Novo's New Insulin Reduces Risk of Low Blood Sugar, Study Shows

November 29 2016 - 4:51PM

Dow Jones News

By Denise Roland

Novo Nordisk A/S said its new insulin Tresiba carries about the

same risk of serious heart problems as Sanofi SA's Lantus but

offers significantly lower risk of dangerously low blood sugar in

people with Type-2 diabetes.

Denmark-based Novo Nordisk said its trial of more than 7,500

patients found that those on Tresiba were 27% less likely to suffer

an episode of severe hypoglycemia, a dangerous condition that

occurs when insulin removes too much sugar from the blood, than

those on Lantus.

It added that for episodes of severe hypoglycemia during sleep,

Tresiba reduced the risk by 54% compared with Lantus. Patients on

Tresiba and Lantus were at equal risk of having serious heart

problems such as heart attack and stroke.

A Sanofi spokesman said the company hadn't yet had a chance to

analyze the trial results.

The results could provide a much-needed boost to a drug that has

so far proved a disappointment. It could turn around Novo Nordisk's

frustrated efforts to have Tresiba gain significant market share

from Lantus, an older insulin that dominates the U.S. drug

market.

When Novo Nordisk launched Tresiba in January, it hoped the

added convenience -- unlike older insulins, it doesn't need to be

taken at the same time daily -- would justify its high price tag

and help it win favor among doctors.

Instead, the company has been forced to offer

deeper-than-expected discounts to win favorable coverage by the

pharmacy-benefit managers that negotiate drug prices on behalf of

health insurers and employers. Even with that coverage, Tresiba has

struggled to win market share from Lantus. As of September, Tresiba

had a 3% share of the U.S. market for long-acting insulin, compared

with Lantus's 66%, according to health-care data company IMS.

But the result of the trial could help win favor from doctors.

Peter Verdult, an analyst at Citi, previously said any result that

showed a benefit of around 30% could shift prescribing habits in

favor of Tresiba.

Still, any boost from the result of the trial may prove

modest.

Pharmacy-benefit managers are eager to contain the ballooning

cost of diabetes after years of price increases by insulin makers

including Novo Nordisk. What's more, there is rising public anger

about the high cost of insulin.

Those pressures have already forced Novo Nordisk to slash its

long-term growth target, saying that it must lower prices for a

"significantly more challenging" U.S. market.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

November 29, 2016 16:36 ET (21:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

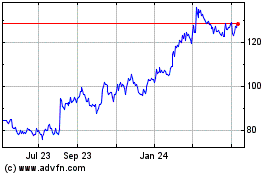

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

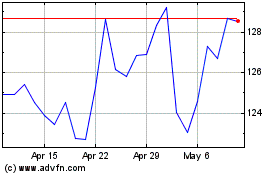

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024