UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15 (d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 28, 2015

OCWEN

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Florida |

|

1-13219 |

|

65-0039856 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

| |

|

|

|

|

1661

Worthington Road, Suite 100

West

Palm Beach, FL 33409

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (561) 682-8000

Not

applicable.

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On October 28, 2015, Ocwen Financial Corporation issued a press release announcing its results for the third quarter ended September 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained under Item 2.02 in this Current Report, including Exhibit 99.1, is being furnished and, as a result, such information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial

Statements and Exhibits. |

| Exhibit

|

|

|

| Number |

|

Description |

| |

|

|

| Exhibit 99.1 |

|

Press release of Ocwen Financial Corporation dated October 28, 2015. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned, hereunto duly authorized.

| |

OCWEN

FINANCIAL CORPORATION

(Registrant) |

| |

|

|

| Date: October

28, 2015 |

By: |

/s/

Michael R. Bourque, Jr. |

| |

|

Michael R.

Bourque, Jr. |

| |

|

Chief Financial

Officer |

| |

|

(On

behalf of the Registrant and as its principal financial officer)

|

Exhibit 99.1

|

Ocwen Financial Corporation® |

FOR

IMMEDIATE RELEASE

OCWEN

FINANCIAL ANNOUNCES OPERATING RESULTS

FOR

THIRD QUARTER 2015

| · | Generated

Q3 2015 Cash Flows From Operating Activities of $239 million |

| · | Ended

September with $731 million of available liquidity, including $459 million of cash on

hand |

| · | Reduced

corporate debt by 47% or $812 million year to date |

West

Palm Beach, FL – (October 28, 2015) Ocwen Financial Corporation, (NYSE:OCN) (“Ocwen” or the “Company”),

a leading financial services holding company, today reported a net loss of $(66.8) million, or $(0.53) per share, for the three

months ended September 30, 2015 compared to a net loss of $(75.3) million, or $(0.58) per share, for the three months ended September

30, 2014. Ocwen generated revenue of $405 million, down 21% compared to the third quarter of the prior year. Cash Flows from Operating

Activities were $239 million for the three months ended September 30, 2015, compared to $349 million during the same period last

year.

“In

the third quarter, we continued to make progress on our strategic and operating initiatives. Our asset sale strategy has succeeded

in generating proceeds and gains for the Company, enabling us to reduce leverage and focus on simplifying our operations. Our

operating cash flow remained strong, enabling us to end the quarter with more than $731 million in available liquidity, including

$459 million of cash on hand. The capital markets also continue to demonstrate strong support for the Company, as we were able

to successfully refinance our $1.8 billion OMART servicing advance facility and execute an amendment with our term loan lenders

to give us more flexibility moving forward” commented Ron Faris, President and CEO of Ocwen.

Mr.

Faris continued, “We are making solid progress in developing our lending capabilities including expansion of our product

offerings. Additionally, we are progressing as expected on the cost improvement initiatives

that we laid out in the third quarter and anticipate identifying additional opportunities to reduce our operating costs. We remain

committed to investing in our risk, compliance and technology infrastructure, and delivering best-in-class service to our customers.”

Third

Quarter Results

Pre-tax

loss for the third quarter of 2015 was $(55.9) million. Pre-tax results were impacted by a number of significant items including

but not limited to: $41.2 million of net gains from sales of performing and non-performing agency mortgage servicing rights (MSRs)

relating to loans with a total unpaid principal balance (UPB) of $22.0 billion, $(23.4) million of interest rate driven impairment

of our GNMA MSRs carried at lower of cost or fair value, $(17.4) million in restructuring costs, including severance and Fiserv

platform exit costs, $(12.5) million of monitor costs, $(11.1) million in legacy servicing claim reserves, $(11.0) million

in legal and other settlement costs and $(8.2) million of expense incurred pursuant to our agreement with New Residential Investment

Corp. in connection with downgrades to our S&P servicer ratings. Servicing recorded a $(12.7) million pre-tax loss inclusive

of the gain on sales of MSRs, MSR fair value changes and legacy servicing claim reserves. The Lending segment generated

$8.6 million of pre-tax income for the third quarter of 2015.

Additional

Business Highlights

| · | Launched

“Ocwen Cares” web site aimed at helping borrowers in distress. |

| · | Continued

joint initiative with NAACP, “Help and Hope for Homeowners,” aimed at encouraging

struggling homeowners to seek assistance. |

| · | Completed

19,470 loan modifications with HAMP modifications accounting for 50% of the total. Modifications

that included some principal reduction accounted for 45% of total modifications. |

| · | The

constant pre-payment rate (“CPR”) decreased from 15.7% in the second quarter

of 2015 to 14.7% in the third quarter of 2015. In the third quarter of 2015, prime CPR

was 17.6%, and non-prime CPR was 11.8%. |

| · | Delinquencies

increased slightly from 13.0% at June 30, 2015 to 13.1% at September 30, 2015, primarily

driven by sales and transfers of performing agency loans. |

| · | Originated

forward and reverse mortgage loans with UPB of $1.1 billion and $198.5 million, respectively.

|

Webcast

and Conference Call

Ocwen

will host a webcast and conference call on Wednesday, October 28, 2015, at 5 p.m., Eastern Time, to discuss its financial results

for the third quarter of 2015. The conference call will be webcast live over the internet from the Company’s website at

www.Ocwen.com, click on the “Shareholder Relations” section. A replay of the conference call will be available via

the website approximately two hours after the conclusion of the call and will remain available for approximately 30 days.

About

Ocwen Financial Corporation

Ocwen

Financial Corporation is a financial services holding company which, through its subsidiaries, is engaged in the servicing and

origination of mortgage loans. Ocwen is headquartered in West Palm Beach, Florida, with offices throughout the United States and

support operations in India and the Philippines. Utilizing proprietary technology, global infrastructure and superior training

and processes, Ocwen provides solutions that help homeowners and make our clients’ loans worth more. Ocwen may post information

that is important to investors on its website (www.Ocwen.com).

Note

Regarding Available Liquidity

Due

to high liquidity levels, Ocwen is currently foregoing borrowings on a number of warehouse and servicing advance facilities and

funding a portion of loans and advances with cash. These assets are pledged to our debt facilities as collateral, and we can re-borrow

on the facilities with short notice. Available liquidity of $731 million represents GAAP cash on hand of $459 million plus this

available borrowing capacity of $272 million (in each case as of September 30, 2015). Available liquidity is a non-GAAP financial

measure. We believe this non-GAAP financial measure provides a useful supplement to discussion and analysis of our liquidity.

We believe this non-GAAP financial measure provides an alternative way to view our liquidity that is instructive. Non-GAAP financial

measures should be viewed in addition to, and not as an alternative for, Ocwen’s reported results under accounting principles

generally accepted in the United States. Other companies may use non-GAAP financial measures with the same or similar titles that

are calculated differently than our non-GAAP financial measures. As a result, comparability may be limited.

Forward

Looking Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act. These forward-looking statements may be identified by a reference to a future period or by the use of forward-looking

terminology. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Our business

has been undergoing substantial change which has magnified such uncertainties. Readers should bear these factors in mind when

considering such statements and should not place undue reliance on such statements. Forward-looking statements involve a number

of assumptions, risks and uncertainties that could cause actual results to differ materially. In the past, actual results have

differed from those suggested by forward looking statements and this may happen again. Important factors that could cause actual

results to differ materially from those suggested by the forward-looking statements include, but are not limited to, the following:

our servicer and credit ratings as well as other actions from various rating agencies, including the impact of recent downgrades

of our servicer and credit ratings; adverse effects on our business as a result of recent regulatory settlements; reactions to

the announcement of such settlements by key counterparties; increased regulatory scrutiny and media attention, due to rumors or

otherwise; uncertainty related to claims, litigation and investigations brought by government agencies and private parties regarding

our servicing, foreclosure, modification and other practices; any adverse developments in existing legal proceedings or the initiation

of new legal proceedings; our ability to effectively manage our regulatory and contractual compliance obligations; our ability

to execute on our strategy to reduce the size of our Agency servicing portfolio; our ability to recognize the benefits of our

deferred tax assets; the adequacy of our financial resources, including our sources of liquidity and ability to sell, fund and

recover advances, repay borrowings and comply with debt covenants; volatility in our stock price; the characteristics of our servicing

portfolio, including prepayment speeds along with delinquency and advance rates; our ability to contain and reduce our operating

costs, including our ability to successfully execute on our cost improvement initiative; our ability to successfully modify delinquent

loans, manage foreclosures and sell foreclosed properties; uncertainty related to legislation, regulations, regulatory agency

actions, government programs and policies, industry initiatives and evolving best servicing practices; as well as other risks

detailed in Ocwen’s reports and filings with the SEC, including its annual report on Form 10-K for the year ended December

31, 2014 (filed with the SEC on May 11, 2015) and its quarterly report on Form 10-Q for the quarter ended June 30, 2015 (filed

with the SEC on July 31, 2015). Anyone wishing to understand Ocwen’s business should review its SEC filings. Ocwen’s

forward-looking statements speak only as of the date they are made and we disclaim any obligation to update or revise forward-looking

statements whether as a result of new information, future events or otherwise.

FOR

FURTHER INFORMATION CONTACT:

| Investors:

|

Media: |

| Stephen

Swett |

John

Lovallo |

Dan

Rene |

| T:

(203) 614-0141 |

T:

(917) 612-8419 |

T:

(202) 973 -1325 |

| E:

shareholderrelations@ocwen.com |

E:

jlovallo@levick.com |

E:drene@levick.com

|

Residential Servicing Statistics

(Dollars in thousands)

| | |

At or for the Three Months Ended | |

| | |

September 30, 2015 | | |

June 30, 2015 | | |

March 31, 2015 | | |

December 31, 2014 | | |

September 30, 2014 | |

| Total unpaid principal balance of loans and REO serviced | |

$ | 288,069,149 | | |

$ | 321,670,579 | | |

$ | 382,214,002 | | |

$ | 398,727,727 | | |

$ | 411,279,614 | |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-performing loans and REO serviced as a % of total UPB (1) | |

| 13.1 | % | |

| 13.0 | % | |

| 12.5 | % | |

| 13.2 | % | |

| 13.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Prepayment speed (average CPR)(2) (3) | |

| 14.7 | % | |

| 15.7 | % | |

| 13.3 | % | |

| 12.7 | % | |

| 12.8 | % |

| | | |

| (1) | Performing

loans include those loans that are less than 90 days past due and those loans for which

borrowers are making scheduled payments under loan modification, forbearance or bankruptcy

plans. We consider all other loans to be non-performing. |

| | | |

| (2) | Average

Constant Prepayment Rate for the prior three months. |

| | | |

| | (3) |

Average CPR for the three months ended September 30, 2015 includes 17.6 % for prime loans and 11.8% for non-prime loans. |

Segment Results (Unaudited)

(Dollars in thousands)

| | |

Three Months | | |

Nine Months | |

| For the Periods Ended September 30, | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Servicing | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 374,936 | | |

$ | 485,303 | | |

$ | 1,269,269 | | |

$ | 1,526,606 | |

| Expenses | |

| 318,439 | | |

| 313,964 | | |

| 940,764 | | |

| 919,998 | |

| Other income (expense), net | |

| (69,239 | ) | |

| (126,821 | ) | |

| (249,947 | ) | |

| (393,939 | ) |

| Income (loss) before income taxes | |

| (12,742 | ) | |

| 44,518 | | |

| 78,558 | | |

| 212,669 | |

| | |

| | | |

| | | |

| | | |

| | |

| Lending | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 29,662 | | |

$ | 26,877 | | |

$ | 106,721 | | |

$ | 86,811 | |

| Expenses | |

| 23,126 | | |

| 22,632 | | |

| 73,497 | | |

| 81,261 | |

| Other income (expense), net | |

| 2,052 | | |

| 2,363 | | |

| 5,793 | | |

| 8,692 | |

| Income before income taxes | |

| 8,588 | | |

| 6,608 | | |

| 39,017 | | |

| 14,242 | |

| | |

| | | |

| | | |

| | | |

| | |

| Corporate Items and Other | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 348 | | |

$ | 1,557 | | |

$ | 2,709 | | |

$ | 4,734 | |

| Expenses | |

| 46,161 | | |

| 118,482 | | |

| 104,133 | | |

| 148,555 | |

| Other income (expense), net | |

| (5,951 | ) | |

| (6,467 | ) | |

| (16,740 | ) | |

| (6,476 | ) |

| Loss before income taxes | |

| (51,764 | ) | |

| (123,392 | ) | |

| (118,164 | ) | |

| (150,297 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Corporate Eliminations | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| — | | |

$ | (39 | ) | |

$ | (58 | ) | |

$ | (118 | ) |

| Expenses | |

| — | | |

| (39 | ) | |

| (58 | ) | |

| (118 | ) |

| Other income (expense), net | |

| — | | |

| — | | |

| — | | |

| — | |

| Income (loss) before income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Consolidated income (loss) before income taxes | |

$ | (55,918 | ) | |

$ | (72,266 | ) | |

$ | (589 | ) | |

$ | 76,614 | |

OCWEN FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

(UNAUDITED)

| | |

Three Months Ended

September 30. | | |

Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Servicing and subservicing fees | |

$ | 360,017 | | |

$ | 465,964 | | |

$ | 1,203,541 | | |

$ | 1,448,096 | |

| Gain on loans held for sale, net | |

| 27,298 | | |

| 27,218 | | |

| 116,934 | | |

| 110,041 | |

| Other revenues | |

| 17,631 | | |

| 20,516 | | |

| 58,166 | | |

| 59,896 | |

| Total revenue | |

| 404,946 | | |

| 513,698 | | |

| 1,378,641 | | |

| 1,618,033 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits | |

| 102,612 | | |

| 99,879 | | |

| 313,599 | | |

| 316,118 | |

| Amortization of mortgage servicing rights | |

| 18,108 | | |

| 60,783 | | |

| 88,188 | | |

| 186,075 | |

| Servicing and origination | |

| 101,545 | | |

| 49,739 | | |

| 255,905 | | |

| 129,473 | |

| Technology and communications | |

| 37,182 | | |

| 44,261 | | |

| 117,793 | | |

| 121,234 | |

| Professional services | |

| 62,428 | | |

| 160,704 | | |

| 191,728 | | |

| 212,745 | |

| Occupancy and equipment | |

| 31,043 | | |

| 24,697 | | |

| 85,530 | | |

| 82,504 | |

| Other | |

| 34,808 | | |

| 14,976 | | |

| 65,593 | | |

| 101,547 | |

| Total expenses | |

| 387,726 | | |

| 455,039 | | |

| 1,118,336 | | |

| 1,149,696 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 5,693 | | |

| 6,593 | | |

| 16,306 | | |

| 17,472 | |

| Interest expense | |

| (118,313 | ) | |

| (133,049 | ) | |

| (362,606 | ) | |

| (409,129 | ) |

| Gain on sale of mortgage servicing rights | |

| 41,246 | | |

| — | | |

| 97,958 | | |

| — | |

| Gain on extinguishment of debt | |

| — | | |

| — | | |

| — | | |

| 2,609 | |

| Other, net | |

| (1,764 | ) | |

| (4,469 | ) | |

| (12,552 | ) | |

| (2,675 | ) |

| Total other expense, net | |

| (73,138 | ) | |

| (130,925 | ) | |

| (260,894 | ) | |

| (391,723 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

| (55,918 | ) | |

| (72,266 | ) | |

| (589 | ) | |

| 76,614 | |

| Income tax expense | |

| 10,832 | | |

| 2,992 | | |

| 21,866 | | |

| 24,374 | |

| Net income (loss) | |

| (66,750 | ) | |

| (75,258 | ) | |

| (22,455 | ) | |

| 52,240 | |

| Net income attributable to non-controlling interests | |

| (119 | ) | |

| (123 | ) | |

| (321 | ) | |

| (165 | ) |

| Net income (loss) attributable to Ocwen stockholders | |

| (66,869 | ) | |

| (75,381 | ) | |

| (22,776 | ) | |

| 52,075 | |

| Preferred stock dividends | |

| — | | |

| — | | |

| — | | |

| (1,163 | ) |

| Deemed dividend related to beneficial conversion feature of preferred stock | |

| — | | |

| (808 | ) | |

| — | | |

| (1,639 | ) |

| Net income (loss) attributable to Ocwen common stockholders | |

$ | (66,869 | ) | |

$ | (76,189 | ) | |

$ | (22,776 | ) | |

$ | 49,273 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings (loss) per share attributable to Ocwen common stockholders | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.53 | ) | |

$ | (0.58 | ) | |

$ | (0.18 | ) | |

$ | 0.37 | |

| Diluted | |

| (0.53 | ) | |

| (0.58 | ) | |

| (0.18 | ) | |

| 0.36 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 125,383,639 | | |

| 130,551,197 | | |

| 125,322,742 | | |

| 133,318,381 | |

| Diluted | |

| 125,383,639 | | |

| 130,551,197 | | |

| 125,322,742 | | |

| 136,881,326 | |

OCWEN FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except share data)

(UNAUDITED)

| | |

September 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| Cash | |

$ | 458,674 | | |

$ | 129,473 | |

| Mortgage servicing rights ($787,344 and $93,901 carried at fair value) | |

| 1,153,295 | | |

| 1,913,992 | |

| Advances | |

| 517,378 | | |

| 893,914 | |

| Match funded advances | |

| 1,955,618 | | |

| 2,409,442 | |

| Loans held for sale ($235,909 and $401,120 carried at fair value) | |

| 526,972 | | |

| 488,612 | |

| Loans held for investment - reverse mortgages, at fair value | |

| 2,319,515 | | |

| 1,550,141 | |

| Receivables, net | |

| 361,572 | | |

| 270,596 | |

| Deferred tax assets, net | |

| 63,866 | | |

| 76,987 | |

| Premises and equipment, net | |

| 44,885 | | |

| 43,310 | |

| Other assets ($18,551 and $13,400 carried at fair value) | |

| 609,279 | | |

| 490,811 | |

| Total assets | |

$ | 8,011,054 | | |

$ | 8,267,278 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Match funded liabilities | |

$ | 1,589,846 | | |

$ | 2,090,247 | |

| Financing liabilities ($2,789,663 and $2,058,693 carried at fair value) | |

| 2,953,518 | | |

| 2,258,641 | |

| Other secured borrowings | |

| 1,001,070 | | |

| 1,733,691 | |

| Senior unsecured notes | |

| 350,000 | | |

| 350,000 | |

| Other liabilities | |

| 1,036,165 | | |

| 793,534 | |

| Total liabilities | |

| 6,930,599 | | |

| 7,226,113 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Ocwen Financial Corporation (Ocwen) stockholders’ equity | |

| | | |

| | |

| Common stock, $.01 par value; 200,000,000 shares authorized; 125,390,482 and 125,215,615 shares issued and outstanding at September 30, 2015 and December 31, 2014, respectively | |

| 1,254 | | |

| 1,252 | |

| Additional paid-in capital | |

| 527,622 | | |

| 515,194 | |

| Retained earnings | |

| 550,373 | | |

| 530,361 | |

| Accumulated other comprehensive loss, net of income taxes | |

| (1,886 | ) | |

| (8,413 | ) |

| Total Ocwen stockholders’ equity | |

| 1,077,363 | | |

| 1,038,394 | |

| Non-controlling interest in subsidiaries | |

| 3,092 | | |

| 2,771 | |

| Total equity | |

| 1,080,455 | | |

| 1,041,165 | |

| Total liabilities and equity | |

$ | 8,011,054 | | |

$ | 8,267,278 | |

OCWEN FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(UNAUDITED)

| | |

For the Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | (22,455 | ) | |

$ | 52,240 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Amortization of mortgage servicing rights | |

| 88,188 | | |

| 186,075 | |

| Loss on valuation of mortgage servicing rights, at fair value | |

| 73,257 | | |

| 13,147 | |

| Impairment of mortgage servicing rights | |

| 25,052 | | |

| — | |

| Gain on sale of mortgage servicing rights | |

| (97,958 | ) | |

| — | |

| Realized and unrealized losses on derivative financial instruments | |

| 8,529 | | |

| 1,955 | |

| Provision for bad debts | |

| 25,272 | | |

| 49,583 | |

| Depreciation | |

| 13,467 | | |

| 16,601 | |

| Amortization of debt issuance costs | |

| 10,385 | | |

| 3,754 | |

| Gain on extinguishment of debt | |

| — | | |

| (2,609 | ) |

| (Gain) loss on sale of fixed assets | |

| (1,095 | ) | |

| 2,093 | |

| Decrease in deferred tax assets, net | |

| 5,700 | | |

| 35,884 | |

| Equity-based compensation expense | |

| 5,130 | | |

| 9,372 | |

| Gain on loans held for sale, net | |

| (116,934 | ) | |

| (110,041 | ) |

| Origination and purchase of loans held for sale | |

| (3,713,311 | ) | |

| (6,007,152 | ) |

| Proceeds from sale and collections of loans held for sale | |

| 3,935,420 | | |

| 6,013,059 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Decrease in advances and match funded advances | |

| 491,654 | | |

| 236,688 | |

| Increase in receivables and other assets, net | |

| (1,899 | ) | |

| (11,806 | ) |

| Increase in other liabilities | |

| 30,726 | | |

| 46,243 | |

| Other, net | |

| 14,866 | | |

| 23,929 | |

| Net cash provided by operating activities | |

| 773,994 | | |

| 559,015 | |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Origination of loans held for investment - reverse mortgages | |

| (781,002 | ) | |

| (565,670 | ) |

| Principal payments received on loans held for investment - reverse mortgages | |

| 105,520 | | |

| 56,193 | |

| Purchase of mortgage servicing rights, net | |

| (10,055 | ) | |

| (19,395 | ) |

| Proceeds from sale of mortgage servicing rights | |

| 598,059 | | |

| 287 | |

| Acquisition of advances in connection with the purchase of mortgage servicing rights | |

| — | | |

| (84,373 | ) |

| Acquisition of advances in connection with the purchase of loans | |

| — | | |

| (60,482 | ) |

| Proceeds from sale of advances and match funded advances | |

| 285,938 | | |

| — | |

| Additions to premises and equipment | |

| (18,335 | ) | |

| (7,716 | ) |

| Proceeds from sale of premises and equipment | |

| 4,758 | | |

| 22 | |

| Cash paid to acquire ResCap Servicing Operations (a component of Residential Capital, LLC) | |

| — | | |

| (54,220 | ) |

| Net cash paid to acquire controlling interest in Ocwen Structured Investments, LLC | |

| — | | |

| (7,834 | ) |

| Distributions of capital from unconsolidated entities | |

| — | | |

| 6,572 | |

| Other | |

| 4,082 | | |

| 4,248 | |

| Net cash provided by (used in) investing activities | |

| 188,965 | | |

| (732,368 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Repayment of match funded liabilities | |

| (500,401 | ) | |

| (329,175 | ) |

| Proceeds from other secured borrowings | |

| 5,647,016 | | |

| 4,352,495 | |

| Repayments of other secured borrowings | |

| (6,572,601 | ) | |

| (4,532,029 | ) |

| Proceeds from issuance of senior unsecured notes | |

| — | | |

| 350,000 | |

| Payment of debt issuance costs | |

| (18,610 | ) | |

| (6,835 | ) |

| Proceeds from sale of mortgage servicing rights accounted for as a financing | |

| — | | |

| 123,551 | |

| Proceeds from sale of loans accounted for as a financing | |

| 803,924 | | |

| 572,031 | |

| Proceeds from sale of advances accounted for as a financing | |

| — | | |

| 88,095 | |

| Repurchase of common stock | |

| — | | |

| (325,609 | ) |

| Payment of preferred stock dividends | |

| — | | |

| (1,163 | ) |

| Proceeds from exercise of common stock options | |

| 413 | | |

| 1,176 | |

| Other | |

| 6,501 | | |

| 1,467 | |

| Net cash (used in) provided by financing activities | |

| (633,758 | ) | |

| 294,004 | |

| | |

| | | |

| | |

| Net increase in cash | |

| 329,201 | | |

| 120,651 | |

| Cash at beginning of year | |

| 129,473 | | |

| 178,512 | |

| Cash at end of period | |

$ | 458,674 | | |

$ | 299,163 | |

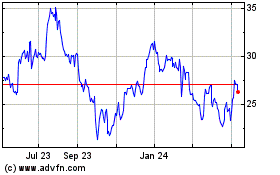

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024