NRG Energy, Inc. (NYSE:NRG) announced today that it has amended

the terms of its previously announced tender offers to purchase

certain of its outstanding senior notes (the “Tender Offers”) to

increase: (i) the tender offer cap for the 2018 Notes from $300

million (the “Initial 2018 Notes Cap”) to $400 million (the

“Increased 2018 Notes Cap”); and (ii) the overall cap for the

Tender Offers from $1.0 billion (the “Initial Maximum Tender Cap”)

to $1.1 billion (the “Increased Maximum Tender Cap”). NRG is also

amending the proration methodology for acceptance of tendered 2018

Notes, as described in greater detail below. All other terms of the

Tender Offers remain unchanged.

The table below sets forth the results of the Tender Offers,

according to information provided by the tender agent, as of the

Early Tender Deadline:

Title of

Notes

Aggregate Principal Amount Outstanding (in

millions)

Amount

of Notes

Tendered (in

millions)

Tender

Offer

Cap (in

millions)

Tender

Offer Consideration(1)

Early

Participation Amount(1)

Total

Consideration(1)

Fixed-Price

Tender Offers

7.625% Senior Notes due 2018 $954 $548

$400 (as amended)

$1,060.00 $30.00 $1,090.00 8.250% Senior Notes due 2020 $1,058 $521

$250 $1,013.75 $30.00 $1,043.75 7.875% Senior Notes due 2021 $1,128

$620 $250 $1,011.88 $30.00 $1,041.88

Dutch Auction

Tender Offer

6.250% Senior Notes due 2022 $1,060 $214 $200 $962.50 $30.00

$992.50 6.625% Senior Notes due 2023 $898 $144 $965.00 $30.00

$995.00 6.250% Senior Notes due 2024 $838 $224 $957.50 $30.00

$987.50

__________

(1) Per $1,000 principal amount of Notes validly tendered and

accepted for purchase. The total consideration includes the Early

Participation Amount.

The Tender Offers are oversubscribed in each series of notes

being conducted as a fixed-price tender offer and for the three

series of notes being conducted as a pooled “Dutch Auction” tender

offer. As a result, NRG will not accept for purchase any additional

notes tendered in the Tender Offers after the “Early Tender

Deadline” of 5:00 p.m., New York City time, on May 20, 2016, with

the exception of 2018 Notes tendered after the Early Tender

Deadline (subject to proration as set forth below). Holders of 2018

Notes will be permitted to submit such notes at any time after the

Early Tender Deadline and on or before June 6, 2016 (the

“Expiration Date”); however, such 2018 Notes tendered after the

Early Tender Deadline will not receive the early participation

amount of $30.00 per $1,000 principal amount of the Notes (the

“Early Participation Amount”).

Assuming the successful consummation of NRG’s previously

announced offering of $1.0 billion in aggregate principal amount of

7.25% senior notes due 2026, NRG expects to make payment on May 25,

2016 (the “Early Payment Date”) for the notes it has accepted for

purchase as of the Early Tender Deadline, subject to proration and

the applicable tender caps as described in the Offer to Purchase,

dated May 9, 2016 (the “Offer to Purchase”). Holders of notes that

were validly tendered prior to the Early Tender Deadline and

accepted for purchase will receive the Total Consideration, which

includes the Early Participation Amount, plus accrued and unpaid

interest up to, but not including, the Early Payment Date.

The settlement date for 2018 Notes validly tendered after the

Early Tender Deadline and on or before the Expiration Date and

which are accepted for purchase will occur promptly following the

Expiration Date.

The withdrawal deadline was 5:00 p.m., New York City time on May

20, 2016. As a result, validly tendered notes may no longer be

withdrawn or revoked.

All Notes (other than the 2018 Notes) validly tendered and not

validly withdrawn prior to the Early Tender Deadline will be

subject to proration as described in the Offer to Purchase. With

respect to the 2018 Notes, the aggregate principal amount of such

notes tendered as of the Early Tender Deadline, which is

approximately $548 million, will be eligible for acceptance subject

to initial proration based on the Initial 2018 Notes Cap. The

excess amount of 2018 Notes tendered as of the Early Tender

Deadline remaining after initial proration, or approximately $248

million, plus the aggregate amount of any 2018 Notes tendered after

the Early Tender Deadline, will be further subject to proration

based on the difference between the Initial 2018 Notes Cap and the

Increased 2018 Notes Cap, or $100 million.

Requests for documents relating to the Tender Offers may be

directed to D.F. King & Co., Inc., the Information Agent, at

(866) 620-2538 (Toll-Free) or (212) 232-3325. BofA Merrill Lynch

and Deutsche Bank Securities Inc. are acting as Dealer Managers for

the Tender Offers. Questions regarding the Tender Offers may be

directed to BofA Merrill Lynch at (888) 292-0070 (U.S. Toll-Free)

or (980) 388-3646 (Collect) or Deutsche Bank Securities Inc. at

(855) 287-1922 (U.S. Toll-Free) or (212) 250-7527 (Collect).

The complete terms and conditions of the Tender Offers are

described in the Offer to Purchase, copies of which may be obtained

at no charge from D.F. King & Co., Inc. The Company reserves

the right to amend the terms of the Tender Offers or to extend the

Expiration Date for the Tender Offers, in its sole discretion, at

any time.

None of the Company, its board of directors, the Dealer

Managers, the Information Agent, or the trustee with respect to the

Notes is making any recommendation as to whether holders of the

Notes should tender any Notes in response to any of the Tender

Offers. Holders must make their own decision as to whether to

tender any of their Notes and, if so, the principal amount of Notes

to tender.

This press release is for informational purposes only and is

not an offer to buy, nor the solicitation of an offer to sell any

of the Notes. The Tender Offers are being made solely by the

Company's Offer to Purchase. The full details of the Tender

Offers, including complete instructions on how to tender Notes, are

included in the Offer to Purchase. Holders of the Notes are

strongly encouraged to carefully read the Offer to Purchase because

it contains important information.

About NRG

NRG is the leading integrated power company in the U.S., built

on the strength of the nation’s largest and most diverse

competitive electric generation portfolio and leading retail

electricity platform. A Fortune 200 company, NRG creates value

through best in class operations, reliable and efficient electric

generation, and a retail platform serving residential and

commercial businesses. Working with electricity customers, large

and small, we continually innovate, embrace and implement

sustainable solutions for producing and managing energy. We aim to

be pioneers in developing smarter energy choices and delivering

exceptional service as our retail electricity providers serve

almost 3 million residential and commercial customers throughout

the country.

Forward-Looking Statements

This communication contains forward-looking statements that may

state NRG’s or its management’s intentions, beliefs, expectations

or predictions for the future. Such forward-looking statements are

subject to certain risks, uncertainties and assumptions, and

typically can be identified by the use of words such as “will,”

“expect,” “estimate,” “anticipate,” “forecast,” “plan,” “believe”

and similar terms. Although NRG believes that its expectations are

reasonable, it can give no assurance that these expectations will

prove to have been correct, and actual results may vary materially.

Factors that could cause actual results to differ materially from

those contemplated above include, among others, risks and

uncertainties related to the capital markets generally.

The foregoing review of factors that could cause NRG’s actual

results to differ materially from those contemplated in the

forward-looking statements included herein should be considered in

connection with information regarding risks and uncertainties that

may affect NRG’s future results included in NRG’s filings with the

SEC at www.sec.gov.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160523005653/en/

NRG Energy, Inc.Media:Karen Cleeve, 609-524-4608Marijke Shugrue,

609-524-5262orInvestors:Kevin Cole, 609-524-4526Lindsey Puchyr,

609-524-4527

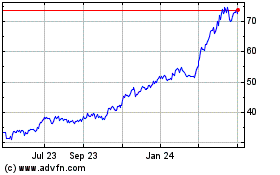

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

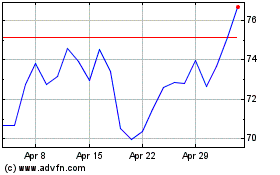

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024