Whole Foods Reaches Installation Deals With SolarCity, NRG Energy

March 08 2016 - 11:02AM

Dow Jones News

By Tess Stynes

Whole Foods Market Inc. reached separate agreements with

SolarCity Corp. and NRG Energy Inc. to install rooftop solar-power

systems on many of the organic- and natural-foods supermarket

chain's stores, giving SolarCity's stock a boost.

SolarCity agreed to install solar-power systems on the rooftops

of nearly a quarter of Whole Foods Market Inc.'s locations across

the U.S. Under the SolarCity agreement, Whole Foods plans to

retrofit 100 of its 434 U.S. stores with rooftop solar systems.

SolarCity will design each location's solar-power systems and plans

to begin installation this spring.

Whole Foods will receive a discount on solar power purchased

from SolarCity, locking in rates for an undisclosed number of

years. Financial terms weren't provided.

Separately, NRG Energy plans to install rooftop solar systems at

as many as 84 Whole Foods stores and distribution centers across

nine states. Financial terms weren't provided.

SolarCity's shares, down 53% this year, rose 9.6% to $26.49 in

recent trading. However, NRG Energy fell 4.7% to $13.

Last month, SolarCity posted stronger-than-expected results for

the fourth quarter, but acknowledged that it was continuing to fall

short of its installation goals.

SolarCity, whose chairman is billionaire entrepreneur Elon Musk,

said it has seen strong residential installations, but it continues

to underperform in commercial installations as big projects often

miss construction deadlines.

The company had forecast that its first-quarter installations

will increase 18% year-to-year but decline 34% from the fourth

quarter. The company cited its decision to shut down its Nevada

business after the state's public utilities commission recently

said that solar-panel users would get paid for their energy at

lower rates.

Princeton, N.J.-based NRG Energy, which last year had unveiled

plans to split off its renewable energy business under then-chief

executive David Crane, recently said that it was reintegrating its

renewable energy business that focuses on commercial and industrial

customers back into NRG. Decisions are expected in the second

quarter on other parts of the renewables business, including its

residential rooftop solar business.

Mr. Crane, who stepped down in December, was the architect of

the company's strategy to expand NRG's fleet of gas- and

coal-burning power plants and build a presence in solar and wind

power. But a billion-dollar investment in renewable energy failed

to generate the profits that Mr. Crane had anticipated and became a

drag on earnings and the company's stock. In September, Mr. Crane

announced a new strategy to split off NRG's renewable-energy

enterprises and find investors willing to sustain them until they

become profitable.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

March 08, 2016 10:47 ET (15:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

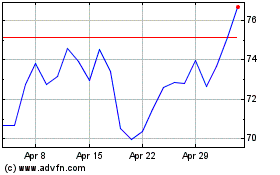

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

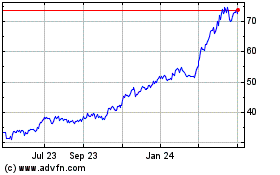

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024