Stocks Fall Amid Tech-Sector Blues While Sterling Steadies -- 2nd Update

October 12 2016 - 7:53AM

Dow Jones News

By Riva Gold

Stocks tilted lower Wednesday amid lingering concerns about the

strength of corporate earnings, while the British pound began to

stabilize following its sharp swings.

Futures pointed to a 0.1% opening loss for the S&P 500,

while shares in Europe and Asia were under pressure after a

downbeat start to the U.S. earnings season sparked a modest selloff

on Wall Street on Tuesday.

Shares of Illumina dropped 25% after the gene-sequencing company

cut its revenue guidance while aluminum giant Alcoa fell around 11%

after reporting third-quarter earnings, leaving some investors

worried about the rest of the earnings season.

In the three quarters where Alcoa fell more than 10% after its

report, the S&P 500 traded down 7.5%, 2.6%, and 6.5% for the

remainder of those three earnings seasons, according to Bespoke

Investment Group.

The Stoxx Europe 600 was little changed by midday as investors

weighed a modest bump in the oil and gas sector against losses in

technology companies. Brent crude oil was up 0.6% at $52.72 a

barrel.

Europe's technology sector was down 2%, leading declines, after

Ericsson AB issued a profit warning for the third quarter, a week

after it announced plans to slash almost 20% of its domestic

workforce. Shares in the Swedish company fell over 17%, while

Nordic rival Nokia fell 4.6%.

In currencies, the British pound was last up 0.2% at $1.2277

after four consecutive days of losses. The pound touched a historic

low against a basket of currencies on Tuesday, according to Bank of

England data released Wednesday morning.

The British currency had fallen sharply late Tuesday, but

recovered during Asian trading hours, rising more than 1.5% against

the dollar, after media reports suggested that U.K. Prime Minister

Theresa May had agreed to hold a parliamentary vote on her plans

for taking Britain out of the European Union.

Analysts said that could limit her ability to push for a "hard

Brexit," spurring some traders to lift their short positions on the

currency.

Still, analysts warned that the news is unlikely to reverse the

broader downward trend for sterling.

The pound right now is a barometer of the government's thinking

on its exit negotiations, said Russ Mould, investment director at

AJ Bell. "It's very difficult to know exactly what will come out of

government at the moment," he said.

London's export-heavy FTSE 100 index, which touched its highest

level in decades on Tuesday, pulled back 0.3% as the British

currency recovered.

In other currencies, the euro fell 0.4% against the dollar to

$1.1015, while the dollar rose 0.2% against the yen to

Yen103.5820.

The WSJ Dollar index, which measures the dollar against a basket

of 16 currencies, was little changed after its biggest daily gain

since August. Expectations have grown recently for the U.S. Federal

Reserve to raise interest rates at its meeting in December,

supporting the dollar.

Fed-fund futures, used by investors to bet on central bank

policy, currently imply a nearly 70% chance of a rate rise by

December, according to CME Group.

"We're a market that is run by central banks right now," said

Bret Chesney, portfolio manager at Alpine Global, noting that

comments from Fed officials have driven most recent moves in the

stock market.

Minutes from the Fed's September meeting are due later

Wednesday. Policy makers voted to leave rates unchanged but three

officials dissented in favor of an increase, so investors will

watch closely for further insight into the debate.

In bonds, the yield on the U.S. 10-year Treasury note was up

slightly at 1.780% from 1.760% on Tuesday. The gap in yield between

the two-year Treasury note, last at 0.883%, and the two-year German

note, last at minus 0.665% is around its highest in a decade,

according to Brown Brothers Harriman.

Earlier, shares in Asia mostly followed Wall Street lower as

expectations rose of U.S. rate increase in December. Japan's Nikkei

Stock Average fell 1.1% while the Hang Seng Index fell 0.6%.

Hiroyuki Kachi and

Matthias Verbergt

contributed to this article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

October 12, 2016 07:38 ET (11:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

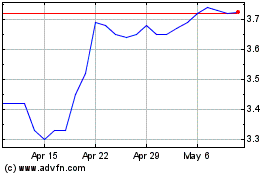

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024