Novo Nordisk Profit Jumps 29% But Earnings Growth Likely To Slow In 2016

October 29 2015 - 9:31AM

Dow Jones News

By Anna Molin

Denmark's Novo Nordisk A/S posted a 29% jump in third-quarter

net profit, but warned that fierce pricing competition and the high

launch costs of a diabetes treatment recently approved in the U.S.

would more than halve the pace of earnings growth next year.

Third-quarter net profit rose to 8.38 billion Danish kroner

($1.24 billion) on net sales of 26.8 billion kroner, up 20% on the

year.

Novo Nordisk, the world's largest insulin maker by volume,

forecast mid-to-high single-digit growth in operating profit for

2016. That compares with the company's own forecast of an increase

of roughly 20% in operating profit for this year.

The clouded outlook illustrates Novo Nordisk's challenge. While

demand for medicines to treat diabetes is soaring--the disease

affects nearly 400 million people world-wide, according to the

International Diabetes Federation--competition is intensifying in

its key U.S. and Chinese markets.

In the U.S., insurers and health-care providers are also putting

pressure on pharmaceutical companies to offer discounts even for

brand-new treatments, and presidential hopefuls, including

Democratic candidate Hillary Clinton, have pledged to stamp out the

"outrageous price gouging" of big pharmaceuticals.

French drug maker Sanofi earlier this year cut the price of its

blockbuster insulin Lantus and the competitive landscape is

hardening with a number of rivals launching new diabetes products

this year and next.

Chief Executive Lars Rebien Sorensen said Novo Nordisk was

counting on its new diabetes treatment, Tresiba, to take market

share from Lantus.

In early 2016, the Danish company will launch a heavy promotion

campaign with 2,000 sales representatives in the U.S. dedicated to

selling Tresiba at a premium price to its predecessor, Levemir.

"We are not going to rebate heavily to get fast access to the

U.S. market," the Danish CEO said.

Analysts questioned this strategy, saying insurers and

health-care providers were likely to demand more data on Tresiba's

benefits before agreeing to pay a higher price.

"This will be a tough fight," Alm. Brand analyst Michael Friis

Jorgensen said.

Write to Anna Molin at anna.molin@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 09:16 ET (13:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

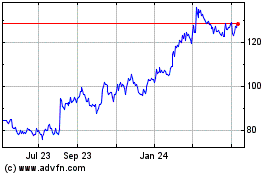

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

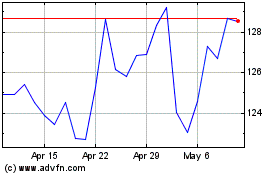

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024