SNL Financial:JP Morgan,BofA,Wells Fargo Tops In Foreclosed Home Loans

October 12 2010 - 3:58PM

Dow Jones News

The banks with the largest dollar amounts of foreclosed home

loans on their books are J.P. Morgan Chase (JPM), Bank of America

(BAC) and Wells Fargo & Co. (WFC), according to analyst firm

SNL Financial.

Several large banks, including J.P. Morgan and Bank of America,

have instituted widespread foreclosure halts due to worries about

documentation problems. The halts come at a time when many of the

biggest lenders are struggling to work through the non-performing

assets still weighing on their books.

J.P. Morgan has $19.5 billion, or 7.5% of its 1- to 4-family

mortgage loans, in foreclosure, according to data from SNL. Bank of

America has $18.7 billion, or 4.39%, and Wells Fargo has $17.5

billion, or 4.74%.

The three big mortgage lenders have billions more in servicing

rights on loans in foreclosure. Bank of America has $88 billion of

loans it services for other lenders where the properties are in

foreclosure; J. P. Morgan has $54.5 billion and Wells Fargo has

$36.4 billion. The data are as of June 30.

State regulators and federal lawmakers are demanding banks halt

foreclosures while they probe allegations of abusive practices by

lenders and loan servicers, including improper reviews of

borrowers' files and problems with documentation. The Wall Street

Journal reported that as many as 40 state attorneys general are set

to announce an investigation into the mortgage servicing industry

on Wednesday.

Bank of America has already agreed to stop the process in 50

states. J.P. Morgan stopped foreclosures in 23 states and will

expand it to a few other states. Wells Fargo and USBancorp (USB)

said last week they would not stop foreclosures. Ally Financial has

suspended evictions and foreclosure sales in 23 states. Goldman

Sachs Group Inc. (GS), which doesn't appear in SNL's data, has

suspended foreclosures through its Litton Loan Servicing unit in an

undisclosed number of states until it completes a review of its

documents.

A J.P. Morgan spokesman said, "We have requested that the courts

not enter judgements in pending matters until we complete our

review" of foreclosure documents. An Ally spokeswoman confirmed the

suspensions. A Litton Loan spokeswoman would not provide more

details. Spokesmen for Bank of America and Wells Fargo did not have

an immediate comment.

A spokesman for USBancorp, in an email, said, "We do not have

plans to halt foreclosures."

SNL ranked Barclays (BCS, BARC.LN), New York Private Bank &

Trust Corp. and Ally as the lenders with the highest percentage of

their 1- to 4-family home loans in foreclosure. According to its

data, Barclays has $495 million, or 17.7% of its 1- to 4-family

loans in foreclosure proceedings, New York Private Bank has $378

million, or 12.05%, and Ally has $2.1 billion, or 10.16%.

Barclays says it sold its HomeEq mortgage servicing operation to

Ocwen Financial Corp. (OCN) last month, making Ocwen the third

largest U.S. subprime servicer.

A spokesman for New York Private Bank, which is controlled by

real estate investor Howard Milstein and family, said the company

expects losses on its portfolio to be minimal, and added, "we do

not service any securitized debt, but only mortgages which we

originated for our own portfolio."

Others in the top ten with the largest percentage of foreclosed

loans are HSBC North America, with 9% of its 1- to 4-family loans

in foreclosure, and MetLife Inc. (MET), with 6.44%. Several of the

top ten were focused on Puerto Rico, where the economy began

slipping before it did in the U.S.: Doral GP Ltd. (DRL) has 8.58%

of its 1- to 4-family loans in foreclosure; First BanCorp Puerto

Rico (FBP) has 7.06%; Oriental Financial Group (OFG) has 6.42%, and

Banco Bilbao Vizcaya Argentaria S.A.'s (BBVA) Puerto Rico operation

has 6.21%. JP Morgan is also in the top ten with the largest

percentage of foreclosed loans.

-By Liz Moyer, Dow Jones Newswires; 212-416-2512;

liz.moyer@dowjones.com

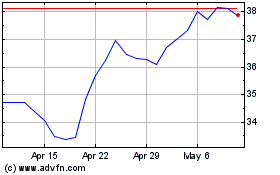

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

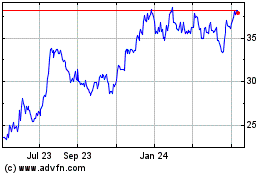

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024