Ocwen Financial Corporation, (NYSE:OCN)

(“Ocwen” or the “Company”), a leading financial

services holding company, today reported a net loss of $(111.2)

million, or $(0.90) per share, for the three months ended March 31,

2016 compared to net income of $34.4 million, or $0.27 per share,

for the three months ended March 31, 2015. Ocwen generated revenue

of $330.8 million, down (35.2)% compared to the first quarter of

the prior year, primarily driven by the impact of sales of agency

mortgage servicing rights (MSRs) and portfolio run-off in 2015.

Expenses were down $49.7 million or 13.1% compared to the first

quarter of 2015, primarily driven by the reduction in the size of

the servicing portfolio partially offset by a $21.0 million

increase in monitor costs and an $8.8 million increase in

unfavorable interest rate driven fair value changes related to GNMA

and GSE MSRs (excluding runoff). Cash Flows provided by Operating

Activities were $140.9 million for the three months ended March 31,

2016, compared to $325.0 million for the same period last year.

First Quarter 2016 Results

Pre-tax loss for the first quarter of 2016 was

$(102.1) million. Pre-tax results were impacted by a number of

significant items including but not limited to: $(32.7) million of

unfavorable interest rate driven fair value changes related to GNMA

and GSE MSRs (excluding runoff) and $(30.0) million of monitor

costs. Adjusting for these two significant items, the Pre-tax loss

was $(39.4) million. Compared to the fourth quarter of 2015,

operating expenses were down $31 million or 9% and adjusted

operating expenses were down $55 million or 17%.

Servicing recorded a $(68.3) million pre-tax

loss inclusive of the $(32.7) million MSR fair value changes. The

Lending segment recorded a $2.0 million pre-tax gain for the first

quarter of 2016 driven by higher lock volumes across the

correspondent and direct channels.

“We are pleased to see the progress of our

ongoing cost improvement efforts. Companywide we saw adjusted

operating expenses decline by $55 million or 17% from the prior

quarter. Excluding MSR fair value changes and monitoring expenses,

which we have no or limited ability to control, and our new

initiative spending, our Servicing and Corporate segments reduced

expenses by $80 million. We are focused on making further progress

on our cost goals while continuing to enhance the borrower

experience. We also remain committed to investing in our lending

businesses, which we believe will drive earnings growth in the

future,” commented Ron Faris, President and CEO of Ocwen.

“Unfortunately, $(30) million of monitor costs and $(33) million in

MSR value decline from the drop in interest rates during the

quarter negatively impacted the first quarter results,” said

Faris.

Additional Business

Highlights

- The constant pre-payment rate (CPR) decreased from 13.3% in the

fourth quarter of 2015 to 12.7% in the first quarter of 2016. In

the first quarter of 2016, prime CPR was 15.5%, and non-prime CPR

was 10.8%.

- Delinquencies decreased from 13.7% at December 31, 2015 to

13.0% at March 31, 2016, primarily driven by improved

collections and loss mitigation efforts.

- Completed 16,604 modifications in the quarter, 46% of which

were HAMP modifications. 45% of modifications included some form of

principal reduction.

- As of April 21, 2016, received trial payments from over 10,000

borrowers under initial implementation of new Streamline HAMP

program.

- In the first quarter of 2016, Ocwen originated forward and

reverse mortgage loans with unpaid principal balance (UPB) of

$788.1 million and $191.2 million, respectively.

- Our reverse mortgage portfolio ended the quarter with an

estimated $106.0 million in undiscounted future gains from future

draws on existing loans, up from an estimated $97.7 million at

December 31, 2015. Neither the anticipated future gains nor the

future funding liability are included in the Company’s financial

statements.

- Amended our Senior Secured Term Loan (SSTL) to provide

additional flexibility under financial covenants.

- Ended the first quarter with a Corporate Debt to Equity ratio

of 1 to 1. For purposes of this calculation, ‘Corporate Debt'

represents our SSTL and our senior unsecured notes debt balances

excluding adjustments for debt issuance costs and associated

discounts, while ‘Equity' means reported stockholders' equity.

- As of April 24, 2016, our new commercial lending business,

Automotive Capital Services, was operational in 12 markets across 8

states with $9.1 million in outstanding receivables.

Webcast and Conference Call

Ocwen will host a webcast and conference call on

Wednesday, April 27, 2016, at 5 p.m., Eastern Time, to discuss its

financial results for the first quarter of 2016. The conference

call will be webcast live over the internet from the Company’s

website at www.Ocwen.com, click on the “Shareholder Relations”

section. A replay of the conference call will be available via the

website approximately two hours after the conclusion of the call

and will remain available for approximately 30 days.

About Ocwen Financial

Corporation

Ocwen Financial Corporation is a financial

services holding company which, through its subsidiaries,

originates and services loans. We are headquartered in West Palm

Beach, Florida, with offices throughout the United States and in

the U.S. Virgin Islands and operations in India and the

Philippines. We have been serving our customers since 1988. We may

post information that is important to investors on our

website (www.Ocwen.com).

Note Regarding Adjusted Operating

Expenses

Adjusted Operating Expense, a non-GAAP measure,

is a supplemental metric used by management to evaluate our

Company’s underlying operating expense performance. Adjusted

Operating Expense adjusts GAAP operating expense for (1) changes in

fair value of our MSRs due to changes in market rates, valuation

inputs and other assumptions, (2) expense related to business

restructuring items such as severance expenses and lease

termination costs, (3) legal, regulatory or counterparty settlement

expenses as well as monitoring costs and (4) other expense items,

including certain non-recurring costs, that management believes do

not reflect the underlying operating expense performance of the

Company, consistent with the intent of providing management and

investors with a supplemental means of evaluating our operating

performance. A reconciliation from GAAP Operating Expense to

Adjusted Operating Expense appears in the appendix of the investor

presentation posted today on www.Ocwen.com. Adjusted Operating

Expense should not be considered an alternative to operating

expense determined in accordance with GAAP. Adjusted Operating

Expense has important limitations as an analytical tool, and should

not be considered in isolation or as a substitute for analysis of

our results as reported under GAAP. We compensate for these

limitations by relying primarily on our GAAP results and using

Adjusted Operating Expense only as a supplemental metric.

Readers are cautioned not to place undue reliance on Adjusted

Operating Expense.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements may be

identified by a reference to a future period or by the use of

forward-looking terminology. Forward-looking statements by their

nature address matters that are, to different degrees, uncertain.

Our business has been undergoing substantial change which has

magnified such uncertainties. Readers should bear these factors in

mind when considering such statements and should not place undue

reliance on such statements. Forward-looking statements involve a

number of assumptions, risks and uncertainties that could cause

actual results to differ materially. In the past, actual results

have differed from those suggested by forward looking statements

and this may happen again.

Important factors that could cause actual

results to differ materially from those suggested by the

forward-looking statements include, but are not limited to, the

following: our servicer and credit ratings as well as other actions

from various rating agencies, including the impact of downgrades of

our servicer and credit ratings; adverse effects on our business as

a result of regulatory investigations or settlements; reactions to

the announcement of such investigations or settlements by key

counterparties; increased regulatory scrutiny and media attention;

uncertainty related to claims, due to rumors or otherwise,

litigation and investigations brought by government agencies and

private parties regarding our servicing, foreclosure, modification

and other practices, including uncertainty related to past, present

or future investigations and settlements with state regulators, the

CFPB, State Attorneys General, the SEC, Department of Justice or

HUD and actions brought under the False Claims Act by private

parties on behalf of the United States of America regarding

incentive and other payments made by governmental entities; any

adverse developments in existing legal proceedings or the

initiation of new legal proceedings; our ability to effectively

manage our regulatory and contractual compliance obligations; our

ability to contain and reduce our operating costs, including our

ability to successfully execute on our cost improvement initiative;

the adequacy of our financial resources, including our sources of

liquidity and ability to sell, fund and recover advances, repay

borrowings and comply with debt agreements, including the financial

and other covenants contained in them; volatility in our stock

price; the characteristics of our servicing portfolio, including

prepayment speeds along with delinquency and advance rates; our

ability to successfully modify delinquent loans, manage

foreclosures and sell foreclosed properties; uncertainty related to

legislation, regulations, regulatory agency actions, government

programs and policies, industry initiatives and evolving best

servicing practices; as well as other risks detailed in Ocwen’s

reports and filings with the SEC, including its annual report on

Form 10-K for the year ended December 31, 2015. Anyone wishing to

understand Ocwen’s business should review its SEC filings. Ocwen’s

forward-looking statements speak only as of the date they are made

and we disclaim any obligation to update or revise forward-looking

statements whether as a result of new information, future events or

otherwise.

| Residential Servicing

Statistics (Unaudited)(Dollars in thousands) |

| |

At or for the Three Months Ended |

| March 31, 2016 |

December 31, 2015 |

September 30, 2015 |

June 30, 2015 |

March 31, 2015 |

| Total unpaid principal

balance of loans and REO serviced |

$ |

237,081,036 |

|

$ |

250,966,112 |

|

$ |

288,069,149 |

|

$ |

321,670,579 |

|

$ |

382,214,002 |

|

| |

|

|

|

|

|

| Non-performing loans and

REO serviced as a % of total UPB (1) |

13.0 |

% |

13.7 |

% |

13.1 |

% |

13.0 |

% |

12.5 |

% |

| |

|

|

|

|

|

| Prepayment speed (average

CPR)(2) (3) |

12.7 |

% |

13.3 |

% |

14.7 |

% |

15.7 |

% |

13.3 |

% |

(1) Performing loans include those loans

that are less than 90 days past due and those loans for which

borrowers are making scheduled payments under loan modification,

forbearance or bankruptcy plans. We consider all other loans to be

non-performing.

(2) Constant Prepayment Rate for the prior three months.

CPR measures prepayments as a percentage of the current

outstanding loan balance expressed as a compound annual rate.

(3) Average CPR for the three months ended

March 31, 2016 includes 15.5% for prime loans and 10.8% for

non-prime loans.

| Segment Results

(Unaudited)(Dollars in thousands) |

|

|

|

| |

For the Three Months Ended March

31, |

| |

2016 |

|

2015 |

|

Servicing |

|

|

|

| Revenue |

$ |

307,427 |

|

|

$ |

471,125 |

|

| Expenses |

276,896 |

|

|

337,911 |

|

| Other expense, net |

(98,789 |

) |

|

(86,492 |

) |

| Income (loss) before income

taxes |

(68,258 |

) |

|

46,722 |

|

| |

|

|

|

|

Lending |

|

|

|

| Revenue |

23,285 |

|

|

37,746 |

|

| Expenses |

21,799 |

|

|

23,785 |

|

| Other income, net |

514 |

|

|

2,022 |

|

| Income before income taxes |

2,000 |

|

|

15,983 |

|

| |

|

|

|

|

Corporate Items and Other |

|

|

|

| Revenue |

45 |

|

|

1,608 |

|

| Expenses |

29,962 |

|

|

16,697 |

|

| Other expense, net |

(5,950 |

) |

|

(4,787 |

) |

| Loss before income taxes |

(35,867 |

) |

|

(19,876 |

) |

| |

|

|

|

|

Corporate Eliminations |

|

|

|

| Revenue |

— |

|

|

(35 |

) |

| Expenses |

— |

|

|

(35 |

) |

| Other income (expense), net |

— |

|

|

— |

|

| Income (loss) before income

taxes |

— |

|

|

— |

|

| |

|

|

|

|

Consolidated income (loss) before income taxes |

$ |

(102,125 |

) |

|

$ |

42,829 |

|

| OCWEN

FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (Dollars in thousands, except per share

data) (UNAUDITED) |

| |

For the Three Months Ended March

31, |

| |

2016 |

|

2015 |

|

Revenue |

|

|

|

| Servicing and subservicing

fees |

$ |

297,496 |

|

|

$ |

446,541 |

|

| Gain on loans held for sale,

net |

15,572 |

|

|

44,504 |

|

| Other revenues |

17,689 |

|

|

19,399 |

|

| Total revenue |

330,757 |

|

|

510,444 |

|

| |

|

|

|

|

Expenses |

|

|

|

| Compensation and benefits |

96,249 |

|

|

105,144 |

|

| Amortization of mortgage servicing

rights |

12,806 |

|

|

38,494 |

|

| Servicing and origination |

95,692 |

|

|

101,802 |

|

| Technology and communications |

26,869 |

|

|

39,351 |

|

| Professional services |

70,907 |

|

|

56,931 |

|

| Occupancy and equipment |

24,745 |

|

|

25,714 |

|

| Other |

1,389 |

|

|

10,922 |

|

| Total expenses |

328,657 |

|

|

378,358 |

|

| |

|

|

|

| Other income

(expense) |

|

|

|

| Interest income |

4,190 |

|

|

5,575 |

|

| Interest expense |

(106,089 |

) |

|

(119,396 |

) |

| Gain on sale of mortgage servicing

rights, net |

1,175 |

|

|

26,406 |

|

| Other, net |

(3,501 |

) |

|

(1,842 |

) |

| Total other expense, net |

(104,225 |

) |

|

(89,257 |

) |

| |

|

|

|

| Income (loss) before

income taxes |

(102,125 |

) |

|

42,829 |

|

| Income tax expense |

9,076 |

|

|

8,440 |

|

| Net income

(loss) |

(111,201 |

) |

|

34,389 |

|

| Net income attributable

to non-controlling interests |

(130 |

) |

|

(34 |

) |

| Net income (loss)

attributable to Ocwen stockholders |

$ |

(111,331 |

) |

|

$ |

34,355 |

|

| |

|

|

|

| Earnings (loss)

per share attributable to Ocwen common stockholders |

|

|

|

| Basic |

$ |

(0.90 |

) |

|

$ |

0.27 |

|

| Diluted |

(0.90 |

) |

|

0.27 |

|

| |

|

|

|

| Weighted

average common shares outstanding |

|

|

|

| Basic |

124,093,339 |

|

|

125,272,228 |

|

| Diluted |

124,093,339 |

|

|

126,999,662 |

|

| OCWEN

FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (Dollars in thousands, except share

data)(UNAUDITED) |

| |

March 31, 2016 |

|

December 31, 2015 |

|

Assets |

|

|

|

| Cash |

$ |

280,513 |

|

|

$ |

257,272 |

|

| Mortgage servicing rights ($732,174

and $761,190 carried at fair value) |

1,078,213 |

|

|

1,138,569 |

|

| Advances, net |

317,348 |

|

|

444,298 |

|

| Match funded advances |

1,720,897 |

|

|

1,706,768 |

|

| Loans held for sale ($321,739 and

$309,054 carried at fair value) |

408,809 |

|

|

414,046 |

|

| Loans held for investment - Reverse

mortgages, at fair value |

2,771,242 |

|

|

2,488,253 |

|

| Receivables, net |

237,583 |

|

|

286,981 |

|

| Premises and equipment, net |

72,323 |

|

|

57,626 |

|

| Other assets ($22,501 and $14,352

carried at fair value) |

520,182 |

|

|

586,495 |

|

| Total assets |

$ |

7,407,110 |

|

|

$ |

7,380,308 |

|

| |

|

|

|

| Liabilities and

Equity |

|

|

|

| Liabilities |

|

|

|

| Match funded liabilities |

$ |

1,537,096 |

|

|

$ |

1,584,049 |

|

| Financing liabilities ($3,171,602

and $2,933,066 carried at fair value) |

3,319,646 |

|

|

3,089,255 |

|

| Other secured borrowings, net |

718,830 |

|

|

762,411 |

|

| Senior unsecured notes, net |

345,847 |

|

|

345,511 |

|

| Other liabilities |

747,223 |

|

|

744,444 |

|

| Total liabilities |

6,668,642 |

|

|

6,525,670 |

|

| |

|

|

|

| Equity |

|

|

|

| Ocwen Financial Corporation (Ocwen)

stockholders’ equity |

|

|

|

| Common stock, $.01 par value;

200,000,000 shares authorized; 123,853,683 and 124,774,516 shares

issued and outstanding at March 31, 2016 and December 31, 2015,

respectively |

1,239 |

|

|

1,248 |

|

| Additional paid-in capital |

522,222 |

|

|

526,148 |

|

| Retained earnings |

214,598 |

|

|

325,929 |

|

| Accumulated other comprehensive

loss, net of income taxes |

(1,658 |

) |

|

(1,763 |

) |

| Total Ocwen stockholders’

equity |

736,401 |

|

|

851,562 |

|

| Non-controlling interest in

subsidiaries |

2,067 |

|

|

3,076 |

|

| Total equity |

738,468 |

|

|

854,638 |

|

| Total liabilities and equity |

$ |

7,407,110 |

|

|

$ |

7,380,308 |

|

| OCWEN

FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

CASH FLOWS (Dollars in

thousands)(UNAUDITED) |

| |

For the Three Months Ended March

31, |

| |

2016 |

|

2015 |

| Cash flows from

operating activities |

|

|

|

| Net income (loss) |

$ |

(111,201 |

) |

|

$ |

34,389 |

|

| Adjustments to reconcile net income

(loss) to net cash provided by operating activities: |

|

|

|

| Amortization of mortgage servicing

rights |

12,806 |

|

|

38,494 |

|

| Loss on valuation of mortgage

servicing rights, at fair value |

29,293 |

|

|

33,175 |

|

| Impairment of mortgage servicing

rights |

29,953 |

|

|

17,769 |

|

| Gain on sale of mortgage servicing

rights |

(1,175 |

) |

|

(26,406 |

) |

| Realized and unrealized losses on

derivative financial instruments |

1,496 |

|

|

1,153 |

|

| Provision for bad debts |

11,382 |

|

|

14,170 |

|

| Depreciation |

5,039 |

|

|

4,344 |

|

| Amortization of debt issuance

costs |

3,277 |

|

|

3,755 |

|

| (Gain) loss on sale of fixed

assets |

— |

|

|

— |

|

| Increase in deferred tax

assets |

— |

|

|

(890 |

) |

| Equity-based compensation

expense |

1,416 |

|

|

2,117 |

|

| Gain on loans held for sale,

net |

(15,572 |

) |

|

(44,504 |

) |

| Origination and purchase of loans

held for sale |

(1,211,076 |

) |

|

(1,036,150 |

) |

| Proceeds from sale and collections

of loans held for sale |

1,165,503 |

|

|

1,142,282 |

|

| Changes in assets and

liabilities: |

|

|

|

| Decrease in advances and match

funded advances |

109,076 |

|

|

104,258 |

|

| Decrease in receivables and other

assets, net |

84,512 |

|

|

1,330 |

|

| Increase in other liabilities |

21,473 |

|

|

20,127 |

|

| Other, net |

4,686 |

|

|

15,605 |

|

| Net cash provided by

operating activities |

140,888 |

|

|

325,018 |

|

| |

|

|

|

| Cash flows from

investing activities |

|

|

|

| Origination of loans held for

investment - reverse mortgages |

(304,058 |

) |

|

(235,271 |

) |

| Principal payments received on

loans held for investment - reverse mortgages |

87,237 |

|

|

26,170 |

|

| Purchase of mortgage servicing

rights, net |

(4,263 |

) |

|

(3,267 |

) |

| Proceeds from sale of mortgage

servicing rights |

15,305 |

|

|

49,465 |

|

| Acquisition of advances in

connection with the purchase of mortgage servicing rights |

— |

|

|

— |

|

| Acquisition of advances in

connection with the purchase of loans |

— |

|

|

— |

|

| Proceeds from sale of advances and

match funded advances |

41,003 |

|

|

1,765 |

|

| Additions to premises and

equipment |

(19,800 |

) |

|

(3,918 |

) |

| Proceeds from sale of premises and

equipment |

— |

|

|

— |

|

| Distributions of capital from

unconsolidated entities |

— |

|

|

— |

|

| Other |

1,624 |

|

|

301 |

|

| Net cash used in investing

activities |

(182,952 |

) |

|

(164,755 |

) |

| |

|

|

|

| |

|

|

|

| |

| OCWEN

FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

CASH FLOWS — (continued) (Dollars in

thousands)(UNAUDITED) |

| |

For the Three Months Ended March

31, |

| |

2016 |

|

2015 |

| Cash flows from

financing activities |

|

|

|

| Repayment of match funded

liabilities |

(46,953 |

) |

|

(89,571 |

) |

| Proceeds from other secured

borrowings |

1,902,472 |

|

|

1,858,258 |

|

| Repayments of other secured

borrowings |

(2,014,474 |

) |

|

(2,042,969 |

) |

| Payment of debt issuance costs |

(2,242 |

) |

|

(12,643 |

) |

| Proceeds from sale of mortgage

servicing rights accounted for as a financing |

|

|

— |

|

| Proceeds from sale of loans

accounted for as a financing |

233,174 |

|

|

238,615 |

|

| Proceeds from sale of advances

accounted for as a financing |

— |

|

|

472 |

|

| Repurchase of common stock |

(5,890 |

) |

|

— |

|

| Proceeds from exercise of common

stock options |

406 |

|

|

413 |

|

| Other |

(1,188 |

) |

|

21 |

|

| Net cash provided by

financing activities |

65,305 |

|

|

(47,404 |

) |

| |

|

|

|

| Net increase (decrease) in

cash |

23,241 |

|

|

112,859 |

|

| Cash at beginning of

year |

257,272 |

|

|

129,473 |

|

| Cash at end of period |

$ |

280,513 |

|

|

$ |

242,332 |

|

| |

|

|

|

Investors:

Stephen Swett

T: (203) 614-0141

E: shareholderrelations@ocwen.com

Media:

John Lovallo

T: (917) 612-8419

E: jlovallo@levick.com

Dan Rene

T: (202) 973 -1325

E: drene@levick.com

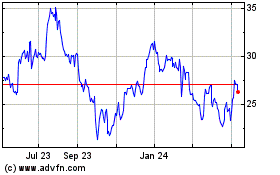

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024