OFG Bancorp (NYSE:OFG) today reported results for the first

quarter ended March 31, 2015.

1Q15 Highlights

- Income available to common shareholders

was a loss of $6.5 million, or ($0.14) per share, which includes a

previously announced provision of ($0.35) per share net of

tax.

- Excluding this, income was $9.4

million, or $0.21 per share diluted. Results compare to $17.1

million, or $0.36 per share diluted, in the preceding quarter, and

$20.3 million, or $0.42 per share diluted, in the year ago

quarter.

- The quarter was adversely affected by:

- $24.0 million provision related to

placing on non-accrual status a 7.5%, $200 million participation in

a fuel purchase line of credit with the Puerto Rico Electric Power

Authority (PREPA), a government utility.

- $7.9 million less in loan interest

income, primarily due to lower acquired balances and yields. This

includes a $1.7 million decline from fewer days and lower cost

recoveries 1Q15 versus 4Q14.

- $4.8 million in provisions for covered

loans, increasing the allowance to $70.7 million. The commercial

loss share coverage with the FDIC is coming to an end on June 30,

2015.

- However, net interest margin continued

strong at 5.42%.

- Continued growth of the Oriental Bank

franchise through the opening of 7,670 net new retail deposit

accounts, reduction in cost of total deposits, core non-interest

fee revenue strength, and major expansion of its ATM network.

- Efficiency ratio in our target range at

51.75%, and improved credit, with declines in net charge offs and

total delinquencies.

- Tangible book value and book value per

common share declined slightly from December 31, 2014, to $15.12

and $17.25, respectively.

CEO Comment

José Rafael Fernández, President, Chief Executive Officer, and

Vice Chairman of the Board, commented:

“We’re clearly disappointed at being forced to take a provision

against our PREPA credit, especially in light of our analysis that

multiple ways exist for the government utility to repay its debts.

Likewise, we remain concerned about the challenges businesses are

forced to face in Puerto Rico’s heavily taxed, underperforming

economy.

“On the plus side, we continued to grow Oriental Bank’s core

franchise serving the commercial and consumer sectors. We prudently

originated quality loans with strong pricing discipline. Despite

normal reductions in our high-yielding acquired loan portfolios,

our NIM at 5.42% and efficiency ratio at less than 52% are among

the best in the industry. Additionally, Oriental’s retail deposit

base and mortgage business are benefiting from successful marketing

attracting an influx of new customers.

“Our outlook for 2015 calls for preserving our performance

metrics and diligently managing expenses, albeit with a decline in

earning assets and NIM. Most of the FDIC indemnification asset

amortization will end in the second half, helping to offset reduced

interest income from acquired loans.

“Operationally, we remain focused on building the Oriental

franchise and further affirming our reputation as the best bank in

Puerto Rico. We will continue to expand our customer base, deepen

client relationships, and differentiate ourselves in terms of

service and innovation.

“Our ultimate goals remain the same: maximize our profitability

and capital; preserve our flexibility to pursue strategic

alternatives; and deploy our strong capital base to increase

shareholder return in a sustainable manner, as we have done

before.”

1Q15 Income Statement Highlights

The following compares data for the first quarter 2015 to the

fourth quarter 2014 unless otherwise noted.

- Total interest income from loans

declined $7.9 million to $97.5 million, reflecting above mentioned

factors and the transition in our loan portfolio as originated

loans with more normal yields grew at a slower pace than

higher-yielding acquired loans fell, due to repayments and

maturities.

- Originated loans: Interest

income increased modestly to $46.3 million as balances grew 2.4%

and yield expanded 4 basis points to 6.63%.

- Acquired non-covered loans:

Interest income fell $4.0 million to $35.7 million as balances

declined 5.6% and yield compressed 23 basis points to 8.58%.

- Covered loans: Interest income

fell $4.3 million to $15.5 million as balances declined 9.3% and

yield reduced 306 basis points to 22.89%.

- Investment securities interest

income declined $1.0 million to $9.5 million. This primarily

reflects higher premium amortization on existing securities.

- Deposit interest expense fell

$1.0 million to $7.1 million. We continued to improve the funding

profile with increases in lower cost demand and savings deposits

and decreases in higher cost time and brokered deposits.

- Borrowing interest expense fell

$0.4 million to $10.3 million. This reflects the use of excess cash

to pay down $52.8 million in maturing wholesale funding

mid-1Q15.

- Provision for loan and lease

losses excluding PREPA increased $1.3 million to $18.2 million,

primarily due to a $3.5 million increase for covered loans.

- Total core non-interest income

declined $1.8 million to $19.2 million. This reflects the absence

of approximately $1.0 million in year-end recognition of insurance

commissions in 4Q14. In addition, broker dealer commissions were

lower due to subdued client trading activity.

- FDIC indemnification asset

amortization increased $1.1 million to $13.1 million in line

with plans for the year. The indemnification asset was $75.2

million at March 31, 2015 versus $97.4 million at December 31,

2014.

- Non-interest expenses fell $5.6

million, to $56.3 million. This reflects decreased costs in all

major categories as well as reduced accruals from 4Q14. In 1Q15,

two branches were consolidated as planned.

- The effective income tax rate

excluding the PREPA provision was 41.58%. For the year, the rate is

expected to be about 36.5%.

1Q15 Business Activity Highlights

The following compares data for the first quarter 2015 to the

fourth quarter 2014 unless otherwise noted.

- Total new loan production (excluding

renewals) increased slightly to $239.4 million. Growth in the

commercial and residential mortgage categories offset declines in

auto and consumer.

- Commercial production increased

2.7% to $85.7 million with a good pipeline for the rest of the

year.

- Residential mortgage production,

most of which is sold into the secondary market, increased 7.8% to

$61.7 million. With one less player in the market, Oriental

continued to expand its share.

- Auto loan production declined

4.9% to $65.9 million. This reflects increased competition from the

captive finance arms of manufacturers, and our own initiative to

increase FICO score requirements to improve credit.

- Consumer loan production

declined 9.5% to $26.2 million, reflecting seasonal trends.

- Cost of deposits declined 7

basis points to 0.70%, and 22 basis points from 0.92% in 1Q14.

- Core retail deposits (demand and

savings) increased 2.2% to $3.4 billion, representing 68.7% of

total deposits versus 66.8% in 4Q14 and 63.4% in 1Q14.

- Subsequent to 1Q15, Oriental expanded

its ATM network 34% to 332 units, making it the second largest in

Puerto Rico with the placement of machines in 72 Walgreens and 13

other retail locations.

March 31, 2015 Balance Sheet Highlights

The following compares data as of March 31, 2015 to December 31,

2014 or for the first quarter 2015 to the fourth quarter 2014

unless otherwise noted.

- Cash and cash equivalents

increased 19.3% to $694.3 million, primarily from repayments of

loans and investment securities.

- Average interest earning assets

of $6.7 billion declined 1.6%. Originated loans increased 2.4%, or

$67.1 million. Acquired loans declined 6.1%, or $128.8 million, due

to scheduled maturities and a reduction of government loan

balances. Investment securities declined 4.7%, or $65.8 million,

primarily due to repayments.

- Puerto Rico government related loans

and securities contractual balances declined $26.7 million to

$626.0 million. This was primarily due to a $25.0 million partial

repayment of a contractual obligation by the Puerto Rico Aqueduct

and Sewer Authority (PRASA). Year over year, PR government related

loans and securities shrunk 19.6% from $778.3 million at March 31,

2014.

- Total stockholders’ equity

declined $5.8 million to $936.4 million. This primarily reflects

the decrease in retained earnings partially offset by an increase

in other comprehensive income.

Credit Quality Highlights

The following compares data for the first quarter 2015 to the

fourth quarter 2014 unless otherwise noted. This also excludes

acquired loans and the PREPA credit and its provision.

- Net charge offs declined

slightly to $8.6 million as we continue to adjust our collection

efforts to evolving credit trends.

- Total delinquency declined 39

basis points to 8.60% primarily due to improvements in mortgage and

auto portfolios.

- Nonperforming loans increased

$4.8 million, primarily due to $7.9 million inflows in the form of

repurchases from GSEs, as well as TDRs, in mortgages.

- Allowance for loan and lease

losses increased $1.3 million to $52.8 million.

Capital Position

The following compares data for the first quarter 2015 to the

fourth quarter 2014.

Regulatory capital ratios continued to be significantly above

requirements for a well-capitalized institution.

- Tangible common equity to total

tangible assets increased to 9.29% from 9.25% based on a 0.8%

decrease in tangible common equity to $675.2 million and a 1.1%

decline in tangible assets to $7.3 billion.

- Common Equity Tier 1 Capital Ratio

(using Basel III methodology) was 12.63%.

- Total risk-based capital ratio

increased to 17.69% from 17.57% based on a 4.2% increase in total

risk-based capital to $887.0 million and a 3.5% increase in total

risk weighted assets to $5.0 billion.

Conference Call

A conference call to discuss OFG’s results for the first quarter

2015, outlook and related matters will be held today, Friday, April

24, 2015 at 10:00 AM Eastern Time. The call will be accessible live

via a webcast on OFG’s Investor Relations website at

www.ofgbancorp.com. A webcast replay will be available shortly

thereafter. Access the webcast link in advance to download any

necessary software.

Financial Supplement

OFG’s Financial Supplement, with full financial tables for the

first quarter ended March 31, 2015, can be found on the Webcasts,

Presentations & Other Files page, on OFG’s Investor Relations

website at www.ofgbancorp.com.

Forward Looking Statements

The information included in this document contains certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on management’s current expectations and involve certain

risks and uncertainties that may cause actual results to differ

materially from those expressed in the forward-looking

statements.

Factors that might cause such a difference include, but are not

limited to (i) the rate of growth in the economy and employment

levels, as well as general business and economic conditions; (ii)

changes in interest rates, as well as the magnitude of such

changes; (iii) a credit default by the government of Puerto Rico;

(iv) the fiscal and monetary policies of the federal government and

its agencies; (v) changes in federal bank regulatory and

supervisory policies, including required levels of capital; (vi)

the relative strength or weakness of the consumer and commercial

credit sectors and of the real estate market in Puerto Rico; (vii)

the performance of the stock and bond markets; (viii) competition

in the financial services industry; and (ix) possible legislative,

tax or regulatory changes.

For a discussion of such factors and certain risks and

uncertainties to which OFG is subject, see OFG’s annual report on

Form 10-K for the year ended December 31, 2014, as well as its

other filings with the U.S. Securities and Exchange Commission.

Other than to the extent required by applicable law, including the

requirements of applicable securities laws, OFG assumes no

obligation to update any forward-looking statements to reflect

occurrences or unanticipated events or circumstances after the date

of such statements.

About OFG Bancorp

Now in its 51st year in business, OFG Bancorp is a diversified

financial holding company that operates under U.S. and Puerto Rico

banking laws and regulations. Its three principal subsidiaries,

Oriental Bank, Oriental Financial Services and Oriental Insurance,

provide a full range of commercial, consumer and mortgage banking

services, as well as financial planning, trust, insurance,

investment brokerage and investment banking services, primarily in

Puerto Rico, through 53 financial centers and 332 ATMs. Investor

information can be found at www.ofgbancorp.com.

OFG BancorpPuerto Rico:Alexandra López,

787-522-6970allopez@orientalbank.comorUS:Anreder&

CompanySteven Anreder, steven.anreder@anreder.comGary Fishman,

gary.fishman@anreder.com212-532-3232

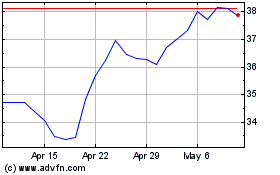

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

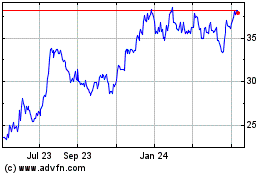

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024