UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 6-K

________________

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

February 24, 2017

________________

NOVO NORDISK A/S

(Exact name

of Registrant as specified in its charter)

Novo Allé

DK- 2880, Bagsvaerd

Denmark

(Address of principal executive offices)

________________

Indicate by check mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F

|

Form 20-F [X]

|

Form 40-F [ ]

|

Indicate by check mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g-32(b):82-________

Novo NordiskA/S InvestorRelations NovoAllé 2880Bagsværd Denmark Telephone: +45 44448888 Internet: www.novonordisk.com CVRno: 24 25 6790 Company announcement No 13 /2017 Notice for the Annual General Meeting of Novo NordiskA/S Bagsværd, Denmark, 24 February 2017 –The Annual General Meeting of Novo Nordisk A/S will be heldon: Thursday 23 March 2017 at 2.00 pm(CET) at Bella Center, entrance West, Center Boulevard 5, 2300 Copenhagen S,Denmark. The notice for the Annual General Meeting, including Appendix 1: Candidates for the Board of Directors and Appendix 2: Revised Remuneration Principles, isenclosed. BOARD OF DIRECTORS –PROPOSED CHANGES INCOMPOSITION All board members elected by the Annual General Meeting are up for election. Bruno Angelici does not seek re-election as member of the Board ofDirectors. The Board of Directors proposes re-election of the following board members elected by the Annual General Meeting: Göran Ando (chairman), Jeppe Christiansen (vice chairman), Brian Daniels, Sylvie Grégoire, Liz Hewitt and MarySzela. The Board of Directors proposes election of Kasim Kutay and Helge Lund as new members of the Board of Directors at the Annual GeneralMeeting. Mr Kutay is chief executive officer of Novo A/S, Denmark. The Board of Directors recommends election of Mr Kutay primarily because of his extensive experience as financial advisor to the pharmaceutical, biotechnology and medical device industries. Furthermore, Mr Kutay has advised healthcare companies on an international basis including companies based in Europe, the USA, Japan andIndia. Mr Lund is former chief executive officer of the integrated gas company, BG Group plc. The Board of Directors recommends election of Mr Lund primarily because of his extensive executive and board experience in large multinational companies headquartered in Scandinavia within regulated markets and significant financial knowledge.

Page 2 of2 Novo NordiskA/S InvestorRelations NovoAllé 2880Bagsværd Denmark Telephone: +45 44448888 Internet: www.novonordisk.com CVRno: 24 25 6790 Company announcement No 13 /2017 Novo Nordisk is a global healthcare company with more than 90 years of innovation and leadership in diabetes care. This heritage has given us experience and capabilities that also enable us to help people defeat other serious chronic conditions: haemophilia, growth disorders and obesity. Headquartered in Denmark, Novo Nordisk employs approximately 42,000 people in 77 countries and markets its products in more than 165 countries. Novo Nordisk's B shares are listed on Nasdaq Copenhagen (Novo-B). Its ADRs are listed on the New York Stock Exchange (NVO). For more information, visit novonordisk.com, Facebook, Twitter, LinkedIn,YouTube Furtherinformation Media: KatrineSperling +45 44426718 krsp@novonordisk.com Ken Inchausti(US) +1 609 7868316 kiau@novonordisk.com Investors: Peter HugreffeAnkersen +45 30759085 phak@novonordisk.com HannaÖgren +45 30798519 haoe@novonordisk.com AndersMikkelsen +45 30794461 armk@novonordisk.com Kasper Veje(US) +1 609 2358567 kpvj@novonordisk.com

Annual GeneralMeeting ofNovoNordiskA/S Scan the QR code with your smartphone to godirectly to the registration site

Page 2•NovoNordiskAnnual GeneralMeeting 2017 To the shareholders of Novo NordiskA/S February2017 The Annual General Meeting will be held on Thursday 23 March 2017 at 2.00 pm (CET) at Bella Center, Center Boulevard 5, DK-2300 Copenhagen S,Denmark Agenda 1. The Board of Directors’ oral report on the Company’s activities in the past financial year. 2. Presentation and adoption of the statutory Annual Report2016. 3. Approval of the remuneration of the Board of Direc- tors for 2016 and the remunerationlevel for 2017. 3.1. 3.2. Approval of actual remuneration for2016. Approval of remuneration level for2017. 4. Resolution to distribute the profit according to the adopted statutory Annual Report2016. 5. Election of members to the Board of Directors, including chairman and vicechairman. 5.1. 5.2. 5.3. Election of chairman. Election of vicechairman. Election of other members to the Board of Directors. 6. Appointment of auditor. 7. Proposals from the Board of Directors: 7.1. 7.2. 7.3. Reduction of the Company’s Bshare capital by nominally DKK10,000,000 by cancellation of Bshares. Authorisation to the Board of Directors to allow the Company torepurchase own shares. Approval of changes to the Remuneration Principles. 8. Proposals from shareholders: 1. Free parking for the shareholders in connection with the informal Shareholders’ Meeting. 2. The buffet after the informal Shareholders’ Meeting is served as set tablecatering (in Danish “dækkes op vedborde”). 9. Any otherbusiness. Elaboration of the items onthe agenda Item1: TheBoardofDirectorsproposesthattheoralreportonthe Company’s activities in the past financial year isnoted by theAnnual GeneralMeeting. Item2: TheBoardof Directorsproposes that thestatutory Annual Report2016 isadopted by the Annual General Meeting. ThestatutoryAnnual Reportisavailable ontheCompany’s website novonordisk.com/annualreport. Item3.1: TheBoardofDirectorsproposesthat theactual remunera- tionoftheBoardofDirectorsfor2016 ofDKK14,400,000 isapproved by the Annual General Meeting. Reference is made topage 50 ofthestatutoryAnnual Report2016. Theactual remuneration for 2016 corresponds tothe re- muneration level approved by the Annual General Meet- ing in2016 forthe2016 financial year. Item3.2: Based on benchmark data from major Danish companies supplemented with benchmark data from Scandinavian companies and European pharmaceutical companies, which in size and complexity aresimilar tothe Company, the Board proposes the following remuneration level for 2017 isapproved by the Annual General Meeting, which isidentical totheremuneration levelfor2016. w The base fee for board members is DKK 600,000. wThechairman shall receive3.00 timesthebase fee. w Thevicechairman shall receive2.00 timesthebase fee. w The Audit Committee chairman shall receive 1.00 timesthebase feeinaddition tothebase fee. w The Audit Committee members shall receive 0.50 timesthebase feeinaddition tothebase fee. w The Nomination Committee chairman shall receive 0.50 timesthebase feeinaddition tothebase fee. w The Nomination Committee members shall receive 0.25 timesthebase feeinaddition tothebase fee.

NovoNordiskAnnual GeneralMeeting 2017 •page 3 w The Remuneration Committee chairman shall re- ceive 0.50 times the base fee in addition to the basefee. w The Remuneration Committee members shall re- ceive 0.25 times the base fee in addition to the basefee. Inaddition theBoardofDirectorsproposestogrant thefol- lowing travelallowance which isidentical tothe travelal- lowance levelfor2016: w Forboard meetings and committee related meet- ings heldinthehomecountryoftheboardmember withfivehoursormoreairtraveleach member shall receiveEUR5,000. w Forboard meetings and committee related meet- ings held outside the home country of the board member,butonhome continent eachmember shall receiveEUR5,000. w Forboard meetings and committee related meet- ings held on another continent than the home country of the board member each member shall receiveEUR10,000. In addition to the above-mentioned fees, the Company pays socialsecuritytaxeswithin theEUimposed byforeign authoritiesinrelationtosuchfees. Theactual remuneration oftheBoardofDirectorsfor2017 shallbeapproved bytheAnnual GeneralMeeting in2018. Item4: TheBoardof Directorsproposesthat the final dividend for 2016isDKK4.60foreachNovoNordiskAorBshareofDKK 0.20.Thetotaldividend for2016 ofDKK7.60includesboth theinterimdividend of DKK3.00 foreach NovoNordiskA and BshareofDKK0.20 which werepaid inAugust 2016 and thefinal dividend ofDKK4.60foreachNovoNordiskA andBshareofDKK0.20tobepaidinMarch2017.Thetotal dividend increased with 19% compared to the 2015 divi- dend ofDKK6.40 foreach NovoNordiskAand Bshareof DKK0.20.Thetotaldividendfor2016 correspondstoapay- outratioof50.2%. Item5: All board members are to be elected orre-elected each year and were most recently elected at the Annual Gen- eral Meeting in 2016. Thus, the termof each of the cur- rentboard members expiresat the Annual General Meet- ing inMarch2017. Item5.1: The Board of Directors proposes re-election for a one year termofGöranAndoaschairman oftheBoardofDirectors. Item5.2: TheBoardof Directorsproposes re-electionforaone year termof Jeppe Christiansen as vicechairman of the Board ofDirectors. Item5.3: BrunoAngelici doesnotseekre-electionasmember ofthe Board ofDirectors. TheBoardof Directorsproposes re-electionfora one year termof the following board members elected by the An- nual General Meeting: Brian Daniels, Sylvie Grégoire, Liz Hewittand MarySzela. The Board of Directors proposes election for a one year term of Kasim Kutay andHelge Lund. TheBoardofDirectorsproposeselectionofKasimKutayas member of the Boardof Directorsprimarily because of his extensiveexperienceasfinancial advisortothepharmaceu- tical, biotechnology and medical device industries.Hasad- visedhealthcarecompanies onan international basisinclud- ing companies based inEurope,theUSA,Japan and India. TheBoardof Directorsproposeselection of Helge Lund as member of the Boardof Directorsprimarily because of his extensiveexecutiveand boardexperienceinlarge multina- tional companies headquartered in Scandinavia within regulated markets and significant financial knowledge. Helge Lund has previously been a member of the Com- pany’s Board of Directors from2014-2015. Please see Appendix 1 fora description of the nominated candidates’ qualifications, including information about oth- erexecutive functions (memberships of executive boards, boardsofdirectors,supervisoryboards, and boardcommit- tees)and demanding organisational tasks held bythe pro- posedcandidates inDanishand foreign companies. Item6: TheBoard of Directorsproposes re-appointment of Price- waterhouseCoopers Statsautoriseret Revisionspartner- selskab (‘PwC’)astheCompany’s auditor.TheAudit Com- mittee has recommended the election of PwCbecause of theirsignificant knowledge ofthepharmaceutical industry

Page 4•NovoNordiskAnnual GeneralMeeting 2017 and exhaustive knowledge of NovoNordisk.Furthermore, PwChas aglobal organisation that provides valuable sup- porttoNovoNordisk’sglobal business.Therecommenda- tion from the Audit Committee has not been influenced by third parties norsubjected toany clause of a contract with athirdpartyrestrictingtheAnnual General Meeting’s choice of certain auditors orauditfirms. Item7.1: The Board of Directorsproposes that the Company’s B share capital is reduced from DKK402,512,800 to DKK 392,512,800 by cancellation of part of the Company’s own holding of B shares at a nominal value of DKK 10,000,000 divided into50,000,000 BsharesofDKK0.20 each equal toa nominal value ofDKK10,000,000. After reduction of the share capital, the Company’s share capital will amount to DKK500,000,000 divided into A share capital of DKK107,487,200 and Bshare capital of DKK392,512,800. Thepurpose ofthereduction oftheCompany’s sharecap- italistodistribute funds totheshareholders byway ofthe Company repurchasing shares in accordance with the au- thorisations granted tothe Board of Directorsat previous Annual General Meetings.If the proposal isadopted, the Company’s holding of own shares will be reduced by 50,000,000 B shares of DKK0.20 each. These B shares wererepurchasedforthetotalsumofDKK15,219,000,000 which means that, in addition to the nominal reduction amount, DKK15,209,000,000 has been distributed tothe shareholders. TheBoardofDirectors’proposal toreducetheCompany’s Bshare capital ismade in ordertomaintain capital struc- tureflexibility. Adoption of the proposal implies the following amend- ment of Article 3.1 of the Articles of Association taking effect upon completion of thecapitalreduction: “3.1 The Company’s share capital amounts to DKK 500,000,000 divided into A share capital of DKK 107,487,200andBsharecapitalofDKK 392,512,800.” Item7.2: TheBoard of Directorsproposes that an authorisation of theBoardofDirectorsisgranted toallow theCompany to repurchase own shares until the next Annual General Meeting in2018. The Company considers it good corporate governance and consistent with the Company’s strategy for its share repurchase programmes that the mandate to repurchase existing shares is limited in amount and affirmed by the Annual General Meeting onaregular basis. Consequently, the Board of Directorsproposes that the Annual General Meeting authorises theBoardofDirectors toallow theCompany torepurchase uptoatotalnominal amount ofDKK50,000,000 own shares, corresponding to 10% of the share capital, subject to a holding limit of 10% of thesharecapital.Therepurchase must take place at a price equal to the share price quoted at the time of the repurchase with a deviation of up to 10%, until the nextAnnual General Meeting in2018. Item7.3: TheBoardofDirectorsproposesthatthechanges totheprin- ciplesforremunerationof boardmembersand executivesin NovoNordiskA/Sincluding thegeneral guidelines forincen- tive-based remuneration (the ‘Remuneration Principles’)are approvedbytheAnnualGeneralMeeting. The following changes are proposed to be made to the Remuneration Principles and approved by the Annual GeneralMeeting : wAnew requirementforthepresidentand chiefexecu- tiveofficertoholdsharescorrespondingto2timesthe annual grosssalaryand forthe executivevicepresi- dentstoholdsharescorrespondingto1timethean- nual grosssalary. wAnabilityfortheCompanytograntasign-onarrange- ment ifa memberofexecutivemanagement ishired fromoutsidetheCompany. w Removal of the Long-term incentive programme (LTIP)shares from the joint pool in the 3 yearlock up periodincase aparticipant resigns. wIncreasetheimportanceof salesgrowth when calcu- latingLTIP. Item8: Theshareholders, Kathe Sohn and Flemming Sohn, have submitted thefollowing proposals foradoption bytheAn- nual GeneralMeeting: Item8.1: The shareholders propose that Novo Nordiskoffers free parking forthe shareholders inconnection with the infor- mal Shareholders’ Meeting.

NovoNordiskAnnual GeneralMeeting 2017 •page 5 As reason for the proposal the shareholders have stated that board members are receiving high travel allowances whentravelling toboardmeetings. Comment bytheBoardofDirectors:TheBoardofDirectors does not support the proposal.Asin previous yearsNovo Nordiskdoesnotoffer freeparking inconnection with the Shareholders’ Meeting.Among otherthings, NovoNordisk does notwish totreatthe shareholders differently.Forex- ample Novo Nordiskdoes not refund transportation ex- penses tointernational shareholders and Danishsharehold- erswho have used public transportation (including metro, taxi,plane etc.)totheShareholders’ Meeting. Item8.2: Theshareholders propose that the buffet after the infor- mal Shareholders’ Meeting isserved as settable catering (inDanish “dækkes opvedborde”). Asreasonfortheproposaltheshareholdershavestatedthat set table catering is more convenient and when Amager- banken heldtheirgeneralmeeting inBellaCentrefor4-5000 participants they paid for the parking and the buffet was served as set table catering for 12 participants per table. NovoNordiskshould learn from this since thereisenough money toemployees resigning fromtheiremployment and boardmemberswhoresignsand ifthereistoomuch money thedividend fortheshareholdersshouldbeincreased. Comment by the Board of Directors:TheBoard of Direc- torsdoesnotsupport theproposal.TheCompany servesa light buffet after the informal Shareholders’ Meeting, which is held approximately one hour after the Annual General Meeting.Thebuffet isonan appropriate but also responsible financial level and also taking the logistics of conducting theAnnual General Meeting and theinformal Shareholders’ Meeting intoconsideration. Additionalinformation Majority requirements Toadopt the proposal under item 7.1 of the agenda, at least two thirdsof the total number of votesinthe Com- pany shall bepresentattheAnnual General Meeting, and notlessthan twothirdsofthevotescastand sharecapital represented shall vote for the proposals, cf. Articles 9.2 and 9.3oftheArticlesofAssociation. All other proposals on the agenda may be adopted by a simple majority of votes, cf. Article9.1 of the Articlesof Association. Recorddate The record date is Thursday 16 March 2017. Share capital Thecurrentsharecapital oftheCompany amounts toDKK 510,000,000 divided into A share capital of DKK 107,487,200 and Bsharecapital ofDKK402,512,800. Each A share capital amount of DKK 0.01 carries 10 votes andeachBsharecapitalamount ofDKK0.01 carries1vote. Participation and voting rights Ashareholder’srighttoattend and voteattheAnnual Gen- eralMeeting shall be determined bythe number of shares heldbysuchshareholderattheendoftherecorddate. Thenumber of shares held by each shareholder at the re- corddateshallbecalculated based onthenumber ofshares registeredintheRegisterofOwnersaswellasany notifica- tion receivedby the Company forregistration but not yet enteredintheRegisterofOwners. Participation is conditional on the shareholder having ob- tained anadmission cardinduetime. How toobtain anadmission card Access to the Annual General Meeting is conditional on the shareholder having requested an admission card by Friday17March 2017 end ofday (CET). Admission and voting cardsfortheAnnual GeneralMeet- ing may beobtained: w by returning the requisition form, duly completed and signed, toVPInvestorServicesA/S,or w by contacting VP Investor Services A/S by phone +45 4358 8891, email: vpinvestor@vp.dk,or fax: +45 4358 8867, or w via the company website: novonordisk.com/AGM orVPInvestorServicesA/S:uk.vp.dk/agm by using CPR/CVRnumber and postal code orthe VPrefer- encenumber. Admission cardsandvotingcardswillbesenttotheaddress towhich thecustodyaccount isregistered. Forfurtherinformation please seenovonordisk.com/AGM .

Page 6•NovoNordiskAnnual GeneralMeeting 2017 How to submit aproxy Proxiesshallbesubmitted byFriday17March 2017 endof day(CET). Voting instructions by proxy may be completed and sub- mitted: w by returning the proxy form, duly completed and signed, intheenvelopetoVPInvestorServicesA/S,or w by downloading a proxy form from novonordisk.com/AGM ; print, complete, sign and send itbyfaxto+45 4358 8867; viaemail: vpinvestor@vp.dk or by ordinary letter to VP Investor Services A/S, Weidekampsgade 14, DK-2300 Copenhagen S, Denmark,or w via the company website: novonordisk.com/AGM or VP Investor ServicesA/S: uk.vp.dk/agm byusing acompatible electronicsig- nature, e.g. apersonal VP-ID.ForholdersofaDan- ish CPR number, the electronic signature used for net banking services offered by credit institutions based in Denmark (Nem-ID) will typically be com- patible. For further information please see novonordisk.com/AGM. From shareholders unable to attend the Annual General Meeting, theBoardofDirectorswould appreciate receiving a proxyora votebycorrespondence inordertoknow the shareholders’ view on the respectiveitems on the agenda and toensurethatthequorum requirementismet. How to vote bycorrespondence Shareholders may vote by correspondence no later than Wednesday 22March 2017 at4.00 pm (CET): w by returning the voting by correspondence form, duly completed and signed, in the envelope toVP InvestorServicesA/S,or w by downloading a voting form from novonordisk.com/AGM ; print, complete, sign and send it by fax to +45 4358 8867; via email: vpinvestor@vp.dk or by ordinary letter to VP Inves- tor Services A/S, Weidekampsgade 14, DK-2300 Copenhagen S, Denmark,or w via the company website: novonordisk.com/AGM or VP Investor Services A/S: uk.vp.dk/agm using the same procedure as describedabove under ‘How to submit aproxy’. Electronic voting An electronic voting device (e-voter)will be used forvot- ing at the Annual General Meeting in relation tospecific agenda items.Thee-votermakes itpossible to conduct votes in the meeting room electronically and faster. The e-voterwillbehanded totheparticipating shareholders at theentrance. Written questions Shareholders may ask written questions tothe Company about theagenda and documents concerning the Annual GeneralMeeting. Written questions shall be sent to AGMEETING@novonordisk.com no later than Tuesday 21 March 2017 (CET). Language Representatives of the Company and the chairman of the Annual General Meeting will conduct their presentations inEnglish.Shareholders may choose tospeak inDanish or English. Simultaneous interpretation from English to Danish and fromDanish toEnglish willbeavailable atthemeeting. Webcast TheAnnual GeneralMeeting willbebroadcast livebyweb- cast in Danish and English on the Company’s website novonordisk.com. The webcast of the Annual General Meeting will also be available on the Company’s website aftertheMeeting.Theinformal Shareholders’ Meeting will be broadcast live by webcast on the Company’s website novonordisk.com. The webcasts will only show the plat- form.SeetheCompany’s personal data policyavailable on novonordisk.com under ‘About NovoNordisk’a‘Corpo- rategovernance’ a’Privacypolicy’. Information onthewebsite Thefollowing information isavailable on novonordisk.com under ‘About NovoNordisk’a ‘Corpo- rate governance’ a ’General meetings and shareholders’ meetings’ until and including thedate of theAnnual Gen- eralMeeting: w Notice to convene the Annual GeneralMeeting; wTheaggregate number of shares and voting rights asofthedate ofthenotice toconvene theAnnual GeneralMeeting; w The documents that will be submitted at the An- nual General Meeting, i.e. the statutory Annual Report2016; wTheproposed revised Remuneration Principles and theproposed revisedArticlesofAssociation; w The agenda and the complete proposals;and w The proxy and voting by correspondence forms.

NovoNordiskAnnual GeneralMeeting 2017 •page 7 You may also request to receive a copy of theabovemen- tioned documents by contacting the Company by phone +45 3075 1126. Dividends Thedividend as approved by the Annual General Meeting willbetransferredtotheshareholders viaVPSecuritiesA/S afterdeduction ofwithholding taxifany. Furtherinformation ondividends may befound inthestat- utoryAnnual Report2016 pages 44-45. Shareholders’ Meeting OnThursday23March2017 at5pm(CET)aftertheAnnual General Meeting, the Company will host an information meeting conducted primarilyin Danish foritsshareholders atBellaCenter,CenterBoulevard5,DK-2300Copenhagen S,Denmark. Furtherinformation about the Shareholders’ Meeting may befound onnovonordisk.com/AGM. How togetthere Public transportation tothe Annual General Meeting and theShareholders’ Meeting ispossible with buses (lines4A, 34 and 250S), orwith theMetro, directionVestamager, to Bella CenterStation. Please notice that the entrance to the Annual General Meeting isatBella Center’sWestentrance which isonthe opposite sidefrom theMetroStation. Parking isavailable outside Bella Centeragainst payment. P5,P1andP2aretheclosestareas. Electronic communication ItispossibletoreceiveAnnual Reports,thequarterlyupdate Share and notices of General Meetings and Shareholders’ Meetings electronically by email from NovoNordisk. You may registeryouremail addressontheInvestorPortal: 1. Gotonovonordisk.com/investors, 2. Inthemenu totheleft, clickthelinkto privateShare- holders 3. Locate `Investor Portal towards the bottom of the page and click `readmore 4. Follow the link `To access Novo Nordisk Investor Portal UK clickhere 5. Log on the InvestorPortalusing yourNemIDorVP-ID. NemIDwill only be compatible if you have a Danish CPRnumber 6. In the menu to the left, click the link`My Profile 7. Confirm the already registered email address orinsert a new email address orand select which publications youwish toreceive. Bestregards Novo NordiskA/S The Board ofDirectors

Page 8•NovoNordiskAnnual GeneralMeeting 2017 Candidates for the Board ofDirectors Appendix1 Generalconsiderations All shareholder-elected board members areto be elected orre-electedeach yearforaoneyeartermand weremost recently elected at the Annual General Meeting in March 2016. Thus, the term for each board member expiresat theAnnual General Meeting inMarch2017. NovoNordiskA/S aims to propose a Board of Directors consisting of persons who have such knowledge and ex- perience that the collective Board of Directorsin the best possible way can attend tothe interests of the Company and the shareholders, with due respecttootherstakehol- dersof theCompany. Theprocessof identifying and selecting suitable candida- tes for the Board of Directors,takes into account the re- quired competences, the resultof the Board of Directors’ self-assessment process and the need for integration of new expertiseanddiversity. TheBoardof Directorshas established a Nomination Com- mittee in order to enhance the process for nominating memberstotheBoard.TheNominationCommitteehasfour members elected by the Board from among itsmembers. TheNominationCommitteeassiststheBoardwithoversight ofa)thecompetenceprofileand compositionoftheBoard, b)nomination of members of the Board,c)nomination of membersofBoardcommittees,andd)othertasks. Innominating candidates, theNomination Committee se- ekstoachieve abalance between renewal and continuity. TheBoard of Directorsactively contributes todeveloping the Company as a global pharmaceutical company, and supervises themanagement’s decisions and operations. Itistheassessment oftheBoardofDirectorsthat thepro- posed composition of the Board of Directorssatisfies the criteria defined by the Board of Directorsas regards the competences and composition oftheBoardofDirectors. TheBoard of Directorsconsiders the size of the Board to be appropriate in relation to the requirements of the Company. Please see the Company’s website: novonordisk.com un- der ‘About Novo Nordisk’a ‘Corporate governance’ a ’Board of Directors’foramoredetailed description of the competence criteriaof theBoardofDirectors. Independence In the Danish Corporate Governance Recommendations 2013 (updated 2014),itisrecommended that atleast half of the board members elected by the General Meeting shall be independent of the Company as defined in the Danish CorporateGovernance Recommendations . Threeof theproposed candidates, DrAndo, MrChristian- sen and Mr Kutay, arenot considered tobe independent of the Company as DrAndo and Mr Christiansen hold a boardposition atNovoA/Sand MrKutayischief executive officer of NovoA/S.Ifall proposed candidates areelected to the Board of Directors,the Board of Directorswill sa- tisfytherequirement oftheDanish CorporateGovernance Recommendations 2013 (updated 2014)that at least half oftheboardmembers electedbytheshareholders shall be independent . Inaddition, theproposed composition of theBoardofDi- rectorswillenable theBoardofDirectorstoelectmembers tothe Audit Committee who qualify as independent and as financial expertsasrequiredand defined bytheUSSe- curities and Exchange Commission (SEC) as well as the Danish ActonApproved Auditors and AuditFirms.

NovoNordiskAnnual GeneralMeeting 2017 •page 9 The individual candidates Göran Ando, MD Chairman of theBoard Chairman of the Nomination Committee Chairman of the Remuneration Committee Born March 1949 Male, Swedish national First elected in2005 Most recently elected in2016 Vice chairman since 2006 Chairman since 2013 Nomination Committee chairman since 2013 Remuneration Committee chairman since2015 Notindependent Management duties Chairman oftheboard ofSymphogen A/S, Denmark. Member of the boards of NovoA/S, Denmark, Molecular Partners AG, Switzerland, EUSA Pharma Ltd., UK, and ICMEC,US. Senior Advisor to Essex Woodlands Health Ventures Ltd., UK. Former positions DrAndo was CEOof Celltech Groupplc, UK,until 2004. Hejoined CelltechfromPharmacia, now Pfizer,US,where hewas executivevicepresident and president ofR&Dwith additional responsibilities for manufacturing, IT,business development and Mergers & Acquisitions (M&A) from 1995 to2003. Special competences Medical qualifications and extensiveexecutivebackground within the international pharmaceutical industry. Education 1978 Specialist in general medicine, Linköping Medical University,Sweden 1973 MD, Linköping Medical University, Sweden Management duties CEOof Fondsmæglerselskabet Maj Invest A/S, Maj Invest Holding A/Sand Emlika ApS,allinDenmark. Mr Christiansen is a member of the executive manage - ment of Maj InvestEquity A/S,Denmark. MrChristiansen ischairman ofHaldorTopsøeA/Sand vice chairman ofMaj Bank A/S, both inDenmark. Member of the boards of NovoA/S, KIRKBIA/Sand Sym- phogen A/S, allinDenmark. Further, Mr Christiansen is a member of the Board of Governorsof DetKgl.Vajsenhus, Denmark. Former positions MrChristiansen was CEOof LDPensions, Denmark, from 2005 until 2009.Priortothat MrChristiansen was execu- tivedirectorinDanske Bank A/S,Denmark, from1999 un- til2004 with responsibility for group equity business and corporate international banking . From 1988 until 1999, Mr Christiansen worked for LDPensions, first as a fund manager and lateras a deputy directorwith responsibility fortheequitybusiness. Special competences Executivebackground and extensiveexperience within the financial sector, in particular in relation to financial and capital market issues as well as insight intothe investor perspective. Audit Committee MrChristiansenisdesignated asAuditCommittee financial expertunder both Danish and USlaw.MrChristiansen re- lies onan exemption to theindependence requirements pursuant totheUSSecuritiesExchangeAct. Education 1985 M.Sc. inEconomics, UniversityofCopenhagen, Denmark JeppeChristiansen Vice chairman of theBoard Member of the Remuneration Committee Member of the AuditCommittee Born November 1959 Male, Danishnational First elected in2013 Most recently elected in 2016 Vice chairman since 2013 Member of the Remuneration Committee since 2015 Member of the Audit Committee since2015 Notindependent

Page 10 •NovoNordiskAnnual GeneralMeeting 2017 The individual candidates Management duties Senioradvisorwith theBostonConsulting Groupand ven- turepartnerwith 5AMVentureManagement, LLC,both in theUS. Former positions From 2000 until 2014 DrDaniels held various manage - ment positions at Bristol-Myers Squibb Pharmaceutical group, US,most recentlyas Senior VicePresident forGlo- bal Development and Medical Affairs and asamember of the senior management team. From 1996 until 2000 Dr Daniels held a seriesof leadership positions at Merck Re- search Laboratories,US. Special competences Extensive experience in clinical development, medical af- fairs and corporatestrategy acrossabroad range ofthera- peutics areas within the pharmaceutical industry, espe- cially intheUS. Education 1987 1981 1981 M.D.,Washington University,St.Louis,US M.A. in Metabolism and Nutritional Biochemistry, Massachusetts Institute of Technology, Cambridge, US B.S. in Life Sciences, Massachusetts Institute of Technology,Cambridge, US BrianDaniels Member of theBoard Born February1959 Male, USnational First elected in2016 Independent Sylvie Grégoire Member of theBoard Member of the AuditCommittee Born November 1961 Female, Canadian andUS national First elected in 2015 Most recently electedin 2016 Audit Committee member since2015 Independent Management duties Chairman of theboard of CorvidiaTherapeutics Inc.,US. Executivechairman of Metriopharm, Switzerland, US. Member of the boards of Galenica AG, Switzerland and PerkinElmerInc.,US. Chairman ofthestrategic committee ofTarixOrphanLLC., US. Advisortothefinancial and biotechcommunity. Former positions Ms Grégoireisformerpresident of Human Genetic Thera- pies Shire PLC, US and Switzerland from 2007 to 2013. Priortothat, she was executive chairman of IDMPharma Inc.,US,from 2006 to2007,and president and chief exe- cutive officer inGlycoFiInc.,USfrom2003 to2004.From 1995 until 2003 Ms Grégoireheld various leadership posi- tionsinBiogen, Inc.,inFranceand theUS,recentlyasexe- cutive vicepresident of TechnicalOperations.Priortothis, Ms Grégoirewas atMerckand Co,inclinical researchand regulatory affairs inCanada, USand Belgium foraperiod of 8yearprior. Special competences Deepknowledge oftheregulatoryenvironmentinboththe USand theEU,having experiencewithallphases ofthepro- duct life cycle including discovery, registration, pre-launch andmanaging thelifecyclewhileonthemarket.Inaddition, shehasfinancial insight including intoP&Lresponsibility. Education 1986 1984 1980 Pharmacy Doctorate degree, State University of NY at Buffalo, US B.A. in Pharmacy, Laval University,Canada Science College degree, Seminaire de Sherbrooke,Canada

NovoNordiskAnnual GeneralMeeting 2017 •page 11 The individual candidates KasimKutay Proposed elected as boardmember Management duties CEO of Novo A/S,Denmark. Member of the board of Novozymes A/S,Denmark. Former positions From2009 to2016 MrKutay was managing director,co- head of Europe and member of the Global Management Committee of Moelis & Co.,UK.From2007 to2009 Mr Kutay was managing directorand head of Financial Solu- tions Group of SUNGroup, UK. From 1989 to 2007 Mr Kutay held a number of positions at Morgan Stanley, UK, including chairman oftheEuropean Healthcare Group.Mr Kutay was member of theBoardof Trusteesof Northwick Park Institute for Medical Research, UK, from 2005 to 2016. Mr Kutay was member of the Board of Governors from 2006 to2011 and the Investment Committee from 2011 to2016 of the School of Oriental and African Stu- dies(SOAS),UK. Special competences Extensiveexperienceasfinancial advisortothepharmaceu- tical, biotechnology and medical device industries.Hasad- visedhealthcare companies onan international basis inclu- ding companies based inEurope,theUSA,Japan andIndia. Education 1987 1986 M.Sc. in Economics, London School of Economics, UK B.Sc. in Economics, London School of Economics, UK Born May 1965 Male, UKnational Notindependent LizHewitt Member of theBoard Chairman of the Audit Committee Member of the NominationCommittee Born November1956 Female, UKnational First elected in 2012 Most recently electedin 2016 Audit Committee chairman since 2015 (member since 2012) Nomination Committee member since 2013 Independent Management duties Member oftheboardofSavills plc,wheresheisalsochair- man of the audit committee, and Melrose Industries plc, where she isalso chairman of the nomination committee, both inUK. External member of the Houseof LordsCommission, UK, whereshealsochairstheaudit committee. Former positions From2004 to2011 Ms Hewittwas GroupDirectorCorpo- rateAffairs forSmith &Nephewplc, UK,and was involved at a senior level in all aspects of the business, including membership of the RiskCommittee.At3iGroupplc, UK, 1986 to2004,MsHewittheldanumber ofrolesfrominve- sting and syndicating privateequitytransactions, torunning the internal consultancy team, culminating in her roleas DirectorCorporateAffairs, when shewas amembership of theRiskCommittee and aTrusteeofthe3iCharitable Fou- ndation.Inherearlycareer,MsHewittqualified withAnder- sen & Coand also worked as a private equity investorfor CiticorpVentureCapital (nowCVC),UK,and GartmoreIn- vestment Management Ltd.,UK. Special competences Extensive experience within the field of medical devices, significant financial knowledge and knowledge about how large international companies operate. Audit Committee Ms Hewittisdesignated as Audit Committee financial ex- pertunder bothDanish and USlaw.MsHewittqualifies as an independent Audit Committee member as defined by theUSSECand isregarded asindependent under theDa- nish ActonApproved Auditors and AuditFirms. Education 1982 CharteredAccountant FCA 1977 BSc(EconHons),UniversityCollege inLondon, UK

The individual candidates Management duties Operating advisor to Clayton Dubilier & Rice, US, and se- nior advisor to McKinsey & Co.,US. Member of the boards of Schlumberger Ltd., Curaçao, and P/F Tjaldur, FaroeIslands. Member of the Board of Trustees of the International Cri- sisGroup. Former positions Mr Lund served as chief executive of BGGroup plc, UK, theglobal oiland gas company, from2015 to2016 when thecompany was acquired byShell.Priortothat MrLund servedaspresident and CEOofStatoil ASA, Norway,from 2004 to2014.From2002 to2004 MrLund servedaspre- sident &CEOofAkerKvaernerASA,Norway,an industrial conglomerate with operations in oiland gas, engineering and construction, pulp and paper and shipbuilding . Prior tothis Mr Lund has also held executive positions in Aker RGI ASA, Norway, an industrial holding company, and Hafslund Nycomed, Norway, an industrial group with business activities inpharmaceuticals andenergy. From 2014 to 2015 Mr Lund was a member ofthe Board of Directors of Novo Nordisk A/S,Denmark. Special competences Extensiveexecutiveand board experience inlarge multina- tional companies headquartered inScandinavia within re- gulated markets and significant financial knowledge. Education 1991 MBA, INSEAD,France 1987 MA Economics, NHH Norwegian School of Economics & Business Administration, Norway Page 12 •NovoNordiskAnnual GeneralMeeting 2017 Helge Lund Proposed elected as boardmember Born October1962 Male, Norwegian national Independent Management duties CEO of Novelion Therapeutics Inc., US. Member of the boards of Coherus Biosciences Inc.,Nove- lion Therapeutics Inc.,and Suneva Medical Inc.,all in the US. Former positions Ms Szela was chief executive officer of Melinta Therapeu- ticsInc.,US,from2013 until2015.From1987 to2012 Ms Szela held various management positions atAbbott Labo- ratories,Inc.,US,mostrecentlyasseniorvicepresident for global strategic marketing &services.From2008 to2010, Ms Szela was president of theU.S.pharmaceuticals divisi- on and from 2002 until 2008 VPof the U.S.Commercial Operations. Priorto 2001, Ms Szela held a series of lea- dership positions intheAbbottHospital ProductsDivision. Special competences Deepunderstanding of theclinical, regulatory and marke- ting aspects ofthepharmaceutical industry inNorthAme- rica,having both operational andstrategic experience. Education 1991 MBA, University of Illinois at Chicago, US 1985 B.S. in Nursing, University of Illinois at Chicago, US MarySzela Member of theBoard Member of the Remuneration Committee Born May 1963 Female, USnational First elected in 2015 Most recently electedin 2016 Remuneration Committee member since 2015 Independent

NovoNordiskAnnual GeneralMeeting 2017 •page 13 Current position Projectvicepresident forNovoNordisk’smealtime insu- lin projects faster-acting insulin aspart and liver-prefer- ential mealtime insulin inGlobalDevelopment. Education 2011 Master of Medical Business Strategies from Copenhagen Business School, Denmark 1992 Master of Science (Pharm) fromCopenhagen University,Denmark Born January 1966 Female, Danishnational First elected in 2014 Nomination Committee member since2015 Current position Laboratory Technician and full-time union representative. Management duties Member of the board of the Novo Nordisk Foundation, Denmark. Education 1980 Degree in medical laboratory technology, Copen- hagen University Hospital,Denmark Born July1956 Female, Danishnational First elected in 2000 Most recently electedin 2014 Liselotte Hyveled Member of the Board (employeerepresentative) Member of the NominationCommittee Anne MarieKverneland Member of the Board (employeerepresentative) Current position External Affairs Director in QualityIntelligence. Management duties Member of the board of HOFORA/S, HOFORForsyning Holding PS,HOFORForsyning Komplementar A/Sand HO- FORForsyning A/S, (allCopenhagen Utilities),Denmark. Education 1988 BSc in Chemical Engineering, Engineering Acade- my ofDenmark Born December 1964 Male, Danishnational First elected in 2006 Most recently electedin 2014 Remuneration Committee member since2015 Søren Thuesen Pedersen Member of the Board (employeerepresentative) Member of the Remuneration Committee Current position Electrician and full-time union representative. Education 2003 1984 Diploma in further training for board members, the Danish Employees’ Capital Pension Fund (LD) Diploma in electrical engineering Born January 1964 Male, Danishnational First elected in1998 Mostrecentlyelectedin2014 Audit Committee member since2013 StigStrøbæk Member of the Board (employeerepresentative) Member of the AuditCommittee Employeerepresentatives

Appendix 2 Principles for remuneration of board members and executives in Novo NordiskA/S (‘Remuneration Principles’) 1,2 1 In Section 4 of the Recommendations on Corporate Governance designated by Nasdaq Copenhagen referred to as “remunerationpolicy”. 2 These Principles include general guidelines for incentive-based remuneration pursuant to Section 139 of the Danish Companies Act. Page 14 •NovoNordiskAnnual GeneralMeeting 2017 TheRemuneration Principles aredesigned toattract, retain and motivate the members of the Board of Directorsand of ExecutiveManagement .Remuneration has been designed toalign theinterestsoftheexecutives with those oftheshare- holders. 1. TheBoardofDirectors 1. Process TheBoard of Directorsreviews board fees annually based on recommendations from the Remuneration Commit- tee.When preparing itsrecommendation, the Remuneration Committee will evaluate board fees against relevant benchmarks ofDanish and otherNordiccompanies aswellasEuropean pharmaceutical companies similartoNovo Nordiskin size, complexity and market capitalisation .Theremuneration of the board members forthe past year and thelevelforthecurrentyearareapproved bytheAnnual General Meeting asaseparate agenda item. 2. Size Each board member shall receivea fixed fee peryear.Boardmembers receivea fixed amount (thebase fee)while the Chairmanship receivesa multiple thereof:the chairman receives3 times the base fee and the vice chairman receives2times thebasefee. Service on the Audit Committee entitles board members toan additional fee:the Audit Committee chairman re- ceives1.00 times thebase fee and theotherAudit Committee members receive0.5times thebase fee. Service on the Nomination Committee entitles board members toan additional fee: the Nomination Committee chairman receives0.5 times the base fee and the otherNomination Committee members receive0.25 times the basefee. ServiceontheRemuneration Committee entitles board members toan additional fee:theRemuneration Commit- teechairman receives0.5times thebase fee and theotherRemuneration Committee members receive0.25 times thebasefee. Individual board members may take onspecific ad hoc tasks outside theirnormal duties assigned bytheBoard.In each such case theBoardshall determine afixed fee (eg perdiem) fortheworkcarriedoutrelatedtothose tasks. Thefixed fee willbe disclosed intheAnnual Report. 3. Social security taxes NovoNordiskpays inaddition tothefixed fee such contribution tosocial securitytaxeswithin theEUimposed by foreign authorities inrelation tothefixedfee. 4. Travelallowance Allboardmembers arepaid afixedtravelallowance when travelling toboardmeetings orcommittee relatedmeet- ings.Notravelallowance ispaid toboard members when notravelisrequiredtoattend board meetings orcom- mittee relatedmeetings.Thetravelallowance willbe disclosed intheAnnual Report. 5. Expenses Expenses such as traveland accommodation in relation toboard meetings as well as relevant education arereim- bursed. 6. Incentive programmes Boardmembers arenotoffered stockoptions, warrants orparticipation inotherincentive schemes.

NovoNordiskAnnual GeneralMeeting 2017 •page 15 2. ExecutiveManagement ExecutiveManagement includes alltheexecutives registered as executives with theDanish Business Authority. 1. Process ExecutiveremunerationisproposedbytheRemuneration Committeeand subsequently approvedbytheBoard. 2. Size andcomposition Executive remuneration isevaluated annually against relevant benchmarks of Danish and otherNordiccompanies as well as European pharmaceutical companies similar toNovoNordiskin terms of size, complexity and market capitalisation .Toensure comparability, executive positions areevaluated inaccordance with an international posi- tionevaluation system which among otherparameters includes and reflectsthedevelopment ofthecompany size measured intermsofcompany revenueand number ofemployees. Theremuneration package consists of afixed base salary, acash-based incentive, along-term share-based incen- tive,a pension contribution andotherbenefits. Forexecutives onan international assignment attherequestofthecompany, theremuneration package isgener- allybased onan equalized hostcountrynetsalaryduring thelength oftheassignment . Thefixed base salary ischosen to attract and retain executives with professional and personal competences re- quired todrivethecompany’s performance. TheShort-termincentive programme (STIP)isdesigned toincentivise theindividual executive forindividual perfor- mance within his/herfunctional areaand toensureshort-termachievements inlinewith company needs. TheLong-term incentive programme (LTIP)isdesigned topromote the collective performance of Executive Man- agement and toalign theinterestsofexecutivesand shareholders.Itfurtherensuresabalance between short-term achievements and long-termthinking. Pension contributions are made to provide an opportunity for executives to build up an income for retirement. Otherbenefits areadded toensurethat overallremuneration iscompetitive and aligned with localpractice. 3. Size of thecomponents Thefixedbase salaryaccounts forapproximately 25% to50% ofthetotalvalue oftheremuneration package .The intervalstatesthespan between “maximum performance” and“on-target-performance” . Inaddition tothe fixed base salary, the executives may be eligible forvariable incentive-based remuneration con- sisting of1)aSTIP,and 2)aLTIP.TheSTIPmay resultinamaximum payout peryearequal to12months’ fixedbase salary plus pension contribution.TheLTIPmay resultinamaximum grant peryearequal to12 months’ fixed base salaryplus pension contribution.Consequently, theaggregate maximum amount that may begranted asincentive foragiven yearisequal to24 months’ fixed base salaryplus pension contribution. This split between fixed and variable remuneration is intended to result in a reasonable part of the salary being linked to performance, while at the same time promoting sound business decisions to achieve the company’s vi- sion. Further, the balance between the components is assessed broadly to be in line with market practice for benchmarked companies.

Page 16 •NovoNordiskAnnual GeneralMeeting 2017 2.4 Incentive programmes 1. Short-term incentive programme (STIP) TheSTIPconsists of a cash-based incentive which islinked tothe achievement of a number of predefined func- tional and individual business targets foreach member ofExecutiveManagement .TheSTIPforeach participating member cannot exceedan amount equal to12 months’ fixed base salary plus pension contribution peryear.The BoardofDirectorsdetermines atthebeginning ofeach yearthemaximum STIPforeach participating member for the given year.Thecalculation of the STIP–if any –fora yearistypically based on the salary in December.The targets forthechief executive officer arefixed bythechairman oftheBoardofDirectorswhile thetargets forthe executive vicepresidents arefixed bythechief executive officer.Thechairman of theBoardevaluates thedegree oftarget achievement foreach member ofExecutiveManagement, and cash-based incentives –ifany –forapar- ticularfinancial yeararepaid atthebeginning ofthesubsequent financial year. STIPissubject torecoveryor‘claw-back’ by NovoNordisk,provided the remuneration was paid on the basis of data which proved to be manifestly misstated due to wilful misconduct orgross negligence by the executive. Claw-backinrelationtotheSTIPispossible upto12months aftertheactual payment ofthecash-based incentive. 2. Long-term incentive programme (LTIP) Each yearinJanuary theBoardof Directorsdecides whether ornottoestablish an LTIPforthat calendaryear. TheLTIPisbased onan annual calculation ofeconomic value creationascompared tothebudgeted performance fortheyearandonsales compared tothebudgeted target fortheyear. Aligned with NovoNordisk’slong-term financial targets, the calculation of economic value creation isbased on reportedoperating profit after taxreduced by a weighted average costof capital (WACC)-basedreturnrequire- ment onaverage investedcapital. A proportion of the calculated economic value creation is allocated to a pool for Executive Management and othermembers of the SeniorManagement Board.TheSeniorManagement Boardconsists of all members ofEx- ecutive Management and seniorvicepresidents. Formembers ofExecutiveManagement thepooloperates with ayearlymaximum allocation perparticipant equal to12 months’ fixed base salary plus pension contribution.TheBoardofDirectorsdetermines atthebeginning of each yearthemaximum allocation perparticipant forthegiven year.Thepoolmay, subject totheBoardofDirec- tors’assessment, bereduced incaseoflower-than-planned performance onsignificant researchand development projects and key sustainability projects. Targets for non-financial performance related to sustainability and re- searchand development projectsmay include achievement ofcertain milestones within setdates. Oncethepoolhas been approved bytheBoardofDirectors,thetotalcash amount isconvertedintoNovoNordisk A/S Bshares at market price.Themarket priceiscalculated as the average trading priceforNovoNordiskA/SB shares onNasdaq Copenhagen intheopen trading window following thereleaseof financial resultsfortheyear priortothe relevant bonus year;iein the open trading window immediately following the Board of Directors’ approval of theprogramme. Thesharesinthepoolareallocated totheparticipants proratedaccording totheirbase salaryasper1Aprilinany given year. Thesharesinthepoolforagiven yearwillbelocked up forthreeyearsbefore itistransferred totheparticipants, including Executive Management . Ifa participant resigns during the lock-up period, his orhershares will be re- moved from thepool.

NovoNordiskAnnual GeneralMeeting 2017 •page 17 Inthe lock-up period the Board of Directorsmay remove shares from the pool in the event of lower-than-planned economic creationand/or sales during such lock-upperiod, eg iftheeconomic profitorsales fall below apredefined threshold. Inthelock-upperiodthemarketvalue ofthepoolwillchange dependent upon thedevelopment intheNovoNordisk Bshareprice,aligning theinterestsofparticipants including ExecutiveManagement withthoseofshareholders. Nodividends arepaid on shares in the bonus pool in the lock-up period and the shares in the bonus pool aread- ministered as partof NovoNordisk’sholding of treasuryshares. NovoNordiskcontinuously coversitsobligations under theLTIPthrough itsholding of treasuryshares. LTIPissubject torecoveryor‘claw-back’ byNovoNordisk,provided theremuneration was paid onthe basis of data which provedtobemanifestly misstated due towilful misconduct orgrossnegligence byaparticipant.Claw-back in relation tothe LTIPispossible up to12 months after therelease of theshares totheparticipants (iefour yearsafter allocation). 5. Pension Thepension contribution isup to25% ofthefixed base salaryincluding bonus. 6. Otherbenefits Executivesreceivenon-monetary benefits such as company cars,phones etc.Executiveson international assignments may receiverelocationbenefits.Such benefits areapproved bytheBoardbydelegation ofpowerstotheRemuneration Committee.TheRemuneration Committee informs theBoardoftheprocessand outcome.Inaddition, executivesmay participate incustomary employee benefit programmes, egemployee sharepurchase programmes. 7. Termination ofemployment NovoNordiskmay terminate the employment of an executive by giving 12 months’ notice. Executives may termi- nate theiremployment bygiving NovoNordisksixmonths’ notice. 8. Severance payment Intheeventoftermination –whether byNovoNordiskorbytheindividual –duetoamerger,acquisition ortakeover ofNovoNordisk,executivesare,inaddition tothenoticeperiod, entitled toaseverance payment of24months’ fixed base salary plus pension contribution.Incase of termination by NovoNordiskforotherreasons, the severance pay- ment isthreemonths’ fixedbase salaryplus pension contribution peryearofemployment asan executiveand taking into account previous employment history;in no event, however, lessthan 12 ormorethan 24 months’ fixed base salary plus pension contribution. Withregard toseverance payment, the employment contracts entered into before 2008 exceedthe 24-month limit described above.Theseverance payment toindividual executives under thecontracts entered intobefore 2008 will, however, notexceed36months’ fixed base salary plus pension contributions. 9. Sign-onarrangement TheBoard of Directorsmay when recruiting new executives who arenotemployed byNovoNordiskat the time of employment grant asign-onarrangement intheform ofcash payment orshareincentive programme.

Page 18 •NovoNordiskAnnual GeneralMeeting 2017 2.10 Shareholding requirements for Executive Management Tofurther align theinterestof the shareholders and ExecutiveManagement theChief ExecutiveOfficershould hold NovoNordiskA/SBsharescorresponding to2timestheannual grosssalaryand theExecutiveVicePresidentsshould hold shares corresponding to 1 time the annual gross salary. TheBoard of Directorsmay grant exemption to this requirement, eg. inconnection with a promotion toChief ExecutiveOfficerorExecutiveVicePresident. 3. Overview Thebelow table provides an overview of the remuneration for members of the Board of Directorsand Executive Management . Board ofDirectors Executive Management Fixed fee/base salary Yes Yes Fee for Committeework Yes No Fee for ad hoctasks Yes No STIP (Short-term incentive programme) No Up to 12 months’ fixed base salary plus pension contribution peryear LTIP (Long-term incentive programme) No Up to 12 months’ fixed base salary plus pension contribution peryear Pension No Up to 25% of fixed base salary, STIP and LTIP Travel allowance and otherexpenses Yes Executive Management receives a minor travel allowance equal tothatofallotherDenmark-based employees Otherbenefits No As approved by the Board by delegation ofpowers to the Remuneration Committee Severancepayment No Based on tenure of employment, 12–24 months’ fixedbasesalarypluspensioncontribution.However, foremployment contractsenteredintobefore2008 such payment would be12–36 months’ fixedbase salaryplus pensioncontribution.

Notes: NovoNordiskAnnual GeneralMeeting 2017 •page 19

Novo Nordisk A/S NovoAllé DK-2880 Bagsværd Denmark novonordisk.com Hotline: +45 30751126 E-mail: AGMeeting@novonordisk.com L a y o u t a n d p r o d u c t i o n : C o r p o r a t e C o m m u n i c a t i o n s . P r i n t e d : B o r d i n g P R O A / S , D e n m a r k

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf of the undersigned, thereunto duly authorized.

|

Date: February 24, 2017

|

NOVO NORDISK A/S

Lars Fruergaard Jørgensen

Chief Executive Officer

|

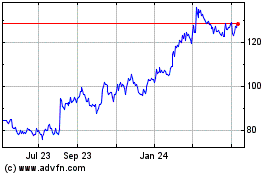

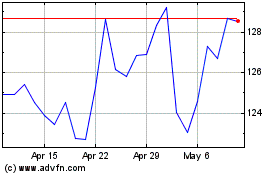

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024