By Cassandra Sweet

A federally backed, $2.2 billion solar project in the California

desert isn't producing the electricity it is contractually required

to deliver to PG&E Corp., which says the solar plant may be

forced to shut down if it doesn't receive a break Thursday from

state regulators.

The Ivanpah Solar Electric Generating System, owned by

BrightSource Energy Inc., NRG Energy Inc. and Alphabet Inc.'s

Google, uses more than 170,000 mirrors mounted to the ground to

reflect sunlight to 450-foot-high towers topped by boilers that

heat up to create steam, which in turn is used to generate

electricity.

But the unconventional solar-thermal project, financed with $1.5

billion in federal loans, has riled environmentalists by killing

thousands of birds, many of which are burned to death--and has so

far failed to produce the expected power.

PG&E is asking the California Public Utilities Commission

for permission to overlook the shortfall and give Ivanpah another

year to sort out its problems, warning that allowing its power

contracts to default could force the facility to shut down. The

commission's staff is recommending that it grant the extension

Thursday.

"Continuing the delivery of [renewable] energy from these

innovative energy facilities is in the interest of all parties and

furthers important state and federal policy goals," a PG&E

spokeswoman said.

Spokesmen for BrightSource, which developed the technology, and

NRG, which operates the plant, declined to comment on its future.

NRG has said it has taken more than a year to adjust equipment and

learn how to best run it.

The Energy Department said last week it supports giving the

plant, which started operating in early 2014, more time.

However, the extension request is opposed by some consumer

groups, who are complaining that the cost of the electricity from

the struggling plant is exorbitant.

Power from the two Ivanpah units that serve PG&E last year

fetched about $200 a megawatt-hour on average during summer months,

and about $135 a megawatt-hour on average the rest of the year,

according to sales data from the Federal Energy Regulatory

Commission.

That compares to an average price of $57 a megawatt-hour for

solar power sold under contracts signed in 2015, according to

Bloomberg New Energy Finance. Power from natural-gas plants went

for $35 a megawatt-hour on average in California's wholesale market

last year, according to a Wall Street Journal analysis of data

compiled by the Energy Department.

PG&E negotiated the contracts in 2009, when solar power

prices were much higher.

"We think PG&E could negotiate a better price," said Karin

Hieta of California's Office of Ratepayer Advocates, which believes

PG&E should cancel the contract or rework the deal.

The portion of the Ivanpah plant that supplies PG&E in 2014

generated 45% of the electricity the state commission expected

under the power contracts, and 68% in 2015, according to a Wall

Street Journal analysis of federal data and state documents.

The plant wasn't required to meet the full amount, under the

confidential terms of the contracts, said Joe Desmond, a senior

vice president at Oakland, Calif.-based BrightSource.

PG&E signed the Ivanpah contracts as part of efforts to

comply with a state law that requires utilities to provide 33% of

their power from solar, wind or other renewable sources by 2020.

State lawmakers last year boosted the mandate to 50% renewables by

2030. A spokesman said PG&E has more renewable energy than it

needs to meet its current requirement, and it is still on track to

meet both mandates.

Helping Hand Tools, an environmental group that fights

construction of new power plants, is also asking the state

commission to reject PG&E's request to give the Ivanpah plant

more time. Unlike traditional solar projects, Ivanpah uses natural

gas to heat boilers to make steam used to warm up its power

turbines, which emits some pollution.

"It's not a renewable energy plant, it's part gas, part solar,"

said Robert Sarvey, a spokesman for the group.

More than 2,000 wild birds died at the Ivanpah plant between

March and August of 2015, according to estimates that biologists

hired by the plant owners filed this week and in December with the

state Energy Commission.

Roughly half of the dead birds the biologists found had feathers

that were singed or burned, most likely from flying through an area

of intense heat between the mirrors and the power towers, according

to the reports.

To be sure, birds also fall prey to other renewable-energy

projects: Wind turbines kill between 140,000 and 328,000 birds in

the U.S. every year, according to a 2013 study by researchers at

the Smithsonian Conservation Biology Institute.

(END) Dow Jones Newswires

March 16, 2016 19:42 ET (23:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

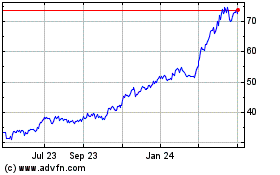

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

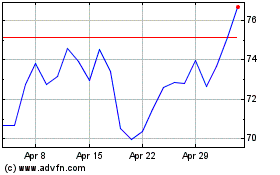

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024