FDIC Faces '3-D Tic-Tac-Toe' In Puerto Rico Banking Crisis

April 08 2010 - 3:51PM

Dow Jones News

The Federal Deposit Insurance Corp. faces a daunting task in

finding a solution for the broken banks in Puerto Rico that doesn't

damage the surviving banks or the island's economy.

The FDIC is trying to minimize its potential loss from three

weak Puerto Rican banks by drumming up interest among banks and

private equity investors in buying W Holding Co Inc.'s (WHI)

Westernbank, R&G Financial Corp.'s (RGFC) R-G Premier Bank, and

EuroBancshares Inc.'s (EUBK) EuroBank, according to several people

familiar with the matter. All three banks are in dire financial

condition; closing them could cost the FDIC insurance fund as much

as $10 billion, based on worst-case losses from recent bank

failures.

None of the banks returned phone calls requesting comment.

The FDIC hired Deutsche Bank AG (DB, DBK.XE) for advice, and the

agency itself is marketing the three banks aggressively to

potential buyers, according to several people familiar with the

matter. The FDIC is hoping to find a solution by April 30, two

people familiar with the matter said.

Not since the savings-and-loan crisis has the FDIC faced such a

steep challenge in a specific banking market, and one as isolated

as Puerto Rico. The three banks in danger of failing have a total

of $21 billion in assets and hold 30% of the island's deposits.

The goal is to strengthen the island's remaining banks--an aim

at the intersection of the FDIC's mandate to protect its funds, and

political interests that would prefer that Puerto Rican banks

swallow the three institutions in danger of failing.

"The end result must be that we have a smaller number of

players, but solid players, that will be lending" in Puerto Rico,

said Pedro Pierluisi, who is the island's nonvoting representative

in Congress. "But if you are as challenged as we are, we should

welcome investment" from foreign banks or mainland investors, he

said.

Puerto Rico has been in a deep recession since 2006, when the

government's fiscal imbalances led the economy into a tailspin.

Popular Inc. (BPOP), Oriental Financial Group Inc. (OFG), Doral

Financial Corp. (DRL), First Bancorp. (FBP), all local Puerto Rican

banks, have expressed interest in expanding on the island through

acquisition.

The surviving Puerto Rican banks, however, "are not in the

greatest shape. Each has its own issue do deal with," said John

Douglas, a partner with law firm Davis Polk & Wardwell, and

former FDIC general counsel.

Oriental recently raised $100 million that it said could be used

to acquire a failed bank. Popular could easily raise $500 million,

said Amanda Larsen, an analyst with Raymond James &

Associates.

Meanwhile, "anybody of any size" among mainland private equity

investors "is taking a look," one lawyer said, "with clear eyes and

fully understanding the risk."

Douglas said he has had clients "kicking the tires," but "it's

hard to gauge what [the interest] will amount to."

One person familiar with the matter said, "Everybody leaves [the

island] shrugging their shoulders."

The biggest problem for banks in Puerto Rico is soured real

estate construction loans. Bank failures could lead to further

writedowns of real estate assets, which could further damage the

island's real estate market and hamper lending.

One tough wrinkle: Foreclosing on delinquent owner-occupied real

estate loans would lead to more unemployment. For almost 15% of

Westernbank's $4 billion in owner-occupied real estate loans,

collection is uncertain, according to the bank's most recent

regulatory filings.

Finding a solution for the island's banks is "three-dimensional

tic-tac-toe," said one lawyer who represents potential

investors.

The FDIC could bundle several banks together, strip out their

troubled assets into a separate "bad bank," and sell those assets

separately. Sources familiar with the matter said such a structure

has come up in discussions between the FDIC and potential bidders,

but bundling three sick banks into one bigger bank may not make the

FDIC's task of finding buyers for the banks any easier.

A big market share in Puerto Rico may not be enough to entice

buyers. Puerto Rico "is not a growth area," said Gerald Ford, a

private equity investor hunting for failed banks, who looked at

Puerto Rican banks in the past. "I don't think we'd be

interested."

Pierluisi said, "Puerto Rico has a lot of potential," but

resolving the banking problems "is indispensible for the

development of the economy."

-By Matthias Rieker, Dow Jones Newswires; 212-416-2471;

matthias.rieker@dowjones.com

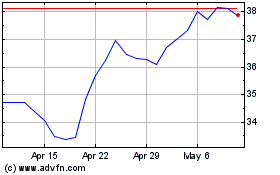

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

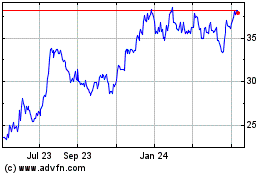

OFG Bancorp (NYSE:OFG)

Historical Stock Chart

From Apr 2023 to Apr 2024