UPDATE -- Ocwen Hosts Seventh Annual Housing Advocacy and Policy Forum

May 18 2016 - 5:41PM

Ocwen Financial Corporation (NYSE:OCN), a leading financial

services holding company, hosted its seventh annual Housing

Advocacy and Policy Forum on Wednesday, May 18, 2016 in Washington,

D.C. The day-long event brought together Ocwen leadership,

government agency officials, and representatives from housing

nonprofits to share insights and explore solutions to challenges

that continue to exist in the aftermath of the nation’s housing

crisis, including access to credit and community

stabilization.

Ron Faris, President and CEO of Ocwen, and Phyllis Caldwell,

Chair of Ocwen’s Board of Directors, updated attendees on corporate

developments, including proactive new leadership under a largely

new Board of Directors. “Major investments in technology, risk

management and compliance have been instituted and have begun to

show tangible results,” stated Ms. Caldwell. “These investments lay

the foundation to better serve our 1.5 million customers and to

aggressively pursue our new vision for growth.”

Access to affordable mortgage credit continues to dominate

policy discussions across the country. Panelists Barry Zigas, from

the Consumer Federation of America, Danny Gardner, from Freddie

Mac, and Gerron Levi, representing the National Community

Reinvestment Coalition, participated in a panel discussion on the

current state of homeownership. The discussion focused on market

dynamics that prevent families from achieving homeownership and

strategies to ensure that qualified borrowers are not excluded from

the housing market.

The second panel covered the evolving landscape of loss

mitigation and community stabilization in a post-HAMP environment.

Participants Mark McArdle, Deputy Assistant Secretary at the U.S.

Department of the Treasury, Jean Mills, from the California Housing

Finance Agency, and Julia Gordon, from the National Community

Stabilization Trust, led a discussion on how to maximize Treasury’s

Hardest Hit Funds program to address neighborhood blight. The

panelists also shared insights on loss mitigation protocols that

are under consideration by industry stakeholders. These protocols

will represent the new industry standard once HAMP expires on

December 31, 2016.

“Everyone who attended this event shares a common goal of

expanding sustainable homeownership and deploying effective loss

mitigation solutions. By working together, and exchanging insights

and ideas, we can strengthen families, neighborhoods and the

housing market as a whole,” commented Julia Gordon, Executive Vice

President, National Community Stabilization Trust.

“While much of the country has moved on from the housing crisis,

many neighborhoods are still being impacted from the lingering

effects of foreclosure,” commented Jean Mills, Director of

Operations at Keep Your Home California. “KYHC offers constructive

solutions for homeowners and communities, however, these problems

cannot be solved by one organization alone. Ocwen’s event was about

listening and discussing how we can work together to address common

challenges and discuss solutions that can make a real difference in

the lives of homeowners.”

For more details on Ocwen’s homeowner outreach efforts, please

visit www.OcwenCares.com.

About Ocwen Financial CorporationOcwen

Financial Corporation is a financial services holding company

which, through its subsidiaries, originates and services loans. We

are headquartered in West Palm Beach, Florida, with offices

throughout the United States and in the U.S. Virgin Islands and

operations in India and the Philippines. We have been serving our

customers since 1988. We may post information that is important to

investors on our website (www.Ocwen.com).

FOR FURTHER INFORMATION CONTACT

Emily Kiggins

ekiggins@levick.com

202 -973-5312

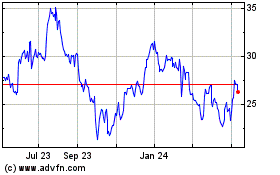

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024