Washington, D.C. 20549

Indicate by check mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g-32(b):82-________

Sales increased by 6% in local currencies and by 4% in Danish kroner to DKK 82.2

billion.

Operating profit decreased by 1% reported in local currencies and by 3% in

Danish kroner to DKK 37.2 billion. Adjusted for the non-recurring income related to the partial divestment of NNIT and the income

related to out-licensing of assets for inflammatory disorders, both in 2015, operating profit in local currencies increased by

7%.

Net profit increased by 10% to DKK 29.2 billion. Diluted earnings per share

increased by 12% to DKK 11.50. Adjusted for the partial divestment of NNIT, net profit and diluted earnings per share increased

by 20% and 22% respectively.

In September, Novo Nordisk announced that Lars Rebien Sørensen, president

and chief executive officer, will retire from the company by the end of 2016. Lars Fruergaard Jørgensen, currently executive

vice president and head of Corporate Development, will succeed him, effective 1 January 2017.

In September, Novo Nordisk announced plans to reduce the workforce by approximately

1,000 employees of the 42,600 positions in the company’s global organisation.

The financial outlook for 2016 has been updated and

the range for sales growth is now expected to be 5–6%, whereas growth in adjusted operating profit is now expected to be

5–7%, both measured in local currencies.

During 2016, the market environment in the USA has become significantly more

challenging, negatively impacting future pricing for Novo Nordisk’s products. Consequently, the preliminary outlook for 2017

indicates low single-digit growth in sales and flat to low single-digit growth in operating profit, both measured in local currencies.

In terms of long-term financial targets, Novo Nordisk no longer deems it achievable to reach the operating profit growth target

of 10% set in February 2016. As a result, the target has been revised and Novo Nordisk is now aiming for an average operating profit

growth of 5%. The two other financial targets remain unchanged.

Lars Rebien Sørensen, president and CEO: “We have reassessed

our long-term target for operating profit growth and our R&D strategy in the light of the challenging market environment in

the USA. As a result, we are reducing our global cost base and parting company with some of our valued employees. Going forward

we are confident that our strong product portfolio with innovative products like Tresiba®, Victoza® and semaglutide will

enable us to deliver on our revised growth targets.”

Novo Nordisk is a global healthcare company with more than 90 years of innovation and

leadership in diabetes care. This heritage has given us experience and capabilities that also enable us to help people defeat

other serious chronic conditions: haemophilia, growth disorders and obesity. Headquartered in Denmark, Novo Nordisk employs approximately

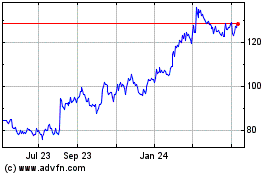

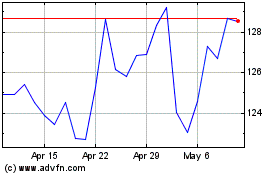

42,600 people in 75 countries, and markets its products in more than 180 countries. Novo Nordisk’s B shares are listed on

Nasdaq Copenhagen (Novo-B). Its ADRs are listed on the New York Stock Exchange (NVO). For more information, visit novonordisk.com

On 28 October 2016 at 13.00 CEST, corresponding to 7.00 am EDT, a conference call will

be held. Investors will be able to listen in via a link on novonordisk.com, which can be found under ‘Investors’.

Presentation material for the conference call will be available approximately one hour before on the same page.

On 31 October 2016 at 14.15 CET, corresponding to 9.15 am EDT, management will give

a presentation to institutional investors and sell-side analysts in London. A webcast of the presentation can be followed via

a link on novonordisk.com, which can be found under ‘Investors’. Presentation material for the webcast will be made

available on the same page.

CONTACTS FOR FURTHER INFORMATION

|

Media:

|

|

Charlotte Zarp-Andersson

|

+45 3079 7603

|

czpa@novonordisk.com

|

|

Ken Inchausti (US)

|

+1 267 809 7552

|

kiau@novonordisk.com

|

|

Investors:

|

|

Peter Hugreffe Ankersen

|

+45 3075 9085

|

phak@novonordisk.com

|

|

Melanie Raouzeos

|

+45 3075 3479

|

mrz@novonordisk.com

|

|

Hanna Ögren

|

+45 3079 8519

|

haoe@novonordisk.com

|

|

Anders Mikkelsen

|

+45 3079 4461

|

armk@novonordisk.com

|

|

Kasper Veje (US)

|

+1 609 235 8567

|

kpvj@novonordisk.com

|

Further information about Novo Nordisk is available

on novonordisk.com.

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 3 of 33

|

|

LIST OF CONTENTS

|

|

|

FINANCIAL PERFORMANCE

|

4

|

|

|

Consolidated financial statement for the first nine months of 2016

|

4

|

|

|

Sales development

|

5

|

|

|

Diabetes and obesity care, sales development

|

6

|

|

|

Biopharmaceuticals, sales development

|

10

|

|

|

Development in costs and operating profit

|

10

|

|

|

Financial items (net)

|

11

|

|

|

Capital expenditure and free cash flow

|

11

|

|

|

Key developments in the third quarter of 2016

|

11

|

|

OUTLOOK

|

13

|

|

|

Long-term financial targets update

|

15

|

|

RESEARCH & DEVELOPMENT UPDATE

|

16

|

|

|

Updated Research and Development strategy

|

16

|

|

|

Diabetes

|

16

|

|

|

Obesity

|

20

|

|

SUSTAINABILITY UPDATE

|

20

|

|

EQUITY

|

20

|

|

CORPORATE GOVERNANCE

|

21

|

|

LEGAL MATTERS

|

22

|

|

MANAGEMENT STATEMENT

|

25

|

|

FINANCIAL INFORMATION

|

26

|

|

|

Appendix 1:

|

Quarterly numbers in DKK

|

26

|

|

|

Appendix 2:

|

Income statement and statement of comprehensive income

|

27

|

|

|

Appendix 3:

|

Balance sheet

|

28

|

|

|

Appendix 4:

|

Statement of cash flows

|

29

|

|

|

Appendix 5:

|

Statement of changes in equity

|

30

|

|

|

Appendix 6:

|

Regional sales split

|

31

|

|

|

Appendix 7:

|

Key currency assumptions

|

32

|

|

|

Appendix 8:

|

Quarterly numbers in USD (additional information)

|

33

|

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 4 of 33

|

FINANCIAL PERFORMANCE

CONSOLIDATED FINANCIAL STATEMENT FOR THE FIRST NINE MONTHS OF 2016

These unaudited consolidated financial statements

for the first nine months of 2016 have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ and on

the basis of the same accounting policies as were applied in the

Annual Report 2015

of Novo Nordisk. Novo Nordisk has adopted

all new, amended or revised accounting standards and interpretations (‘IFRSs’) as published by the IASB that are endorsed

by the EU and effective for the accounting period beginning on 1 January 2016. These IFRSs have not had a significant impact on

the consolidated financial statements for the first nine months of 2016.Furthermore, the financial report including the consolidated

financial statements for the first nine months of 2016 and Management’s review have been prepared in accordance with additional

Danish disclosure requirements for interim reports of listed companies

Amounts in DKK million, except number of shares, earnings

per share and full-time equivalent employees.

|

PROFIT AND LOSS

DKK million

|

|

|

9M 2016

|

|

|

|

9M 2015

|

|

|

|

% change 9M

2015

to 9M 2016

|

|

|

Net sales

|

|

|

82,208

|

|

|

|

79,051

|

|

|

|

4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

69,943

|

|

|

|

67,471

|

|

|

|

4

|

%

|

|

Gross margin

|

|

|

85.1

|

%

|

|

|

85.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and distribution costs

|

|

|

20,468

|

|

|

|

20,273

|

|

|

|

1

|

%

|

|

Percent of sales

|

|

|

24.9

|

%

|

|

|

25.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development costs

|

|

|

10,093

|

|

|

|

9,574

|

|

|

|

5

|

%

|

|

Percent of sales

|

|

|

12.3

|

%

|

|

|

12.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative costs

|

|

|

2,796

|

|

|

|

2,693

|

|

|

|

4

|

%

|

|

Percent of sales

|

|

|

3.4

|

%

|

|

|

3.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income, net

|

|

|

640

|

|

|

|

3,388

|

|

|

|

N/A

|

|

|

Non-recurring income from the initial public offering of NNIT A/S

|

|

|

-

|

|

|

|

2,376

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

|

37,226

|

|

|

|

38,319

|

|

|

|

(3

|

%)

|

|

Operating margin

|

|

|

45.3

|

%

|

|

|

48.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial items (net)

|

|

|

(370

|

)

|

|

|

(5,150

|

)

|

|

|

(93

|

%)

|

|

Profit before income taxes

|

|

|

36,856

|

|

|

|

33,169

|

|

|

|

11

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

7,630

|

|

|

|

6,567

|

|

|

|

16

|

%

|

|

Effective tax rate

|

|

|

20.7

|

%

|

|

|

19.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit

|

|

|

29,226

|

|

|

|

26,602

|

|

|

|

10

|

%

|

|

Net profit margin

|

|

|

35.6

|

%

|

|

|

33.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER KEY NUMBERS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, amortisation and impairment losses

|

|

|

2,077

|

|

|

|

1,944

|

|

|

|

7

|

%

|

|

Capital expenditure (tangible assets)

|

|

|

4,559

|

|

|

|

3,028

|

|

|

|

51

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash generated from operating activities

|

|

|

37,161

|

|

|

|

28,168

|

|

|

|

32

|

%

|

|

Free cash flow

|

|

|

31,603

|

|

|

|

27,280

|

|

|

|

16

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

87,340

|

|

|

|

85,195

|

|

|

|

3

|

%

|

|

Equity

|

|

|

41,327

|

|

|

|

43,109

|

|

|

|

(4

|

%)

|

|

Equity ratio

|

|

|

47.3

|

%

|

|

|

50.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average number of diluted shares outstanding (million)

|

|

|

2,540.6

|

|

|

|

2,586.7

|

|

|

|

(2

|

%)

|

|

Diluted earnings per share / ADR (in DKK)

|

|

|

11.50

|

|

|

|

10.28

|

|

|

|

12

|

%

|

|

Diluted earnings per share / ADR adjusted for non-recurring income from NNIT IPO (in DKK)

|

|

|

11.50

|

|

|

|

9.40

|

|

|

|

22

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full-time equivalent employees end of period

|

|

|

42,605

|

|

|

|

40,261

|

|

|

|

6

|

%

|

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 5 of 33

|

SALES DEVELOPMENT

Sales increased by 6% measured in local currencies and by 4% in Danish

kroner. Sales growth was realised within both diabetes care and biopharmaceuticals, with the majority of growth originating from

Tresiba

®

, Victoza

®

, Norditropin

®

and Saxenda

®

, while sales of NovoSeven

®

and NovoRapid

®

declined.

|

Sales split per therapy

|

|

|

Sales

9M 2016

DKK

million

|

|

|

|

Growth

as reported

|

|

|

|

Growth

in local

currencies

|

|

|

|

Share of

growth

in local

currencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The diabetes and obesity care segment

|

|

|

|

|

|

|

|

|

|

New-generation insulin

1)

|

|

|

2,752

|

|

|

|

182

|

%

|

|

|

185

|

%

|

|

|

37

|

%

|

|

-

Tresiba ®

|

|

|

2,506

|

|

|

|

184

|

%

|

|

|

187

|

%

|

|

|

33

|

%

|

|

Modern insulin

|

|

|

35,291

|

|

|

|

(4

|

%)

|

|

|

(1

|

%)

|

|

|

(7

|

%)

|

|

-

NovoRapid ®

|

|

|

14,406

|

|

|

|

(4

|

%)

|

|

|

(2

|

%)

|

|

|

(7

|

%)

|

|

-

NovoMix ®

|

|

|

7,886

|

|

|

|

(5

|

%)

|

|

|

(1

|

%)

|

|

|

(2

|

%)

|

|

-

Levemir ®

|

|

|

12,999

|

|

|

|

(2

|

%)

|

|

|

1

|

%

|

|

|

2

|

%

|

|

Human insulin

|

|

|

8,152

|

|

|

|

(4

|

%)

|

|

|

0

|

%

|

|

|

0

|

%

|

|

Victoza®

|

|

|

14,649

|

|

|

|

12

|

%

|

|

|

13

|

%

|

|

|

33

|

%

|

|

Other diabetes and obesity care

2)

|

|

|

4,278

|

|

|

|

22

|

%

|

|

|

26

|

%

|

|

|

18

|

%

|

|

-

Saxenda ®

|

|

|

1,037

|

|

|

|

327

|

%

|

|

|

331

|

%

|

|

|

16

|

%

|

|

Diabetes and obesity care total

|

|

|

65,122

|

|

|

|

4

|

%

|

|

|

6

|

%

|

|

|

81

|

%

|

|

The biopharmaceuticals segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Haemophilia

3)

|

|

|

7,651

|

|

|

|

(3

|

%)

|

|

|

(1

|

%)

|

|

|

(2

|

%)

|

|

-

NovoSeven ®

|

|

|

6,940

|

|

|

|

(7

|

%)

|

|

|

(6

|

%)

|

|

|

(9

|

%)

|

|

Norditropin®

|

|

|

6,568

|

|

|

|

14

|

%

|

|

|

16

|

%

|

|

|

19

|

%

|

|

Other biopharmaceuticals

4)

|

|

|

2,867

|

|

|

|

3

|

%

|

|

|

4

|

%

|

|

|

2

|

%

|

|

Biopharmaceuticals total

|

|

|

17,086

|

|

|

|

4

|

%

|

|

|

6

|

%

|

|

|

19

|

%

|

|

Total sales

|

|

|

82,208

|

|

|

|

4

|

%

|

|

|

6

|

%

|

|

|

100

|

%

|

1)

Comprises Tresiba®, Xultophy®

and Ryzodeg® .

2)

Primarily NovoNorm®, needles

and Saxenda®.

3)

Comprises NovoSeven®, NovoEight®

and NovoThirteen®.

4)

Primarily Vagifem® and Activelle®.

All regions contributed to sales growth; however, the USA was the main

contributor with 44% share of growth measured in local currencies, followed by International Operations and Region China contributing

27% and 16% respectively. Sales growth in the USA was positively impacted by approximately 1.5 percentage points due to non-recurring

adjustments to rebates in the Medicaid patient segment in first quarter of 2016 related to Norditropin

®

.

Sales growth in International Operations of 13% measured in local currencies was positively impacted by approximately 3 percentage

points due to the significant inflationary effects in Argentina and Venezuela.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 6 of 33

|

|

Sales split per region

|

|

|

Sales

9M

DKK

million

|

|

|

|

Growth

as reported

|

|

|

|

Growth

in local

currencies

|

|

|

|

Share of

growth

in local

currencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USA

|

|

|

41,851

|

|

|

|

5

|

%

|

|

|

6

|

%

|

|

|

44

|

%

|

|

Europe

|

|

|

15,407

|

|

|

|

0

|

%

|

|

|

2

|

%

|

|

|

6

|

%

|

|

International Operations

|

|

|

10,173

|

|

|

|

0

|

%

|

|

|

13

|

%

|

|

|

27

|

%

|

|

Region China

|

|

|

7,918

|

|

|

|

5

|

%

|

|

|

11

|

%

|

|

|

16

|

%

|

|

Pacific*

|

|

|

6,859

|

|

|

|

11

|

%

|

|

|

6

|

%

|

|

|

7

|

%

|

|

Total sales

|

|

|

82,208

|

|

|

|

4

|

%

|

|

|

6

|

%

|

|

|

100

|

%

|

* Pacific includes Japan, Korea, Oceania and Canada

Please refer to appendix 6 for further details on sales in the first nine months

of 2016.

The sales split is presented in accordance with the regional structure

introduced in connection with the annual report for 2015. For 2017, an updated format for regional reporting will be introduced

in order to reflect the regional structure revised in connection with the changes in Executive Management announced in September

2016.

In the following sections, unless otherwise noted,

market data are based on moving annual total (MAT) from August 2016 and August 2015 provided by the independent data provider IMS

Health.

DIABETES AND OBESITY CARE, SALES DEVELOPMENT

Sales of diabetes and obesity care products increased by 6% measured

in local currencies and by 4% in Danish kroner to DKK 65,122 million. Novo Nordisk is the world leader in diabetes care with a

global value market share of 27%.

Insulin

Sales of insulin increased by 3% measured in local

currencies and were unchanged in Danish kroner at DKK 46,195 million. Measured in local currencies, sales growth was driven by

International Operations and Region China. Novo Nordisk is the global leader with 46% of the total insulin market and 45% of the

market for modern insulin and new-generation insulin, both measured in volume.

Sales of new-generation insulin (Tresiba

®

,

Xultophy

®

and Ryzodeg

®

) reached DKK 2,752 million

compared with DKK 977 million in 2015.

Sales of Tresiba

®

(insulin degludec),

the once-daily new-generation insulin, reached DKK 2,506 million compared with DKK 882 million in 2015. The roll-out of Tresiba

®

continues and the product has now been launched in 47 countries. In the USA, where Tresiba

®

was launched broadly in January 2016, the feedback from patients and prescribers is encouraging, and the product has achieved wide

commercial and Medicare

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 7 of 33

|

Part D formulary coverage. In Japan, where Tresiba

®

was launched in March 2013 with similar reimbursement as insulin glargine U100, its share of the basal insulin market has grown

steadily, and Tresiba

®

has now captured 40% of the basal insulin market measured in monthly

value market share. Similarly, Tresiba

®

has shown solid penetration in other markets with

reimbursement at a similar level to insulin glargine U100, whereas penetration remains modest in markets with restricted market

access.

Xultophy

®

(IDegLira), a once-daily

single-injection combination of insulin degludec (Tresiba

®

) and liraglutide (Victoza

®

),

is currently marketed in six countries, and launch activities are progressing as planned.

Ryzodeg

®

, a soluble formulation

of insulin degludec and insulin aspart, has now been marketed in eight countries, and feedback from patients and prescribers is

encouraging.

Sales of modern insulin decreased by 1% in local currencies

and by 4% in Danish kroner to DKK 35,291 million. Sales declined in the USA, Europe and Pacific partly offset by a positive contribution

from International Operations and China. Sales of modern insulin and new-generation insulin in total constitute 82% of Novo Nordisk’s

sales of insulin measured in value.

INSULIN MARKET SHARES

(volume, MAT)

|

Novo Nordisk’s share

of total insulin market

|

Novo Nordisk’s share

of the modern insulin

and

new-generation insulin market

|

|

|

August

2016

|

August

2015

|

August

2016

|

August

2015

|

|

Global

|

46%

|

46%

|

45%

|

45%

|

|

USA

|

37%

|

37%

|

38%

|

38%

|

|

Europe

|

46%

|

47%

|

45%

|

47%

|

|

International Operations*

|

55%

|

54%

|

51%

|

52%

|

|

China**

|

55%

|

56%

|

61%

|

62%

|

|

Japan

|

52%

|

52%

|

50%

|

50%

|

Source: IMS, August 2016 data. * Data for 13 selected

markets representing approximately 70% of Novo Nordisk’s diabetes sales in the region. ** Data for mainland China, excluding

Hong Kong and Taiwan.

USA

Sales of insulin in the USA decreased by 1% in both local currencies

and Danish kroner. Sales declined due to lower NovoLog

®

and NovoLog

®

Mix 70/30 prices, a NovoLog

®

and NovoLog

®

Mix

70/30 contract loss effective from 1 January 2016 and a declining premix insulin segment, which was countered by growth in the

basal insulin segment due the positive contribution from the introduction of Tresiba

®

.

54% of Novo Nordisk’s modern insulin volume in the USA is used in the prefilled devices FlexPen

®

and FlexTouch

®

.

Europe

Sales of insulin in Europe increased by 1% in local currencies and

decreased by 1% in Danish kroner. Sales were driven by the penetration of Tresiba

®

as

well as a positive contribution from Xultophy

®

across the region, partly offset by contracting

modern insulin sales and the ceased distribution of Tresiba

®

and Xultophy

®

in Germany. The

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 8 of 33

|

device penetration in Europe is high, and 96% of Novo Nordisk’s

insulin volume is being used in devices, primarily NovoPen

®

and FlexPen

®

.

International Operations

Sales of insulin in International Operations increased by 14% in local

currencies and by 1% in Danish kroner. The growth in local currencies reflects growth in modern insulin, the new-generation insulin

products Tresiba

®

and Ryzodeg

®

as well as human

insulin. Currently, 58% of Novo Nordisk’s insulin volume in the major private markets is used in devices.

Region China

Sales of insulin in Region China increased by 11% in local currencies

and by 5% in Danish kroner. The sales growth is driven by growth of the overall diabetes care market and the continued market penetration

of the three modern insulin products, where Novo Nordisk has improved its share of volume growth and thereby stabilised its market

share. Currently, 98% of Novo Nordisk’s insulin volume in China is used in devices, primarily the durable device NovoPen

®

.

Pacific

Sales of insulin in Pacific were unchanged in local currencies and

increased by 5% in Danish kroner. The sales development reflects continued strong uptake of Tresiba

®

in Japan which is offset by continued volume decline of the Japanese insulin volume market and lower human insulin sales in the

region. The device penetration in Japan is high with 98% of Novo Nordisk’s insulin volume being used in devices.

Victoza

®

(GLP-1 therapy

for type 2 diabetes)

Victoza

®

sales increased

by 13% in local currencies and by 12% in Danish kroner to DKK 14,649 million. Sales growth is driven by the USA and International

Operations. The GLP-1 segment’s value share of the total diabetes care market has increased to 9.2% compared with 7.7% in

2015. Victoza

®

is the market leader in the GLP-1 segment with a 60% value market share.

GLP-1 MARKET SHARES

(value, MAT)

|

GLP-1 share of total

diabetes care market

|

Victoza® share

of GLP-1 market

|

|

|

August

2016

|

August

2015

|

August

2016

|

August

2015

|

|

Global

|

9.2%

|

7.7%

|

60%

|

68%

|

|

USA

|

10.8%

|

9.0%

|

57%

|

66%

|

|

Europe

|

9.3%

|

8.5%

|

68%

|

76%

|

|

International Operations*

|

2.8%

|

2.3%

|

81%

|

87%

|

|

China**

|

0.9%

|

0.8%

|

54%

|

53%

|

|

Japan

|

4.8%

|

2.6%

|

66%

|

67%

|

Source:

IMS, August 2016 data. * Data for 13 selected markets representing approximately 70% of Novo Nordisk’s diabetes sales in

the region. ** Data for mainland China, excluding Hong Kong and Taiwan.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 9 of 33

|

USA

Sales of Victoza

®

in the

USA increased by 14% both in local currencies and in Danish kroner. Sales growth is driven by an underlying prescription volume

growth of the GLP- 1 class of more than 30% in the USA. The growth of the GLP-1 market continues to be driven by recently introduced

competing once-weekly products and Victoza

®

. The value share of the GLP-1 class of the

total US diabetes care market has increased to 10.8%. Despite intensified competition, Victoza

®

is still the market leader with a 57% value market share.

Europe

Sales in Europe increased by 1% in local currencies and decreased by

1% in Danish kroner. Sales growth is driven by the Nordic countries and Portugal offset by declining sales in the United Kingdom,

Germany and France. In Europe, the share of the GLP-1 class of the total diabetes care market in value has increased to 9.3%. Victoza

®

is the GLP-1 market leader with a value market share of 68%.

International Operations

Sales in International Operations increased by 29% in local currencies

and by 19% in Danish kroner. Sales growth is primarily driven by a number of countries in the Middle East and Latin America. The

value share of the GLP-1 class of the total diabetes care market increased to 2.8%. Victoza

®

is the GLP-1 market leader across International Operations with a value market share of 81%.

Region China

Sales in Region China increased by 24% in local currencies and by 17%

in Danish kroner. In China, the GLP-1 class, which represents a modest 0.9% of the total diabetes care market in value, is generally

not reimbursed. Victoza

®

holds a GLP-1 value market share of 54%.

Pacific

Sales in Pacific increased by 19% in local currencies and by 23% in

Danish kroner. The sales growth reflects the continued expansion of the GLP-1 market in Japan, as well as a positive market development

in Canada. In Japan, the GLP-1 class represents 4.8% of the total diabetes care market value compared with 2.6% in 2015. Victoza

®

remains the leader in the class with a value market share of 66%.

Other diabetes and obesity care

Sales of other diabetes and obesity care, which predominantly consists

of oral antidiabetic products, needles and Saxenda

®

, increased by 26% in local currencies

and by 22% in Danish kroner to DKK 4,278 million. Saxenda

®

, liraglutide 3 mg for weight

management, was launched in May 2015 and sales were DKK 1,037 million in the first nine months of 2016 compared with DKK 243 million

in 2015. In the USA, promotional activities are progressing as planned, and feedback from patients and prescribers is encouraging.

Saxenda

®

has now been launched in 12 countries.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 10 of 33

|

BIOPHARMACEUTICALS, SALES DEVELOPMENT

Sales of biopharmaceutical products increased by

6% measured in local currencies and by 4% in Danish kroner to DKK 17,086 million. Sales growth is primarily driven by the USA,

International Operations and Europe.

Haemophilia

Sales of haemophilia products decreased by 1% measured in local currencies

and by 3% in Danish kroner to DKK 7,651 million. The sales decline was primarily driven by lower NovoSeven

®

sales in the USA, partly offset by the roll-out of NovoEight

®

in Europe and the USA as

well as by NovoSeven

®

in Pacific.

Norditropin

®

(growth

hormone therapy)

Sales of Norditropin

®

increased

by 16% measured in local currencies and by 14% in Danish kroner to DKK 6,568 million. The sales growth is primarily derived from

the USA reflecting a significant positive non-recurring adjustment to rebates in the Medicaid patient segment relating to the period

2010-2015. This positive impact has been partly offset by lower volumes. Novo Nordisk is the leading company in the global growth

hormone market with a 23% market share measured in volume.

Other biopharmaceuticals

Sales of other products within biopharmaceuticals, which predominantly

consist of hormone replacement therapy-related (HRT) products, increased by 4% measured in local currencies and by 3% in Danish

kroner to DKK 2,867 million. Sales growth is driven by a positive impact from pricing of Vagifem

®

in the USA.

DEVELOPMENT IN COSTS AND OPERATING PROFIT

The cost of goods sold increased by 6% to DKK 12,265 million, resulting

in a gross margin of 85.1% measured in both local currencies and Danish kroner, compared with 85.4% in 2015. The gross margin was

negatively impacted by ramp-up costs for new manufacturing capacity and product mix due to lower NovoSeven

®

sales partly countered by a positive impact from net prices, driven by non-recurring Medicaid rebate adjustments and Victoza

®

sales.

Sales and distribution costs increased by 4% in local currencies and by

1% in Danish kroner to DKK 20,468 million. The modest increase in costs is driven by sales force investments in selected countries

in International Operations and by costs related to the Tresiba

®

launch in the USA.

Research and development costs increased by 6% in local currencies and by

5% in Danish kroner to DKK 10,093 million. The increase in costs reflects higher research costs for diabetes and obesity projects,

while development costs were unchanged due to the completion of the cardiovascular outcomes trial DEVOTE and the SWITCH phase 3b

development programme, both for insulin degludec, as well as the phase 3a programme SUSTAIN for the once-weekly GLP-1 analogue

semaglutide. This is partly offset by increasing costs related to the PIONEER programme for oral semaglutide, for which six of

the planned 10 trials have been initiated during the first nine months of 2016.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 11 of 33

|

Administration costs increased by 7% in local currencies and by 4%

in Danish kroner to DKK 2,796 million. The higher administrative costs are mainly related to higher employee-related costs in International

Operations.

Other operating income (net) was DKK 640 million compared with DKK 3,388

million in 2015. The lower level of income reflects the non-recurring income from the partial divestment of NNIT, an IT service

and consultancy company, in connection with the Initial Public Offering on Nasdaq Copenhagen as well as non-recurring income related

to the out-licensing of assets for inflammatory disorders, both in 2015.

Operating profit decreased by 1% in local currencies and by 3% in Danish

kroner to DKK 37,226 million. Adjusted for the income related to the partial divestment of NNIT (DKK 2,376 million) and the income

related to the out-licensing of assets for inflammatory disorders (DKK 449 million), both in 2015, the growth in operating profit

was 7% in local currencies.

FINANCIAL ITEMS (NET)

Financial items (net) showed a net loss of DKK 370 million compared

with a net loss of DKK 5,150 million in 2015.

In line with Novo Nordisk’s treasury policy, the most significant

foreign exchange risks for the group have been hedged, primarily through foreign exchange forward contracts. The foreign exchange

result was a loss of DKK 349 million compared with a loss of DKK 5,101 million in 2015. This development reflects loss on foreign

exchange hedging involving especially the Japanese yen, US dollar and Chinese yuan versus the Danish krone.

CAPITAL EXPENDITURE AND FREE CASH FLOW

Net capital expenditure for property, plant and equipment was DKK

4.6 billion compared with DKK 3.0 billion in 2015. Net capital expenditure was primarily related to investments in a new production

facility for a range of diabetes active pharmaceutical ingredients, a new diabetes care filling capacity and an expansion of the

manufacturing capacity for biopharmaceutical products.

Free cash flow was DKK 31.6 billion compared with DKK 27.3 billion in 2015.

The increase of 16% compared with 2015 primarily reflects the increased cash flow from operating activities and a lower level of

tax prepayments in 2016, which more than offset the impact from the non-recurring proceeds from the partial divestment of NNIT

in 2015.

KEY DEVELOPMENTS IN THE THIRD QUARTER OF 2016

Please refer to appendix 1 for an overview of the quarterly numbers

in DKK and to appendix 6 for details on sales in the third quarter of 2016.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 12 of 33

|

Sales in the third quarter of 2016 increased by 5% in local currencies

and by 3% in Danish kroner compared with the same period in 2015. The growth was driven by Tresiba

®

,

Victoza

®

, Saxenda

®

and Norditropin

®

,

partly offset by modern insulin and NovoSeven

®

. From a geographic perspective, sales growth

in local currencies was driven by International Operations, Region China and the USA, growing by 17%, 11% and 2% respectively.

In the USA, the modest sales growth is driven by continued strong Victoza

®

and Saxenda

®

growth and the positive contribution from the introduction of Tresiba

®

in the basal insulin

segment, but partly offset by a NovoLog

®

and NovoLog

®

Mix 70/30 contract loss, lower modern insulin prices, a declining premix insulin segment as well as lower NovoSeven

®

sales.

The gross margin was 85.5% in the third quarter of 2016 compared with 85.6%

in the same period last year. The decline of 0.1 percentage point reflects a less favourable product mix due to a lower share of

NovoSeven

®

sales partly countered by increased Victoza

®

sales.

Sales and distribution costs increased by 1% in local currencies and decreased

1% in Danish kroner in the third quarter of 2016 compared with the same period last year, primarily reflecting controlled and focused

promotional activities in the USA.

Research and development costs increased by 6% in local currencies and

by 5% in Danish kroner in the third quarter of 2016 compared with the same period last year. The increase in costs is driven by

increased research costs for the progression of the early diabetes and obesity portfolio as well as costs incurred in connection

with the update of the Research and Development strategy.

Administrative costs increased by 9% in local currencies and increased by

7% in Danish kroner in the third quarter of 2016 compared with the same period last year. The increase in costs is driven by severance

costs related to the announced management changes and lay-offs in headquarter functions.

Other operating income (net) was DKK 202 million in the third quarter of

2016 compared with DKK 227 million in the same period last year.

Operating profit increased by 5% in local currencies and by 4% in Danish

kroner in the third quarter of 2016 compared with the same period last year.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 13 of 33

|

OUTLOOK

OUTLOOK 2016

The current expectations for 2016 are summarised in the table below:

|

Expectations are as reported,

|

Expectations

|

Expectations

|

|

if not otherwise stated

|

28 October 2016

|

5 August 2016

|

|

Sales growth

|

|

|

|

in local currencies

|

5-6%

|

5-7%

|

|

as reported

|

Around 2 percentage points lower

|

Around 2 percentage points lower

|

|

|

|

|

|

Operating profit growth*

|

|

|

|

in local currencies

|

5-7%

|

5-8%

|

|

as reported

|

Around 2 percentage points lower

|

Around 3 percentage points lower

|

|

|

|

|

|

Financial items (net)

|

Loss of around DKK 600 million

|

Loss of around DKK 600 million

|

|

Effective tax rate

|

20-22%

|

20-22%

|

|

Capital expenditure

|

Around DKK 7.0 billion

|

Around DKK 7.0 billion

|

Depreciation, amortisation

and impairment

losses

|

Around DKK 3.0 billion

|

Around DKK 3.0 billion

|

|

Free cash flow

|

DKK 38-41 billion

|

DKK 38-41 billion

|

*

Adjusted DKK 2,376 million for the partial divestment of NNIT and DKK 449 million for the income related to the out-licensing

of assets for inflammatory disorders, both in 2015.

For 2016, the range for

sales growth

is now expected to be 5–6%

measured in local currencies. This reflects expectations for continued robust performance for Victoza

®

and Tresiba

®

as well as a contribution from Saxenda

®

and Xultophy

®

. These sales drivers are expected to be partly countered by an impact from

a contract loss in the USA for NovoLog

®

and NovoLog

®

Mix 70/30, the loss of exclusivity for products within hormone replacement therapy in the USA, further intensifying competition

within diabetes and biopharmaceuticals especially in the USA, as well as adverse macroeconomic conditions in several markets in

International Operations. Given the current level of exchange rates versus the Danish krone, growth reported in DKK is still expected

to be around 2 percentage points lower than the local currency level.

For 2016,

operating profit growth

is now expected to be 5–7%

measured in local currencies, adjusted by DKK 2,376 million for the partial divestment of NNIT and by DKK 449 million for the income

related to the out-licensing of assets for inflammatory disorders, both in 2015. The expectations for operating profit growth reflect

the updated sales growth forecast, modest growth in sales and distribution costs to support continued launch activities and research

and development costs to support the progress of Novo Nordisk’s pipeline as well as severance costs in relation to the lay-offs

announced in September 2016. Given the current level of exchange rates versus the Danish krone, growth reported in DKK is now expected

to be around 2 percentage points lower than the local currency level.

For 2016, Novo Nordisk still expects financial items

(net) to be a loss of around DKK 600 million. The current expectation reflects losses associated with foreign exchange hedging

contracts, mainly related to the Japanese yen, US dollar and Chinese yuan versus the Danish krone.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 14 of 33

|

The

effective tax rate

for 2016 is still expected to be in the range

of 20–22%.

Capital expenditure

is still expected to be around DKK 7.0 billion

in 2016, primarily related to investments in an expansion of the manufacturing capacity for biopharmaceutical products, additional

capacity for active pharmaceutical ingredient production within diabetes care and a capacity expansion of the diabetes care filling.

Depreciation, amortisation and impairment losses

are still expected to be around DKK 3.0 billion.

Free cash flow

is still expected to be DKK 38–41 billion, which primarily reflects settlements with tax authorities for a number of significant

tax cases.

With regard to the

financial outlook for 2017

, Novo Nordisk expects

to provide detailed guidance on expectations in connection with the release of the full-year financial results for 2016 on 2 February

2017. At present, the preliminary plans for 2017 in local currencies indicate low single-digit growth in sales and flat to low

single-digit growth in operating profit. The preliminary plans reflect expectations for continued robust performance of Tresiba

®

,

Victoza

®

and the portfolio of modern insulins, as well as a positive sales contribution

from Saxenda

®

and Xultophy

®

. Sales growth from

these products are expected to be partly countered by intensifying competition and challenging market access conditions within

both diabetes care and biopharmaceuticals especially in the USA, the loss of exclusivity for products within hormone replacement

therapy in the USA, as well as the macroeconomic conditions in some markets in International Operations. Given the current level

of exchange rates versus the Danish krone, reported sales and operating profit growth in 2017 are expected to be similar to the

growth in local currencies.

All of the above expectations are based on the assumptions that the global

economic environment will not significantly change business conditions for Novo Nordisk during 2016 and 2017, and that currency

exchange rates, especially the US dollar, will remain at the current level versus the Danish krone. Please refer to appendix 7

for key currency assumptions.

Novo Nordisk has hedged expected net cash flows in a number of invoicing

currencies and, all other things being equal, movements in key invoicing currencies will impact Novo Nordisk’s operating

profit as outlined in the table below.

Key invoicing

currencies

|

Annual impact on Novo Nordisk’s

operating profit of a 5%

movement in currency

|

Hedging period

(months)

|

|

USD

|

DKK 2,000 million

|

12

|

|

CNY

|

DKK 300 million

|

11*

|

|

JPY

|

DKK 190 million

|

12

|

|

GBP

|

DKK 70 million

|

12

|

|

CAD

|

DKK 75 million

|

11

|

* Chinese yuan traded offshore (CNH) used as proxy when

hedging Novo Nordisk’s CNY currency exposure

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 15 of 33

|

The financial impact from foreign exchange hedging is included in Financial

items (net).

LONG-TERM FINANCIAL TARGETS UPDATE

Novo Nordisk introduced four long-term financial targets in 1996 to

balance short- and long-term considerations thereby ensuring a focus on shareholder value creation. The targets were subsequently

revised and updated on several occasions most recently in connection with the annual results for 2015 released in February 2016.

At the most recent review, the Board of Directors approved three updated

long-term financial targets to guide Novo Nordisk’s performance. The targets were updated based on an assumption of a continuation

of the prevailing business environment. It was also noted, that significant changes to the business environment, including the

structure of the US healthcare system, regulatory requirements, pricing and market access environment, competitive environment,

healthcare reforms, exchange rates and changes to accounting standards could significantly impact the time horizon for achieving

the long-term targets or require them to be revised.

Since February 2016, the market environment in the USA within both diabetes

care and biopharmaceuticals has become significantly more challenging, negatively impacting future pricing for Novo Nordisk’s

products, especially for insulin and human growth hormone products. Consequently, Novo Nordisk no longer deems it achievable to

reach the operating profit growth target of 10%. As a result hereof, the target has been revised and Novo Nordisk is now aiming

for an average operating profit growth of 5%.

The target level for operating profit after tax to net operating assets is

unchanged at 125%. The target reflects the expectation of a continued operating profit growth combined with a stable effective

tax rate and gradual increase in net operating assets, partly related to an expanded fixed asset investment to sales ratio to accommodate

future sales growth primarily within diabetes care.

The target level for the cash to earnings ratio is maintained at 90%, as

expected continued growth in International Operations and expanding investment priorities will gradually impact net operating assets.

Given the inherent volatility in this ratio, the target will be pursued looking at the average over a three-year period.

The revised targets have been prepared based on the assumption of a continuation

of the current business environment. Significant changes to the business environment, including the structure of the US healthcare

system, regulatory requirements, pricing and market access environment, competitive environment, healthcare reforms, exchange rates

and changes to accounting standards may significantly impact the time horizon for achieving the long-term targets or require them

to be revised.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 16 of 33

|

|

LONG-TERM FINANCIAL TARGETS

|

Previous

target

Feb. 2016

|

Updated

target

|

|

Operating profit growth

|

10%

|

5%

|

|

Operating profit after tax to net operating assets

|

125%

|

125%

|

|

Cash to earnings

|

90%

|

90%

|

RESEARCH & DEVELOPMENT UPDATE

UPDATED RESEARCH AND DEVELOPMENT STRATEGY

In connection with the 2015 Capital Markets Day, Novo Nordisk presented

its R&D strategy and priorities, which focused on addressing unmet medical needs within the core therapeutic disease areas

of diabetes, haemophilia and growth hormone treatment as well as developing a pipeline of novel therapies within obesity. Furthermore,

Novo Nordisk presented its plans to expand into adjacent disease areas by leveraging existing technology platforms and pursuing

external research collaborations to support in-house innovation.

Novo Nordisk’s R&D strategy and priorities have now been updated

to reflect the increasingly challenging payer environment, particularly in the US market, by applying an even higher innovation

threshold for progressing R&D projects. Furthermore, Novo Nordisk will further intensify exploration of current assets in adjacent

disease areas of high unmet need as well as identify new assets using our existing technology platform. In addition to the already

established adjacent areas; NASH (Non-alcoholic steatohepatitis), diabetic kidney disease and cardiovascular disease are new areas

to be pursued, both in research and development.

As a result of the updated R&D strategy and priorities, Novo Nordisk will not

progress its current development projects within oral insulin and combinations involving oral insulin. In addition, a number

of changes to the portfolio of early-stage projects will also be implemented. Novo Nordisk furthermore intends to strengthen

its activities for in- licensing of early and mid-stage projects as well as external academic collaborations. Novo

Nordisk’s current late-stage development portfolio will not be affected by the changes.

DIABETES

Novo Nordisk submits application in the US for including data from the

two SWITCH trials in the Tresiba® (NN1250) label

In September 2016, Novo Nordisk announced the submission of a supplemental

application to the US Food and Drug Administration (FDA) for including data from the two SWITCH phase 3b trials in the label for

Tresiba

®

.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 17 of 33

|

In SWITCH 1, people with type 1 diabetes were randomised to cross-over

treatment with Tresiba

®

and insulin glargine U100, respectively, both in combination with

insulin aspart. During the study’s maintenance period, people treated with Tresiba

®

on average had 11% fewer episodes of overall symptomatic blood glucose confirmed hypoglycaemia, 36% fewer episodes of nocturnal

blood glucose confirmed symptomatic hypoglycaemia and 35% fewer episodes of severe hypoglycaemia. All of the above results were

statistically significant, and similar results were seen in the full treatment period.

In SWITCH 2, people with type 2 diabetes were randomised

to cross-over treatment with Tresiba

®

and insulin glargine U100, respectively, both in

combination with oral antidiabetic drugs. During the study’s maintenance period, people treated with Tresiba

®

on average had 30% fewer episodes of overall blood glucose confirmed symptomatic hypoglycaemia and 42% fewer episodes of nocturnal

blood glucose confirmed symptomatic hypoglycaemia, both favouring Tresiba

®

over insulin

glargine U100. Both observations were statistically significant and similar results were observed for the full treatment period.

For severe hypoglycaemia there was a 46%, but not statistically significant reduction of the episodes in the maintenance period,

and a statistically significant 51% reduction of the episodes in the full treatment period for Tresiba

®

compared to insulin glargine U100.

The requirements for objectively comparing hypoglycaemia episodes between

the two treatments were fulfilled given that the mean end of treatment HbA

1c

was similar between

treatments in both studies. In both studies, Tresiba

®

generally appeared to have a safe

and well-tolerated profile.

Novo Nordisk submits application to regulatory authorities to include

LEADER data in the Victoza® (NN2211) label

On 25 October 2016, Novo Nordisk announced the

submission of a supplemental New Drug Application (sNDA) to the US Food and Drug Administration (FDA) and a Type II Variation application

to the European Medicines Agency (EMA) for including data from the LEADER cardiovascular outcomes trial in the product information

of Victoza

®

(liraglutide).

LEADER was a multicentre, international, randomised,

double-blind, placebo-controlled trial investigating the long-term (3.5–5 years) effects of Victoza

®

(liraglutide up to 1.8 mg) compared to placebo, both in addition to standard of care, in people with type 2 diabetes at high risk

of major cardiovascular events. LEADER was initiated in September 2010 and randomised 9,340 people with type 2 diabetes from 32

countries. The primary endpoint was the first occurrence of a composite cardiovascular outcome comprising cardiovascular death,

non-fatal myocardial infarction (heart attack) or non-fatal stroke.

In the LEADER trial, Victoza

®

statistically significantly reduced the risk of cardiovascular death, non-fatal myocardial infarction (heart attack) and non-fatal

stroke by 13% versus placebo, when added to standard of care. The overall risk reduction was derived

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 18 of 33

|

from a statistically significant 22% reduction in

cardiovascular death with Victoza

®

treatment versus placebo and non-significant reductions

in non-fatal myocardial infarction and non-fatal stroke.

The safety profile of Victoza

®

in LEADER was generally consistent with previous liraglutide clinical trials.

FDA extends regulatory review period for IDegLira (NN9068) by three months

In September 2016, Novo Nordisk announced that the FDA had extended

the regulatory review period for IDegLira, the fixed-ratio combination of insulin degludec and liraglutide in adults with type

2 diabetes.

The FDA informed Novo Nordisk that a three-month extension was required in

order to complete its review of the new drug application (NDA) for IDegLira. Novo Nordisk submitted the NDA to the FDA in September

2015, and with the extension of the review the action date is now expected in December 2016.

Novo Nordisk receives Complete Response Letter in the US for faster-acting

insulin aspart (NN1218)

In October 2016, Novo Nordisk announced that it had received a Complete Response

Letter from the FDA regarding the NDA for faster-acting insulin aspart.

In the letter, the FDA requested additional information related to the assay

for the immunogenicity and clinical pharmacology data before the review of the NDA could be completed. Novo Nordisk is evaluating

the content of the Complete Response Letter and will work closely with the FDA to resolve the outstanding issues.

The NDA for faster-acting insulin aspart was submitted to the FDA in December

2015. Faster-acting insulin aspart is currently also under review in the EU, Switzerland, Canada, Brazil, South Africa and Argentina.

Oral semaglutide (NN9924) phase 3a trials initiations progress as planned

In February 2016, Novo Nordisk initiated the first phase 3a trial PIONEER

3 with oral semaglutide, an oral formulation of Novo Nordisk’s long-acting GLP-1 analogue semaglutide using the Emisphere

Eligen

®

SNAC enhancer technology, and the study is now fully recruited.

In addition, Novo Nordisk has initiated recruitment for five additional

trials under the PIONEER programme: PIONEER 1 (a monotherapy in approximately 700 people), PIONEER 2 (a trial comparing oral semaglutide

with the SGLT-2 inhibitor empagliflozin in approximately 800 people), PIONEER 4 (a trial comparing oral semaglutide with the GLP-1

analogue liraglutide in approximately 700 people), PIONEER 5 (a trial evaluating oral semaglutide in people with moderate renal

impairment) and PIONEER 7 (a flexible dose adjustment of oral semaglutide in approximately 500 people). At this time, recruitment

is proceeding according to plans, and the remaining phase 3a trials in the

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 19 of 33

|

oral semaglutide PIONEER programme are anticipated to be initiated

within the next 3-4 months.

Phase 3a trial DUAL II Japan initiated with IDegLira (NN9068)

In September 2016, Novo Nordisk initiated its second phase 3a trial

with IDegLira in Japan. In the 26-week DUAL II Japan trial approximately 210 adults with type 2 diabetes inadequately controlled

on basal insulin or pre-mix insulin and oral anti- diabetics will be randomised to either IDegLira or insulin degludec. The combined

DUAL Japan development programme comprising DUAL I Japan and DUAL II Japan is expected to enrol more than 1,000 people.

OI338GT (NN1953) discontinued in phase 2 development

In October 2016, Novo Nordisk decided to discontinue the further development

of the oral insulin project OI338GT, as the emergent product profile and required overall investments have been assessed not to

be commercially viable in the increasingly challenging payer environment.

52nd Annual Meeting of the European Association for

the Study of Diabetes (EASD) 12- 16 September 2016 in Munich, Germany

At the 52

nd

annual meeting of the EASD

held in Munich, Germany, results from Novo Nordisk’s research and development activities were presented. Among the key

presentations was an EASD-hosted symposium where detailed data from the SUSTAIN 6 study were presented. The study showed that

semaglutide, a GLP-1 analogue administrated once-weekly, when added to standard of care, statistically significantly reduced

the risk of the composite primary endpoint of cardiovascular death, non-fatal myocardial infarction and non-fatal stroke by

26% compared to placebo in a study with 3,297 adults with type 2 diabetes with elevated cardiovascular risk.

The presented results at EASD also comprised additional clinical data from

the DUAL V, a phase 3b trial where Xultophy

®

(IDegLira) was more than four times more

likely to reach fasting plasma glucose targets than insulin glargine U100. Furthermore, additional results from the LEADER phase

3b trial showed that the progression of kidney damage was statistically significantly lower with Victoza

®

treatment versus placebo, as measured by urinary albumin creatinine ratio, when both were added to standard of care in adults with

type 2 diabetes with elevated cardiovascular risk.

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 20 of 33

|

OBESITY

Glucagon-GLP-1 co-agonist 1177 (NN9277) phase 1 trial initiated

In October 2016, Novo Nordisk initiated the phase

1 trial with Glucagon-GLP-1 co- agonist 1177. The single-dose trial will investigate safety, tolerability and pharmacokinetics

of the drug in around 60 healthy adults.

SUSTAINABILITY UPDATE

Novo Nordisk announces plans to reduce workforce by approximately

1,000 employees

In September 2016, Novo Nordisk announced its intention to reduce its workforce by approximately 1,000

employees of the 43,102 employees (42,605 FTE positions) in the company’s global organisation. The decision was one of

several actions taken to reduce operating costs as the company faces a challenging competitive environment in 2017,

especially in its large US market. The reductions are expected to affect R&D units and headquarter staff functions as

well as positions in the global commercial organisation. Around 500 of the lay-offs are expected to be in Denmark.

Novo Nordisk expands access to low-priced insulin

Novo Nordisk has renewed its long-term commitment to provide access

to affordable insulin with an expanded scope. Human insulin will be offered at a guaranteed ceiling price (4 USD per vial in 2017)

to least developed and low-income countries as well as to selected humanitarian relief organisations. The new commitment replaces

the long- standing differential pricing policy offered to the world’s least developed countries (LDCs). The Access to Insulin

Commitment was announced in September by CEO Lars Rebien Sørensen at an event in connection with the UN General Assembly

where he was joined by the heads of the WHO and the International Red Cross.

EQUITY

Total equity was DKK 41,327 million at the end of the first nine months

of 2016, equivalent to 47.3% of total assets, compared with 50.6% at the end of the first nine months of 2015. Please refer to

appendix 5 for further elaboration of changes in equity.

2016 share repurchase programme

On 5 August 2016, Novo Nordisk announced a share repurchase

programme of up to DKK 3.4 billion to be executed from 5 August to 26 October 2016, as part of an overall 2016 programme of

up to DKK 14 billion to be executed during a 12-month period. The purpose of the programme is to reduce the company’s

share capital. Under the programme, Novo Nordisk has repurchased 11,389,334 B shares for an amount of DKK 3.4 billion in the

period from 5 August to 26 October. The programme was concluded on 26 October 2016.

As of 26 October 2016, Novo Nordisk A/S has repurchased a total of 31,175,337

B shares equal to a transaction value of DKK 10.5 billion under the up to DKK 14 billion

Financial

Performance

|

Outlook

|

R&D

|

Sustainability

|

Equity

|

Corporate

Governance

|

Legal

|

Financial

Information

|

|

|

Company announcement No 74 /

2016

|

|

Financial report for the period 1 January 2016 to 30 September 2016

|

Page 21 of 33

|

programme beginning 3 February 2016. The Board of Directors has based

on the solid outlook for the free cash flow generation in 2016 approved an expansion of the 2016 share repurchase programme of

up to DKK 14 billion with DKK 1.0 billion to DKK 15.0 billion.

As of 26 October 2016, Novo Nordisk A/S and its wholly-owned affiliates