First Quarter 2015 Financial Highlights

- $840 million of Adjusted EBITDA1

- $364 million of Free Cash Flow (FCF)

before Growth investments

2015 Financial Guidance and Capital Allocation Update

- 2015 Guidance reaffirmed:

- Adjusted EBITDA of $3,200-$3,400

million2

- FCF before growth investments of

$1,100-$1,300 million

- Completed $112 million of share

repurchases, including $56 million of the authorized share

repurchases announced on March 16, 2015 (Phase II)

- Announcing $81 million increase to

Phase II program, bringing the total available share repurchase

authorization to $125 million

- Established capital allocation program

that will apportion cash in an amount equal to the approximately

$600 million of expected drop down proceeds from NRG Yield over the

balance of the year equally among share repurchases, corporate debt

reduction and future yield eligible projects

Business and Operational Highlights

- On April 9, 2015, NRG and NRG Yield

established a new residential solar partnership, enabling NRG to

bring the cost of capital benefit of NRG Yield to the NRG Home

Solar lease program

- On May 5, 2015, NRG Yield shareholders

approved creation of new share class, enabling ongoing capital

replenishment at NRG and providing NRG Yield access to growth

capital without the need for investment by NRG.

- On May 8, 2015, NRG and NRG Yield plan

to form a new partnership that will invest in and hold operating

portfolios of distributed generation assets owned or developed by

NRG

NRG Energy, Inc. (NYSE:NRG) today reported a record first

quarter Adjusted EBITDA of $840 million in its first quarter 2015

financial results, with $552 million from NRG Business and NRG

Renew combined3, $166 million from NRG Home, and $122 million from

NRG Yield. First quarter adjusted cash flow from operations totaled

$525 million. Net loss for first quarter 2015 was $120 million, or

$0.37 per diluted common share compared to net loss of $56 million,

or $0.18 per diluted common share for first quarter 2014.

“Outstanding execution across all businesses enabled NRG to

achieve record first quarter results, outpacing even the results of

last year’s polar vortex-assisted first quarter, with our

competitive retail business showing particular strength,” said

David Crane, NRG’s Chief Executive Officer. “With a strongly

hedged baseload position and the continuing implementation of our

fleet repowering program, we are well-positioned for the balance of

2015 and beyond.”

1 Excludes negative contribution of $40 million from NRG Home

Solar2 Excludes projected negative contribution of $100 million

from NRG Home Solar3 Includes Corporate Segment

Segment Results

Table 1: Adjusted EBITDA

($ in millions) Three Months Ended Segment

3/31/15 3/31/14 Business (1)(2) $535 $595 Home Retail

166 115 Renew (1) 32 12 NRG Yield (1) 122 92 Corporate

(15) 3 Adjusted EBITDA(3) $840 $817

(1) In accordance with GAAP, 2014 results have been restated to

include full impact of the assets in the NYLD drop down

transactions which closed on January 2, 2015 and June 30, 2014.(2)

See Appendices A-4 and A-5 for NRG Business regional Reg G

reconciliations.(3) See Appendices A-1 and A-2 for Operating

Segment Reg G reconciliations; excludes negative contribution of

$40 million and $1 million from Home Solar for first quarter 2015

and 2014, respectively.

Table 2: Net Income/(Loss)

($ in millions) Three Months Ended Segment

3/31/15 3/31/14 Business (1)(2) $29 $(6) Home

Retail(2) 104 185 Home Solar (45) (2) Renew (1)(2) (50) (48) NRG

Yield (1)(2) (11) 22 Corporate (147) (207) Net Loss

$(120) $(56)

(1) In accordance with GAAP, 2014 results have been restated to

include full impact of the assets in the NYLD drop down

transactions which closed on January 2, 2015 and June 30, 2014.(2)

Includes mark-to-market gains and losses of economic hedges.

NRG Business: First Quarter Adjusted EBITDA was $535

million; $60 million lower than in first quarter 2014. Drivers of

the $60 million decrease were as follows:

- East Region: ($158 million) due to

lower generation and lower average realized energy and capacity

prices, but partially offset by a $62 million contribution from the

EME coal assets acquired on April 1, 2014.

- West Region: ($27 million) due to a

change in contracted volumes and decreased pricing for certain

capacity contracts.

- Offset by Gulf Coast Region: $51

million increase due to higher realized energy margins.

NRG Home Retail: First quarter Adjusted EBITDA was $166

million, $51 million higher than first quarter 2014 driven

primarily by higher sales volume stemming from increased load from

weather, favorable supply costs, effective margin management and

higher customer counts. This includes the impact of year-over-year

customer count increases and product growth partially offset by

increased operating costs to support additional customers.

NRG Renew: First quarter Adjusted EBITDA was $32 million,

$20 million higher than in first quarter 2014 primarily due to

contributions from the wind assets acquired from the EME

acquisition and ramp up of Ivanpah.

NRG Yield: First quarter Adjusted EBITDA was $122

million, $30 million higher than in first quarter 2014 primarily

due to the Alta Wind acquisition and the drop down assets acquired

by NRG Yield in first quarter 2015.

Liquidity and Capital Resources

Table 3: Corporate Liquidity

($ in millions)

3/31/15 12/31/14 Cash at NRG-Level $786 $661

Revolver 1,424 1,367

NRG-Level

Liquidity $2,210 $2,028 Restricted cash 443 457

Cash at Non-Guarantor Subsidiaries 1,378 1,455

Total Liquidity $4,031 $3,940

NRG-Level cash as of March 31, 2015, was $786 million, an

increase of $125 million over the end of 2014, and $1,424 million

was available under the Company’s credit facilities at the end of

the current quarter. Total liquidity was $4,031 million including

restricted cash and cash at non-guarantor subsidiaries (primarily

GenOn and NRG Yield)4.

Residential Solar Partnership with NRG Yield

On April 9, 2015, NRG and NRG Yield formed a new partnership

that will invest in and hold operating portfolios of residential

solar assets developed by NRG Home Solar. The partnership is

structured to enable NRG Yield to realize increased cash dividends

from this new and growing asset class while providing NRG continued

access to the customer and the residual value following the

contract period. The partnership will invest in portfolios of

leases once they have reached operating status and

will initially include an existing, unlevered portfolio of

over 2,200 leases representing approximately 17MW, and an

in-development, tax equity financed portfolio of approximately

13,000 leases representing approximately 90MW, with an average

lease term for the existing and new leases of approximately 17 to

20 years.

Under the terms of the partnership agreement, NRG Yield will

receive 95% of the economics until achieving a targeted return,

expected to be achieved commensurate with the end of the lease

period, after which NRG will receive 95% of the economics. NRG

Yield has initially invested $26 million into the partnership which

covers the 2,200 existing, unlevered leases with the proceeds

already distributed to NRG.

NRG Yield has initially committed to invest up to $150 million

of additional cash equity into the partnership over time which is

expected to be fully invested in 2015 of which an additional $7

million has been invested to date. NRG intends to offer additional

opportunities in residential solar to NRG Yield over time through

this partnership.

4 See Appendix A-6 for First Quarter 2015 Sources and Uses of

Liquidity detail.

Distributed Generation Partnership

On May 8, 2015, NRG and NRG Yield plan to form a new partnership

that will invest in and hold operating portfolios of distributed

solar assets developed by NRG Renew, a subsidiary of NRG. The

partnership will be structured similarly to the above Residential

Solar Partnership allowing NRG to periodically monetize its

distributed solar investments and NRG Yield to invest in a growing

segment of the solar market.

Under the terms of the partnership agreement, NRG Yield will

receive 95% of the economics until achieving a targeted return,

expected to be achieved commensurate with the end of the customer

contract period, after which NRG will receive 95% of the

economics

NRG Yield has initially committed to invest up to $100 million

of cash equity into the partnership over time. None of which has

been utilized to date but the partnership is expected to be fully

invested over the next 18 months.

NRG Yield Recapitalization

On May 5, 2015, NRG Yield shareholders approved the creation of

two new classes of NRG Yield common stock. The equity

recapitalization is expected to provide NRG Yield the flexibility

to raise capital for future acquisitions while also maintaining the

strong strategic sponsorship of its parent, NRG Energy, Inc.

The recapitalization will be effectuated through a stock split

of each share class. Each share of the Class A stock will be split

into one Class A and one Class C share, and each share of Class B

stock held by NRG will be split into one Class B and one Class D

share. The Class C stock will have equal economic rights with Class

A stock and a 1/100th voting right. The Class D stock will not have

any economic rights (as NRG’s economic interest is held exclusively

through its ownership of NRG Yield LLC) and will have a 1/100th

voting right.

In connection with the recapitalization described above, the

Company amended the Right of First Offer Agreement between NRG and

NRG Yield to include approximately 800MW of new, long-term contract

natural gas assets in California5, approximately 900MW of wind

assets and up to $250 million of equity investments in residential

solar and distributed generation portfolios.

Outlook for 2015

Driven by robust first quarter results and a significantly

hedged baseload portfolio over the remainder of 2015, the Company

is reaffirming its guidance range for fiscal year 2015. As in

previous quarters, the Company’s guidance assumes normalized

weather in core markets.

Table 4: 2015 Adjusted EBITDA and FCF before Growth

Investments Guidance

5/8/15 2/27/15 ($ in millions) 2015

2015 Adjusted EBITDA (1) $3,200 –3,400 $3,200 – 3,400

Interest payments (1,160) (1,160) Income tax (40) (40) Adjusted

EBITDA from NRG Home Solar (100) (100) Working capital/other

changes 250 250 Adjusted Cash flow from operations $2,150 –

2,350 $2,150 – 2,350 Maintenance capital expenditures, net

(480)-(510) (480)-(510) Environmental capital expenditures, net

(305)-(335) (330)-(360) Preferred dividends (10) (10) Distributions

to non-controlling interests (190)-(210) (190)-(210) Free

cash flow – before Growth investments $1,100 – 1,300 $1,100

– 1,300

(1) 2015 guidance excludes expected negative contribution of

$100 million from NRG Home Solar.

5 Alternative proposal being considered by CPUC to reduce the

Carlsbad project by one unit or approximately 100MW.

2015 Capital Allocation Update

NRG has repurchased $56 million of its common stock at an

average cost of $24.65 per share as part of the $100 million Phase

II portion of the 2015 common stock repurchase program announced on

March 16, 2015. Together with the completion of Phase I of the

common stock purchase program during the first quarter, NRG has

purchased a total of $112 million of NRG common stock since

December 31, 2014.

The Company is announcing an $81 million increase to Phase II,

leaving a total of $125 million remaining under the Phase II

program.

On April 20, 2015, NRG declared a quarterly dividend on the

Company's common stock of $0.145 per share, payable May 15, 2015,

to stockholders of record as of May 1, 2015, representing $0.58 on

an annualized basis.

On an annualized basis, the common stock dividends represent

approximately 16% of free cash flow before growth, and when

combined with the Phase I and Phase II share repurchases, capital

returned to shareholders represents approximately 36% of NRG’s

mid-point 2015 free cash flow before growth.

As NRG continues the process of dropping down its contracted

assets into NRG Yield, with an estimated $600 million in equity

value of drop downs expected over the balance of 2015, the Company

is focused on right sizing the pro forma balance sheet to support

its merchant businesses, excluding the contracted assets sold to

NRG Yield, while providing greater clarity to shareholders of the

benefits of NRG Yield drop downs. To do this in a more orderly and

predictable fashion, the Company hereby announces its intention to

allocate cash, in an amount approximately equal to the proceeds

from the sale of assets to NRG Yield, equally among corporate debt

reduction, repurchase of NRG shares (in addition to its Phase I and

Phase II programs) and reinvestment in contracted assets that could

form the basis for subsequent drop downs and capital recycling.

The Company's common stock dividend is subject to available

capital, market conditions and compliance with associated laws and

regulations.

Earnings Conference Call

On May 8, 2015, NRG will host a conference call at 9:30 a.m.

Eastern to discuss these results. Investors, the news media and

others may access the live webcast of the conference call and

accompanying presentation materials by logging on to NRG’s website

at http://www.nrgenergy.com and clicking on “Investors.” The

webcast will be archived on the site for those unable to listen in

real time.

About NRG

NRG is leading a customer-driven change in the U.S. energy

industry by delivering cleaner and smarter energy choices, while

building on the strength of the nation’s largest and most diverse

competitive power portfolio. A Fortune 250 company, we create value

through reliable and efficient conventional generation while

driving innovation in solar and renewable power, electric vehicle

ecosystems, carbon capture technology and customer-centric energy

solutions. Our retail electricity providers serve almost 3 million

residential and commercial customers throughout the country. More

information is available at www.nrgenergy.com. Connect with NRG

Energy on Facebook and follow us on Twitter @nrgenergy.

Safe Harbor Disclosure

In addition to historical information, the information presented

in this communication includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Exchange Act. These statements involve

estimates, expectations, projections, goals, assumptions, known and

unknown risks and uncertainties and can typically be identified by

terminology such as “may,” “should,” “could,” “objective,”

“projection,” “forecast,” “goal,” “guidance,” “outlook,” “expect,”

“intend,” “seek,” “plan,” “think,” “anticipate,” “estimate,”

“predict,” “target,” “potential” or “continue,” or the negative of

these terms or other comparable terminology. Such forward-looking

statements include, but are not limited to, statements about the

Company’s future revenues, income, indebtedness, capital structure,

plans, expectations, objectives, projected financial performance

and/or business results and other future events, and views of

economic and market conditions.

Although NRG believes that its expectations are reasonable, it

can give no assurance that these expectations will prove to have

been correct, and actual results may vary materially. Factors that

could cause actual results to differ materially from those

contemplated above include, among others, general economic

conditions, hazards customary in the power industry, weather

conditions, competition in wholesale power markets, the volatility

of energy and fuel prices, failure of customers to perform under

contracts, changes in the wholesale power markets, changes in

government regulation of markets and of environmental emissions,

the condition of capital markets generally, our ability to access

capital markets, unanticipated outages at our generation

facilities, adverse results in current and future litigation,

failure to identify or successfully implement acquisitions and

repowerings, our ability to implement value enhancing improvements

to plant operations and companywide processes, our ability to

obtain federal loan guarantees, the inability to maintain or create

successful partnering relationships with NRG Yield and other third

parties, our ability to operate our businesses efficiently

including NRG Yield, our ability to retain retail customers, our

ability to realize value through our commercial operations strategy

and the creation of NRG Yield, the ability to successfully

integrate the businesses of acquired companies, the ability to

realize anticipated benefits of acquisitions (including expected

cost savings and other synergies) or the risk that anticipated

benefits may take longer to realize than expected, the ability to

sell assets to NRG Yield, Inc., and our ability to pay dividends

and initiate share repurchases under our capital allocation plan,

which may be made from time to time subject to market conditions

and other factors, including as permitted by United States

securities laws. Furthermore, any common stock dividend is subject

to available capital and market conditions.

NRG undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. The adjusted

EBITDA and free cash flow guidance are estimates as of May 8, 2015.

These estimates are based on assumptions believed to be reasonable

as of that date. NRG disclaims any current intention to update such

guidance, except as required by law. The foregoing review of

factors that could cause NRG’s actual results to differ materially

from those contemplated in the forward-looking statements included

in this Earnings Presentation should be considered in connection

with information regarding risks and uncertainties that may affect

NRG's future results included in NRG's filings with the Securities

and Exchange Commission at www.sec.gov.

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three months ended March 31, (In millions,

except for per share amounts) 2015

2014 Operating Revenues Total operating revenues $

3,826 $ 3,486

Operating Costs and Expenses

Cost of operations 3,062 2,737 Depreciation and amortization 395

335 Selling, general and administrative 263 222 Acquisition-related

transaction and integration costs 10 12 Development activity

expenses 34 19 Total operating costs and expenses

3,764 3,325 Gain on postretirement benefits curtailment and sale of

assets 14 19

Operating Income 76 180

Other Income/(Expense) Equity in (loss)/earnings of

unconsolidated affiliates (3 ) 7 Other income, net 19 11 Loss on

debt extinguishment — (41 ) Interest expense (301 ) (255 ) Total

other expense (285 ) (278 )

Loss Before Income Taxes (209 )

(98 ) Income tax benefit (73 ) (31 )

Net Loss (136 ) (67 )

Less: Net loss attributable to noncontrolling interest and

redeemable noncontrolling interests (16 ) (11 )

Net Loss Attributable to NRG Energy,

Inc.

(120 ) (56 ) Dividends for preferred shares 5 2

Loss Available for Common Stockholders $ (125 ) $ (58 )

Loss per Share Attributable to NRG Energy, Inc. Common

Stockholders Weighted average number of common shares

outstanding — basic and diluted 336 324

Loss per Weighted

Average Common Share — Basic and Diluted $ (0.37 ) $ (0.18 )

Dividends Per Common Share $ 0.15 $ 0.12

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE LOSS

(Unaudited)

Three months ended March 31, 2015

2014 (In millions) Net Loss $ (136 ) $ (67 )

Other Comprehensive (Loss)/Income, net of tax Unrealized

loss on derivatives, net of income tax benefit of $6 and $3 (12 )

(9 ) Foreign currency translation adjustments, net of income tax

(benefit)/expense of $(7) and $2 (11 ) 6 Available-for-sale

securities, net of income tax (benefit)/expense of $(4) and $2 (1 )

6 Defined benefit plans, net of tax expense of $4 and $0 7 2

Other comprehensive (loss)/income (17 ) 5

Comprehensive Loss (153 ) (62 ) Less: Comprehensive loss

attributable to noncontrolling interest and redeemable

noncontrolling interests (29 ) (15 )

Comprehensive Loss

Attributable to NRG Energy, Inc. (124 ) (47 ) Dividends for

preferred shares 5 2

Comprehensive Loss Available

for Common Stockholders $ (129 ) $ (49 )

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

March 31, 2015

December 31, 2014

(In millions, except shares) (unaudited)

ASSETS Current Assets Cash and cash

equivalents $ 2,164 $ 2,116

Funds deposited by counterparties

68 72 Restricted cash 443 457 Accounts receivable — trade, less

allowance for doubtful accounts of $21 and $23 1,179 1,322

Inventory 1,109 1,247 Derivative instruments 2,029 2,425 Cash

collateral paid in support of energy risk management activities 400

187 Deferred income taxes 188 174 Renewable energy grant

receivable, net 68 135 Prepayments and other current assets 474

447 Total current assets 8,122 8,582

Property, plant and equipment, net of accumulated depreciation

of $8,264 and $7,890 22,276 22,367

Other

Assets Equity investments in affiliates 772 771 Notes

receivable, less current portion 67 72 Goodwill 2,520 2,574

Intangible assets, net of accumulated amortization of $1,511 and

$1,402 2,491 2,567 Nuclear decommissioning trust fund 586 585

Derivative instruments 591 480 Deferred income taxes 1,484 1,406

Non-current assets held-for-sale 17 17 Other non-current assets

1,404 1,244

Total other assets

9,932 9,716

Total Assets $ 40,330 $

40,665

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities Current portion of long-term debt and

capital leases $ 465 $ 474 Accounts payable 1,045 1,060 Derivative

instruments 1,884 2,054 Cash collateral received in support of

energy risk management activities 68 72 Accrued expenses and other

current liabilities 1,047 1,199 Total current

liabilities 4,509 4,859

Other Liabilities

Long-term debt and capital leases 20,050 19,900 Nuclear

decommissioning reserve 314 310 Nuclear decommissioning trust

liability 328 333 Deferred income taxes 20 21 Derivative

instruments 650 438 Out-of-market contracts, net of accumulated

amortization of $585 and $562 1,221 1,244 Other non-current

liabilities 1,549 1,574 Total non-current liabilities

24,132 23,820

Total Liabilities 28,641

28,679 2.822% convertible perpetual preferred stock 293 291

Redeemable noncontrolling interest in subsidiaries 19 19

Commitments and Contingencies Stockholders’ Equity

Common stock

4 4 Additional paid-in capital 8,362 8,327 Retained earnings 3,413

3,588 Less treasury stock, at cost — 81,865,411 and 78,843,552

shares, respectively (2,059 ) (1,983 ) Accumulated other

comprehensive loss (191 ) (174 ) Noncontrolling interest 1,848

1,914

Total Stockholders’ Equity 11,377

11,676

Total Liabilities and Stockholders’ Equity $

40,330 $ 40,665

NRG ENERGY, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Three months ended March 31, 2015

2014 (In millions) Cash Flows from Operating

Activities Net loss $ (136 ) $ (67 ) Adjustments to reconcile

net income/(loss) to net cash provided by operating activities:

Distributions and equity in earnings of unconsolidated affiliates

32 (2 ) Depreciation and amortization 395 335 Provision for bad

debts 15 21 Amortization of nuclear fuel 13 11

Amortization of financing costs and debt

discount/premiums

(4 ) (5 ) Adjustment for debt extinguishment — 19 Amortization of

intangibles and out-of-market contracts 19 13 Amortization of

unearned equity compensation 11 8 Changes in deferred income taxes

and liability for uncertain tax benefits (83 ) (111 ) Changes in

nuclear decommissioning trust liability (3 ) 5 Changes in

derivative instruments 261 525 Changes in collateral deposits

supporting energy risk management activities (213 ) (407 )

Gain on postretirement benefits

curtailment and sale of assets

(14 ) (19 ) Cash used by changes in other working capital (33 ) 65

Net Cash Provided by Operating Activities 260

391

Cash Flows from Investing Activities Acquisitions

of businesses, net of cash acquired (1 ) (218 ) Capital

expenditures (252 ) (237 ) (Increase)/decrease in restricted cash,

net (11 ) 3 Decrease in restricted cash to support equity

requirements for U.S. DOE funded projects 25 56 Decrease in notes

receivable 5 1 Investments in nuclear decommissioning trust fund

securities (193 ) (188 ) Proceeds from the sale of nuclear

decommissioning trust fund securities 196 183 Proceeds from

renewable energy grants and state rebates 2 387 Proceeds from sale

of assets, net of cash disposed of — 77 Cash proceeds to fund cash

grant bridge loan payment — 57 Other (41 ) 3

Net Cash

(Used)/Provided by Investing Activities (270 ) 124

Cash Flows from Financing Activities Payment of dividends to

common and preferred stockholders (51 ) (41 ) Payment for treasury

stock (79 ) — Net receipts from/(payments for) settlement of

acquired derivatives that include financing elements 40 (223 )

Proceeds from issuance of long-term debt 248 1,564 Contributions

to, net of distributions from, noncontrolling interest in

subsidiaries (25 ) 9 Proceeds from issuance of common stock 1 3

Payment of debt issuance costs — (23 ) Payments for short and

long-term debt (94 ) (873 )

Net Cash Provided by Financing

Activities 40 416 Effect of exchange rate changes

on cash and cash equivalents 18 2

Net Increase in

Cash and Cash Equivalents 48 933

Cash and Cash Equivalents

at Beginning of Period 2,116 2,254

Cash and

Cash Equivalents at End of Period $ 2,164 $ 3,187

Appendix Table A-1: First Quarter 2015

Adjusted EBITDA Reconciliation by Operating Segment

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/(loss)

($ in millions) Home Retail Home Solar Business Renew Yield

Corp Total

Net Income/(Loss) Attributable to NRG Energy, Inc

104 (45) 29 (50) (11)

(147) (120) Plus: Net Loss Attributable to

Non-Controlling Interest - - - (6) (5) (5) (16) Interest Expense,

net - - 18 31 70 179 298 Income Tax - - - (6) (4) (63) (73)

Depreciation, Amortization and ARO Expense 30 5 240 64 55 7 401

Amortization of Contracts - - (12) (1) 12 1 -

EBITDA

134 (40) 275 32 117 (28)

490 Adjustment to reflect NRG share of Adjusted EBITDA in

unconsolidated affiliates - - 4 - 12 3 19 Integration &

Transaction Costs - - - - - 10 10 Deactivation costs - - 3 - - - 3

NRG Home Solar EBITDA - 40 - - - - 40 Market to Market (MtM)

losses/(gains) on economic hedges 32 - 253 - (7) - 278

Adjusted

EBITDA 166 -

535 32 122 (15)

840

Appendix Table A-2: First Quarter 2014

Adjusted EBITDA Reconciliation by Operating Segment

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/ (loss)

($ in millions) Home Retail Home Solar Business Renew Yield

Corp Total

Net Income/(Loss) Attributable to NRG Energy, Inc

185 (2) (6) (48)

22 (207) (56) Plus: Net

(Loss)/Income Attributable to Non-Controlling Interest - - - (17) 4

2 (11) Interest Expense, net 1 - 17 26 26 182 252 Loss on Debt

Extinguishment - - - 1 - 40 41 Income Tax - - - - 3 (34) (31)

Depreciation Amortization and ARO Expense 30 1 230 49 24 6 340

Amortization of Contracts (1) - 1 - 1

- 1

EBITDA 215 (1) 242

11 80 (11) 536 Adjustment to reflect

NRG share of Adjusted EBITDA in unconsolidated affiliates - - (3) -

12 2 11 Integration & Transaction Costs, gain on sale - - (18)

- - 12 (6) Deactivation Costs - - 3 - - - 3 Legal Settlement 4 - -

- - - 4 NRG Home Solar EBITDA - 1 - - - - 1 MtM (gains)/losses on

economic hedges (104) - 371 1 - - 268

Adjusted EBITDA 115 -

595

12 92 3 817

Appendix Table A-3: 2015 and 2014 First

Quarter Adjusted Cash Flow from Operations Reconciliations

The following table summarizes the

calculation of adjusted cash flow operating activities providing a

reconciliation to net cash provided by operating activities

($ in millions)

Three months ended

March 31, 2015

Three months ended

March 31, 2014

Net Cash Provided by Operating Activities 260

391 Adjustment for change in collateral 213 407

Reclassifying of net receipts (payments) for settlement of acquired

derivatives that include financing elements 40 (223) Add: Merger

and integration expenses 12 33

Adjusted Cash Flow from Operating

Activities 525 608 Maintenance CapEx, net [1]

(85) (62) Environmental CapEx, net (49) (50) Preferred dividends

(2) (2) Distributions to non-controlling interests (25) (7) Free

Cash Flow – before Growth investments 364 487

(1) Excludes merger and integration CapEx of $3 million in Q1

2015 and $5 million in Q1 2014

Appendix Table A-4: First Quarter 2015

Regional Adjusted EBITDA Reconciliation for NRG Business

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/ (loss)

($ in millions) East Gulf Coast West B2B Carbon 360 Total

Net Income/(Loss) Attributable to NRG Energy, Inc 88

35 (24) (64) (6) 29 Plus:

Interest Expense, net 18 - - - - 18 Depreciation, Amortization and

ARO Expense 77 145 16 2 - 240 Amortization of Contracts (14) 2 (1)

1 - (12)

EBITDA 169 182 (9) (61)

(6) 275 Adjustment to reflect NRG share of Adjusted

EBITDA in unconsolidated affiliates - (1) 1 1 3 4 Deactivation

costs 2 - 1 - - 3 Market to Market (MtM) losses/(gains) on economic

hedges 253 (65) (1) 66 - 253

Adjusted EBITDA 424 116 (8)

6 (3) 535

Appendix Table A-5: First Quarter 2014

Regional Adjusted EBITDA Reconciliation for NRG Business

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to net

income/(loss)

($ in millions) East Gulf Coast West B2B Carbon 360 Total

Net Income/(Loss) Attributable to NRG Energy, Inc 184

(300) 6 106 (2) (6) Plus:

Interest Expense, net 16 1 - - - 17 Depreciation Amortization and

ARO Expense 70 143 12 4 1 230 Amortization of Contracts (5) 6 (2) 2

- 1

EBITDA 265 (150) 16 112

(1) 242 Adjustment to reflect NRG share of Adjusted

EBITDA in unconsolidated affiliates (1) - - (3) 1 (3) Integration

& Transaction Costs, gain on sale 6 (24) - - - (18)

Deactivation Costs 2 - 1 - - 3 MtM losses/(gains) on economic

hedges 247 239 2 (117) - 371

Adjusted EBITDA 519 65 19

(8) -

595

Appendix Table A-6: First Quarter 2015

Sources and Uses of Liquidity

The following table summarizes the sources

and uses of liquidity in the first quarter of 2015.

($ in millions)

Three months ended

March 31, 2015

Sources: Adjusted Cash Flow from Operations $ 525 Debt

Proceeds, NRG Yield 210 Increase in Credit Facility 57 Debt

proceeds, other project debt financing 38

Uses: Collateral

Postings 213 Maintenance and Environmental Capex, net 134 Share

Repurchases, and Common and Preferred Stock Dividends 130 Growth

Investments and Acquisitions, net 122 Debt Repayments 94

Distributions to Non-Controlling Entities 25 Merger and

Integration-related payments and other investing and financing

activities 21

Change in Total Liquidity $

91

EBITDA and Adjusted EBITDA are non-GAAP financial measures.

These measurements are not recognized in accordance with GAAP and

should not be viewed as an alternative to GAAP measures of

performance. The presentation of Adjusted EBITDA should not be

construed as an inference that NRG’s future results will be

unaffected by unusual or non-recurring items.

EBITDA represents net income before interest (including loss on

debt extinguishment), taxes, depreciation and amortization. EBITDA

is presented because NRG considers it an important supplemental

measure of its performance and believes debt-holders frequently use

EBITDA to analyze operating performance and debt service capacity.

EBITDA has limitations as an analytical tool, and you should not

consider it in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are:

- EBITDA does not reflect cash

expenditures, or future requirements for capital expenditures, or

contractual commitments;

- EBITDA does not reflect changes in, or

cash requirements for, working capital needs;

- EBITDA does not reflect the significant

interest expense, or the cash requirements necessary to service

interest or principal payments, on debt or cash income tax

payments;

- Although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and EBITDA does not

reflect any cash requirements for such replacements; and

- Other companies in this industry may

calculate EBITDA differently than NRG does, limiting its usefulness

as a comparative measure.

Because of these limitations, EBITDA should not be considered as

a measure of discretionary cash available to use to invest in the

growth of NRG’s business. NRG compensates for these limitations by

relying primarily on our GAAP results and using EBITDA and Adjusted

EBITDA only supplementally. See the statements of cash flow

included in the financial statements that are a part of this news

release.

Adjusted EBITDA is presented as a further supplemental measure

of operating performance. Adjusted EBITDA represents EBITDA

adjusted for mark-to-market gains or losses, asset write offs and

impairments; and factors which we do not consider indicative of

future operating performance. The reader is encouraged to evaluate

each adjustment and the reasons NRG considers it appropriate for

supplemental analysis. As an analytical tool, Adjusted EBITDA is

subject to all of the limitations applicable to EBITDA. In

addition, in evaluating Adjusted EBITDA, the reader should be aware

that in the future NRG may incur expenses similar to the

adjustments in this news release.

Adjusted cash flow from operating activities is a non-GAAP

measure NRG provides to show cash from operations with the

reclassification of net payments of derivative contracts acquired

in business combinations from financing to operating cash flow, as

well as the add back of merger and integration related costs. The

Company provides the reader with this alternative view of operating

cash flow because the cash settlement of these derivative contracts

materially impact operating revenues and cost of sales, while GAAP

requires NRG to treat them as if there was a financing activity

associated with the contracts as of the acquisition dates. The

Company adds back merger and integration related costs as they are

one time and unique in nature and do not reflect ongoing cash from

operations and they are fully disclosed to investors.

Free cash flow (before Growth investments) is adjusted cash flow

from operations less maintenance and environmental capital

expenditures, net of funding, and preferred stock dividends and is

used by NRG predominantly as a forecasting tool to estimate cash

available for debt reduction and other capital allocation

alternatives. The reader is encouraged to evaluate each of these

adjustments and the reasons NRG considers them appropriate for

supplemental analysis. Because we have mandatory debt service

requirements (and other non-discretionary expenditures) investors

should not rely on free cash flow before Growth investments as a

measure of cash available for discretionary expenditures.

NRG Energy, Inc.Media:Karen Cleeve, 609-524-4608orMarijke

Shugrue, 609-524-5262orInvestors:Matthew Orendorff,

609-524-4526orLindsey Puchyr, 609-524-4527

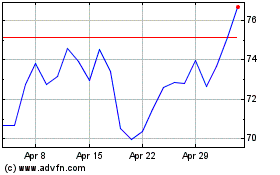

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

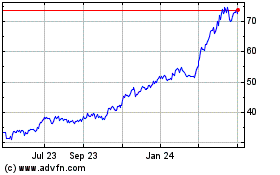

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024