OFG Bancorp (NYSE:OFG) today reported results for the third

quarter ended September 30, 2016.

3Q16 Highlights

- Net income available to shareholders

totaled $11.7 million, or $0.26 per share fully diluted,

compared to $10.9 million, or $0.25 per share fully diluted, in

2Q16. In the year ago quarter, OFG reported $1.1 million, or $0.03

per share fully diluted.

- Oriental Bank’s overall business

performance continued strong. New loan generation totaled

$226.8 million. Banking and wealth management fee revenues remained

level versus 2Q16. Retail and commercial deposits grew 2.2%. Net

new customer accounts continued to increase at a 4% annualized

rate.

- Major credit exposure

eliminated. As previously announced, Oriental Bank sold its

participation in a Puerto Rico Electric Power Authority (PREPA)

fuel line of credit, with the transaction settling after the

quarter end. The sale eliminated $183.0 million of non-performing

assets. As a result of the sale, a number of metrics used in

this release reflect the exclusion of the PREPA credit

facility.

- Credit quality remained stable, with

a meaningful improvement in net charge offs (NCOs), excluding

PREPA. NCOs declined to 1.15% from 1.21% in 2Q16 while

non-performing loan rates at 3.68% remained nearly level with 2Q16.

Separately, early and total delinquencies were below year-ago

levels.

- Capital continued to build.

Tangible book value per common share increased to $15.18 from

$14.96 in 2Q16. Tangible common equity ratio increased to 10.25%

from 9.92%.

- Net Interest Margin (NIM)

expanded to 4.95% from 4.69% in 2Q16. Excluding cost

recoveries, NIM rose to 4.70% from 4.64%.

- Costs remained under control.

The operating efficiency ratio improved to 57.69%, the best level

in the last five quarters, as a result of continued focus on

optimizing the expense base.

CEO Comment

José Rafael Fernández, President, Chief Executive Officer, and

Vice Chairman of the Board, commented: “OFG delivered another

strong quarter. Diluted EPS of $0.26 was slightly better than the

two prior quarters, and our Return on Average Assets at 0.91% and

Return on Average Tangible Common Stockholders' Equity at 7.06%

were the highest they’ve been in the last five quarters.

“We continue to deliver consistent earnings while being

proactive in our business development strategies and prudently

managing balance sheet risk. We are particularly pleased to have

found an optimal exit point for the PREPA credit facility. This

eliminated our single largest credit exposure and significantly

reduced our Puerto Rico government related exposures. It also

meaningfully increased our capital ratios and contributed to

improved credit quality through a major reduction in non-performing

loans.

“Oriental Bank’s franchise growth confirms the successful

customer differentiation achieved in our business delivery model,

emphasizing higher levels of advisory relationships and superior

levels of service.

“New loan generation was good, with solid yield expansion.

Retail and commercial deposits rose across all categories, due in

part to continued growth in net new customers. We have been able to

reduce borrowings, with an important reduction in interest expense

and positive contribution to NIM. Non-interest revenues and

expenses continue to be well managed, while Oriental seamlessly

assumed the servicing of its originated residential mortgage loans

portfolio.”

3Q16 Income Statement Highlights

The following compares data for the third quarter 2016 to the

second quarter 2016, unless otherwise noted.

- Interest Income from Loans rose

$2.9 million to $82.6 million. A large portion of the increase came

from a $2.2 million recovery from former Eurobank loans. While the

non-acquired portfolio grew, acquired loan portfolios continued to

run off.

- Interest Income from Securities

declined $0.3 million to $8.0 million, mainly due to lower balances

in the mortgage-backed securities (MBS) portfolio.

- Interest Expense declined $0.9

million to $13.7 million due to lower borrowings.

- Total Provision for Loan and Lease

Losses increased $9.0 million to $23.5 million. Provision for

non-acquired loans included $2.9 million towards the sale of the

PREPA credit and another $2.9 million for a single commercial loan.

Provision for BBVA PR acquired loans included $4.4 million for a

Puerto Rico Housing Finance Authority (PRHFA) loan, which now has a

carrying amount of $3.5 million or 31% of the unpaid principal

balance.

- Total Banking and Wealth Management

Revenues remained level at $18.3 million. Banking service fees

increased due to higher transaction volume. Mortgage banking

revenues grew, reflecting better mark to market on sales. Wealth

management remained level, excluding certain annual broker dealer

and insurance fees received in 2Q16.

- Other Gains reflected a $5.0

million recovery from a Bear Stearns claim of loss in 2009 from the

BALTA private label collateralized mortgage obligation.

- Total Non-Interest Expenses

increased $1.1 million to $54.9 million. Total operating expenses

were $0.4 million lower despite higher compensation expenses due to

the number of business days in the quarter as well as general and

administrative expenses for the servicing conversion initiative.

OREO related expenses increased $1.2 million as part of normal

activities.

- Income Tax Expense benefited

from a $0.3 million resolution of a contingent tax position as well

as from a reduction of the effective income tax rate, now estimated

at 26.0%.

September 30, 2016 Balance Sheet Highlights

The following compares data as of September 30, 2016 to June 30,

2016, unless otherwise noted.

- Total Loans Net Held for

Investment at $4.30 billion remained level.

- Total Investments declined $22.2

million to $1.30 billion, mainly due to prepayments in the MBS

portfolio.

- Total Puerto Rico Government Related

Exposure fell 50.0% to $202.4 million, when taking the sale of

PREPA into account. Balances now primarily consist of loans to the

five largest municipalities.

- Total Deposits increased $110.7

million to $4.75 billion across all categories, reflecting deposits

from new and existing clients. Excluding brokered deposits,

deposits increased $91.2 million.

- Total Borrowings declined $237.0

million to $800.3 million primarily due to net pay down of $200.5

million in FHLB advances and the maturity of a subordinated capital

note of $67.0 million.

- Total Stockholders’ Equity was

up $9.0 million to $924.9 million due to the increase in retained

earnings.

Credit Quality Highlights

The following compares data as of September 30, 2016 to June 30,

2016, unless otherwise noted.

- Net Charge-Off Rate (ex-PREPA)

at 1.15% fell 6 basis points due to declines in the auto and

commercial lending categories.

- Early Delinquency Rate was 3.70%

and total delinquency 6.92%, down 7 and 14 basis points,

respectively, from year ago levels due to proactive measures

implemented to deal with the economic environment.

- Non-Performing Loan Rate at

3.68% declined 541 basis points reflecting the sale of PREPA, but

was up only 12 basis points from the prior quarter ex-PREPA.

- Allowance for Loan and Lease

Losses fell $50.6 million to $62.2 million, also reflecting the

sale of PREPA. As a result, the loan loss reserve ratio to total

loans (excluding acquired loans) decreased to 2.06% from

3.53%.

Capital Position

The following compares data as of September 30, 2016 to June 30,

2016, unless otherwise noted.

Regulatory capital ratios continued to be significantly above

requirements for a well-capitalized institution.

- Tangible Common Equity to Total

Tangible Assets at 10.25% increased 33 basis points to the

highest level in five quarters.

- Common Equity Tier 1 Capital

Ratio (using Basel III methodology) increased to 13.34% from

12.64%.

- Total Risk-Based Capital Ratio

increased to 18.73% from 18.00%.

Conference Call

A conference call to discuss OFG’s results for the third quarter

2016, outlook and related matters will be held today, Friday,

October 21, 2016 at 10:00 AM Eastern Time. The call will be

accessible live via a webcast on OFG’s Investor Relations website

at www.ofgbancorp.com. A webcast replay will be available shortly

thereafter. Access the webcast link in advance to download any

necessary software.

Financial Supplement

OFG’s Financial Supplement, with full financial tables for the

third quarter ended September 30, 2016, can be found on the

Webcasts, Presentations & Other Files page, on OFG’s Investor

Relations website at www.ofgbancorp.com.

Non-GAAP Financial Measures

In addition to our financial information presented in accordance

with GAAP, management uses certain “non-GAAP financial measures”

within the meaning of the SEC Regulation G, to clarify and enhance

understanding of past performance and prospects for the future. See

Tables 9-1 and 9-2 in OFG’s above-mentioned 3Q16 Financial

Supplement for reconciliation of GAAP to non-GAAP Measures and

Calculations.

Forward Looking Statements

The information included in this document contains certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on management’s current expectations and involve certain

risks and uncertainties that may cause actual results to differ

materially from those expressed in the forward-looking

statements.

Factors that might cause such a difference include, but are not

limited to (i) the rate of growth in the economy and employment

levels, as well as general business and economic conditions; (ii)

changes in interest rates, as well as the magnitude of such

changes; (iii) a credit default by the government of Puerto Rico;

(iv) the fiscal and monetary policies of the federal government and

its agencies; (v) changes in federal bank regulatory and

supervisory policies, including required levels of capital; (vi)

the relative strength or weakness of the consumer and commercial

credit sectors and of the real estate market in Puerto Rico; (vii)

the performance of the stock and bond markets; (viii) competition

in the financial services industry; and (ix) possible legislative,

tax or regulatory changes.

For a discussion of such factors and certain risks and

uncertainties to which OFG is subject, see OFG’s annual report on

Form 10-K for the year ended December 31, 2015, as well as its

other filings with the U.S. Securities and Exchange Commission.

Other than to the extent required by applicable law, including the

requirements of applicable securities laws, OFG assumes no

obligation to update any forward-looking statements to reflect

occurrences or unanticipated events or circumstances after the date

of such statements.

About OFG Bancorp

Now in its 52nd year in business, OFG Bancorp is a diversified

financial holding company that operates under U.S. and Puerto Rico

banking laws and regulations. Its three principal subsidiaries,

Oriental Bank, Oriental Financial Services and Oriental Insurance,

provide a full range of commercial, consumer and mortgage banking

services, as well as financial planning, trust, insurance,

investment brokerage and investment banking services, primarily in

Puerto Rico, through 48 financial centers. Investor information can

be found at www.ofgbancorp.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161021005334/en/

For OFG BancorpPuerto Rico:Idalis Montalvo,

787-777-2847idalis.montalvo@orientalbank.comorUS:Steven

Anreder and Gary Fishman,

212-532-3232sanreder@ofgbancorp.comgfishman@ofgbancorp.com

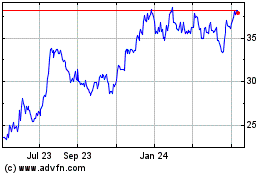

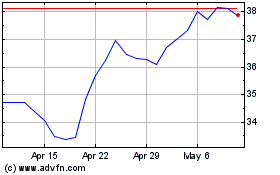

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024