Upsized IPO of Biotech Company Intellia Prices at Top of Range

May 05 2016 - 8:58PM

Dow Jones News

By Josh Beckerman

Intellia Therapeutics Inc., a biotechnology company working on

"editing" defective genes, said its initial public offering of 6

million shares priced at $18 each.

The Cambridge, Mass., company filed confidential IPO paperwork

in September and disclosed its plans in April. Last week, it

estimated it would sell 5 million shares at $16 to $18 each.

Intellia is developing potential treatments for liver and blood

diseases and cancer. It is one of the companies focused on a

technology called Crispr-Cas9 that has raised hopes for future

drugs that could home in on specific genes and remove them.

The company's shareholders include Novartis AG, which

participated in a $15 million Series A financing round and a $70

million Series B round, and Regeneron Pharmaceuticals Inc., which

recently signed a six-year licensing and collaboration agreement

with Intellia. The deal called for a $75 million upfront payment to

Intellia, and the purchase of $50 million of stock in a private

placement at the same time as the IPO.

Intellia's venture-capital backers include Atlas Venture and

Orbimed Advisors. Atlas and Caribou Biosciences launched the

company in 2014.

Intellia will trade on the Nasdaq Global Market under the symbol

NTLA.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

May 05, 2016 20:43 ET (00:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

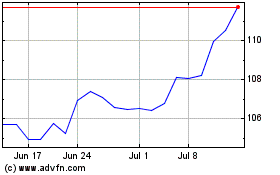

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

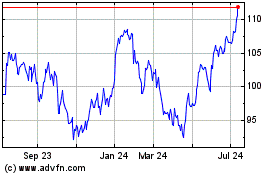

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024