Thomas A. Fanning and David Crane on their different strategies

for cleaner energy

Utilities have gone through huge dislocations and disruptions in

recent years, and big financial bets are being made as they

position themselves for energy markets of the future. Wall Street

Journal Global Energy Editor Elena Cherney talked to two key

players with divergent approaches: Thomas A. Fanning, chief

executive of Southern Co., and David Crane, who until December was

CEO of NRG Energy Inc. Edited excerpts of their conversation

follow.

MS. CHERNEY: You both took very different approaches to

transitioning to cleaner energy. David, you told me you were fired

by your board at NRG for being too radical. You also said that you

wished you had been more radical. What did you mean?

MR. CRANE: There are roughly 55 power companies in the U.S. that

produce most of the generation. In 2006, when I became very

sensitized to the carbon issue, I looked at the carbon intensities

of the 55 companies. We were 54th, or second-most carbon intense,

and the one that was ahead of us, Mirant, we ended up buying.

I went to the board and said, "Look, it's unlikely that the

world's going to allow us to [continue to] do this."

So we started on renewables. We tried to build a nuclear plant,

because I'm a big believer in nuclear as a zero-carbon source. But

I found that you had to talk about that to motivate an employee

base that wants to basically do what it has always done. So one of

the reasons I was so outspoken was to motivate the employee base,

and ultimately that made me a bit of a controversial figure.

MS. CHERNEY: Tom, you took a different approach. You described

it as a more natural evolution.

MR. FANNING: I take my management group through this exercise

from time to time where we really try to think about how much

change is out there. It is up to us, as leaders, to kind of see

around the corners.

We've moved in our energy production: Coal, before I got there,

70%; coal this year will be 28%. Gas back then was 15%, 16%; now it

is going to be about 50%. We've developed our own technology that

produces less carbon than natural gas. Renewables, we're moving

forward in a big way on solar, particularly, and some wind. Energy

efficiency, we just announced a really important acquisition,

PowerSecure International [a provider of distributed generation,

giving power customers more control over the energy they use].

The whole notion is to understand really how this model will

evolve and try to skate to where that puck will be. If you do it in

kind of a transparent, orderly way, you don't have this notion of

disruption. You have a notion of natural evolution.

MS. CHERNEY: Also, you're building a nuclear facility. Not a lot

of people are doing those things. Where do you see that mix

going?

MR. FANNING: All of the above. Nuclear, we are leading the

renaissance in new nuclear. If the country is serious about carbon,

we need nuclear in the mix. It's really hard to do nuclear. Our

deal, if you include all capital costs and all financing costs: $15

billion over 10 years. Coal, we all know that coal is under

pressure. We developed this technology where we can actually

consume coal, gasify it, capture 65% of the carbon and move on.

We've taken our lumps on that deal. That deal, probably, because

gas is so cheap right now, isn't going to happen elsewhere in the

U.S. But I'm darn sure that there's a great market for it around

the world.

MS. CHERNEY: David, can carbon capture be made to work

commercially in the U.S.?

MR. CRANE: First, Tom and Southern Co. should be commended for

what they've done with nuclear and with pre-combustion carbon

capture. But they've essentially demonstrated that those two

technologies are not cost effective. We cannot afford for

post-combustion carbon capture not to be cost effective. If we're

going to win the fight against climate change, it must succeed in

that regard when you include India and China plants. I don't think

post-combustion carbon capture, as it's done, with a technology

that's borrowed from the chemical industry, is going to get it

done.

We need a disruptive change. Overall, I would tell you that I

believe this country, the world, will win the fight against climate

change by taking the carbon out of fossil fuels before it wins the

war against climate change by making the world an all-renewable

plus battery-storage place.

MR. FANNING: Nuclear absolutely needs to be part of the

portfolio, and in the portfolio it's cost effective. Let me explain

that. The energy from our nuclear plant that we're building in

Georgia is going to be the equivalent price of about $1 per million

BTU. Now, gas is really cheap right now. The query is how long will

gas remain at that price.

Think about stock ownership as you build your own personal

portfolios. You buy some stocks that are really secure. Then you

want to have some stuff that's kind of risky and more volatile.

Maybe it's got a long-term return potential.

When you think about constructing an energy portfolio that has

got to achieve the balance of clean, safe, reliable, affordable, it

is absolutely clear. Now, there's a temporal feature here. It will

change over time. But it is a dominant solution to build nuclear --

relatively high capital cost, very cheap energy, zero volatility,

essentially.

It looks like coal is winding down. Renewables become much more

important. I've always been a fan of solar. The bridge in the

middle is gas. Every one of those has a different risk/return

profile, a different capital and energy mix, and as a portfolio,

they work.

MS. CHERNEY: David, do you agree?

MR. CRANE: In the sense that he has to get his cost basis passed

through the public service commissions of various states, arguments

like he just made about diversification of portfolio work. In the

competitive [market for energy] diversification of portfolio

doesn't necessarily work. Energy has usually been a winner-take-all

business. And right now in the U.S., the winner-take-all is natural

gas.

One of the things we should be talking about is the role the

utilities are playing in snuffing out distributed generation. The

premise [put forth by Tom] is that a central grid system is only as

strong as its weakest link. We're talking about an economy we built

in the U.S. built off 130 million wooden poles. It's shocking that

we could be this obsolete.

But every utility in the country except one, Green Mountain

Power in Vermont, is fighting the market penetration of people

making their own electricity. That's why, if you have an industry

that's based, "Oh, we're gonna give this company a monopoly and

hope that they do the right thing by the customer," that's not

going to be the best approach.

MR. FANNING: Tom and I are great friends, we really are. He's

dead wrong. Southern Co., actually our largest subsidiary, Georgia

Power, was named by the solar industry as the investor-owned

utility of the year by the solar industry. You want to buy rooftop

solar? I am glad to sell it to you.

Write to reports@wsj.com

(END) Dow Jones Newswires

April 13, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

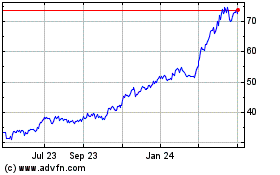

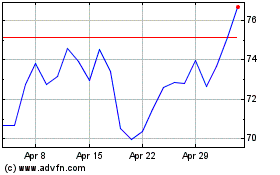

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024