As filed with

the Securities and Exchange Commission on November 12, 2015

Registration

No. 333-207716

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment No. 1

to

FORM S-4

REGISTRATION

STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

OCWEN FINANCIAL

CORPORATION

(Exact

name of registrant as specified in its charter)

Florida

(State or other jurisdiction of

incorporation or organization) |

6162

(Primary Standard Industrial

Classification Code Number) |

65-0039856

(I.R.S. Employer

Identification Number) |

1661

Worthington Road, Suite 100

West Palm Beach, Florida 33409

(561) 682-8000

(Address, including zip code and

telephone number, including

area code, of Registrant’s principal executive offices)

Ronald M.

Faris

President and Chief Executive Officer

1661 Worthington Road, Suite 100

West Palm Beach, Florida 33409

(561) 682-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| |

Copies to: |

|

| |

|

|

| Timothy M. Hayes |

|

John P. Berkery |

| Executive Vice President and |

|

Mayer Brown LLP |

| General Counsel |

|

1221 Avenue of the Americas |

| c/o Ocwen Financial Corporation |

|

New York, New York 10020 |

| 1661 Worthington Road, Suite 100 |

|

(212) 506-2500 |

| West Palm Beach, Florida 33409 |

|

|

| (561) 682-8000 |

|

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effectiveness of this registration statement

and the satisfaction or waiver of all other conditions pursuant to the exchange offer described herein.

If

the securities being registered on this Form are being offered in connection with the formation of a holding company and there

is compliance with General Instruction G, check the following box. o

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. o

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer x |

Accelerated

filer o |

Non-accelerated

filer o

(Do not check if a smaller reporting company) |

Smaller

reporting company o |

If

applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange

Act Rule 13e-4(i) (Cross-Border Issue Tender Offer) o

Exchange

Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter

become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become

effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

Amendment No. 1 to the Ocwen Financial Corporation Registration Statement on Form S-4 (Registration No. 333-207716),

originally filed with the Securities and Exchange Commission on November 2, 2015, is being filed for the sole purpose of

filing Exhibits 5.1, 5.2 and 25.1 and updating the Exhibit Index accordingly. This Amendment No. 1 does not relate to the

contents of the prospectus that forms a part of the Registration Statement and, accordingly, the prospectus has not been

included herein.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 20. Indemnification of Directors And Officers.

We were organized

under the laws of the State of Florida and are subject to the Florida Business Corporation Act, or the FBCA. Subject to the procedures

and limitations stated therein Section 607.0831 of the FBCA provides that a director is not personally liable for monetary damages

to the corporation or any person for any statement, vote, decision or failure to act, regarding corporate management or policy,

by a director unless (a) the director breached or failed to perform his duties as a director and (b) the director’s breach

of, or failure to perform, those duties constitutes: (i) a violation of criminal law, unless the director had reasonable cause

to believe his conduct was lawful or had no reasonable cause to believe his conduct was unlawful; (ii) a transaction from which

the director derived an improper personal benefit, either directly or indirectly; (iii) a circumstance under which the liability

provisions of Section 607.0834 of the FBCA, relating to a director’s liability for voting in favor of or assenting to an

unlawful distribution, are applicable; (iv) in a proceeding by, or in the right of the corporation to procure a judgment in its

favor or by or in the right of a shareholder, conscious disregard for the best interest of the corporation, or willful misconduct;

or (v) in a proceeding by or in the right of someone other than the corporation or a shareholder, recklessness or an act or omission

which was committed in bad faith or with malicious purpose or in a manner exhibiting wanton or willful disregard of human rights,

safety or property.

Subject to the procedures

and limitations stated therein, Section 607.0850(1) of the FBCA empowers a Florida corporation, such as us, to indemnify any person

who was or is a party to any proceeding (other than any action by, or in the right of, the corporation), by reason of the fact

that he or she is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation

as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against

liability incurred in connection with such proceeding, including any appeal thereof, if he or she acted in good faith and in a

manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any

criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

Section 607.0850(2)

of the FBCA also empowers a Florida corporation, such as us, to indemnify any person who was or is a party to any proceeding by

or in the right of the corporation to procure a judgment in its favor by reason of the fact that he or she is or was a director,

officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses and amounts paid in settlement

not exceeding, in the judgment of the Board of Directors, the estimated expense of litigating the proceeding to conclusion, actually

and reasonably incurred in connection with the defense or settlement of such proceeding, including any appeal thereof, if he or

she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the corporation,

except that no indemnification may be made in respect of any claim, issue or matter as to which such person shall have been adjudged

to be liable unless, and only to the extent that, the court in which such proceeding was brought, or any other court of competent

jurisdiction, shall determine upon application that, despite the adjudication of liability but in view of all circumstances of

the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper.

To the extent that

a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any proceeding

referred to in Sections 607.0850(1) or 607.0850(2) of the FBCA, or in defense of any claim, issue or matter therein, he or she

shall be indemnified against expenses actually and reasonably incurred by him or her in connection therewith.

The indemnification

and advancement of expenses provided pursuant to Section 607.0850 of the FBCA are not exclusive, and a corporation may make any

other or further indemnification of or advancement of expenses to any of its directors, officers, employees or agents under any

bylaw, agreement, vote of shareholders or disinterested directors, or otherwise, both as to action in his or her official capacity

and as to action in another capacity while holding such office. However, a director, officer, employee or agent is not entitled

to indemnification or advancement of expenses if a judgment or other final adjudication establish that his or her actions, or omissions

to act, were material to the cause of action so adjudicated and constitute: (i) a violation of the criminal law, unless the director,

officer, employee or agent had reasonable cause to believe his conduct was lawful or had no reasonable cause to believe his conduct

was unlawful; (ii) a transaction from which the director, officer, employee or agent derived an improper personal benefit; (iii)

in the case of a director, a circumstance under which the liability provisions of Section 607.0834 of the FBCA, relating to a director’s

liability for voting in favor of or assenting to an unlawful distribution, are applicable; or (iv) willful misconduct or a conscious

disregard for the best interests of the corporation in a proceeding by or in the right of the corporation to procure a judgment

in its favor or in a proceeding by or in the right of a shareholder.

Our Amended and

Restated Articles of Incorporation provide that we shall, to the fullest extent permitted by Section 607.0850 of the FBCA, as the

same may be amended and supplemented, indemnify any and all persons whom it shall have power to indemnify under Section 607.0850

of the FBCA from and against any and all of the expenses, liabilities or other matters referred to in or covered by Section 607.0850

of the FBCA. Further, the indemnification provided for in our Amended and Restated Articles of Incorporation is not exclusive of

any other rights to which those indemnified may be entitled under any by-law, agreement, vote of stockholders or disinterested

directors or otherwise, both as to action in his or her official capacity and as to action in another capacity while holding such

office and shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit

of the heirs, executors and administrators of such person.

We have also entered

into an indemnification agreement with each of our executive officers and directors. These agreements require us to indemnify these

individuals to the fullest extent permitted under Florida law against liabilities that may arise by reason of their service to

us, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified.

We maintain

an insurance policy covering directors and officers under which the insurer agrees to pay, subject to certain exclusions, for any

claim made against our directors and officers for a wrongful act for which they may become legally obligated to pay or for which

we are required to indemnify our directors and officers.

Item 21. Exhibits and Financial Statement Schedules.

(a) The exhibits filed herewith are

set forth in the attached Exhibit Index, which is incorporated herein by reference.

(b) All of the financial statement

schedules for which provision is made in the applicable accounting regulations of the Commission are not required under the applicable

instructions or are not applicable and therefore have been omitted.

Item 22. Undertakings.

(a) The undersigned registrant hereby

undertakes:

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most

recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered

(if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant

to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate

offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement. |

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering. |

| (4) | That, for purposes of determining liability under the Securities Act of 1933 to any purchaser: |

(i) If the registrants are

relying on Rule 430B:

(A) Each prospectus filed

by the registrants pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed

prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required

to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating

to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by

section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that

is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to

the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

or

(ii) If the registrants are subject to Rule 430C,

each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration

statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part

of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that

no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated

or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will,

as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such date of first use.

| (5) | That, for the purpose of determining liability of the registrants under the Securities Act of 1933 to any purchaser in the

initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller

to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant

to Rule 424; |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred

to by the undersigned registrant; |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

(b) Insofar as indemnification for

liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant

pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by a registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

(c) The undersigned registrant hereby

undertakes to respond to requests for information that is incorporated by reference into the prospectus pursuant to Items 4,

10(b), 11, or 13 of this Form, within one business day of receipt of such request, and to send the incorporated documents by first

class mail or other equally prompt means. This includes information contained in documents filed subsequent to the effective date

of the registration statement through the date of responding to the request.

(d) The undersigned registrant hereby

undertakes to supply by means of post-effective amendment all information concerning a transaction, and the company being acquired

involved therein, that was not the subject of and included in the registration statement when it became effective.

SIGNATURES

Pursuant to the requirements of the

Securities Act, the registrant has duly caused this Amendment No. 1 to the Registration Statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the city of West Palm Beach, Florida on November 12, 2015.

| |

OCWEN FINANCIAL CORPORATION |

| |

|

|

|

| |

By: |

/s/ Michael R. Bourque Jr. |

|

| |

|

Michael R. Bourque Jr. |

|

| |

|

Executive Vice President and Chief Financial Officer |

|

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| * |

|

Chairman of |

|

|

| Barry N. Wish |

|

the Board of Directors |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

President, Chief Executive Officer and |

|

|

| Ronald M. Faris |

|

Director (principal executive officer) |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

|

|

|

| Alan J. Bowers |

|

Director |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

|

|

|

| Phyllis R. Caldwell |

|

Director |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

|

|

|

| Ronald J. Korn |

|

Director |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

|

|

|

| William H. Lacy |

|

Director |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

|

|

|

| Robert A. Salcetti |

|

Director |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

|

|

|

| DeForest B. Soaries, Jr. |

|

Director |

|

November 12, 2015 |

| |

|

|

|

|

| /s/ Michael R. Bourque Jr. |

|

Executive Vice President and

Chief Financial Officer |

|

|

| Michael R. Bourque Jr. |

|

(principal financial officer) |

|

November 12, 2015 |

| |

|

|

|

|

| * |

|

Senior Vice President and

Chief Accounting Officer |

|

|

| Catherine M. Dondzila |

|

(principal accounting officer) |

|

November 12, 2015 |

| |

|

|

|

|

|

| *By: |

/s/ Michael R. Bourque

Jr. |

|

|

|

|

Michael R. Bourque Jr.

Attorney-in-Fact

|

|

|

|

|

EXHIBIT INDEX

| 2.1 |

Separation Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Portfolio Solutions S.A. (1) |

| 2.2 |

Purchase Agreement dated as of June 5, 2011, by and between The Goldman Sachs Group, Inc. and Ocwen Financial Corporation † (2) |

| 2.3 |

Purchase Agreement, dated as of October 19, 2011, by and among Morgan Stanley (solely for purposes of Article 5, Section 7.4, Section 8.7, Article 11 and Article 12), SCI Services, Inc., Saxon Capital Holdings, Inc., Morgan Stanley Mortgage Capital Holdings, LLC and Ocwen Financial Corporation † (3) |

| 2.4 |

Amended and Restated Purchase Agreement, dated March 18, 2012, among Ocwen Financial Corporation (solely for purposes of Section 6.11, Section 6.12, Section 7.4, Section 7.8, Section 7.14, Section 10.2(b), Article 11 and Article 12), Ocwen Loan Servicing, LLC, Morgan Stanley (solely for purposes of Article 5, Section 7.4, Article 11 and Article 12), SCI Services, Inc., Saxon Mortgage Services, Inc., and Morgan Stanley Mortgage Capital Holdings, LLC (4) |

| 2.5 |

Merger Agreement, dated as of October 3, 2012, by and among Ocwen Financial Corporation, O&H Acquisition Corp., Homeward Residential Holdings, Inc., and WL Ross & Co. LLC † (5) |

| 2.6 |

Asset Purchase Agreement between Ocwen Loan Servicing, LLC, and Residential Capital, LLC, Residential Funding Company, LLC, GMAC Mortgage, LLC, Executive Trustee Services, LLC, ETS of Washington, Inc., EPRE LLC, GMACM Borrower LLC, and RFC Borrower LLC dated as of November 2, 2012 † (6) |

| 2.7 |

Mortgage Servicing Rights Purchase and Sale Agreement between Ocwen Loan Servicing, LLC and One West Bank, FSB dated as of June 13, 2013 (7) |

| 2.8 |

Purchase and Sale Agreement, dated as of March 29, 2013, by and among Altisource Portfolio Solutions, Inc., Altisource Solutions S.à r.l., Ocwen Financial Corporation, Homeward Residential, Inc. and Power Valuation Services, Inc. (8) |

| 2.9 |

Repurchase Letter Agreement, dated as of September 23, 2013, by and among Ocwen Financial Corporation and the holders of Series A Perpetual Convertible Preferred Stock party thereto (9) |

| 3.1 |

Amended and Restated Articles of Incorporation (10) |

| 3.2 |

Articles of Amendment to Articles of Incorporation (26) |

| 3.3 |

Articles of Amendment to Articles of Incorporation (26) |

| 3.4 |

Articles of Amendment to Articles of Incorporation (11) |

| 3.5 |

Articles of Correction (11) |

| 3.6 |

Articles of Amendment to Articles of Incorporation, Articles of Designation, Preferences and Rights of Series A Perpetual Convertible Preferred Stock (12) |

| 3.7 |

Amended and Restated Bylaws of Ocwen Financial Corporation (13) |

| 4.1 |

Form of Certificate of Common Stock (10) |

| 4.2 |

Reference is made to Exhibits 3.1, 3.2, 3.3, 3.4, 3.5, 3.6 and 3.7 |

| 4.3 |

Indenture, dated as of May 12, 2014, between Ocwen Financial Corporation and The Bank of New York Mellon Trust Company, N.A. (29) |

| 4.4 |

Registration Rights Agreement, dated May 12, 2014, between Ocwen Financial Corporation and Barclays Capital Inc.(29) |

| 5.1 |

Form of Opinion of Mayer Brown LLP (filed herewith) |

| 5.2 |

Form of Opinion of Assistant General Counsel of Ocwen Financial Corporation (filed

herewith) |

| 10.1** |

Ocwen Financial Corporation 1996 Stock Plan for Directors, as amended (14) |

| 10.2** |

Ocwen Financial Corporation 1998 Annual Incentive Plan, as amended (15) |

| 10.3** |

Amended Ocwen Financial Corporation 1991 Non-Qualified Stock Option Plan, dated October 26, 1999 (16) |

| 10.4** |

Ocwen Financial Corporation Deferral Plan for Directors, dated March 7, 2005 (17) |

| 10.5** |

Ocwen Financial Corporation 2007 Equity Incentive Plan, dated May 10, 2007 (18) |

| 10.6** |

Ocwen Mortgage Servicing, Inc. Amended and Restated 2013 Preferred Stock Plan (26) |

| 10.7 |

Tax Matters Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (1) |

| 10.8 |

Employee Matters Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (1) |

| 10.9 |

Technology Products Services Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (1) |

| 10.10 |

Services Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (1) |

| 10.11 |

Data Center and Disaster Recovery Services Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (1) |

| 10.12 |

Intellectual Property Agreement, dated as of August 10, 2009, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (1) |

| 10.13 |

Support Services Agreement, dated as of August 10, 2012, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (19) |

| 10.14 |

Services Agreement, dated as of October 1, 2012, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (20) |

| 10.15 |

Technology Products Services Agreement, dated as of October 1, 2012, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (20) |

| 10.16 |

Data Center and Disaster Recovery Services Agreement, dated as of October 1, 2012, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (20) |

| 10.17 |

Intellectual Property Agreement, dated as of October 1, 2012, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (20) |

| 10.18 |

First Amendment to Support Services Agreement, dated as of October 1, 2012, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (20) |

| 10.19 |

First Amendment to Services Agreement, dated as of October 1, 2012, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (20) |

| 10.20 |

First Amendment to Technology Products Services Agreement, dated as of October 1, 2012, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (20) |

| 10.21 |

First Amendment to Data Center and Disaster Recovery Services Agreement, dated as of October 1, 2012, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (20) |

| 10.22 |

First Amendment to Intellectual Property Agreement, dated as of October 1, 2012, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (20) |

| 10.23 |

Second Amendment to Services Agreement, dated as of March 29, 2013, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (8) |

| 10.24 |

Second Amendment to Technology Products Services Agreement, dated as of March 29, 2013, by and between Ocwen Financial Corporation Altisource Solutions S.à r.l. (8) |

| 10.25 |

Second Amendment to Data Center and Disaster Recovery Services Agreement, dated as of March 29, 2013, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (8) |

| 10.26 |

Second Amendment to Intellectual Property Agreement, dated as of March 29, 2013, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (8) |

| 10.27 |

First Amendment to Services Agreement, dated as of March 29, 2013, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (8) |

| 10.28 |

First Amendment to Technology Products Services Agreement, dated as of March 29, 2013, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (8) |

| 10.29 |

First Amendment to Data Center and Disaster Recovery Services Agreement, dated as of March 29, 2013, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (8) |

| 10.30 |

First Amendment to Intellectual Property Agreement, dated as of March 29, 2013, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (8) |

| 10.31 |

Third Amendment to Services Agreement, dated as of July 24, 2013, by and between Ocwen Financial Corporation and Altisource Solutions S.à r.l. (26) |

| 10.32 |

Second Amendment to Services Agreement dated July 24, 2013 by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (26) |

| 10.33 |

First Amended and Restated Support Services Agreement dated September 12, 2013, by and between Ocwen Mortgage Servicing, Inc. and Altisource Solutions S.à r.l. (26) |

| 10.34 |

Agreement dated as of April 12, 2013 by and among Altisource Solutions S.à r.l., Ocwen Financial Corporation and Ocwen Mortgage Servicing, Inc. (21) |

| 10.35 |

Master Servicing Rights Purchase Agreement, dated October 1, 2012, between Ocwen Loan Servicing, LLC and HLSS Holdings, LLC (26) |

| 10.36 |

Sale Supplement, dated February 10, 2012, between Ocwen Loan Servicing, LLC and HLSS Holdings, LLC (4) |

| 10.37 |

Master Subservicing Agreement, dated October 1, 2012, between Ocwen Loan Servicing, LLC and HLSS Holdings, LLC (26) |

| 10.38 |

Subservicing Supplement, dated February 10, 2012, between Ocwen Loan Servicing, LLC and HLSS Holdings, LLC (4) |

| 10.39 |

Professional Services Agreement, dated February 10, 2012, between Ocwen Financial Corporation, together with its subsidiaries and affiliates, and HLSS Management, LLC (4) |

| 10.40 |

Sale Supplement, dated as of July 1, 2013, to the Master Servicing Rights Purchase Agreement, dated as of October 1, 2012, between Ocwen Loan Servicing, LLC, HLSS Holdings, LLC and Home Loan Servicing Solutions, Ltd. (22) |

| 10.41 |

Subservicing Supplement, dated as of July 1, 2013, to the Master Subservicing Agreement, dated as of October 1, 2012, between Ocwen Loan Servicing, LLC and HLSS Holdings LLC (22) |

| 10.42 |

Amendment, dated as of September 30, 2013, to the Sale Supplement, dated as of July 1, 2013, to the Master Servicing Rights Purchase Agreement, dated as of October 1, 2012, between Ocwen Loan Servicing, LLC, HLSS Holdings, LLC and Home Loan Servicing Solutions, Ltd. (23) |

| 10.43 |

Amendment, dated as of September 30, 2013, to the Subservicing Supplement, dated as of July 1, 2013, to the Master Subservicing Agreement, dated as of October 1, 2012, between Ocwen Loan Servicing, LLC and HLSS Holdings LLC (23) |

| 10.44 |

Amendment, dated as of February 4, 2014, to the Sale Supplement dated as of July 1, 2013, the Sale Supplement dated February 10, 2012 and various other sale supplements, between Ocwen Loan Servicing, LLC, HLSS Holdings, LLC and Home Loan Servicing Solutions, Ltd. (26) |

| 10.45 |

Amendment, dated as of February 4, 2014, to the Subservicing Supplement dated as of July 1, 2013, the Subservicing Supplement dated as of February 10, 2012 and various other subservicing supplements, among Ocwen Loan Servicing, LLC and HLSS Holdings, LLC (26) |

| 10.46 |

Registration Rights Agreement, made and entered into as of December 27, 2012, by and among Ocwen Financial Corporation and the Holders (as defined therein) (13) |

| 10.47 |

Guarantee between Ocwen Financial Corporation and OneWest Bank, FSB dated as of June 13, 2013 (7) |

| 10.48 |

Senior Secured Term Loan Facility Agreement dated as of February 15, 2013 by and among Ocwen Loan Servicing, LLC, as Borrower, Ocwen Financial Corporation, as Parent, Certain Subsidiaries of Ocwen Financial Corporation, as Subsidiary Guarantors, the Lender Parties thereto, and Barclays Bank PLC, as Administrative Agent (24) |

| 10.49 |

Pledge and Security Agreement dated as of February 15, 2013 between each of the Grantor Parties thereto, and Barclays Bank PLC, as Collateral Agent (24) |

| 10.50 |

Amendment No. 1 to Senior Secured Term Loan Facility Agreement and Amendment No. 1 to Pledge and Security Agreement dated as of September 23, 2013 by and among Ocwen Loan Servicing, LLC, as Borrower, Ocwen Financial Corporation, as Parent, Certain Subsidiaries of Ocwen Financial Corporation, as Subsidiary Guarantors, the Lender Parties thereto, and Barclays Bank PLC, as Administrative Agent and Collateral Agent (9) |

| 10.51** |

Description of USVI Relocation Package of Ocwen Mortgage Servicing, Inc. (27) |

| 10.52** |

Surrender of Stock Options, dated as of April 22, 2014, between Ocwen Financial Corporation and William C. Erbey (28) |

| 10.53 |

Reference is made to Exhibit 4.3 |

| 10.54 |

Reference is made to Exhibit 4.4 |

| 10.55 |

Repurchase Letter Agreement, dated as of July 14, 2014, by and among Ocwen Financial Corporation and the holders of Series A Perpetual Convertible Preferred Stock party thereto (30) |

| 10.56 |

Consent Order pursuant to New York Banking Law §44, dated December 19, 2014, between Ocwen Financial Corporation, Ocwen Loan Servicing, LLC, and the New York State Department of Financial Services (31) |

| 10.57 |

Retirement Agreement, dated as of January 16, 2015, by and among Ocwen Financial Corporation, Ocwen Mortgage Servicing, Inc. and William C. Erbey. (32) |

| 10.58 |

Amendment No. 2 to Senior Secured Term Loan Facility Agreement, dated as of March 2, 2015, by and among Ocwen Loan Servicing, LLC, as Borrower, Ocwen Financial Corporation, as Parent, Certain Subsidiaries of Ocwen Financial Corporation, as Subsidiary Guarantors, the Lender Parties thereto, and Barclays Bank PLC, as Administrative Agent and Collateral Agent (33) |

| 10.59 |

Form of Indemnification Agreement (34) |

| 10.60 |

Form of Undertaking to Repay Advancement of Indemnification Expenses (34) |

| 10.61 |

Amendment No. 2 to Master Servicing Rights Purchase Agreement and Sale Supplements, dated as of April 6, 2015 (35) |

| 10.62 |

Amendment No. 3 to Senior Secured Term Loan Facility Agreement, dated as of April 17, 2015, by and among Ocwen Loan Servicing, LLC, as Borrower, Ocwen Financial Corporation, as Parent, Certain Subsidiaries of Ocwen Financial Corporation, as Subsidiary Guarantors, the Lender Parties thereto, and Barclays Bank PLC, as Administrative Agent and Collateral Agent (36) |

| 10.63 |

Amendment No. 4 to Senior Secured Term Loan Facility Agreement and Amendment

No. 2 to Pledge and Security Agreement, dated as of October 16, 2015, by and among Ocwen Loan Servicing, LLC, as borrower,

Ocwen Financial Corporation, as parent, certain subsidiaries of Ocwen Financial Corporation, as subsidiary guarantors, the

lender parties thereto, and Barclays Bank PLC, as administrative agent and collateral agent (37) |

| 11.1 |

Computation of earnings per share (39) |

| 12.1* |

Ratio of earnings to fixed charges |

| 21.1 |

Subsidiaries (40) |

| 23.1* |

Consent of Independent Registered Public Accounting Firm |

| 23.2 |

Consent of Mayer Brown LLP (contained in Exhibit 5.1) (filed herewith) |

| 24.1* |

Power of Attorney |

| 25.1 |

Statement of eligibility on Form T-1 of Wilmington Savings Fund Society, FSB, with

respect to the indenture governing the 6.625% Senior Notes due 2019 (filed herewith) |

| 99.1* |

Form of Letter of Transmittal |

| 99.2* |

Form of Notice of Guaranteed Delivery |

| 99.3* |

Form of Instruction Letter |

| 99.4 |

Consent Judgment dated February 26, 2014 of the United States District Court for the District of Columbia (26) |

| 101.INS* |

XBRL Instance Document |

| 101.SCH* |

XBRL Taxonomy Extension Schema Document |

| 101.CAL* |

XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF* |

XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB* |

XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE* |

XBRL Taxonomy Extension Presentation Linkbase Document |

| ** | Management contract or compensatory plan or agreement. |

| † | The schedules referenced in the Purchase Agreements, the Merger Agreement and the Asset Purchase Agreement have been omitted

in accordance with Item 601 (b)(2) of Regulation S-K. A copy of any referenced schedules will be furnished supplementally to the

SEC upon request. |

| (1) | Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with the

SEC on August 12, 2009. |

| (2) | Incorporated by reference to the similarly described exhibit

included with the Registrant’s Form 8-K filed with the SEC on June 6, 2011. |

| (3) | Incorporated by reference to Exhibit 2.1 of the Registrant’s

Form 8-K filed with the SEC on October 24, 2011. |

| (4) | Incorporated by reference from the similarly described

exhibit included with the Registrant’s Quarterly Report on Form 10-Q for the period ended March 31, 2012. |

(5)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on October 5, 2012.

(6)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on November 8, 2012.

(7)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on June 13, 2013.

(8)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed on April

4, 2013.

(9)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed on September

24, 2013.

(10)

Incorporated by reference from the similarly described exhibit filed in connection with the Registrant’s Registration

Statement on Form S-1 (File No. 333-5153) as amended, declared effective by the SEC on September 25, 1996.

(11)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Annual Report on Form

10-K for the year ended December 31, 2010.

(12)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on December 28, 2012.

(13)

Incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed with the SEC on May 10, 2013.

(14)

Incorporated by reference from the similarly described exhibit filed in connection with the Registrant’s Registration

Statement on Form S-8 (File No. 333-44999), effective when filed with the SEC on January 27, 1998.

(15)

Incorporated by reference from the similarly described exhibit to our definitive Proxy Statement with respect to our 2003

Annual Meeting of Shareholders as filed with the SEC on March 28, 2003.

(16)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Quarterly Report on

Form 10-Q for the period ended March 31, 2000.

(17)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Annual Report on Form

10-K for the year ended December 31, 2004.

(18)

Incorporated by reference from the similarly described exhibit to our definitive Proxy Statement with respect to our 2007

Annual Meeting of Shareholders as filed with the SEC on March 30, 2007.

(19)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on August 16, 2012.

(20)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on October 5, 2012.

(21)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on April 18, 2013.

(22)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on July 8, 2013.

(23)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Quarterly Report on

Form 10-Q for the period ended September 30, 2013.

(24)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on February 19, 2013.

(25)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on September 24, 2013.

(26)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Annual Report on Form

10-K for the year ended December 31, 2013.

(27)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Quarterly Report on

Form 10-Q for the period ended March 31, 2014.

(28)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Quarterly Report on

Form 10-Q for the period ended March 31, 2014.

(29)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on May 13, 2014.

(30)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on July 14, 2014.

(31)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on December 22, 2014.

(32)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on January 20, 2015.

(33)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on March 3, 2015.

(34)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on March 26, 2015.

(35)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on April 6, 2015.

(36)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 8-K filed with

the SEC on April 20, 2015.

(37)

Incorporated by reference from the similarly described exhibit included with the Registrant's Form 8-K filed with the

SEC on October 19, 2015.

(38)

Incorporated by reference from “Note 22 — Basic and Diluted Earnings (Loss) per Share” on page F-55

of our Consolidated Financial Statements.

| (39) | Incorporated by reference from “Note 15 – Basic and

Diluted Earnings per Share” to the unaudited Consolidated Financial Statements included in the Registrant’s Form 10-Q

for the period ended March 31, 2015 filed with the SEC on May 15, 2015. |

(40)

Incorporated by reference from the similarly described exhibit included with the Registrant’s Form 10-K for the year

ended December 31, 2014 filed with the SEC on May 11, 2015.

| |

Exhibit

5.1 |

Mayer

Brown LLP

1221 Avenue

of the Americas

New York, New York 10020

Main Tel

+1 212 506 2500

Main Fax +1 212 262 1910

www.mayerbrown.com

|

| |

| November

12, 2015 |

Ocwen Financial Corporation

1000 Abernathy Road NE, Suite

210

Atlanta, Georgia 30328 |

| |

| |

Ladies and Gentlemen:

We

have acted as special counsel to Ocwen Financial Corporation, a Florida corporation (the “Company”), in connection

with the preparation of a Registration Statement on Form S-4 (the “Registration Statement”), including the

prospectus constituting a part thereof (the “Prospectus”), filed with the Securities and Exchange Commission

under the Securities Act of 1933, as amended (the “Securities Act”), relating to an offer to exchange (the

“Exchange Offer”) all of the outstanding $350 million aggregate principal amount of the Company’s 6.625%

Senior Notes due 2019 (the “Original Notes”), which were issued in a transaction exempt from the registration

requirements of the Securities Act, for an equal principal amount of the Company’s newly issued 6.625% Senior Notes due

2019, which are registered under the Registration Statement (the “New Notes”). The Original Notes were issued,

and the New Notes will be issued, pursuant to an Indenture, dated May 12, 2014 (the “Indenture”), between the

Company and The Bank Of New York Mellon Trust Company, N.A., as trustee (the “Trustee”). The terms and conditions

of the Exchange Offer are set forth in the Prospectus.

In rendering

the opinions expressed herein, we have examined (i) the Registration Statement, including the Prospectus, (ii) an executed copy

of the Indenture, and (iii) an executed copy of the global certificate representing the New Notes. We have also examined such

other documents, certificates and opinions and have made such further investigations as we have deemed necessary or appropriate

for purposes of the opinions expressed below.

In

expressing the opinions set forth below, we have assumed the genuineness of all signatures, the authenticity of all documents

submitted to us as originals, the conformity to the original documents of all documents submitted to us as certified, conformed

or photostatic copies and the legal competence of each individual executing any document. As to all parties, we have assumed the

due authorization, execution and delivery of all documents and, other than with respect to the Company, the validity and enforceability

thereof against all parties thereto in accordance with their respective terms.

Mayer Brown

LLP operates in combination with other Mayer Brown entities with offices in Europe and Asia

and is associated with Tauil & Chequer Advogados, a Brazilian law partnership.

Ocwen Financial Corporation

November 12,

2015

Page 2

As to

matters of fact (but not as to legal conclusions), to the extent we deemed proper, we have relied on certificates of responsible

officers of the Company and of public officials.

Based

upon, and subject to, the matters stated herein, we are of the opinion that the New Notes,

when duly executed and delivered by or on behalf of the Company and authenticated by the Trustee in accordance with the Indenture,

and issued in exchange for an equal principal amount of Original Notes pursuant to and in accordance with the terms of

the Exchange Offer, will constitute valid and legally binding obligations of the Company

enforceable against the Company in accordance with their terms and entitled to the benefits of the Indenture, subject to applicable

bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or similar laws affecting the enforcement of creditors’

rights or remedies generally and by equitable principles relating to enforceability, including principles of good faith and fair

dealing (regardless of whether enforcement is sought in a proceeding at law or in equity).

The

opinions contained herein are limited to Federal laws of the United States and the laws of the State of New York. We are not purporting

to opine on any matter to the extent that it involves the laws of any other jurisdiction.

The

opinions expressed herein are as of the date hereof. We assume no obligation to update or supplement this letter to reflect any

facts or circumstances that may hereafter come to our attention or any changes in applicable law that may hereafter occur.

We

hereby consent to the reference to our firm under the caption “Legal Matters” in the Prospectus which is filed as

part of the Registration Statement, and to the filing of this opinion as an exhibit to such Registration Statement. In giving

this consent, we do not admit that we are “experts” within the meaning of Section 11 of the Securities Act or within

the category of persons whose consent is required by Section 7 of the Securities Act.

| |

Very truly yours, |

| |

|

| |

/s/ Mayer Brown LLP |

| |

|

| |

Mayer Brown LLP |

Exhibit 5.2

Annie Zaffuto

Assistant General Counsel

November

12, 2015

Ocwen Financial Corporation

1661 Worthington Road,

Suite 100

West Palm Beach, Florida

33409 |

|

| |

Ladies and Gentlemen:

I

am Assistant General Counsel of Ocwen Financial Corporation, a Florida corporation (the “Company”). The

Company has prepared a Registration Statement on Form S-4 (the “Registration Statement), including the

prospectus constituting a part thereof (the “Prospectus”), filed with the Securities and Exchange Commission

(the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”),

relating to an offer to exchange (the “Exchange Offer”) all of the outstanding $350 million aggregate principal

amount of the Company’s 6.625% Senior Notes due 2019 (the “Original Notes”), which were issued in a transaction

exempt from the registration requirements of the Securities Act, for an equal principal amount of the Company’s newly issued

6.625% Senior Notes due 2019, which are registered under the Registration Statement (the “New Notes”). The

Original Notes were issued, and the New Notes will be issued, pursuant to an Indenture, dated May 12, 2014 (the “Indenture”),

between the Company and The Bank Of New York Mellon Trust Company, N.A., as trustee (the “Trustee”). The terms

and conditions of the Exchange Offer are set forth in the Prospectus.

In

rendering the opinions expressed herein, I, or attorneys acting as counsel to the Company under my supervision, have examined

(i) the Registration Statement, including the Prospectus, (ii) an executed copy of the Indenture, (iii) an executed copy of the

global certificate representing the New Notes, (iv) a certificate from the Secretary of State of Florida, dated November 10, 2015,

as to the status of the Company as a corporation in the State of Florida (the “Florida Certificate”) and (v)

a certificate signed by an Assistant Secretary of the Company dated the date hereof. I have also examined such other documents

and instruments and have made such further investigations as I have deemed necessary or appropriate in connection with this opinion,

including, without limitation, the Certificate of Incorporation and the By-Laws of the Company, as amended to date, certain resolutions

of the Board of Directors of the Company relating to, among other things, the Registration Statement, the Exchange Offer and the

issuance of the New Notes.

Ocwen Financial Corporation

November 12, 2015

Page 2

In

expressing the opinions set forth below, I have assumed the genuineness of all signatures, the authenticity of all documents submitted

to me as originals, the conformity to the original documents of all documents submitted to me as certified, conformed or photostatic

copies and the legal competence of each individual executing any document. As to all parties, other than the Company, I have assumed

the due authorization, execution and delivery of all documents, and, as to all parties I have assumed the validity and enforceability

thereof against all parties thereto in accordance with their respective terms. As to any facts relevant to the opinions stated

herein that I did not independently establish or verify, I have relied upon statements and representations of officers and other

representatives of the Company and others and of public officials.

Based

upon, and subject to, the matters stated herein, I am of the opinion that:

(i) The

Company is a corporation validly existing under the laws of the State of Florida, its corporate status is active and it has the

corporate power and authority to execute and deliver the New Notes and perform all of its obligations thereunder.

(ii) The

Company has duly authorized the New Notes to be issued in exchange for an equal principal amount of Original Notes pursuant to

and in accordance with the terms of the Exchange Offer by all necessary corporate action.

The

foregoing opinions are subject to the following qualifications, limitations and assumptions:

A. The

opinions presented herein are limited to the matters specifically set forth herein and no other opinion shall be inferred beyond

the matters expressly stated.

B. My

opinion in paragraph (i) above with respect to the valid existence and corporate status of the Company is based solely upon the

Florida Certificate.

I

am licensed to practice law in the State of Florida and the opinions contained herein are limited to the laws of the State of

Florida. I am not purporting to opine on any matter to the extent that it involves the laws of any other jurisdiction.

The

opinion expressed herein is as of the date hereof. I assume no obligation to update or supplement this letter to reflect any facts

or circumstances that may hereafter come to my attention or any changes in applicable law that may hereafter occur.

I

hereby consent to the reference to me under the caption “Legal Matters” in the Prospectus which is filed as part of

the Registration Statement, and to the filing of this opinion as an exhibit to such Registration Statement. In giving this consent,

I do not admit that I am an “expert” within the meaning of Section 11 of the Securities Act or within the category

of persons whose consent is required by Section 7 of the Securities Act or the rules and regulations of the Commission.

| |

Very truly yours, |

| |

|

| |

/s/ Annie Zaffuto |

| |

Assistant General Counsel |

Exhibit 25.1

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM T-1

STATEMENT

OF ELIGIBILITY

UNDER

THE TRUST INDENTURE ACT OF 1939

OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

Check

if an Application to Determine Eligibility of a Trustee Pursuant to Section 305(b)(2) __

WILMINGTON

SAVINGS FUND SOCIETY, FSB

(Exact name of

Trustee as specified in its charter)

| N/A |

51-0054940 |

| (Jurisdiction

of incorporation of organization if not a U.S. national bank) |

(I.R.S.

Employer Identification No.) |

500 Delaware

Avenue, 11th Floor

Wilmington,

DE 19801

(302)

792-6000

(Address of principal

executive offices, including zip code)

WILMINGTON

SAVINGS FUND SOCIETY

CONTROLLERS

OFFICE

500 Delaware

Avenue

Wilmington,

DE 19801

(302)

792-6000

(Name, address,

including zip code, and telephone number, including area code, of agent of service)

Ocwen Financial

Corporation

(Exact

name of obligor as specified in its charter)

|

| Florida |

65-0039856 |

| (State

or other jurisdiction or incorporation or organization) |

(I.R.S.

Employer Identification No.) |

1661 Worthington

Road, Suite 100

West Palm

Beach, Florida 33409

(Address of principal

executive offices, including zip code)

6.625% Senior

Notes due 2019

(Title of the

indenture securities)

| ITEM 1. | GENERAL

INFORMATION. |

| | |

| | Furnish the following

information as to the trustee: |

(a) Name

and address of each examining or supervising authority to which it is subject.

| Securities and Exchange Commission |

FDIC |

| Washington, DC 20549 |

Washington, DC 20549 |

| |

|

| Federal Reserve |

Office of the Comptroller of the Currency |

| District 3 |

New York, NY 10173 |

| Philadelphia, PA |

|

(b) Whether

it is authorized to exercise corporate trust powers.

The trustee

is authorized to exercise corporate trust powers.

| ITEM 2. | AFFILIATIONS

WITH THE OBLIGOR. |

| | |

| | If the obligor

is an affiliate of the trustee, describe each affiliation: |

Based upon an examination of the

books and records of the trustee and information available to the trustee, the obligor is not an affiliate of the trustee.

| ITEM 16. | LIST

OF EXHIBITS. |

| | |

| | Listed below are

all exhibits filed as part of this Statement of Eligibility and Qualification. |

| Exhibit 1. |

A copy of the Certified Federal Savings Association

Charter of Wilmington Savings Fund Society, FSB. |

| Exhibit 2. |

The authority of Wilmington Savings Fund Society, FSB to commence

business was granted under the Charter for Wilmington Savings Fund Society, FSB, incorporated herein by reference to Exhibit

1. |

| Exhibit 3. |

The authorization to exercise corporate trust powers was granted

under the Charter for Wilmington Savings Fund Society, FSB, incorporated herein by reference to Exhibit 1. |

| Exhibit 4. |

A copy of the existing Bylaws of Wilmington Savings Fund Society,

FSB. |

| Exhibit 5. |

Not applicable. |

| Exhibit 6. |

The consents of Wilmington Savings Fund Society, FSB required by

Section 321(b) of the Act. |

| Exhibit 7. |

Current Report of the Condition of Wilmington Savings Fund Society,

FSB, published pursuant to law or the requirements of its supervising or examining authority. |

| Exhibit 8. |

Not applicable. |

| Exhibit 9. |

Not applicable. |

Pursuant

to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, Wilmington Savings Fund Society, FSB, a federal

savings bank organized and existing under the laws of the United States of America, has duly caused this Statement of Eligibility

to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of Wilmington and State of Delaware

on the 2 day of November, 2015.

| |

|

|

|

|

|

| |

|

|

WILMINGTON

SAVINGS FUND SOCIETY, FSB |

| |

|

|

|

|

|

| Attest: |

/s/ Harrison

Gelber |

|

By: |

/s/

Kristin L. Moore |

|

| Assistant

Secretary |

|

Name: |

Kristin L. Moore |

|

| |

|

|

Title: |

Vice President |

|

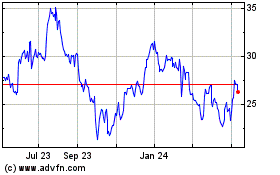

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024