Ocwen to Pay $2 Million in SEC Settlement

January 20 2016 - 6:10PM

Dow Jones News

Mortgage-servicing company Ocwen Financial Corp., which has

faced regulatory scrutiny for its interactions with related

companies, will pay a $2 million penalty in a settlement with the

Securities and Exchange Commission.

Ocwen previously said it accrued $2 million for an expected

pact.

The SEC said on Wednesday that Ocwen used a "flawed, undisclosed

methodology" to value mortgage assets and said the company's

internal controls "failed to prevent conflicts of interest"

involving its former chairman.

New York state regulators, which had criticized Ocwen's

relations with affiliated companies and its practices regarding

distressed mortgage borrowers, forced Chairman William C. Erbey to

step down as part of a settlement announced in late 2014.

The company has been working to sell some of its

mortgage-servicing rights and concentrate on mortgages not owned by

government agencies. It has been cutting jobs and in September

announced plans to cut about 10% of its U.S. workforce.

It narrowed its loss during the third quarter, though the

company posted a 21% drop in revenue.

(END) Dow Jones Newswires

January 20, 2016 17:55 ET (22:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

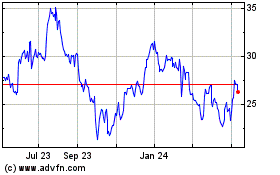

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024