Novartis Profit Dives 57% on Eye-Care Woes --2nd Update

January 27 2016 - 9:57AM

Dow Jones News

By John Letzing and Denise Roland

Novartis AG outlined plans to revive its ailing eye-care

business as the unit contributed to a 57% decline in fourth-quarter

net profit, but earnings were also hit by the strength of the U.S.

dollar and a one-time charge related to losses at the Swiss drug

giant's Venezuela business.

The company said it would narrow Alcon's focus to surgical

equipment and vision-care products, such as contact lenses, by

hiving off ophthalmic drugs into the company's giant

pharmaceuticals division.

The Swiss firm also appointed former Hospira boss Mike Ball to

lead the slimmed-down Alcon division, replacing Jeff George. Chief

Executive Joe Jimenez said of Mr. George's departure: "He's had a

tough year at Alcon and with all the changes Jeff felt now was a

good time to step down." Mr. Ball left Hospira last year, after it

was acquired by Pfizer Inc.

Novartis shares were down 3% at 81.15 Swiss francs on Wednesday

afternoon.

Alcon has struggled recently amid increased competition in the

lens implant market and the entry of cheaper copycats of some

ophthalmic drugs. Stripping out the effect of the strong dollar,

sales at the unit fell 6% in the fourth quarter, to $2.3 billion,

while operating income decreased 36% to $132 million.

Mr. Jimenez said Novartis would invest about $200 million in a

plan that should boost Alcon's performance, and that he expects the

unit would begin to "return to growth by the end of this year."

Novartis's CEO, who had previously said he was open to selling

off underperforming parts of Alcon, said that "for now" the company

planned to keep all of the business.

Mr. Jimenez said separating the eye drugs from the surgical

equipment and contact lenses would mean the remainder of Alcon

could focus on a "surgical innovation model" which is centered on

making incremental improvements based on feedback from surgeons, in

contrast to the much longer time scale involved in pharmaceutical

innovation. He said Novartis would license in new technologies to

bolster the innovation pipeline for surgical devices. He added that

the slimmed-down Alcon would also improve its customer service,

which he admitted had suffered due to cost cuts.

The Alcon overhaul comes at a tough juncture for Novartis, which

is bracing for its best-selling cancer drug Gleevec losing U.S.

exclusivity in February. It said it expected revenue and profit for

2016 to be "broadly in line" with results in 2015.

The company is leaning heavily on two new launches--Entresto for

heart failure and Cosentyx for psoriasis and certain rheumatic

ailments--to help offset the expected sharp drop-off in Gleevec

sales this year.

Entresto, which analysts expect to generate $5 billion in annual

sales at its peak, has got off to a slow start as two-thirds of

heart failure patients are covered by Medicare, which can delay

reimbursement decisions for six months post-launch. The heart

failure drug generated just $5 million in sales in the fourth

quarter. David Epstein, head of Novartis' pharmaceuticals unit,

said reimbursement for Entresto had improved "substantially" during

January, with 70% of Medicare patients now covered. "In many ways,

the full launch of the product is only just starting," he said.

Cosentyx by contrast, has progressed "strongly," said Novartis,

bringing in $121 million of revenue in the fourth quarter.

For Novartis as a whole, net income fell to $1.05 billion in the

quarter ended in December, compared with $2.45 billion in the same

period a year earlier.

Revenue dipped 4% to $12.52 billion, the company said. Core net

income, which strips out one-time events such as impairments or

gains, fell 5% to $2.7 billion, Novartis said. Analysts had

expected revenue of $12.7 billion and core net income of $2.7

billion.

As well as the drag from the weak Alcon unit, profit took a hit

from a $346 million write-down on Novartis' Venezuela business,

related largely to the currency impact of high inflation in the

country. The decline was also sharpened by a one-off gain in the

previous year of around $400 million from the sale of Novartis'

shares in LTS Lohmann Therapie-Systeme AG.

Stripping out the effect of the strong dollar, revenue increased

4% and net income fell 34%. Mr. Jimenez said he expected the strong

dollar to continue to affect reported results through 2016, but

said the effect would lessen.

Novartis pharmaceuticals unit provided a bright spot for the

results. Excluding the impact of the strong dollar, the unit posted

a 9% increase in both revenue and operating income to $7.9 billion

and $1.5 billion respectively. The company said its newer products

generated nearly half of these sales.

On top of the Alcon restructuring, Novartis said it planned to

move off-patent drugs worth around $900 million in sales from its

pharmaceuticals unit into Sandoz, its generics business. Mr.

Jimenez said he believed this would generate growth since those

products would be more strongly promoted as part of Sandoz.

In addition, Novartis said it plans to take steps including

centralizing manufacturing to reduce costs by $1 billion annually

by 2020. The effort will involve one-time restructuring costs of

about $1.4 billion spread over five years, Novartis said.

Write to John Letzing at john.letzing@wsj.com and Denise Roland

at Denise.Roland@wsj.com

(END) Dow Jones Newswires

January 27, 2016 09:42 ET (14:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

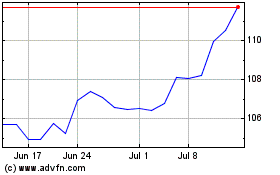

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

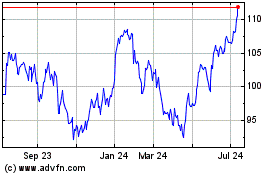

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024