Lawmakers Probe Tax Incentives Received by Solar-Energy Firms

September 15 2016 - 3:47PM

Dow Jones News

By Brody Mullins, Ianthe Jeanne Dugan and Richard Rubin

Congressional lawmakers have launched a formal investigation

into whether solar-energy companies improperly received billions of

dollars in tax incentives from the Obama administration.

The Senate Finance Committee and the House Ways and Means

Committee on Wednesday sent letters to seven foreign and domestic

companies in the solar industry, expanding a more limited probe

started earlier this year.

The recipients included three firms in the residential solar

industry, SolarCity Corp., Sunrun Inc. and Sungevity Inc., and four

solar utility companies -- SunEdison Inc., Abengoa SA, NextEra

Energy Inc. and NRG Energy Inc.

A spokesman for SolarCity said the "answers to the questions

posed are fairly straightforward, and we will provide them as

requested."

Officials at SunEdison, Abengoa and NRG Energy declined to

comment. NextEra, Sunrun and Sungevity didn't respond to requests

for comment.

Congressional investigators are examining the use of tax

incentives for solar-power companies, third-party financing and how

the companies determine the value of the credits.

The probe is being run by Sen. Orrin Hatch (R., Utah), the

chairman of the Senate Finance Committee, and Rep. Kevin Brady (R.,

Texas), the head of the Ways and Means panel.

Earlier this year, Mr. Hatch began looking into the roughly $25

billion in cash grants that solar and other "green energy" firms

have received during the Obama administration. He concluded that

the Treasury Department and the Internal Revenue Service -- which

are also examining the valuations -- don't have adequate controls

over the program.

At issue is a Treasury Department policy that gives solar firms

a 30% investment tax credit on the cost of acquiring a system. The

tax credit provides a dollar-for-dollar reduction in income taxes

otherwise owed by a taxpayer; the companies could also opt to get a

grant instead of a credit.

But the 30% calculation isn't always straightforward because of

the economics of the industry. Solar-energy developers don't

necessarily have the income to use the credits or the funds to buy

and install solar energy systems. So they routinely enlist big

investors and transfer the tax benefits. Some also lease systems to

homeowners and businesses.

So there is debate over the fair market value of the solar

energy systems -- the price paid by a buyer, whether it is a

homeowner or an institutional investor. Those calculations are made

by independent appraisers, solar firms say, following IRS

guidelines.

Staff at the Senate Finance Committee said the Treasury

Department and the IRS don't have a long-term method for

identifying companies that received the cash grants in the past to

ensure they don't apply for other tax incentives in the future for

the same investments.

The Treasury Department's inspector general had recommended the

creation of such a tracking system. Congressional investigators

found that the IRS had taken some steps toward doing so, but hasn't

put in place a system to track the grant recipients in the long

term.

Some investment tax credits can be carried on a company's books

for decades, so there is a worry that the IRS wouldn't catch

companies that were double dipping in the federal tax

incentives.

A Treasury Department spokeswoman declined to comment, citing

pending litigation.

The Treasury Department in 2012 began asking solar firms for

more information on their calculations about the fair market value

of solar energy systems that have been built, according to public

filings by solar firms. And the IRS has said it was weighing

whether the valuations have been inflated. The inquiries are

ongoing.

"If the Internal Revenue Service or the U.S. Treasury Department

were to object to amounts we have claimed as too high of a fair

market value on such systems, it could have a material adverse

effect on our business, financial condition and prospects," Solar

City wrote in a recent federal financial filing.

The firm has said that its valuations are correct, and even

below Treasury Department guidance about where they should be. But

it has said that its results could be affected if its position is

disputed by a federal audit, the outcome of the Treasury

investigation, or changes in guidelines. This could force them to

reimburse some institutions that buy their tax credits as

investments.

Solar City received about $501.1 million in credits through Dec.

31, 2014, so even a 5% adjustment downward "would obligate us to

repay approximately $25.1 million to our fund investors," the

company wrote.

The green energy tax program was launched in 2009 as part of

President Barack Obama's plan to stimulate the U.S. economy and

promote investments in renewable energy in the aftermath of the

financial crisis.

Write to Brody Mullins at brody.mullins@wsj.com, Ianthe Jeanne

Dugan at ianthe.dugan@wsj.com and Richard Rubin at

richard.rubin@wsj.com

(END) Dow Jones Newswires

September 15, 2016 15:32 ET (19:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

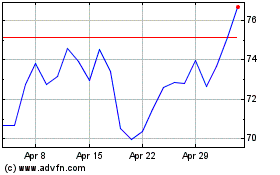

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

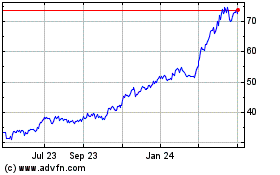

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024