NRG Energy, Inc. Announces the Repurchase of 100% of its Outstanding Convertible Perpetual Preferred Stock

June 13 2016 - 7:00AM

Business Wire

NRG Energy, Inc. (NYSE:NRG) announced today that it has

completed the repurchase from Credit Suisse First Boston of 100% of

the outstanding shares of its $344.5 million 2.822% preferred stock

at a price of $225.9 million by using cash on hand. The preferred

stock was originally issued in August of 2005, at 3.625% preferred

coupon.

Mauricio Gutierrez, President and Chief Executive Officer

commented, “This successful repurchase at a significant discount

will generate approximately $10 million in annual dividend savings

and shows continued advancement of reducing costs and executing on

our liability management strategy.”

About NRG

NRG is the leading integrated power company in the U.S., built

on the strength of the nation’s largest and most diverse

competitive electric generation portfolio and leading retail

electricity platform. A Fortune 200 company, NRG creates value

through best in class operations, reliable and efficient electric

generation, and a retail platform serving residential and

commercial businesses. Working with electricity customers, large

and small, we continually innovate, embrace and implement

sustainable solutions for producing and managing energy. We aim to

be pioneers in developing smarter energy choices and delivering

exceptional service as our retail electricity providers serve

almost 3 million residential and commercial customers throughout

the country.

Forward-Looking Statements

This communication contains forward-looking statements that may

state NRG’s or its management’s intentions, beliefs, expectations

or predictions for the future. Such forward-looking statements are

subject to certain risks, uncertainties and assumptions, and

typically can be identified by the use of words such as “will,”

“expect,” “estimate,” “anticipate,” “forecast,” “plan,” “believe”

and similar terms. Although NRG believes that its expectations are

reasonable, it can give no assurance that these expectations will

prove to have been correct, and actual results may vary materially.

Factors that could cause actual results to differ materially from

those contemplated above include, among others, risks and

uncertainties related to the capital markets generally.

The foregoing review of factors that could cause NRG’s actual

results to differ materially from those contemplated in the

forward-looking statements included herein should be considered in

connection with information regarding risks and uncertainties that

may affect NRG’s future results included in NRG’s filings with the

SEC at www.sec.gov.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160613005590/en/

NRG Energy, Inc.Media:Karen Cleeve, 609-524-4608orMarijke

Shugrue, 609-524-5262orInvestors:Kevin Cole, 609-524-4526orLindsey

Puchyr, 609-524-4527

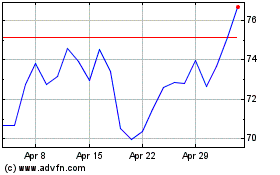

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

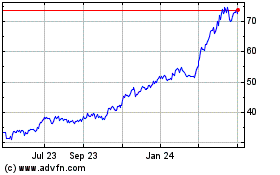

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024