Novartis Profit Hurt by U.S. Settlement -- 4th Update

October 27 2015 - 11:15AM

Dow Jones News

By Denise Roland and John Letzing

ZURICH-- Novartis AG said Tuesday that third-quarter profit fell

42% from the same period last year, as the Swiss drug giant settled

claims that it paid rebates to encourage specialty pharmacies to

increase prescriptions.

The Basel, Switzerland-based pharmaceuticals giant said agreed

to pay $390 million as part of a settlement with the U.S. Justice

Department regarding claims that the company induced specialty

pharmacies to boost prescriptions for Novartis drugs by paying

kickbacks in the form of rebates.

Chief Executive Joe Jimenez said the rebates were designed to

incentivize specialty pharmacies to ensure that patients completed

a course of medicine. He added that Novartis still used this "quite

common" practice at specialty pharmacies in the U.S. "We continue

to maintain that specialty pharmacies must continue to play a role

in ensuring patient adherence," he said. "How that's going to play

out as to whether we change our behavior or not remains to be

seen."

The settlement relates to a June court filing by the Justice

Department based on earlier whistleblower allegations from a former

sales manager, who accused the company of using illegal kickbacks

to boost sales of two drugs and sought up to $3.35 billion in

damages and fines. The case centered on separate issues from those

currently plaguing Valeant Pharmaceuticals International Inc. over

its relationship with mail-order specialty pharmacy Philidor Rx

Services LLC.

Novartis said the settlement hasn't been finalized and that it

neither admits nor denies liability. It is "something we want to

put behind us and that's why we've reached an agreement and

settlement in principle," said Mr. Jimenez.

The settlement hurt Novartis's net income, which fell to $1.81

billion, or $0.75 a share in the quarter ended in September,

compared with $3.1 billion, or $1.27 a share a year earlier. The

year-earlier figure included a one-time gain of around $800 million

from a divestment.

Core net income, which strips out one-time events such as

settlements, impairments, or gains, fell 2% to $3.06 billion,

Novartis said. Net sales fell 6% to $12.27 billion.

Stripping out the effect of the strong dollar, core net income

increased 13% and sales increased 6%.

Analysts had expected core net income of $3.2 billion for the

third quarter, and sales of $12.7 billion.

The miss was largely due to a weak performance by Novartis's

eye-care division, Alcon, which is facing increased competition for

its surgical products and the entry of cheaper generics on a number

of its drugs. Net sales at Alcon were $2.3 billion and core

operating income was $703 million, down 2% and 12% in constant

currencies.

Mr. Jimenez said the company was developing a "growth

acceleration plan" for Alcon which would involve increasing

innovation. He said Novartis would update its outlook for Alcon in

its full-year results in January.

Third-quarter sales at Novartis's dominant pharmaceuticals

division increased 7% at constant currencies to $7.6 billion,

missing analyst expectations of $7.8 billion. The company said

growth was mostly driven by seven products, including a combination

treatment for metastatic melanoma that it acquired as part of its

$20 billion asset-swap deal with GlaxoSmithKline PLC. Core

operating income was $2.4 billion, up 18% in constant

currencies.

Mr. Jimenez said this "tremendous margin improvement" was down

to the company's efforts to eliminate duplication between its three

business units on back-office functions such as IT, accounting and

procurement.

The Novartis boss also said he expected uptake of new potential

blockbuster Entresto, for chronic heart failure, to speed up next

year after federal health-care plans make decisions on

reimbursement. The drug, introduced in July, has had a slow start

since two-thirds of heart failure patients are covered by Medicaid,

which can delay reimbursement decisions for six months post-launch,

said Mr. Jimenez.

Sandoz, the company's generics division, posted sales of $2.3

billion, 9% higher than a year earlier in constant currencies, in

line with analysts' expectations. The company attributed this to

volume growth offsetting price erosion.

Earlier this year, Sandoz launched a copycat version of Amgen

Inc.'s Neupogen in the U.S., making it the first so-called

biosimilar to enter the American market. Mr. Jimenez said the

launch had gone "quite well" but warned it would "take some time to

build up" since pharmacies didn't automatically substitute Neupogen

with Sandoz's product Zarxio.

Novartis said it was on track to deliver percentage net-sales

growth in the mid-single digits and core-operating-income growth in

the high single digits, based on continuing operations at constant

currencies, confirming earlier guidance.

Novartis shares were down 1.6% in afternoon trading Tuesday.

Write to Denise Roland at Denise.Roland@wsj.com and John Letzing

at john.letzing@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 27, 2015 11:00 ET (15:00 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

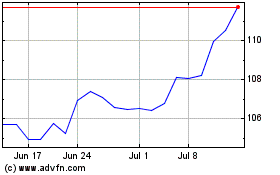

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

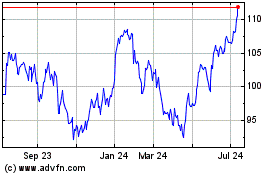

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024