UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 26, 2015

(Date

of earliest event reported)

QUANEX BUILDING PRODUCTS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-33913 |

|

26-1561397 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1800 West Loop South, Suite 1500,

Houston, Texas |

|

77027 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 713-961-4600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On March 3, 2015, the Registrant

issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 5.07. |

Submission of Matters to a Vote of Security Holders |

On February 26, 2015, the

Company held its Annual Meeting of Stockholders, pursuant to notice and proxy mailed on January 23, 2015, to the Company’s stockholders of record as of January 7, 2015. There were 34,799,047 shares of common stock entitled to

vote at the meeting, and a total of 33,602,701 shares were represented at the meeting in person or by proxy.

At the Annual Meeting, two

directors were elected for terms expiring at the Company’s 2018 Annual Meeting, with the following tabulation of votes for each nominee:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director Nominee |

|

Votes For |

|

|

Votes Withheld |

|

|

Broker

Non-Votes |

|

|

Percent of Shares

Cast in Favor * |

|

| Joseph D. Rupp |

|

|

32,451,293 |

|

|

|

234,531 |

|

|

|

916,877 |

|

|

|

99.28 |

% |

|

|

|

|

|

| Robert R. Buck |

|

|

32,199,227 |

|

|

|

486,597 |

|

|

|

916,877 |

|

|

|

98.51 |

% |

| * |

Excludes Broker Non-Votes |

In addition to the election of directors, stockholders at

the Annual Meeting took the following actions:

| |

• |

|

Provided an advisory “say on pay” vote approving the Company’s executive compensation programs; and |

| |

• |

|

Ratified the Audit Committee’s appointment of Grant Thornton LLP as the Company’s independent auditor for the fiscal year ending October 31, 2015. |

The tabulation of votes for each of these proposals is set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proposal |

|

Votes For |

|

|

Votes Against |

|

|

Abstain |

|

|

Broker

Non-Votes |

|

|

Percent of

Shares Cast in

Favor * |

|

| Advisory Vote to Approve Executive Compensation |

|

|

31,835,835 |

|

|

|

774,828 |

|

|

|

75,161 |

|

|

|

916,877 |

|

|

|

97.40 |

% |

|

|

|

|

|

|

| Ratification of Company’s Independent Auditor |

|

|

33,346,864 |

|

|

|

238,682 |

|

|

|

17,155 |

|

|

|

— |

|

|

|

99.24 |

% |

| * |

Excludes Broker Non-Votes |

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| *99.1 |

|

Press Release dated March 3, 2015 |

| † |

Management Compensation or Incentive Plan |

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

QUANEX BUILDING PRODUCTS CORPORATION

(Registrant) |

|

|

|

| March 3, 2015

(Date) |

|

|

|

/S/ KEVIN P.

DELANEY Kevin P. Delaney

Senior Vice President – General Counsel and Secretary |

Exhibit Index

|

|

|

| 99.1 |

|

Press release dated March 3, 2015 |

Exhibit 99.1

Quanex Building Products Corporation Reports First Quarter

2015 Results and Affirms Full Year 2015 Guidance

Houston, Texas, March 3, 2015 – Quanex Building Products Corporation (NYSE:NX), a leading supplier of window and door components,

today released results for the first quarter ended January 31, 2015.

“While we expected roughly flat sales growth in the first quarter because

of a planned contraction in our vinyl business, all of our other product lines continued to grow faster than the industry,” said Chairman, President and Chief Executive Officer Bill Griffiths. “This, together with the current trajectory of

our operating performance, gives us sufficient confidence to reaffirm our full year EBITDA guidance,” said Griffiths.

Financial highlights for the

first quarter include:

| |

• |

|

Q1 2015 net sales increased 1.2% to $128 million vs. $126 million in Q1 2014 |

| |

• |

|

Q1 2015 loss from continuing operations of ($3.1) million vs. loss of ($1.2) million in Q1 2014 |

| |

• |

|

Q1 2015 diluted loss per share from continuing operations of ($0.09) vs. ($0.03) in Q1 2014 |

| |

• |

|

Q1 2015 EBITDA of $2.6 million vs. $7.7 million in Q1 2014 |

| |

• |

|

Cash balance of $63.9 million and no borrowings on $150 million revolving credit facility |

At the

company’s annual shareholder meeting held at the Company’s corporate offices in Houston, Texas on February 26, 2015, board members Joseph D. Rupp and Robert R. Buck were elected by Quanex shareholders to serve a new three-year term

expiring in 2018. Quanex shareholders also ratified an advisory resolution approving the compensation of the Company’s named executive officers and the appointment of Grant Thornton LLP as the Company’s independent registered public

accounting firm for the fiscal year ending October 31, 2015.

Additionally, the Board of Directors declared a quarterly cash dividend of $0.04 per

share on the company’s common stock, payable March 31, 2015, to shareholders of record on March 16, 2015.

On September 5, 2014, the

Board of Directors authorized a $75 million share repurchase program. The program was completed in February 2015, resulting in the repurchase of 3,992,229 shares at an average cost of $18.79 (inclusive of commissions).

Additional information related to first quarter 2015 results, including a reconciliation of EBITDA (defined as net income or loss before interest, taxes,

depreciation and amortization and other, net) to its most comparable GAAP measure, can be found in the supplemental schedules accompanying this press release.

Conference Call Information

Quanex will host its conference call today, March 3, 2015 at 11:00 a.m. (Eastern) to discuss its results and outlook. The call will be available via

webcast at www.quanex.com in the Investors section.

Forward Looking Statements

Statements that use the words “estimated,” “expect,” “could,” “should,” “believe,” “will,”

“might,” or similar words reflecting future expectations or beliefs are forward-looking statements. The forward-looking statements include, but are not limited to, future operating results of Quanex, the future financial condition of

Quanex, future uses of cash and other expenditures, expenses and tax rates, expectations relating to the Company’s industry, and the Company’s future growth, including revenue and EBITDA guidance. The statements and guidance set forth in

this release are based on current expectations. Actual results or events may differ materially from this release. Factors that could impact future results may include, without limitation, the effect of both domestic and global economic conditions,

the impact of competitive products and pricing, the availability and cost of raw materials, and customer demand. For a more complete discussion of factors that may affect the Company’s future performance, please refer to the Company’s

Annual Report on Form 10-K for the fiscal year ended October 31, 2014, under the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” in our other documents filed with the Securities

and Exchange Commission from time to time. Any forward-looking statements in this press release are made as of the date hereof, and Quanex Building Products Corporation undertakes no obligation to update or revise any forward-looking statements to

reflect new information or events.

Financial Contact: Marty Ketelaar, 713-877-5402; Media Contact: Valerie Calvert, 713-877-5305

For additional information, please visit www.quanex.com

QUANEX BUILDING PRODUCTS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In

thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended January 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Net sales |

|

$ |

127,893 |

|

|

$ |

126,379 |

|

| Cost of sales |

|

|

105,804 |

|

|

|

96,189 |

|

| Selling, general and administrative |

|

|

19,496 |

|

|

|

22,503 |

|

| Depreciation and amortization |

|

|

8,208 |

|

|

|

8,544 |

|

| Asset impairment charges |

|

|

— |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(5,615 |

) |

|

|

(862 |

) |

| Interest expense |

|

|

(141 |

) |

|

|

(141 |

) |

| Other, net |

|

|

(151 |

) |

|

|

96 |

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(5,907 |

) |

|

|

(907 |

) |

| Income tax benefit (expense) |

|

|

2,813 |

|

|

|

(304 |

) |

|

|

|

|

|

|

|

|

|

| Loss from continuing operations |

|

|

(3,094 |

) |

|

|

(1,211 |

) |

| Income (loss) from discontinued operations, net of taxes |

|

|

23 |

|

|

|

(2,689 |

) |

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,071 |

) |

|

$ |

(3,900 |

) |

|

|

|

|

|

|

|

|

|

| Earnings (loss) per common share: |

|

|

|

|

|

|

|

|

| From continuing operations |

|

$ |

(0.09 |

) |

|

$ |

(0.03 |

) |

| From discontinued operations |

|

$ |

— |

|

|

$ |

(0.08 |

) |

| Diluted earnings (loss) per common share: |

|

|

|

|

|

|

|

|

| From continuing operations |

|

$ |

(0.09 |

) |

|

$ |

(0.03 |

) |

| From discontinued operations |

|

$ |

— |

|

|

$ |

(0.08 |

) |

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

|

35,079 |

|

|

|

37,003 |

|

| Diluted |

|

|

35,079 |

|

|

|

37,003 |

|

| Cash dividends per share |

|

$ |

0.04 |

|

|

$ |

0.04 |

|

QUANEX BUILDING PRODUCTS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

January 31, 2015 |

|

|

October 31, 2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

63,924 |

|

|

$ |

120,384 |

|

| Accounts receivable, net |

|

|

39,334 |

|

|

|

55,193 |

|

| Inventories, net |

|

|

59,831 |

|

|

|

57,358 |

|

| Deferred income taxes |

|

|

24,662 |

|

|

|

21,442 |

|

| Prepaid and other current assets |

|

|

5,715 |

|

|

|

6,052 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

193,466 |

|

|

|

260,429 |

|

| Property, plant and equipment, net |

|

|

110,033 |

|

|

|

109,487 |

|

| Deferred income taxes |

|

|

7,295 |

|

|

|

1,545 |

|

| Goodwill |

|

|

68,802 |

|

|

|

70,546 |

|

| Intangible assets, net |

|

|

67,889 |

|

|

|

70,150 |

|

| Other assets |

|

|

5,524 |

|

|

|

4,956 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

453,009 |

|

|

$ |

517,113 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

31,016 |

|

|

$ |

41,488 |

|

| Accrued liabilities |

|

|

22,920 |

|

|

|

32,482 |

|

| Income taxes payable |

|

|

— |

|

|

|

107 |

|

| Current maturities of long-term debt |

|

|

190 |

|

|

|

199 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

54,126 |

|

|

|

74,276 |

|

| Long-term debt |

|

|

568 |

|

|

|

586 |

|

| Deferred pension and postretirement benefits |

|

|

5,309 |

|

|

|

4,818 |

|

| Liability for uncertain tax positions |

|

|

548 |

|

|

|

4,626 |

|

| Other liabilities |

|

|

11,152 |

|

|

|

11,887 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

71,703 |

|

|

|

96,193 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

376 |

|

|

|

376 |

|

| Additional paid-in-capital |

|

|

249,497 |

|

|

|

249,600 |

|

| Retained earnings |

|

|

207,760 |

|

|

|

202,319 |

|

| Accumulated other comprehensive loss |

|

|

(8,528 |

) |

|

|

(5,708 |

) |

| Treasury stock at cost |

|

|

(67,799 |

) |

|

|

(25,667 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

381,306 |

|

|

|

420,920 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

453,009 |

|

|

$ |

517,113 |

|

|

|

|

|

|

|

|

|

|

QUANEX BUILDING PRODUCTS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(In

thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended January 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,071 |

) |

|

$ |

(3,900 |

) |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

8,208 |

|

|

|

10,294 |

|

| Stock-based compensation |

|

|

1,264 |

|

|

|

1,090 |

|

| Deferred income tax benefit |

|

|

(3,239 |

) |

|

|

(1,885 |

) |

| Excess tax benefit from share-based compensation |

|

|

(60 |

) |

|

|

(1 |

) |

| Asset impairment charges |

|

|

— |

|

|

|

510 |

|

| Other, net |

|

|

(478 |

) |

|

|

728 |

|

| Changes in assets and liabilities, net of effects from acquisitions and dispositions: |

|

|

|

|

|

|

|

|

| Decrease in accounts receivable |

|

|

15,323 |

|

|

|

26,654 |

|

| Increase in inventory |

|

|

(2,920 |

) |

|

|

(15,998 |

) |

| Increase in other current assets |

|

|

(12 |

) |

|

|

(594 |

) |

| Decrease in accounts payable |

|

|

(10,298 |

) |

|

|

(10,894 |

) |

| Decrease in accrued liabilities |

|

|

(10,934 |

) |

|

|

(15,027 |

) |

| Decrease (increase) in income taxes payable |

|

|

(58 |

) |

|

|

26 |

|

| Increase in deferred pension and postretirement benefits |

|

|

520 |

|

|

|

915 |

|

| Increase (decrease) in other long-term liabilities |

|

|

13 |

|

|

|

(1,087 |

) |

| Other, net |

|

|

(5 |

) |

|

|

(2,315 |

) |

|

|

|

|

|

|

|

|

|

| Cash used for operating activities |

|

|

(5,747 |

) |

|

|

(11,484 |

) |

| Investing activities: |

|

|

|

|

|

|

|

|

| Acquisitions, net of cash acquired |

|

|

— |

|

|

|

(5,161 |

) |

| Capital expenditures |

|

|

(7,321 |

) |

|

|

(6,748 |

) |

| Proceeds from property insurance claim |

|

|

513 |

|

|

|

400 |

|

| Proceeds from disposition of capital assets |

|

|

— |

|

|

|

303 |

|

|

|

|

|

|

|

|

|

|

| Cash used in investing activities |

|

|

(6,808 |

) |

|

|

(11,206 |

) |

| Financing activities: |

|

|

|

|

|

|

|

|

| Repayments of other long-term debt |

|

|

(23 |

) |

|

|

(26 |

) |

| Common stock dividends paid |

|

|

(1,448 |

) |

|

|

(1,490 |

) |

| Issuance of common stock |

|

|

— |

|

|

|

331 |

|

| Excess tax benefit from share-based compensation |

|

|

60 |

|

|

|

1 |

|

| Purchase of treasury stock |

|

|

(42,748 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Cash used in financing activities |

|

|

(44,159 |

) |

|

|

(1,184 |

) |

| Effect of exchange rate changes on cash and cash equivalents |

|

|

254 |

|

|

|

(55 |

) |

| Decrease in cash and cash equivalents |

|

|

(56,460 |

) |

|

|

(23,929 |

) |

| Cash and cash equivalents at beginning of period |

|

|

120,384 |

|

|

|

49,736 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

63,924 |

|

|

$ |

25,807 |

|

|

|

|

|

|

|

|

|

|

NOTE: The cash flow statement presentation includes the sources and uses of cash for the discontinued operations as operating,

investing and financing cash flows, as applicable, combined with such cash flows for continuing operations, as permitted by U.S. GAAP.

QUANEX BUILDING PRODUCTS CORPORATION

NON-GAAP FINANCIAL MEASURE DISCLOSURE

(In thousands)

(Unaudited)

EBITDA (defined as net income or

loss before interest, taxes, depreciation and amortization and other, net) is a non-GAAP financial measure that Quanex management uses to measure its operational performance and assist with financial decision-making. EBITDA is a key metric used by

management in determining the value of annual incentive awards for its employees. We believe this non-GAAP measure (included under market conditions outlined in our forward-looking guidance) provides a consistent basis for comparison between

periodes, and will assist investors in understanding our financial performance when comparing our results to other investment opportunities. EBITDA may not be the same as that used by other companies. The company does not intend for this information

to be considered in isolation or as a substitute for other measures prepared in accordance with GAAP.

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended January 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

Quanex |

|

|

Quanex |

|

| Net loss |

|

$ |

(3,071 |

) |

|

$ |

(3,900 |

) |

| (Income) loss from discontinued operations, net of taxes |

|

|

(23 |

) |

|

|

2,689 |

|

| Income tax (benefit) expense |

|

|

(2,813 |

) |

|

|

304 |

|

| Other, net |

|

|

151 |

|

|

|

(96 |

) |

| Interest expense |

|

|

141 |

|

|

|

141 |

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(5,615 |

) |

|

|

(862 |

) |

| Depreciation and amortization |

|

|

8,208 |

|

|

|

8,544 |

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

2,593 |

|

|

$ |

7,682 |

|

|

|

|

|

|

|

|

|

|

| Financial Statistics as of January 31, 2015 |

|

|

|

|

|

|

|

|

| Book value per common share: |

|

|

|

|

|

$ |

11.22 |

|

| Total debt to capitalization: |

|

|

|

|

|

|

0.2 |

% |

| Return on invested capital: |

|

|

|

|

|

|

7.3 |

% |

| Actual number of common shares outstanding: |

|

|

|

|

|

|

33,976,102 |

|

QUANEX BUILDING PRODUCTS CORPORATION

PRE-TAX & AFTER TAX PRESENTATION

(In

millions, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

| Pre-Tax Presentation |

|

Q1 2015

$MM |

|

|

Q1 2014

$MM |

|

| Operating Loss from Continuing Operations As Reported |

|

$ |

(5.9 |

) |

|

$ |

(0.9 |

) |

| Benefit (Reduction) to Operating Income (Loss): |

|

|

|

|

|

|

|

|

| IG Warranty Reserve Benefit |

|

|

— |

|

|

|

(2.8 |

) |

| Transaction Related Expenses |

|

|

— |

|

|

|

0.4 |

|

| Discontinued ERP Expenses* |

|

|

— |

|

|

|

0.3 |

|

|

|

|

|

|

|

|

|

|

| Operating Loss from Continuing Operations As Adjusted |

|

$ |

(5.9 |

) |

|

$ |

(3.0 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| After-Tax Presentation |

|

Q1 2015

$MM |

|

|

Q1 2015

EPS |

|

|

Q1 2014

$MM |

|

|

Q1 2014

EPS |

|

| Loss from Continuing Operations As Reported |

|

$ |

(3.1 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.2 |

) |

|

$ |

(0.03 |

) |

| Benefit (Reduction) to EPS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IG Warranty Reserve Benefit |

|

|

— |

|

|

|

— |

|

|

|

(2.1 |

) |

|

|

(0.06 |

) |

| Transaction Related Expenses |

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.01 |

|

| Discontinued ERP Expenses |

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Loss from Continuing Operations As Adjusted * |

|

$ |

(3.1 |

) |

|

$ |

(0.09 |

) |

|

$ |

(2.9 |

) |

|

$ |

(0.07 |

) |

| * |

Q1 2014 includes $258K of accelerated depreciation related to the SAP Implementation |

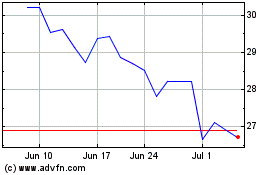

Quanex (NYSE:NX)

Historical Stock Chart

From Mar 2024 to Apr 2024

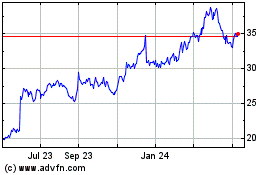

Quanex (NYSE:NX)

Historical Stock Chart

From Apr 2023 to Apr 2024