OFG Bancorp (NYSE:OFG) today reported results for the first

quarter ended March 31, 2016.

1Q16 Highlights

- Net income available to shareholders

amounted to $10.7 million, or $0.24 per share fully diluted. This

compares to a loss of $4.4 million, or ($0.10) per share, in the

preceding quarter, and a loss of $6.5 million, or ($0.14) per

share, in the same quarter a year ago.

- Oriental Bank’s retail franchise

continued to grow. New loan generation at $226 million, with

commercial lending leading the way, remained at high levels. Total

customers increased in excess of a 4.0% annualized rate from

December 31, 2015.

- Credit quality continued to improve.

Net charge-offs of loans (excluding acquired loans) declined to

1.30% from 1.67% in 4Q15. The provision for loan losses fell 18.6%

from 4Q15’s adjusted amount (see Table 1). Early and total

delinquency rates declined below both the previous and year-ago

quarters.

- Puerto Rico investment securities

balance fell 62.2% to $6.7 million, reflecting the sale of $12.8

million (average yield of 6.60%) in securities of the Puerto Rico

Industrial Development Company (PRIDCO) and the Puerto Rico Public

Buildings Authority (PBA).

- Net Interest Margin (NIM) expanded to

4.67%, reflecting better yields on interest earning assets.

- Tangible book value per common share

increased to $14.68 from $14.53, and tangible common equity (TCE)

ratio increased to 9.50% from 9.10%.

CEO Comment

José Rafael Fernández, President, Chief Executive Officer, and

Vice Chairman of the Board, commented:

“We are pleased with our first quarter results. This is

particularly so after a tough 2015 in which we had to deal with the

termination of our commercial share loss agreement with the FDIC

and other de-risking actions.

“During the quarter, Oriental Bank originated $226 million in

new loans, while maintaining our traditional discipline in credit

and pricing standards. In addition, we continued to introduce

innovative features for our retail clients, such as Cardless Cash

mobile phone ATM access—another first for Oriental Bank in Puerto

Rico.

“The bank capitalized on market conditions to partially unwind a

high-rate repurchase agreement, and to sell our PRIDCO and PBA

securities and certain of our mortgage-backed securities (MBS). The

aggregate gains and losses had no impact on the 1Q16 income

statement, but will help to improve NIM going forward.

“Of note was our reduced credit costs and operating expenses.

The active management of retail credit has improved results with

lower charge-off levels and provisions, and steady enhancement in

our credit metrics. We continue to closely monitor these trends

given the uncertainty regarding Puerto Rico’s fiscal situation.

“Last year’s rightsizing efforts are evident in our reported

non-interest expenses. The efficiency ratio improved from the

previous quarter to 59.56%, the lowest since 1Q15, and is

approaching our high 50s% target.”

1Q16 Income Statement Highlights

The following compares GAAP Results for the first quarter 2016

to GAAP and Non-GAAP Adjusted Results the fourth quarter 2015.

There are no Non-GAAP Adjustments in 1Q16.

Table 1

Quarter ended

December 31, 2015 March 31, 2016 Actual

Results Quarter Specific Adjusted Results

Actual Results

(Dollars in thousands, except per share

data) (unaudited)

(US GAAP) Items(1) (Non-GAAP)

(US GAAP)(2)

Interest income

$ 92,907 - 92,907

$

91,306 Interest expense

(17,285) -

(17,285)

(16,331) Net interest income

75,622 - 75,622

74,975 Provision for loan and lease

losses, excluding acquired loans

(45,012) (30,345) (14,667)

(10,660) Provision for acquired BBVAPR loan and lease losses

(7,332) (4,900) (2,432)

(2,324) (Recapture) provision

for acquired Eurobank loan and lease losses

154

- 154

(805) Total provision for loan

and lease losses, net (52,190) (35,245)

(16,945)

(13,789)

Net interest income after provision for

loan and lease losses

23,432 (35,245) 58,677

61,186 Banking and wealth

management revenues

19,349 - 19,349

17,125

Other-than-temporary impairment losses on investment securities

(1,244) (1,244) -

- FDIC shared-loss expense, net

(4,400) (1,589) (2,811)

(4,029) Gain on FDIC

shared-loss coverage in sale of loans

- - -

- Other

(losses) gains, net

565 - 565

407 Total non-interest income

14,270 (2,833) 17,103

13,503 Compensation and

employee benefits

(18,717) - (18,717)

(20,284) Rent

and occupancy costs

(8,111) - (8,111)

(7,822) General

and administrative expenses

(31,714) (1,462)

(30,252)

(26,751) Total non-interest

expense (58,542) (1,462) (57,080)

(54,857) Income before taxes (20,840)

(39,540) 18,700

19,832 Income tax expense (benefit)

(19,863) 6,171

5,661 Net income

(977) 12,529

14,171 Preferred stock dividends

(3,466) (3,466)

(3,465) Net income

(loss) available to common shareholders $ (4,443)

$ 9,064

$ 10,706 Earnings (loss) per common

share - basic $ (0.10) $

0.21 $

0.24 Earnings (loss) per common share - diluted

$ (0.10) $

0.21 $ 0.24

(1) 4Q15 results included the following quarter specific items:

($30.4) million provision related to the PREPA line, ($4.9) million

impairment during the annual recasting of a BBVA PR loan pool,

($1.5) million in legal fees related to PREPA’s restructuring,

($1.6) million in a final settlement with the FDIC related to the

expiration of the commercial loss sharing agreement, ($1.2) million

in OTTI, and a $19.9 million tax benefit.

(2) 1Q16 Other Gains (Losses) included the effect of the

following transactions: (i) $16.1 million gain on the sale of

$272.1 million (average yield of 3.00%) of MBS; (ii) $12.0 million

cost of unwinding $268.0 million (average rate of 4.78%) in

repurchase agreements; and (iii) loss of $4.1 million on the sale

of $12.8 million (average yield of 6.60%) of PRIDCO and PBA

securities. The aggregate gains and losses had no impact on the

1Q16 income statement.

Adjusted for the above-listed factors:

- Interest Income declined $1.6

million to $91.3 million. This was due to lower balances in BBVA PR

acquired loans and in the investment securities portfolio,

partially offset by higher interest income from a greater volume of

originated loans, higher yields on cash equivalents due to higher

market rates, and higher yields on some BBVA PR loans due to better

cash flows experienced in recent quarters.

- Interest Expense declined $1.0

million to $16.3 million. This reflected the previously mentioned

unwinding of repurchase agreements, partially offset by higher

balances and costs for brokered CDs.

- Total Provision for Loan and Lease

Losses declined $3.2 million on an adjusted basis to $13.8

million. This was primarily due to lower net charge-off

levels.

- Net Interest Margin increased to

4.67% from 4.55% reflecting the reasons mentioned above.

- Total Banking and Wealth Management

Revenues declined $2.2 million on an adjusted basis to $17.1

million. Client trading volumes in our broker-dealer continued to

fall due to the uncertainty in the Puerto Rico market.

- FDIC Shared-Loss Expense,

Net increase of $1.2 million on an adjusted basis to reflect

prior valuation changes in the covered mortgage portfolio.

- Total Non-Interest Expenses

declined $2.2 million on an adjusted basis to $54.9 million. This

was primarily due to lower general and administrative expenses,

partially offset by investments in customer technology.

- Effective Income Tax Rate was

forecasted at approximately 29% for the near-term, including this

quarter.

March 31, 2016 Balance Sheet Highlights

The following compares data as of March 31, 2016 to December 31,

2015 unless otherwise noted.

- Total loans declined to $4.36

billion from $4.43 billion, as originated loans partially offset

outflows in acquired loans.

- Total investments declined to

$1.33 billion from $1.62 billion due to the previously mentioned

sale of MBS and prepayments of mortgage-backed securities.

- Puerto Rico central government and

public corporation loan balances fell 6.5% to $198.2 million.

Loans to Puerto Rico municipalities remained nearly level at $203.6

million. As previously mentioned, Puerto Rico investment securities

balances came down 62.2% to $6.7 million.

- Total deposits increased to

$4.78 billion from $4.72 billion due to higher demand deposits

partially offset by lower short-term brokered balances.

- Total borrowings declined to

$1.1 billion from $1.37 billion due to the previously mentioned

unwinding of a repurchase agreement.

- Total stockholders’ equity

increased to $903.8 million from $897.1 million, reflecting an

increase in retained earnings, partially offset by a decline in

accumulated other comprehensive income, net.

Credit Quality Highlights

The following compares data for the first quarter 2016 to the

fourth quarter 2015 unless otherwise noted.

- Net charge-off (NCO) rate at

1.30% fell 37 basis points, chiefly due to a large decline in the

commercial lending category as compared to 4Q15 when commercial

lending NCOs increased due to one loan.

- Early delinquency rate continued

to fall to 3.51%, its lowest level in the last five quarters, due

to measures taken to proactively manage the effects of the economic

environment.

- Non-performing loan rate at

9.58% declined 16 basis points with our favorable experience in

commercial, auto and mortgage lending offsetting a small increase

from consumer lending.

- Allowance for loan and lease

losses increased $0.6 million to $113.2 million. Coverage of

loans (excluding acquired loans) increased to 3.63% from

3.62%.

Capital Position

The following compares data for the first quarter 2016 to the

fourth quarter 2015.

Regulatory capital ratios continued to be significantly above

requirements for a well-capitalized institution.

- Tangible common equity to total

tangible assets at 9.50% increased 40 basis points.

- Common Equity Tier 1 Capital Ratio

(using Basel III methodology) increased to 12.33% from

12.15%.

- Total risk-based capital ratio

increased to 17.67% from 17.30%.

Conference Call

A conference call to discuss OFG’s results for the first quarter

2016, outlook and related matters will be held today, Friday, April

22, at 10:00 AM Eastern Time. The call will be accessible live via

a webcast on OFG’s Investor Relations website at

www.ofgbancorp.com. A webcast replay will be available shortly

thereafter. Access the webcast link in advance to download any

necessary software.

Financial Supplement

OFG’s Financial Supplement, with full financial tables for the

first quarter ended March 31, 2016, can be found on the Webcasts,

Presentations & Other Files page, on OFG’s Investor Relations

website at www.ofgbancorp.com.

Non-GAAP Financial Measures

In addition to our financial information presented in accordance

with GAAP, management uses certain “non-GAAP financial measures”

within the meaning of the SEC Regulation G, to clarify and enhance

understanding of past performance and prospects for the future.

Forward Looking Statements

The information included in this document contains certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on management’s current expectations and involve certain

risks and uncertainties that may cause actual results to differ

materially from those expressed in the forward-looking

statements.

Factors that might cause such a difference include, but are not

limited to (i) the rate of growth in the economy and employment

levels, as well as general business and economic conditions; (ii)

changes in interest rates, as well as the magnitude of such

changes; (iii) a credit default by the government of Puerto Rico;

(iv) the fiscal and monetary policies of the federal government and

its agencies; (v) changes in federal bank regulatory and

supervisory policies, including required levels of capital; (vi)

the relative strength or weakness of the consumer and commercial

credit sectors and of the real estate market in Puerto Rico; (vii)

the performance of the stock and bond markets; (viii) competition

in the financial services industry; and (ix) possible legislative,

tax or regulatory changes.

For a discussion of such factors and certain risks and

uncertainties to which OFG is subject, see OFG’s annual report on

Form 10-K for the year ended December 31, 2015, as well as its

other filings with the U.S. Securities and Exchange Commission.

Other than to the extent required by applicable law, including the

requirements of applicable securities laws, OFG assumes no

obligation to update any forward-looking statements to reflect

occurrences or unanticipated events or circumstances after the date

of such statements.

About OFG Bancorp

Now in its 52nd year in business, OFG Bancorp is a diversified

financial holding company that operates under U.S. and Puerto Rico

banking laws and regulations. Its three principal subsidiaries,

Oriental Bank, Oriental Financial Services and Oriental Insurance,

provide a full range of commercial, consumer and mortgage banking

services, as well as financial planning, trust, insurance,

investment brokerage and investment banking services, primarily in

Puerto Rico, through 48 financial centers. Investor information can

be found at www.ofgbancorp.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160422005484/en/

Puerto Rico:Alexandra López,

787-522-6970allopez@orientalbank.comorUS:Steven Anreder and

Gary Fishman,

212-532-3232sanreder@ofgbancorp.comorgfishman@ofgbancorp.com

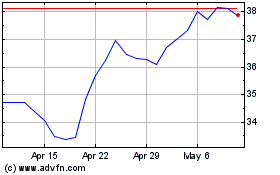

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

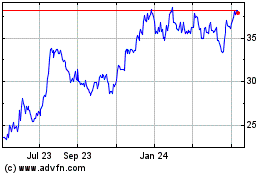

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024