cancellations due to poor economics, where the customers had to pay for sunken costs.

Major Risks

Review of OIEC's problem plant examples showed important guidelines for pre-approval of new facilities. In each OIEC example, a public service commission found the decision to build the plant was prudent. Prudent decision-making is an ongoing process throughout construction and the operating life of the generation asset, and cancelling an uneconomic plant is ultimately to the ratepayers' advantage. The public should not have to pay on an uneconomic facility. Consequently, the Commission needs a plant cancellation policy. Next, public service commissions control cost overruns by limiting CWIP through general rate cases and periodic cost reviews between general rate cases, typically on an annual basis, although 17 O.S. §286 allows up to two years between general rate cases. Another approach to control cost overruns is to set a cap on what can be spent without a hearing. Here, OG&E is proposing a cap based on its estimate for each year of construction, plus five percent. In any event, a cancellation policy is a complex question. Under the regulatory contract concept, the Commission does not meet legislative goals by bankrupting a utility or trashing the utility's credit rating. Cost of service ratemaking is supposed to provide a utility with a reasonable opportunity to recover its capital costs. A past approach used by this Commission is to pay for sunken costs through a rider which pays for unrecovered costs over time. I submit that was the approach used for cancellation of PSO's Black Fox Nuclear Plant in 1982.

The IRP and the Multi-step Pre-approval Process

For utility regulation, the central legislative goal is to provide customers with continuous, reliable electricity of good quality at the lowest reasonable rates. Toward that end, the legislative scheme set up a multi-step planning process for adding new equipment. Effective July 1, 1983, 17 O.S. §157 subsection A set up a two step planning process. The first step is the Commission's ten-year assessment of the electrical power and energy requirements for the entire State. The second step is a Commission proceeding for a least cost study-integrated resource plan ("IRP") presented by the utility to allow stakeholders input into the

planning process.

Under 17 O.S. §157 A and OAC 165:35-37, OG&E presented its construction plans in its 2014 IRP (Tr. Exhibit No 11). Under the IRP, OG&E is gradually shifting generation resources while maintaining fuel diversity. Unfortunately, the 2014 IRP proceeding failed to resolve how OG&E should finalize its construction plans for the ECP and MMP. As a result, the dispute in the current OG&E application mirrors the dispute in the IRP proceeding. OG&E contends that neither the statutes nor the Commission rules require a competitive procurement for other generation sources as a precondition to upgrading existing facilities based on sound engineering judgment. OER, Sierra Club and the Wind Coalition disagree. OER and Sierra Club propose an aggressive shift to wind and gas generation without coal units. They contend that the wind/gas mix will save customers billions of dollars and provide cleaner skies.

The Prudence Test

Three major issues arise from the lack of competitive procurement. First, did 17 O.S. §286 or OAC 165:35 require competitive procurement? Second, did case law require competitive procurement? Third, how does the lack of competitive procurement affect the burden of proof?

To begin, a public utility has a duty to manage its business efficiently and economically, and how a utility meets that duty is a subject of inquiry in Commission rate reviews. In that regard, case law developed a "prudency test" which is not constitutionally mandated and only amounts to a judicially recognized method of valuing utility property. Under the prudence test, a utility is compensated for all prudent investments, irrespective of whether the individual investments are deemed necessary or beneficial in hindsight. A utility's actions are considered prudent if they are reasonable and least-cost, given the facts and circumstances known or which should have been known at the time a decision is made. Duquesne Light Co. v. Barasch, 488 U.S. 299, 307-316 (1989), 109 S.Ct. 609, 102 L.Ed. 646.

17 O.S. §286 neither has a prudency test nor specifically requires a prudency review. OAC 165:35-34-1, 165:35-34-3, 165:35-35-1, 165:35-38-4, and 165:35-38-5 give the utility the option to streamline the Commission's review of prudency by going through a competitive bidding process before

construction. OG&E did not avail itself of that presumption. It did not send out RFPs to test the market; it only competitively bid the equipment after it selected the equipment that it wanted to use.

Approval of the ECP depends on whether OG&E's costs are excessive. Under the regulatory contract, the Commission lacks authority to dictate internal management decisions of an electric utility, but the Commission can reject or modify amounts to be added to rate base if they are excessive or extravagant. PSO of Ok. v. State, 1997 OK 145 ¶11, 948 P.2d 713, 718, Opponents of the ECP contend that there are cheaper ways to solve the environmental compliance problem. The parties presented life cycle cost analyses for various types of generators. The studies showed the net present value of the total cost of electricity over a thirty year planning horizon corresponding to the useful life of a coal unit. The Interveners opposing the ECP wanted more wind power to be included in the mix, because of savings from the federal production tax credit ("PTC"). As previously noted, OER and Sierra Club wanted a major increase in wind power along with a shift from coal units to gas fired combined cycle units. At the other end of the spectrum, OIEC wanted to keep all of the coal units and forego the cost of converting two coal units to natural gas.

I generally adopt Dr. Roach's analysis, which recommends OG&E's "scrub/convert" plan, because it ranks well cost-wise among the options in OG&E's scenario/sensitivity study, and the fuel diversity that it maintains best spreads the risks associated with fuel price volatility and future environmental regulations.

Sierra Club contends that shifting to wind and natural gas will save large amounts of money in view of foreseeable EPA regulations. Sierra Club anticipates that EPA will adopt final regulations on the Clean Power Plant Rule sometime this year. That prediction may be overly optimistic, in view of litigation in the rulemaking. Nevertheless, I find that the Commission cannot reasonably predict the nature and outcome of any as yet unfiled, future EPA rulemaking, Congressional action, or any judicial decision on a statute or regulation. Therefore, maintaining fuel diversity is important to protect the public against the risk of fuel price escalation.

Section 286 B Requirements

For the ECP, OG&E had to show the cost of upgrades and the concomitant income and operating expenses attendant with the projected use of the completed plants. Southwestern Public Service Co. v.

State, 1981 OK 136, 637 P.2d 92, 99. Viewing 17 O.S. §286 B together with Ok. Const. art. IX, §18 and 17 O.S.§152 produces the following requirements that OG&E had to prove:

1.OG&E has a need for the available capacity from the generator units covered by the application.

2.The equipment for the proposed retrofits is necessary to comply with EPA regulations under the Clean Air Act (42 U.S.C.§7401, et seq.).

3.The technology is feasible, i.e., it is likely to meet the regulatory requirements set by EPA under the Clean Air Act. The Commission cannot commit huge sums of money to experimental technology.

4.Since OG&E's generator units are subject to the SPP Integrated Marketplace, OG&E had to show that SPP will dispatch the retrofitted plants, and OG&E had to estimate income and operating expenses associated with SPP dispatches.

5.OG&E had to present reasonable estimates for purchase and installation costs along with operation and maintenance costs covering the planning horizon, which is the thirty year life of the generating assets.

6.The ECP expenditures must represent the least-reasonable cost, and the project must be likely to payout.

7.OG&E had to show that purchase and installation of equipment were subject to competitive bids and that the method of financing the projects reflects the least reasonable cost for financing.

8.OG&E had to show that a general rate case is not needed, because base rates are still just and reasonable.

The ECP Evidence

1.As updated by more recent load forecasts, the IRP shows that OG&E needs the capacity of the units to be upgraded. Sierra Club presented a statistical argument showing that improvements in system efficiency could eliminate the need for one or two coal plants. In that regard, the IRP discusses OG&E's efforts on the efficiency issue. The Commission has implemented demand side management ("DSM"), advanced metering infrastructure ("AMI") and SmartGrid programs to improve the efficiency of OG&E's

distribution system. Under the efficiency programs, OG&E has taken steps to improve its generation mix by tailoring generation to load using AMI data, reducing line loss on distribution lines and reducing applied power requirements for inductive loads through improvements in reactive power management. The evidence shows that improvements in efficiency equate with approximately 400 MWs of generation for 2015. That improvement should displace generation that is more expensive than the coal fired units.

2.OG&E's proposed equipment for the ECP meets EPA's best available retrofit technology standard ("BART"). There is no issue about whether the equipment will work, but Sierra Club contends that OG&E is under equipping the plants insofar as future regulations, which Sierra Club believes are reasonably foreseeable. I side with PUD's witness Dr. Roach: the future of federal environmental regulation is uncertain; the best approach is to adopt OG&E's scrub/convert plan, which provides a least reasonable cost, by maintaining fuel diversity and spreading the risk of fuel volatility and future environmental regulation.

3.SPP dispatch and associated income and operating costs were not in dispute. The arguments over life cycle costs centered on unknown future environmental costs and comparisons of OG&E's ECP with plans with different generators.

4.The contracts for purchase and installation of the ECP equipment went through competitive bidding. I find that OG&E presented a reasonable estimate of the total costs for ECP.

5.However, a full rate review is necessary to address the cost recovery issues.

Wind Power and Combined Cycle Plants

The Wind Coalition, OER and Sierra Club presented financial models showing huge savings from wind power. OER's economist Judah Rose contends that with 20%-25% wind power at peak load, the PTC lowers life cycle costs between $3 billion and $3.3 billion dollars, and that amount of wind power would lower life cycle costs $1 billion and $1.4 billion dollars in a post-PTC environment. However, the future of the PTC is in doubt. The parties noted that Congress only extended the PTC for three weeks at the end of 2014, and I take judicial notice of the fact that in January of 2015, the U.S. Senate rejected a bill for a five year extension of the PTC. Congress has subsidized wind power since 1992. During that time, federal law

makers have twice allowed the PTC to expire, and they may do so again. The PTC is a hard sell to federal law makers. The PTC in effect forces taxpayers in non-wind power states to subsidize utility bills in wind states and to do so for all customers, even those who are not in financial distress. After twenty three years of federal subsidies, wind power still only competes with coal because of the PTC. Wind power also exerts "negative pricing" on nuclear plants. Shuttering nuclear plants increases reliance on fossil fuels for base load generation, contrary to federal policy goals to improve air quality and reduce green house gas emissions. In view of the foregoing problems, Congress has three options: let the PTC expire, reduce the subsidy or phase it out over time. What approach Congress will select remains to be seen.

The next problem with wind power is transportation. The proposed wind plants share an OG&E transmission line, and OG&E's witness Mr. McCauley identified a congestion problem on that transmission line. Mr. McCauley is an electric engineer who manages the OG&E transmission system. Congestion occurs when SPP curtails upstream generation when shipments on the transmission line approach or exceed a flow limit of a flow gate. OER's economist Mr. Rose and Sierra Club's electrical engineer Ms. Tripp contend that OG&E could contract around the congestion problem, and Ms. Tripp concluded that congestion penalties only add fifteen percent to the cost of wind power. However, Mr. McCauley testified that Rose did not understand the nature of the congestion problem and that upgrading the Woodward substation as proposed by Rose will not fix the congestion problem. Mr. McCauley stated that the contract provisions suggested by Mr. Rose and Ms. Tripp will not solve the congestion problem, they simply move the congestion problem downstream. Mr. McCauley testified that congestion and congestion penalties will continue until OG&E completes a transmission line upgrade scheduled for completion in 2020. I adopt Mr. McCauley's opinion and find that OG&E's failure to seek more wind power was reasonable under the circumstances.

The wind power proponents presented another argument about the benefits shifting from coal-fired generation to natural gas fired combined cycle plants ("CCs"). OG&E did not issue RFPs for gas CCs on the SPP. The Commission rules did not require it to do so, but opponents of the ECP contend that RFPs were necessary to establish the lowest reasonable costs. I find that OG&E presented a prima facie case for its

capital costs and that the burden of going forward with the evidence then shifted to the opponents. In that regard, the evidence about the CCs on SPP is inconclusive, because it involves a small sample of CCs and failed to show actual contracts. Outside its current application, OG&E proposes building a new CC to be completed in 2020. The current problem is that absent major wind power, forecasts for the SPP cost of electricity do not support an immediate, major shifts to CCs. OG&E's gradual shift to more gas generation is prudent in the context of the current application.

Dr. Roach's Three Conditions

For the ECP, PUD's witness Dr. Roach recommended approval of the project subject to three conditions: (1) OG&E is not entitled to stranded costs if it abandons any coal unit before the end of its useful life in 2044; (2) OG&E must maintain unit performance throughout the useful life of each coal unit; and (3) after this proceeding, OG&E must send out RFPs for 200 MW of wind generation.

The first two conditions arise from concern that ratepayers need protection if future conditions render a coal plant uneconomic. There are two problems with the first two conditions. First, they are based on speculation about future events, and it is well settled that the Commission cannot base on speculation any order provision that affects rates. Next, the regulatory contract requires the Commission to balance the competing interests of investors and consumers. We do not know the facts and circumstances on an uncertain date when a coal plant becomes uneconomic. As a result, the Commission presently lacks the evidence to balance the interests as required by law.

With respect to the third condition, the benefits of wind power need to be addressed after this proceeding. At the evidentiary hearing, OG&E promised to submit RFIs for wind in 2015. Dr. Roach proposed a requirement for an RFP of 200 MWs. An RFP is an offer for a contract, arguably within the exclusive prerogative OG&E management. Also, certain Interveners question whether an RFP for 200 MWs will elicit the appropriate response; producers may ignore the proposal if it is too low. However, 200 MWs is consistent with OG&E's current wind portfolio. Based on the foregoing facts, I recommend RFIs for at least 200 MWs to be issued within thirty days after a final order in this cause.

Rate of Return Problem

For the EGP, an important issue is the allowed rate of return ("ROR") or cost of capital used in the EGP and the formula for base rates. Ordinarily, the ROR is the weighted average cost of capital ("WACC"), typically a highly contested issue in a general rate case. However, the ROR from Order No. 599558 comes from a stipulation between the parties. According to OG&E's witness Ms. Richard, the ROR is comprised of a return on equity (10.2%) and a debt interest weighted against each other, plus a factor to collect income taxes. See Richard, Direct Testimony page six. This formula produces a ROR of 11.7%. See Richard, Direct Testimony page 9. Walmart's expert Mr. Chriss and OIEC's Attorney/CPA Mr. Garrett showed that market conditions have changed since issuance of Order No. 599558 in 2012. Trial Exhibit No. 69 is a Rate Case Summary prepared by the Edison Electric Institute. The exhibit shows that the average ROE granted by public utility commissions went from a high of 10.84% in 2012 to a low of 9.89% in 2014. Meanwhile, OIEC's Mr. Garrett calculated a new allowed ROE to be 9.75%. Reducing the ROE to 9.75% would reduce the revenue requirement for ECP by $13,716,326 dollars. OG&E's witness, Mr. Reed, and OSA's witness, Mr. Fetter, contend that the testimony and exhibits of Chriss and Garrett are impressionistic, but not probative of what the ROE or ROR should be.

I submit that the Commission needs a general rate case to resolve the ROR issue. ROR includes both the cost of debt that the company uses to finance its rate base and the cost of equity. In general rate cases, the cost of debt is often the weighted average of the interest rates that the company pays on its long-term, corporate bonds. However, the cost of equity is a complex problem, because it represents the returns that shareholders need to ensure that they continue to finance the company. In WACC analysis, there are several ways to estimate the cost of equity. The method briefly mentioned during the hearing was the popular capital asset pricing model ("CAPM") which has two basic components, the risk-free cost of capital and the risk premium. The risk-free cost of capital is generally considered to be the interest that the U.S. government pays on long-term bonds. The repayment of these bonds is generally considered to be secure, so the interest rate reflects only the investors' time value of money. The risk premium is the amount of return that investors

require because the actual earnings of the company are uncertain. The risk premium for a company is estimated by analyzing the degree to which the variation in the return on the stock follows the variation in the averaged returns on all stocks in the market. Once the Commission determines the costs of debt and equity, the Commission combines them into a WACC using the company's capital structure as the weights. Here, the evidentiary record fails to provide all of the data necessary to calculate a WACC to gauge the stipulated ROR from 2012. As a result, I recommend that the Commission postpone consideration of the cost recovery issues, until the Commission establishes in the next general rate case the proper rate of return, return on equity, and capital structure for ratemaking purposes.

AFUDC Rate Problem

OG&E asked for an AFUDC as an alternative to CWIP. Order No. 599558 set the AFUDC interest rate at the ROE of 10.2%. The AFUDC interest rate is generally lower than the rate of return, even though some public utility commissions have used ROR as the AFUDC rate, although review of the NRRI website shows that common practice is to calculate an AFUDC rate using the FERC's AFUDC formula. Nevertheless, if the Commission bases the AFUDC rate on the ROE like Order No. 599558, the resulting AFUDC rate of 10.2% does not make sense if the current return on equity should be 9.75%. As a result, the Commission should postpone consideration of the AFUDC rate until the next general rate case.

Project Financing versus the Capital Structure

OG&E' s Ms. Richard testified about the financing for the ECP and MMP. In simplest terms, OG&E will finance ECP and MMP with 47% debt at 6% debt and 53% stock at 10.2%. OIEC's Mr. Garrett observed that the Commission could reduce the revenue requirement for the ECP by $37,346,048 dollars by increasing debt to 53% and reducing equity to 47%, and he contends that such a change should have no effect on OG&E's bond rating. OG&E opposed the change, because OG&E contends that it would affect OG&E's bond rating and access to capital. However, I find that the evidentiary record in this docket is insufficient for me to change either the interest and dividend rates in the financing formula or the capital structure of the company for ratemaking purposes. As a result, I recommend that the Commission postpone consideration of the financing

issue until the next general rate case.

The Issues with MMP

I agree with PUD's witness Dr. Roach that the MMP is incomplete, and that the Commission should not grant pre-approval at this time. To begin with, OG&E failed to provide a reasonable estimate of how much the project will cost. OG&E never finalized its estimate on the installation costs. During the evidentiary hearing, OG&E was still negotiating the installation costs with its contractor. Next, QSC noted in its Statement of Position that OG&E proposes to decommission and demolish the existing generation facilities at an undisclosed time and for an unknown amount. OG&E failed to provide a decommissioning and demolition analysis to show salvage value and address any environmental cleanup problems. As a result, the financial liability for the existing equipment is unknown.

The next problem is the shift from a cycling plant to a peaking plant. Estimated costs for the combustion turbines ("CTs") appear on Table 9 on page 20 of the IRP (Tr. Exhibit 11). During the evidentiary hearing in this cause, OG&E changed its choice of CT brand and model. but OG&E contends that the performance of its current choice is comparable to what is in the IRP, but at a lower cost. Be that as it may, the levelized cost of electricity should rise when you shift from steam units to CTs, which are only used for peaking, because CTs generate more expensive power. Under the SPP Integrated Marketplace, SPP is the balancing authority in charge of dispatching the Mustang Plant with the new CTs. When you shift from a cycling plant to a peaking plant, you change the merit order of the generation facility in the SPP dispatch queue. The Wind Coalition's electrical engineer, Mr. Peaco, and OIEC's electrical engineer, Mr. Norwood, showed that OG&E failed to prove if and when SPP will dispatch the CTs. OG&E presented some SPP transmission planning studies suggesting future need for CTs. However, we do not know how much power SPP will buy from the Mustang facility. That fact is critical, because Southwestern Public Service Co. v. State 1981 OK 136, 637 P.2d 92, 99 requires a showing of the income and operating expense for a generating asset as precondition to adding the asset to rate base. I cannot recommend approval of the MMP at this time because of the foregoing uncertainties.

Stranded Costs

OG&E seeks to set up a regulatory asset for stranded balances in coal handling and ash disposal equipment accounts when Muskogee units 4 and 5 are converted to natural gas and for the remaining portions of the useful lives of the steam units to be retired by the MMP. Since I am not granting the MMP, the discussion of stranded costs focuses the coal handling and ash disposal equipment with an amount in controversy of $35.6 million dollars, which OG&E proposes to recover over six years under the EGP. OIEC objected to a change in depreciation rates, because Order No. 599558 (the last base rate order) involved a stipulation whereby the parties including OIEC agreed not to change depreciation rates until the next general rate case. OG&E has promised to file an application for a new general rate order after the end of this proceeding. As a result, I recommend that the Commission defer consideration of the stranded costs until the next general rate case.

Attorney Fees and Expert Witness Fees

OG&E seeks to set up a regulatory asset for attorney fees and expert witness fees. OG&E estimates those costs to be $1.5 million dollars. OIEC objected to regulatory asset treatment, because OG&E failed to present evidence showing that the professional rates charged are reasonable and that the time spent on each task was reasonable. OG&E stated that it will submit the necessary evidence in the next general rate case and that the Commission does not need to rule on the dollar amounts at this time. As a result, I recommend that the Commission defer the regulatory asset issue to the next general rate case.

Fuel Adjustment Clause

OG&E proposes to modify its Fuel Adjustment Clause ("FAC") tariff to include two new FERC accounts 502 and 548 to record and recover actual costs for AQCS consumables, which are products, such as limestone, powder activated carbon and ammonia. According to OG&E's witness Ms. Richard's Direct Testimony on page five, the proposed adjustments to the FAC range from $37.1 million dollars in 2016 to $153.4 million dollars in 2019. OG&E contends that it needs an automatic adjustment clause, because the cost of AQCS consumables is variable, i.e., dependent on the amount of electricity generated. OG&E contends

that recovery through base rates would mean a cycle of under and over recovery, while flowing related revenues and expenses through the FAC, which has a true-up provision, achieves a balance, which is fair to customers and OG&E investors. OG&E estimated unrecoverable expenses if the Commission fails to grant recovery now. However, I agree with OIEC that the FAC modification is beyond the scope of this proceeding. 17 O.S. §286 limits early cost recovery to capital costs. AQCS is not a capital cost. Next, under 17 O.S. §251, the FAC is limited to recovery of costs for fuel and purchased power, and AQCS consumables are not fuel. If OG&E wants an automatic adjustment clause for AQCS then OG&E should apply under the Commission's general rate making authority, i.e., in the next base rate case.

Recommendation

After review of the record, I recommend the following:

1.The Commission should not raise rates at this time.

2.For the Environmental Compliance Plan, the Commission should grant pre- approval of estimated costs for new equipment as set by contract, including installation costs covered by a contract. Any equipment or installation cost still being negotiated at the end of the evidentiary hearing is excluded but may be considered at the next general rate case. The Commission should postpone consideration of all other cost recovery issues until the next general rate case. My recommendation for pre-approval is subject to one condition, which is that Commission should direct OG&E to issue RFIs for at least 200 MWs of wind power within thirty days after issuance of a final order in this cause.

3.The Commission should direct the Commission's PUD Director to commence a general rate case.

4.The Commission should deny the Mustang Modernization. Plan.

|

| | |

Respectfully submitted, | | |

/s/ Ben Jackson | | 6/8/2015 |

Ben Jackson | Date | |

Administrative Law Judge | | |

| | |

XC: | | |

Commissioner Anthony | | |

Commissioner Murphy | | |

Commissioner Hiett | | |

Joseph Briley | | |

Teryl Williams | | |

Nicole King | | |

Kimber Shoop | | |

Natasha Scott | | |

Cheryl Vaught | | |

Jerry J. Sanger | | |

Thomas P. Schroedter | | |

Rick D. Chamberlain | | |

Ronald E. Stakem | | |

Jacquelyn Dill | | |

Lee Paden | | |

William L. Humes | | |

Deborah R. Thompson | | |

Kendall E. Parrish | | |

Michael Deceker | | |

Court Clerk | | |

Commission records | | |

OG&E Environmental Compliance Plan Overview and Status

*Anticipated Dates

1 Revised Response to Discovery Request OIEC 2-1 Dated March 10, 2015

2 Burch Rebuttal Testimony Page 17 line 31. (Total Is reflective of two units at $38MM/unit)

3 Burch Rebuttal Testimony Page 17 line 25

4 Burch Rebuttal Testimony Page 17 line 20

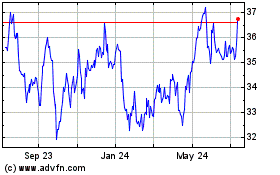

OGE Energy (NYSE:OGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

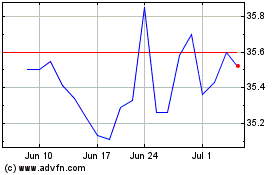

OGE Energy (NYSE:OGE)

Historical Stock Chart

From Apr 2023 to Apr 2024