Nokia Sees Demand Cooling For Telecoms Gear

February 11 2016 - 4:30AM

Dow Jones News

Nokia Corp. has warned of an impending slowdown in the

telecommunications-equipment sector amid growing worries about the

health of the global economy, just as the Finnish company's

integration of the recently acquired Alcatel-Lucent SA gathers

speed.

"The first quarter, in particular, looks quite challenging as

customers assess their [capital-expenditure] plans in light of

increasing macro-economic uncertainty," said Nokia Chief Executive

Rajeev Suri on Thursday.

"We see a flattish capex environment for all addressable markets

in 2016," Mr Suri said, underlining less buoyant activity in China

now that the rollout of new-generation wireless networks is nearly

complete in the country.

The Finnish group's wary outlook echoes recent comments from

other technology companies and comes days after management

disappointed investors with its forecast for how much revenue it is

set to gain from its intellectual-property portfolio after a patent

deal with Samsung Electronics Co.

It contrasts with Nokia's robust performance at the end of last

year, with the group reporting a steep rise in fourth-quarter

profit to €1.79 billion euros, inflated by €1.3 billion in proceeds

mostly from the sale of its mapping business last year to a

consortium of German auto makers.

Excluding that gain, net profit rose 53% to €498 million in the

three months to end-December, ahead of market expectations, and up

from €325 million in the same quarter a year ago. Growth at Nokia's

patent-licensing business helped offset lower demand for its

telecom-network equipment.

Nokia said it is too early to provide an outlook for the new

combined company--Nokia in the final stages of completing its $16.6

billion takeover offer for Alcatel-Lucent--but will update

investors in around three months time.

But Nokia did say at the start of the month that, including the

patent pact with Samsung, it expects to receive at least €1.3

billion in cash between 2016 and 2018 related to settled and

continuing arbitration regarding its intellectual property, well

below some analysts' expectations.

Alcatel-Lucent is at least finishing its life as an independent

company in robust health, surpassing a long-delayed goal of

reporting positive free cash flow for an entire year in 2015 and

fulfilling its turnaround plan. The Franco-American group reported

net profit of €589 million euros, or 18 cents a share, more than

double net profit of €271 million, or 8 cents a share, a year

earlier.

Nokia repeated a previous assessment that the tie-up would

result in merger-related benefits worth around €900 million by

2018.

"We have been operating as a combined company for a month,"

Nokia's Mr. Suri said.

Nokia said on Wednesday that it controls 91.25% of the share

capital of Alcatel-Lucent. Nokia needs to own 95% of the stock to

squeeze out the remaining shareholders.

The Finnish company said shareholders will receive an ordinary

dividend of at €0.16 a share for 2015 plus a special dividend of

€0.10 a share, up from €0.14 a share in 2014

--Sam Schechner contributed to this article.

Write to Christina Zander at christina.zander@wsj.com

(END) Dow Jones Newswires

February 11, 2016 04:15 ET (09:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

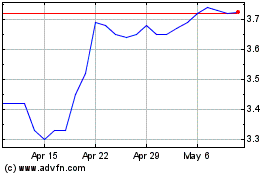

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024