Ligand Pharma to Buy Genetic Engineering Company OMT -- 2nd Update

December 17 2015 - 7:49PM

Dow Jones News

By Josh Beckerman

Biotech company Ligand Pharmaceuticals Inc. (LGND) has agreed to

buy genetic-engineering company OMT Inc. for about $178 million in

cash and stock, a deal it says has potential for "significant"

financial contribution and lengthy periods of patent

protection.

OMT's animal-based platforms are used to generate human

therapeutic antibodies. OMT is majority-owned by investment firm

Essex Woodlands.

OMT's three platforms are OmniRat, OmniMouse and OmniFlic, based

on engineered rats with fixed light chains. Its technology is

licensed to various drug companies and biotech companies including

Amgen Inc., Pfizer Inc. and Seattle Genetics Inc.

The deal, slated to close in January, will include $92.6 million

in cash and stock worth about $85.4 million.

Ligand said it expects 2016 revenue between $113 million and

$117 million, including about $6 million from OMT. It reaffirmed

its prior revenue guidance for the original Ligand business.

Last month the company issued guidance of $75 million to $76

million for this year.

Ligand targets therapeutic areas including oncology,

inflammation and blood disorders. Its products include Promacta,

which increases blood platelets and is licensed to Novartis AG

(NVS, NOVN.VX).

Ligand said the OMT deal is projected to increase 2017 adjusted

earnings per share by about 20 cents.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

December 17, 2015 19:34 ET (00:34 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

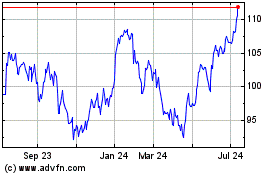

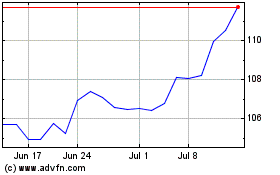

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024