UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15 (d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 11, 2015

OCWEN

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Florida |

|

1-13219 |

|

65-0039856 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

1000

Abernathy Road NE, Suite 210

Atlanta,

Georgia 30328

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (561) 682-8000

Not

applicable.

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

o |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item

2.02 |

Results

of Operations and Financial Condition. |

On

May 11, 2015, Ocwen Financial Corporation (the “Company”) issued a press release announcing that the Company has filed

its Annual Report on Form 10-K for the year ended December 31, 2014 without a qualification as to its ability to operate as a

going concern. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The

Company has reported a net loss of $(469.6) million, or $(3.60) per share, for the year ended December 31, 2014, compared

to previously released preliminary financial results for 2014 of a net loss of ($546.0) million, or ($4.18) per share.

The change from the previously released preliminary financial results was due to the reversal of a potential valuation

allowance of approximately $77 million against its remaining deferred tax asset, which, as previously discussed in the

Company’s press release of April 14, 2015, reflected a conservative view of the Company’s results and financial

position based on information available as of that date.

The

information contained under Item 2.02 in this Current Report, including Exhibit 99.1, is being furnished and, as a result, such

information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

| Item

5.02 | Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers. |

On

May 11, 2015, the Board of Directors (the “Board”) of the Company appointed Alan J. Bowers to the Board to serve until

the Company’s next annual meeting of shareholders and until his successor is duly elected and qualified. Also on May 11,

2015, the Board fixed the number of directors comprising the Board at eight. The Board’s Nomination/Governance Committee

and the Board have determined that Mr. Bowers is an independent director under the listing standards of the New York Stock Exchange.

Alan

J. Bowers, 60, has since December 2010 served as a director of Walker & Dunlop, Inc., a publicly traded commercial real estate

finance company, as Lead Director and on the Audit Committee, and Nominating and Corporate Governance Committee (Chairman). Mr.

Bowers also serves on the Board and as Audit Committee Chairman of La Quinta Inns & Suites, a publicly traded hotel chain

and American Achievement Corp., a privately held manufacturer and distributer of graduation products. Mr. Bowers is also a board

member of Quadel Consulting Corp., a privately held government contract manager and consulting firm.

Prior

to Mr. Bowers’ retirement in 2005, Mr. Bowers was the President and Chief Executive Officer and a board member of Cape Success,

LLC, a private equity-backed staffing service and information technology solutions business, from 2001-2004. Previously, Mr. Bowers

was the President and Chief Executive Officer and a board member of MarketSource Corporation, a marketing and sales support service

firm, and of MBL Life Assurance Corporation, a life insurance company. Mr. Bowers also served on the boards and as Audit Committee

Chairman of Refrigerated Holdings, Inc., a temperature controlled logistics firm, Roadlink Inc., a trucking and logistics company,

and Fastfrate Holdings, Inc., a Canadian trucking and logistics company. Mr. Bowers has been a certified public accountant since

1978 and served as Staff Auditor, Audit Partner and Managing Partner, serving a diverse client base during his tenure at Coopers

& Lybrand, L.L.P., and as a Staff Accountant with Laventhol & Horwath, CPAs.

Mr.

Bowers received his Bachelor of Science in Accounting from Montclair State University and his Master’s in Business Administration

from St. John’s University.

Mr.

Bowers will receive compensation for his services as a director in accordance with the Company’s standard compensation program

for non-management directors, which provides for an annual retainer of $60,000 paid in cash and an annual award of restricted

shares of common stock valued at $80,000.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

Exhibit

Number |

|

Description |

| |

|

|

| 99.1 |

|

Press release

of Ocwen Financial Corporation dated May 11, 2015. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned, hereunto duly authorized.

| |

OCWEN

FINANCIAL CORPORATION

(Registrant) |

| |

|

|

| Date: May

12, 2015 |

By: |

/s/

Michael R. Bourque, Jr. |

| |

|

Michael R.

Bourque, Jr. |

| |

|

Chief Financial

Officer |

| |

|

(On

behalf of the Registrant and as its principal financial officer) |

Exhibit 99.1

|

Ocwen Financial Corporation® |

FOR IMMEDIATE RELEASE

OCWEN FINANCIAL FILES 2014 FORM 10-K WITHOUT A QUALIFICATION ABOUT ITS ABILITY TO OPERATE AS A GOING CONCERN

Atlanta, GA - (May 11, 2015) Ocwen Financial Corporation, (NYSE:OCN) ("Ocwen" or the "Company"), a leading financial services holding company, today announced that it has filed its 2014 Form 10-K with the SEC.

“We believe the filing of our 2014 Form 10-K, without a qualification as to our ability to operate as

a going concern, is additional evidence that our strategy to strengthen our compliance management system, strengthen the service

we provide to our customers and improve our financial stability is working and that confidence in the Company is being restored,”

stated Ron Faris, President and Chief Executive Officer of Ocwen. “We can now focus more of our resources and energies

on building our origination capabilities and executing on our 2015 strategic initiatives which include:

| • | Improving the Company’s risk management, compliance and corporate governance programs;

|

| | | |

| • | Improving capital efficiency and utilization; |

| | | |

| • | Achieving our internal earnings per share targets; |

| | | |

| • | Improving customer satisfaction and reducing defect rates; |

| | | |

| • | Improving delinquency rates and increasing non-foreclosure resolutions; |

| | | |

| • | Improving diversity and inclusion programs; |

| | | |

| • | Improving franchise value and brand enhancement; and |

| | | |

| • | Completing key technological initiatives.” |

| | | |

The Company expects to file its first quarter Form 10-Q on or before May 18, 2015.

About

Ocwen Financial Corporation

Ocwen

Financial Corporation is a financial services holding company which, through its subsidiaries, is engaged in the servicing and

origination of mortgage loans. Ocwen is headquartered in Atlanta, Georgia, with offices throughout the United States and support

operations in India and the Philippines. Utilizing proprietary technology, global infrastructure and superior training and processes,

Ocwen provides solutions that help homeowners and make our clients’ loans worth more. Ocwen may post information that is

important to investors on its website (www.Ocwen.com).

Ocwen Financial Corporation

2014 Results

May 11, 2015

FORWARD

LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements by their

nature address matters that are, to different degrees, uncertain. Forward-looking statements involve a number of assumptions, risks

and uncertainties that could cause actual results to differ materially.

Important factors that could cause actual results to differ materially from those suggested by the forward-looking

statements include, but are not limited to, the following: adverse effects on our business as a result of recent regulatory settlements;

reactions to the announcement of such settlements by key counterparties; increased regulatory scrutiny and media attention, due

to rumors or otherwise; uncertainty related to claims, litigation and investigations brought by government agencies and private

parties regarding our servicing, foreclosure, modification and other practices; any adverse developments in existing legal proceedings

or the initiation of new legal proceedings; our ability to effectively manage our regulatory and contractual compliance obligations;

our ability to execute on our strategy to reduce the size of our Agency servicing portfolio; the adequacy of our financial resources,

including our sources of liquidity and ability to fund and recover advances, repay borrowings and comply with debt covenants; our

servicer and credit ratings as well as other actions from various rating agencies, including the impact of recent downgrades of

our servicer and credit ratings; volatility in our stock price; the characteristics of our servicing portfolio, including prepayment

speeds along with delinquency and advance rates; our ability to contain and reduce our operating costs; our ability to successfully

modify delinquent loans, manage foreclosures and sell foreclosed properties; uncertainty related to legislation, regulations, regulatory

agency actions, government programs and policies, industry initiatives and evolving best servicing practices; as well as other

risks detailed in Ocwen's reports and filings with the Securities and Exchange Commission (SEC), including its annual report on

Form 10-K for the year ended December 31, 2014 (filed with the SEC on 05/11/15). Anyone wishing to understand Ocwen's business

should review its SEC filings. Ocwen's forward-looking statements speak only as of the date they are made and, except for our ongoing

obligations under the U.S. federal securities laws, we undertake no obligation to update or revise forward-looking statements whether

as a result of new information, future events or otherwise.

FOR FURTHER

INFORMATION CONTACT:

| Investors:

|

Media: |

| Stephen

Swett |

John

Lovallo |

Dan

Rene |

| T: (203) 614-0141

|

T: (917) 612-8419 |

T: (202) 973 -1325 |

| E: shareholderrelations@ocwen.com

|

E: jlovallo@levick.com |

E:

drene@levick.com |

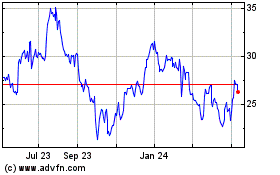

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024